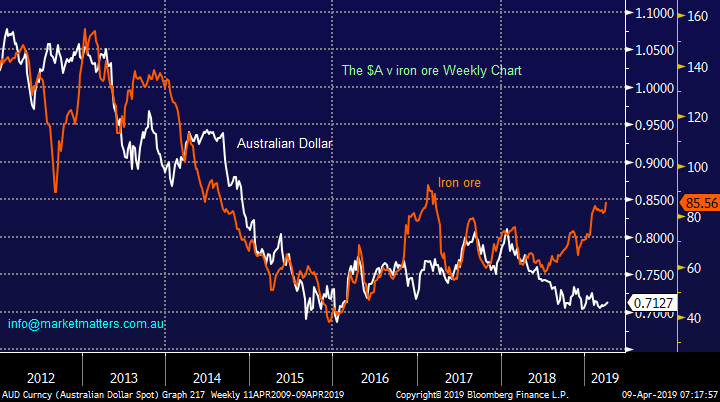

Should we be jumping on board the iron ore train? (CWN, HLS, PTM, RSG, FMG, BHP, RIO)

Yesterday the ASX200 bounced back from the sell-off at the end of last week rallying a solid 40-points with the strength in our resources stocks shrugging off the weakness in our banking sector i.e. Commonwealth Bank (CBA) slipped -0.3% but BHP Group (BHP) rallied +1.7%. However it wasn’t all about a strong resources market as we saw less than 25% of the ASX200 close in the red highlighting the strength of the broad based market. During the day it felt like traders / investors were buying our SPI futures and selling our global counterparts, perhaps taking some $$ off the table following the Australian markets underperformance last week.

On the day the Energy and Materials (Resources) sectors were the obvious winners but the Healthcare sector also slipped in under the radar gaining +1.5% basically in line with the other two. Heavyweights CSL Ltd (CSL), ResMed (RMD) and Cochlear (COH) all performed strongly but we remain cautious this sector medium-term which has enjoyed the tailwind of $US earnings over the last decade. However, almost in contradiction we continue to hold ResMed (RMD) in the MM Growth Portfolio which has been tempting to take our profits a few times but we will give it room for now.

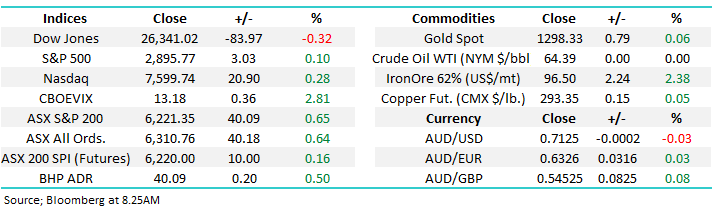

If we are correct and the market is positioning itself for a begrudging pullback towards 6000 we would not be surprised to see at least a few days consolidation around the psychological 6200 area.

The ASX200 has now achieved our upside target area switching us back to a neutral / bearish stance short-term.

Overnight US were mixed with the Dow and Russell 2000 falling while the S&P500 gained +0.1%, the SPI is pointing to a solid open locally, up around 15-points helped by BHP which closed up almost 20c in the US.

Today we are again going to look at the big 3 players in the iron ore space which is exceeding many investors expectations, including our own – we question is it time for MM to rethink its view? Importantly the first economic signs are emerging that Chinese stimulus is working its magic, as it usually does, a clear bullish tailwind for the Australian resources market.

However the elephant in the room is when will Vale announce their production is coming back, that will be an extremely volatile day in my opinion.

ASX200 Chart

Crown Resorts (CWN) $11.747

This morning we have awoken to the news that Las Vegas giant Wynn Resorts is in the market to buy Jamie Packers Crown Resorts (CWN) – they already make a billion a year making CWN a very realistic target for them + Jamie & Steve Wynn have a strong history together.

Its easy to call this approach opportunistic as the CWN share price has struggled under the cloud of uncertainty caused by the company’s Sydney Barangaroo development but we may have a keen seller here – is Jamie Packer simply over it and ready to cash in? Wynn and Packer know each other well raising the question if he would show this level of interest without a degree of insight into the Australians consideration to exiting? Our initial feeling is this deal has far more chance of going through than others currently on the table in the market.

From a risk / reward basis we now like both Crown (CWN) and Star Entertainment (SGR) at yesterday’s closing level but we will need to asses the impact of this news on their respective share prices this morning.

MM likes both CWN and SGR at yesterday’s prices.

Crown Resorts (CWN) Chart

Star Entertainment (SGR) Chart

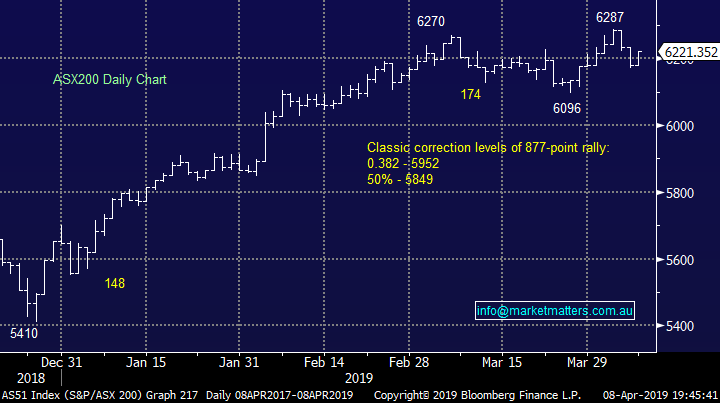

Healius (HLS) $2.97

MM went long HLS in mid-March at $2.65 making it easy to consider grabbing the quick 12% profit but the reason for the position remains i.e. MM believes the market has underestimated the potential takeover bid from Chinese Jangho.

3 key points:

- Healius have a very good asset base that is not generating the earnings it should. While they’re not ‘cheap’ on an estimated P/E of 19.2x for FY19, it’s the asset base plus the earnings potential of that asset base that is important.

- Their largest shareholder, Chinese based Jangho has made a takeover offer at $3.25 per share in early January which was rejected – described as opportunistic, undervaluing the business.

- After the stock pulled back by ~12% Market Matters bought the stock for two reasons. 1. The belief that the bid from Chinese suitor Jangho at A$3.25 has more credibility than the market was pricing in 2. If another bid didn’t eventuate, HLS was already in a turnaround phase, cutting costs and improving earnings.

While we’ve bought HLS with one eye on the takeover from its largest shareholder, the risk v reward to own the stock below $2.70 was compelling before we consider the takeover, closer to $3 it’s a comfortable hold, not a buy.

MM remains bullish HLS targeting the $3.40 area, or close to 15% higher.

Healius (HLS) Chart

The winner that caught our eye yesterday was Resolute Mining (RSG) which rallied almost 8% on the day. The relatively small gold stock led the way on the local market thanks to an impressive quarterly update.

MM is bullish RSG technically with stops below $1.20, excellent risk / reward.

Resolute Mining (RSG) Chart

Conversely the loser which caught our eye yesterday was Platinum falling 4% taking the companies decline to almost 13% over the last month alone.

MM remains bearish PTM looking for a test of $4.50 and then $4.

Platinum Asset Mgt (PTM) Chart

Should we just jump onboard the iron ore train?

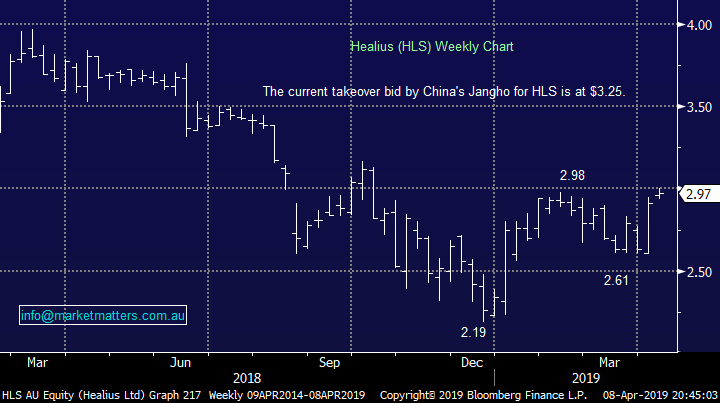

We have shown the below chart a number of times over recent weeks and we continue to believe its an elastic band tightening by the day – we remain bullish the $A targeting a test of 80c.

Currently local resources are enjoying the perfect tailwind of rising underlying commodity prices while the $A remains very subdued. We believe part of this tailwind will be removed medium-term but if iron ore remains at current levels, or rises further, a stronger $A is unlikely to significantly harm the miners.

Conversely If we look at the chart below the last time the $A ignored a strong rally in iron ore was in late 2016 when the currency proved correct as the bulk commodity proceeded to tumble 30% - a scenario few are considering today.

$A v iron ore Chart

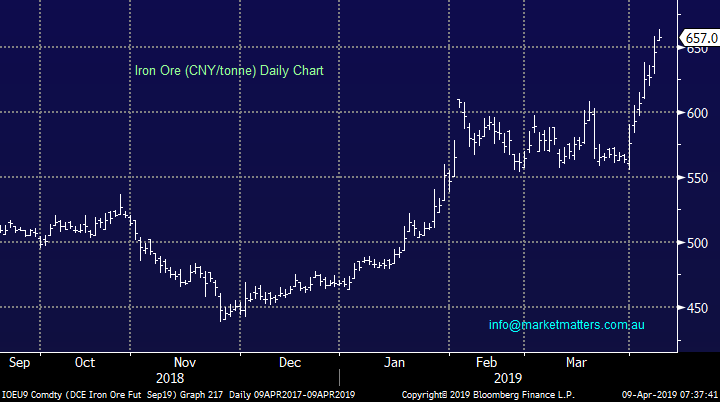

The iron ore chart (s) below shows the sharp rally in the bulk commodity since the Vale disaster this year on the 25th of January.

If we were looking at the first chart from a purely technical perspective we would now have a target well over $US100/tonne medium-term (in line with Citi’s view) although the picture is not as clear in the Chinese Renminbi futures contract.

However this a market with many strong driving fundamental issues with the previously mentioned Vale supply the most important this year, sharp 10-20% pullbacks is almost common for the commodity and it could easily be far more if Vale were to just hint at returning some decent supply in the future – our ideal buy price for iron ore is ~15% lower, from a risk / reward perspective we cannot chase at todays prices.

MM is currently neutral iron ore but very open-minded to higher prices in 2019.

Iron ore ($US/tonne) Chart

Iron ore Futures (CNY/tonne) - China Chart

Now quickly moving onto the 3 major Australian players in the iron ore space – the stocks who have dragged the ASX200 higher in 2019.

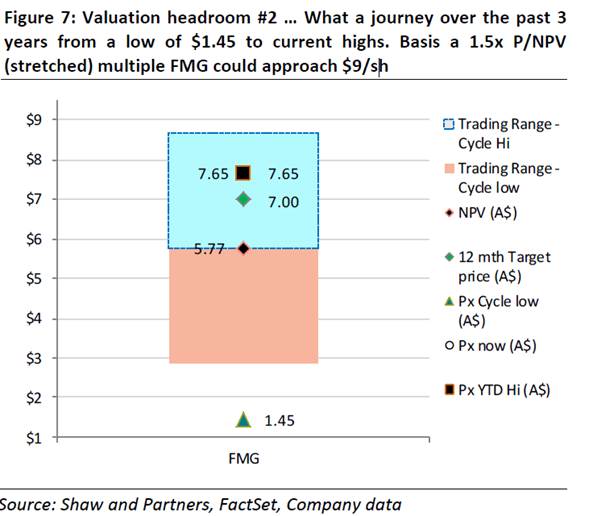

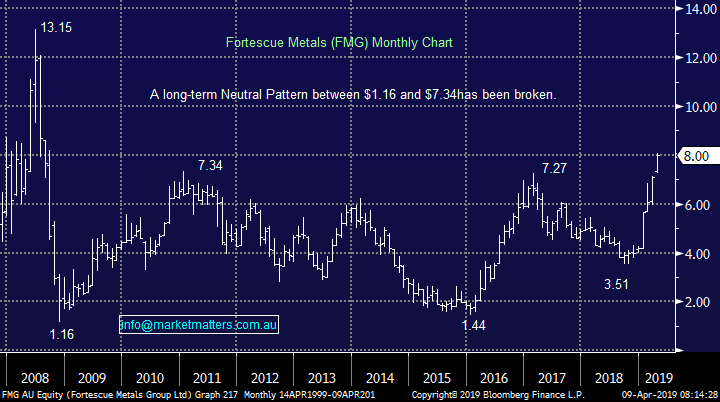

1 Fortescue Metals (FMG) $8

Fortescue (FMG) has enjoyed the tailwind of a higher Iron Ore price amplified by a reduced discount to the benchmark prices applied to their Ore while they also announced a new JV project to help with blend quality in the future. That makes total sense with FMG using cash generated now to help future proof the business.

Yesterday FMG hit decade new highs closing at the psychological $8 level. Technically the stock has “broken out” and can be bought with stops below $6.50 – not exciting risk / reward. The stocks trading on a conservative valuation while yielding over 5% fully franked which implies a pullback in the iron ore price is expected by some.

From a valuation perspective, the obvious question is how far can FMG run? The below chart looks at a multiple of net present value (NPV), which essentially measures the value of FMG cash flows and applied a multiple to it. 1.5x is a very bullish multiple!

MM likes FMG but is looking for a more optimum risk / reward opportunity.

Fortescue Metals (FMG) Chart

2 RIO Tinto (RIO) $101.48.

RIO have told the market the recent Cyclone will impact Iron Ore production by -14mpta plus of course Vale has the longer term issues impacting supply by around 40mpta for the next 2-3 years. All in all, this makes for a tight Iron Ore market and yesterday we saw RIO clear the $100 handle – the first time since the GFC.

RIO looks fabulous at the moment as it breaks above the psychological $100 area but when we stand back and look at its impressive rally since late 2016 there has already been 3 decent corrections all well in excess of $10 illustrating that chasing strength can be dangerous with resource stocks. Having missed this last leg up in RIO logic now tells us to be patient.

MM likes RIO but the $90 area is our preferred entry.

RIO Tinto (RIO) Chart

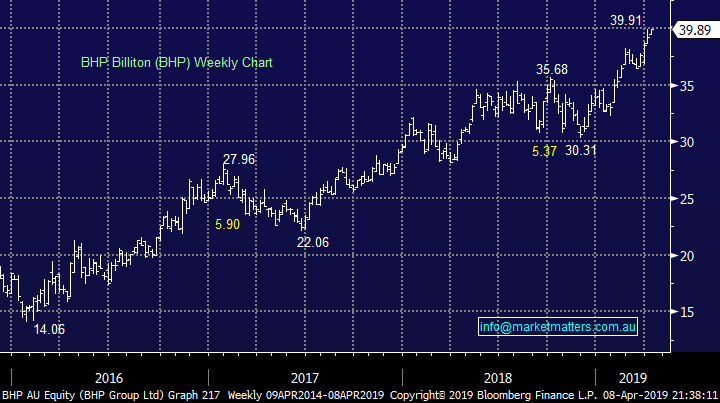

3 BHP Group (BHP) $39.89

The Big Australian (BHP) is enjoying tailwinds from basically it’s entire commodities mix and this morning it looks set to break over $40. However similar to RIO, BHP is not unused to a decent correction leading us to believe that chasing at current levels is not prudent although higher prices would not surprise, its just comes down to risk / reward.

Similar to the other 2 BHP is now yielding strongly as it becomes an almost “cash cow” with the banks having passed the baton to the miners for yield, who would have predicted that 5-years ago!

MM likes BHP but now ideally ~$36.

BHP Group (BHP) Chart

Conclusion

MM likes all 3 of BHP, FMG and RIO but plan to be patient on entry at this point in time.

Global Indices

US stocks again closed mixed last night with the tech based NASDAQ rallying slightly while the Dow fell -0.3%. We still think the NASDAQ has another ~6% upside medium-term but the next few weeks look more questionable.

With both the S&P500 and tech based NASDAQ reaching fresh 2019 highs we have turned mildly neutral / negative US stocks.

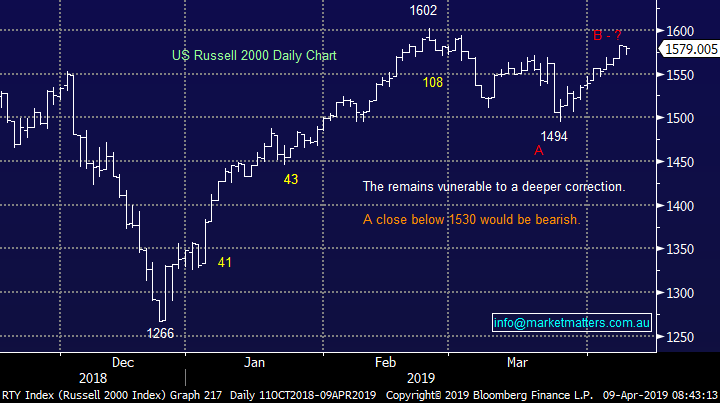

US Russell 2000 Chart

No change with European indices even as the BREXIT fiasco rolls on, markets are encountering some resistance from our targeted “sell zones”, we remain cautious or even bearish the region at this stage, especially into fresh 2019 highs.

German DAX Chart

Overnight Market Matters Wrap

· The US equity markets rallied recovered most of its losses late in the session to close mixed with marginal change overnight as investors weigh up expectations of US corporate earnings to fall while the Fed continues its dovish stance.

· Dr Copper on the LME and Iron Ore advanced overnight, with BHP expected to outperform the broader market after ending its US session up an equivalent of 0.5% from Australia’s previous close.

· The March SPI Futures is indicating the ASX 200 to open 17 points higher this morning, testing the 6240 level.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 09/04/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.