Can we find any value in recent underperformers? (NCM, NST, BOQ, BEN, BAL, DHG, CSR, BSL, ORE, SYR, S32)

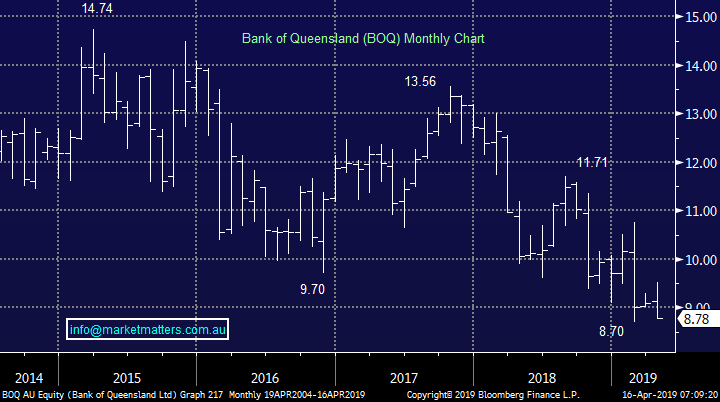

The SPI futures got it right on Friday night when they suggested the ASX200 would ignore the Dows 269-rally, the ASX200 actually closed unchanged on a very lacklustre day which felt like the Easter holidays were already in many players minds. The Banking sector stopped the market slipping into the red with all of the “Big Four” closing up more than +0.5% while the Financials, Healthcare, “yield play” and Gold stocks had a tough day at the office.

On a sector level only the gold stocks really stood out with selling across the sector from Regis Resources (RRL) -1.2% to Evolution Mining (EVN) -3.9% - we have looked at a couple a little later. The selling had no obvious catalyst and perhaps on a relatively low volume day we just saw a one fund manager lighten their exposure to the sector but we will be watching carefully as we like the sector into weakness.

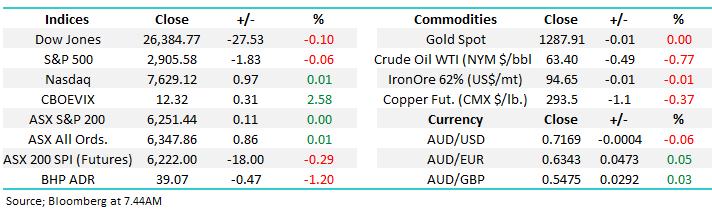

No change, we continue to feel the market is positioning itself for a begrudging pullback towards 6100 and potentially 6000 with the recent 7-weeks consolidation around the psychological 6200 area fitting our mildly negative picture but a close below 6220 is now required technically for us to feel on the money.

The ASX200 has now achieved our upside target area switching us back to a neutral / bearish stance short-term.

Overnight the US indices closed slightly lower led by weakness in the banking sector following average results by Goldman Sachs and Citigroup but the tech based NASDAQ still managed to close in the green. Locally the SPI futures are calling the ASX200 to open down around 15-points with BHP’s 50c decline in the US likely to weigh early.

Today we are delving into the red and looking at 10 stocks who have fallen by more than 5% over the last week, not a good performance in a neutral environment where the market has basically traded sideways. With MM sitting on large cash positions it’s easy to consider stocks that have fallen as a buying opportunity but we must always remember that statistically your swimming against the tide buying weak stocks i.e. be extremely selective.

ASX200 Chart

Our 2 favourite gold stocks if yesterdays weakness persists over the coming weeks are Newcrest (NCM) and Northern Star (NST) with the later more of a long-shot in terms of our ideal entry but gold and the stocks within the sector can be volatile at times e.g. ST Barbara has fallen ~40% since late February.

Newcrest Mining (NCM) $24.90.

Yesterday we saw NCM fall -2.4% which certainly caught our attention with the large miner sitting on our radar into weakness. In January the company announced an excellent 2nd quarter update which included the healthy combination of increased production and cost reductions. Obviously for NCM to become very exciting moving forward we need to see gold break clear of the $US13 region but we can see that unfolding in 2019 / 2020.

MM currently likes NCM around the $23.50 area.

Newcrest Mining (NCM) Chart

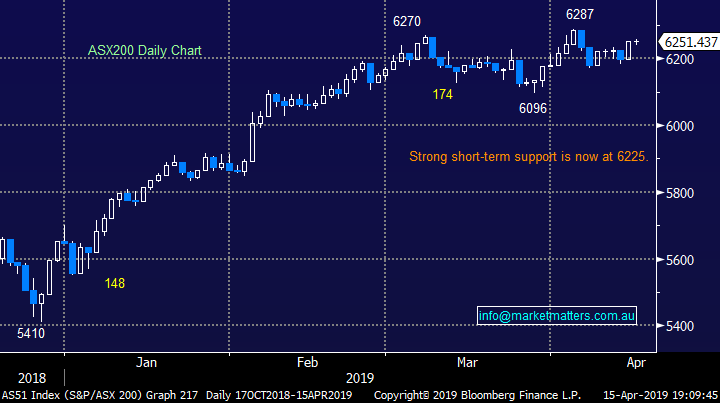

Northern Star (NST) $8.90.

Yesterday we saw NST fall -3.6% but there’s still a long way to go for our ideal buy zone for this high flying local gold stock. As a bonus NST operates in Australia and North America removing the potential volatility of exposure to Papua New Guinea and other such colourful countries.

With a cost of production below $A1200 todays almost $A1800 things look great but obviously a fall in the gold price, or rise in the $A will dampen things – perhaps if we are correct and the $A is headed towards 80c against the $US our optimistic retracement will unfold.

MM currently likes NST around the $7 region but we acknowledge that’s ~20% below todays close.

Northern Sar (NST) Chart

Scanning the standout 10 recent underperformers.

Interestingly of the 10 stocks that have fallen by 5% or more only 3 stocks were not from the currently very popular Materials / Resources sector i.e. Bank of Queensland (BOQ) -7.7%, Bellamy’s (BAL) -9% and Domain Holdings (DHG) -7.5%.

Materials: CSR Ltd (CSR) -5.9%, BlueScope Steel (BSL) -7.9%, Orocobre (ORE) -6.7%, Sims Metal (SGM) -14.3%, Galaxy Resources (GXY) -5.7%, Syrah Resources (SYR) -15.5% and South32 (S32) -7.3%.

When we take a glance at the Materials sector as an index its only 2% below its multi-year high following a very impressive rally, the sector “feels” like its in the early stages of at least a mild pullback.

ASX200 Materials Sector Chart

Today we have bracketed the stocks together in a few cases as we look for any interesting scenarios following recent weakness.

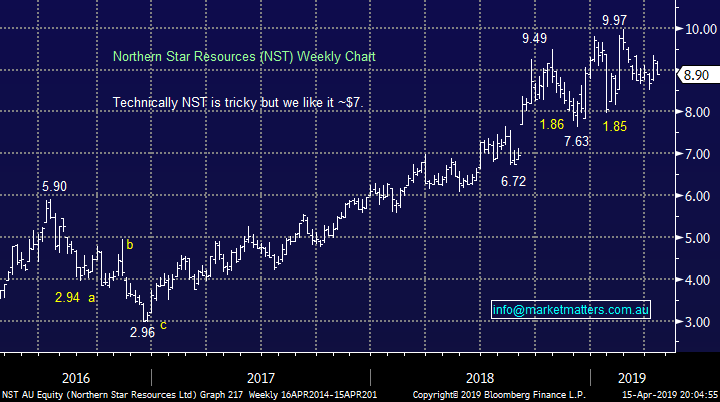

1 Bank of Queensland (BOQ) $8.78

Last week BOQ released its half year results which even the CEO described as poor due to challenging revenue and cost environment. The stock was not surprisingly slammed and it now sits within striking distance today of fresh 5-year lows, the stock’s current yield of 8.66% fully franked is clearly attractive but the question is will it remain sustainable.

Due to the huge IT and structural costs facing the likes of BOQ, Bendigo Bank (BEN) and Suncorp (SUN) in the years ahead we believe mergers are almost inevitable, an outcome that would in all probability produce a nice healthy shot in the arm for the respective stocks. MM is considering a relatively small holding in both BOQ and BEN which pay excellent dividends starting next month in anticipation of such mergers.

MM likes BOQ into weakness looking for sector mergers in the years ahead.

Bank of Queensland (BOQ) Chart

Bendigo Bank (BEN) Chart

2 Bellamy’ s (BAL) $9.31.

We discussed BAL in the Weekend Report as “Trade of the Week” saying – “This is a case of risk / reward as opposed to pure quality, Bellamy’s has been a trading stock for the last few years and until further notice it will remain so to MM. So far over the last 2-years BAL has followed the technical picture extremely well while the downtrend has been painful for long-term investors.”

We called the stock an aggressive buy with stops below $9.30, assuming those stops are triggered today which feels likely our view will become neutral to negative.

MM would only consider BAL into fresh lows below $6.50.

Bellamy’s (BAL) Chart

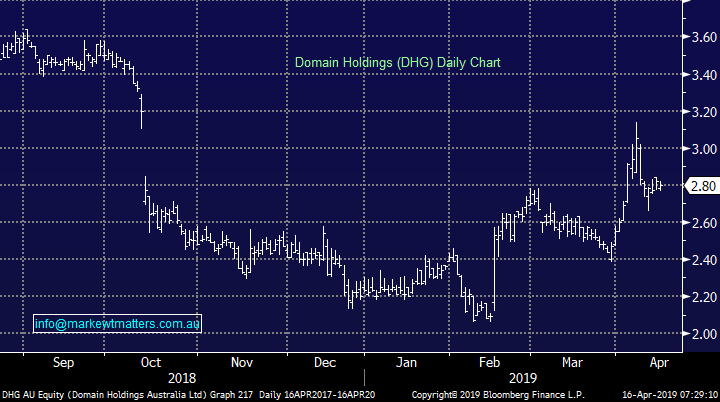

3 Domain Holdings (DHG) $$2.80

DHG is the understudy / rival to REA Group (REA) and both have struggled since the backend of 2018 with falling property prices and more importantly turnover / listings an issue. If the Australian property market moves into a period of multi-year stagnation things could easily become much tougher.

We are not keen on DHG but if we were buying stops would be below $2.65.

MM is neutral DHG

Domain Holdings (DHG) Chart

4 CSR Ltd (CSR) $3.40

Building company CSR has clearly suffered from the construction slowdown with the question being is its bounce in 2019 in anticipation of an improving outlook in 2020 and beyond, or is it’s a dead cat bounce as we saw in mid-2018.

The company’s shares are trading on an undemanding Est P/E for 2019 of 9.3x while yielding 7.8% fully franked. We can see reason to start slowly building a position in CSR but we would maintain some $$ to average if we do find ourselves in a global recession which could easily lead to a break of the 2018 $2.62 low.

MM is neutral to positive CSR with ideal initial buying ~$3.20.

CSR Ltd (CSR) Chart

5 BlueScope Steel / Sims Metal (SGM)

Last week MM was stopped out of our SGM position but BSL has now slipped into a reasonable risk / reward area but not for us after last week.

MM likes BSL at current levels with stops below $12.90.

BlueScope Steel (BSL) Chart

6 Orocobre (ORE) / Galaxy Resources (GXY)

In 2018 the lithium space became way too euphoric and optimistic ignoring the increased supply that was come on line which led to a collapse in the likes of ORE and GXY however the electric car et al revolution is very real hence the demand side looks likely to remain strong. The question here is whats fair value moving forward. The answer we currently have put in the too hard basket with so many moving parts e.g. in China there are now 500 EV companies (electric vehicle) surely a number that will more than half in the years ahead illustrating the excesses that new industries can create which are very dangerous especially for those arriving late to the party.

NB The professional market remains bearish both of the stocks with GXY and ORE the 1st and 8th most shorted stocks in the market – not a good sign to us.

MM is neutral both ORE and GXY.

Orocobre (ORE) Chart

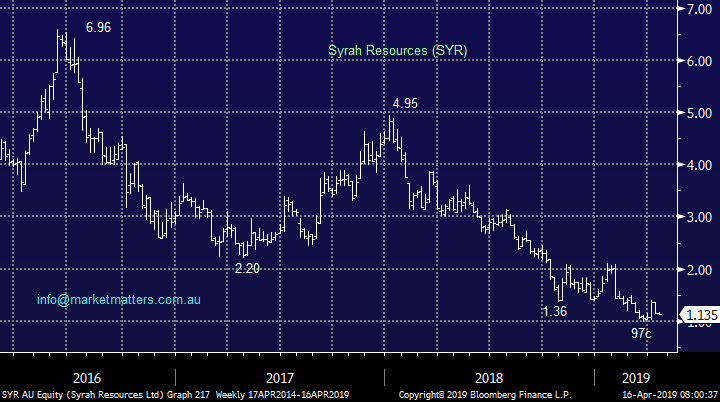

7 Syrah Resources (SYR) $1.13

Graphite miner SYR has been an awful tale of wealth destruction over the last 3-years as the market remains unconvinced they can turn their production into profits in the EV space - a similar tale to ORE and GXY.

Syrah is still the second most shorted stock in the ASX200.

MM is neutral SYR.

Syrah Resources (SYR) Chart

8 South32 (S32)

We have been wary of diversified miner S32 for weeks and the stock price is starting to reflect our fears – a further decline of 10-20% would not surprise. If the Materials sector is indeed poised for a pullback it would appear that S32 is going to lead the way.

The company produced solid half year earnings in February and is undergoing a buyback which increases the disappointment with the recent performance – we don’t like markets that fall on “good news”.

MM is bearish S32.

South32 (S32) Chart

Conclusion

Of the 10 stocks looked at today none really excited us right now.

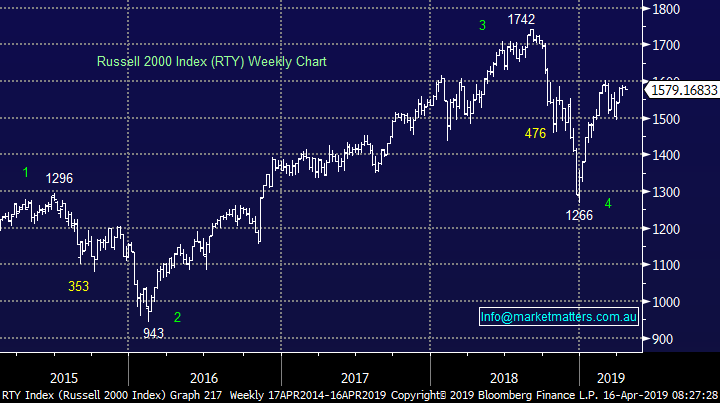

Global Indices

US stocks were again very quiet last night as Easter approaches. Medium-term we still think the NASDAQ has another ~5% upside medium-term but a pullback feels overdue – importantly our 8000 target for the NASDAQ is only a good week or two away in today’s market!

With both the S&P500 and tech based NASDAQ recently reaching fresh 2019 highs we have turned mildly neutral / negative US stocks.

US Russell 2000 Chart

No change with European indices with BREXIT gaining an extension it’s again become yesterday’s “fish and chip paper”, we remain cautious or even slightly bearish in this region.

German DAX Chart

Overnight Market Matters Wrap

· The US equities market closed with little change overnight as current earnings from financials (Citigroup and Goldman Sachs last night) reported in line with analyst expectations.

· On the commodities front, crude oil lost 0.77% to settle at US$63.40/bbl. as a report showed an increase in US oil-rig activity.

· Locally, our Aussie battler and bonds will be in focus as the RBA releases the minutes of April’s rate decision meeting.

· BHP is expected to underperform the broader market, likely from its energy exposure, after ending its US session down an equivalent of -1.20% from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open marginally lower, testing the 6245 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/04/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.