Are we seeing the next big sector rotation with healthcare & resources set to be the losers?

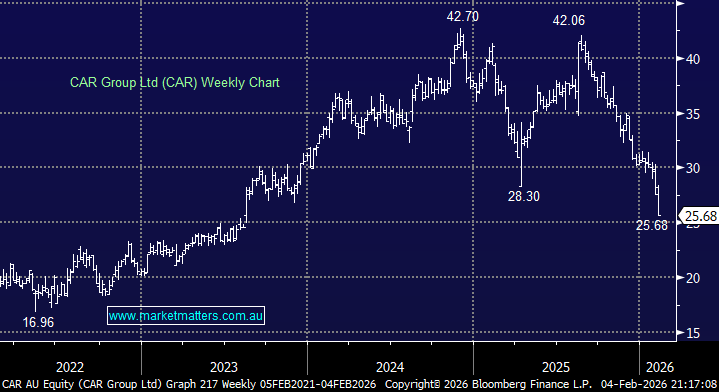

“Hump Day” was fascinating this week as we saw the ASX200 slip 21-points while under the hood the volatility was really eye catching as sector rotation accelerated like a pumped up Ferrari, we saw the Financials & Telco’s rally ~+1% & +1.6% while the Healthcare & Resources fell -1.5% and -1.9% respectively. However on the stock level the rotation was even more pronounced as we saw the iron ore stocks get smacked with Fortescue (FMG) leading the way tumbling -8.3% while boring old Telstra (TLS) rallied +2.1% making fresh 6-month highs.

Its been a long time since we saw the “Big 3” RIO, BHP and FMG fall on average over 5% in just one day but the firm banking sector again managed to limit the overall markets loss. The markets are fascinating at present, with a number of questions being asked including are the banks holding up because of looming rate cuts which may lead to a recovery in the Australian housing market? Are investors starting to embrace the MM view that the $A has found a floor which creates a headwind for resources and healthcare stocks but makes our overall index attractive to O/S Investors moving forward? For every answer a new question appears to surface but happily with the increased volatility on the stock level comes increased opportunity.

For the record MM believes the answer to the above 2 questions is yes in both cases with the banks also enjoying a major tailwind of anticipated rate cuts making their dividends very attractive while the pressure on margins / earnings not appearing to come under scrutiny at present. Also with the “Big 3” resources the iron ore price is the tune leading the share price dance.

Our short-term outlook for the ASX200 is unchanged, we continue to feel the market is positioning itself for a begrudging pullback towards 6100 and potentially 6000 with the recent 7-weeks consolidation around the psychological 6200 area fitting our mildly negative picture, a close below 6220 is now required technically for us to feel on the money.

The ASX200 has achieved our upside target area switching us back to a neutral / bearish stance short-term.

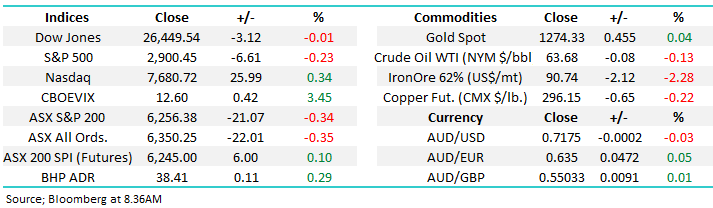

Overnight the US indices again closed mixed with the S&P500 lower but the tech based NASDAQ higher, the main standout was the Healthcare sector which fell almost 3%. The SPI futures are calling the ASX200 to open marginally higher.

As we head into the break we thought this morning was an opportune time for us to reassess 3 of the most influential sectors in the ASX200 before the long Easter break.

**There will be no Weekend Report on Easter Sunday, reports resuming Tuesday morning**

ASX200 Chart

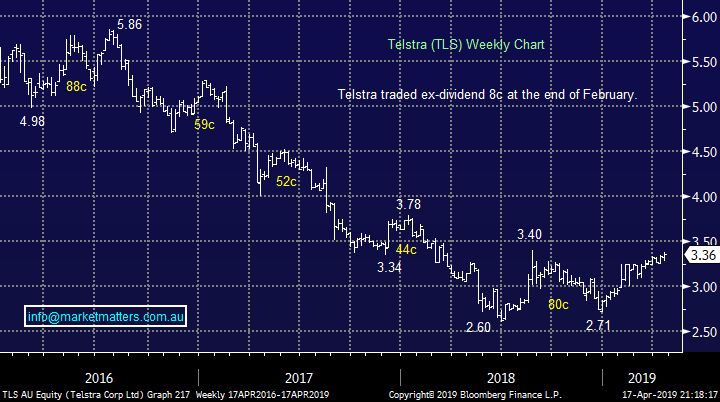

We mentioned Telstra (TLS) earlier following its strong day rallying to fresh 6-month highs, MM remains bullish targeting the $3.50 area, or 4% higher. At this stage we are pondering by what degree to reduce our large exposure to TLS if / when our target area is reached. This is a position that has attracted a few tough questions / comments throughout the months in our Monday Question reports but so far its illustrating perfectly that investing is about both the business quality and the price you pay for it.

MM remains bullish TLS with an initial target ~$3.50.

Telstra (TLS) Chart

Situation risk is something all investors live with week to week and its why prudent investing incorporates a spread of risk – having all your eggs in one basket when a left field event occurs can be a financially very painful experience.

Yesterday we woke up to see Italian soccer giants Juventus had lost in the Champions League to young upstarts Ajax from Holland, a result that was not in the script for Ronaldo et al. The stock was hammered closing down 18% as the revenue loss from the early exit from soccer’s major club competition was calculated – the E100m “punt” by the Italians when they bought Ronaldo is now looking questionable, a bit like a poorly executed takeover.

Juventus Football Club (JUVE IM) Chart

Are we at an inflection point for 3 large Australian sectors.

Today we have taken a look at 3 of the major sectors within the ASX200 as rotation is dominating the market i.e. money is being switched between both stocks and sectors as opposed to leaving / entering the overall market, this is illustrated by the ASX200 bouncing around the 6200 region for ~8-weeks.

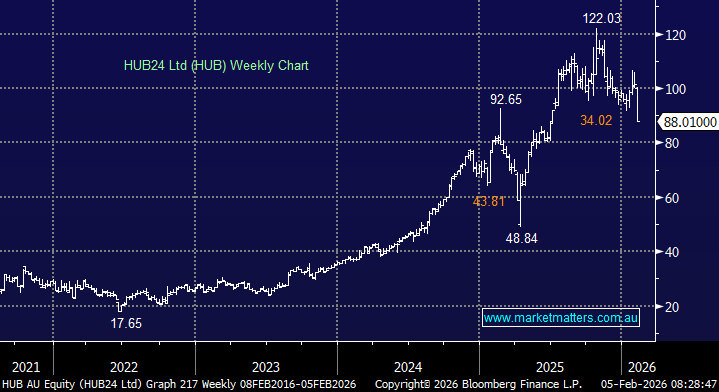

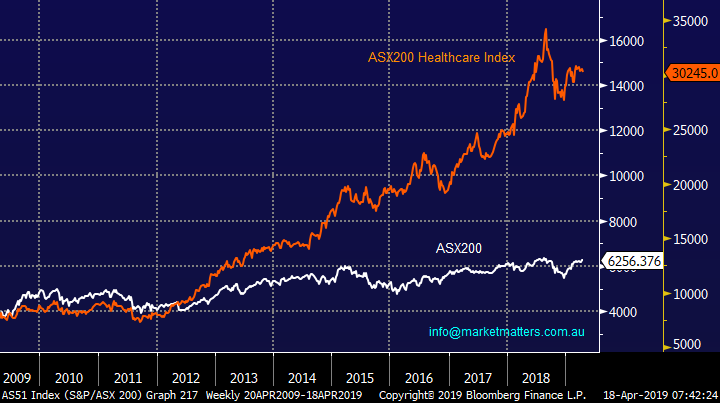

1 Australian Healthcare sector

I have started off with the healthcare sector as we have been fairly vocal around the sector in 2018/9. Since the GFC the ASX200 has doubled while the Healthcare sector has more than quadrupled but the story has been very different since August last year when we have seen the popular sector fall ~10% while the index has slipped less than 2%, before we include dividends. The market has rerated the sector on a price / valuation basis with the question is there further to go.

The major stocks in the sector like CSL, Cochlear (COH) and ResMed (RMD) are world class businesses but what price should we pay, especially as we still believe the market is overweight these outperformers – it’s a similar story to Telstra earlier but in reverse. In this case we like these businesses but MM feels there is a very good chance of buying them cheaper.

Over the last decade the sector has enjoyed the strong tailwind of a weak $A and falling interest rates but we feel these multi-year trends are slowly coming to a conclusion – remember stocks generally turn at least 6-months before the underlying fundamental changes.

MM remains cautious at best towards the healthcare sector at current levels and will maintain an underweight position at most.

ASX200 v ASX200 Healthcare sector Chart

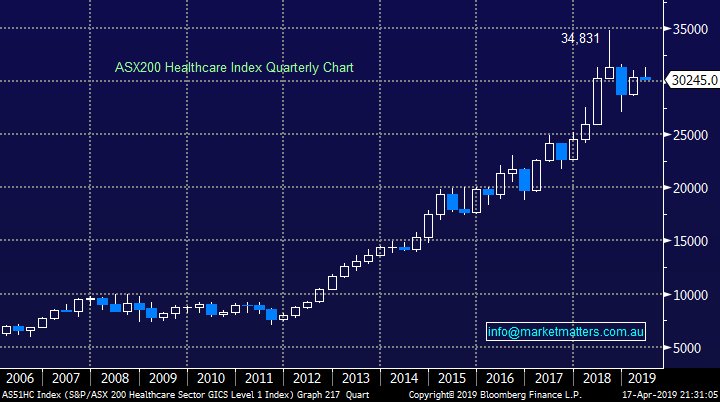

When we look at the Healthcare sector long-term a further 15% pullback would not surprise, in the bigger picture its hardly a dent in the extremely impressive advance which primarily kicked into gear ~2011.

From a risk / reward perspective we like the Healthcare sector as one over 10% lower.

ASX200 Healthcare Index Chart

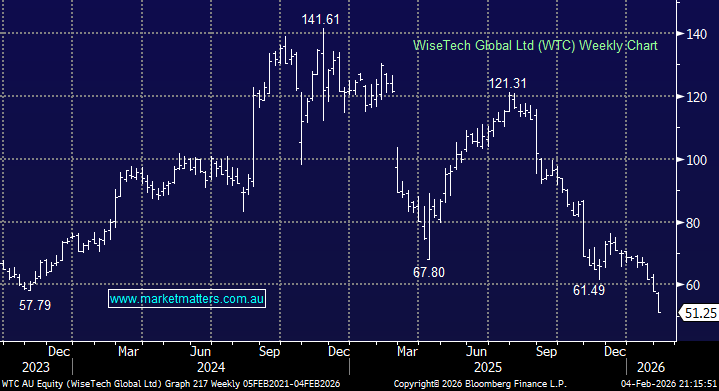

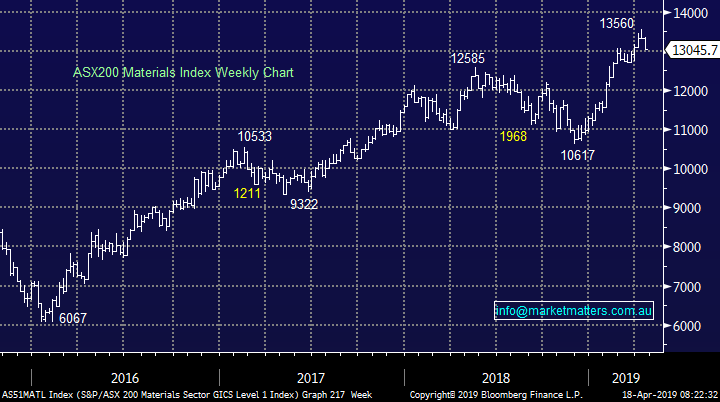

2 Australian Materials / Resources sector

The Australian resources sector has enjoyed a bumper few years but we should not lose sight that along the way the sector has pulled back 11% and 15% warning us that chasing the current new highs is a dangerous game. Much of the surge in 2019 is due to the Vale disaster in Brazil which sent the price of iron ore up over 50% but history tells us that this type of event has often created tops in markets – in the last 2-days Fortescue (FMG) has dropped over 10% showing the volatility in the sector.

Undoubtedly the “Big 3” have now become impressive cash cows and their capital management programs has clearly put them into the corner of high yielding stocks but with the underlying risk of commodity prices moving forward.

MM likes the resources stocks into weakness where the risk / reward becomes more attractive..

ASX200 v ASX200 Materials / Resources sector Chart

When we take a glance at the Materials sector as an index its only 3.7% below its multi-year high following a very impressive rally, the sector “feels” like it’s in the relatively early stages of at least a mild pullback.

Technically we like the sector ~2.5% lower with stops another 5% lower, good risk / reward.

ASX200 Materials Sector Chart

3 Australian Banking sector

MM is concerned that the markets focusing on the yield of the banks and not their earnings risk moving forward but we are still currently comfortable with our equal holdings in CBA, NAB and Westpac. If we consider the extreme case of NAB, its yielding 7.8% fully franked while 3-year bond yields are at their lowest level in history, its hard to argue with the “wriggle room” for dividends to be trimmed and still remain extremely attractive from an income / yield perspective.

Also from a long-term perspective the banks have been falling for 4-years so valuations are clearly becoming more attractive it’s a play off between efficiency improvements as branches are closed / headcounts reduced and underlying margin contraction in today’s tough low interest rate environment.

MM is considering adding some regional banks to our Growth Portfolio for reasons discussed in previous reports.

ASX200 v ASX200 Banking sector Index Chart

We often talk about the elastic band being too strethed and when we look below its not hard to see why healthcare stocks have encountered some selling and banks a little buying. Likewise the value gap between resources and banks has continued to stretch in 2019 but it doesn’t feel as pronounced to us just yet but we would not be surprised to see some “hot money” leave the resources sector as looked the case yesterday.

ASX200 Banking / Healthcare & Materials Sectors Chart

Conclusion

Of the 3 sectors we saw today at current levels we are not keen on Healthcare, like Resources a few % lower and are comfortable with our bank holding from a yield perspective.

Global Indices

US stocks were again very quiet last night as Easter approaches. Medium-term we still think the NASDAQ has another ~5% upside medium-term but a pullback feels overdue – importantly our 8000 target for the NASDAQ is only a good week or two away in today’s market!

With both the S&P500 and tech based NASDAQ recently reaching fresh 2019 highs we have turned mildly neutral / negative US stocks.

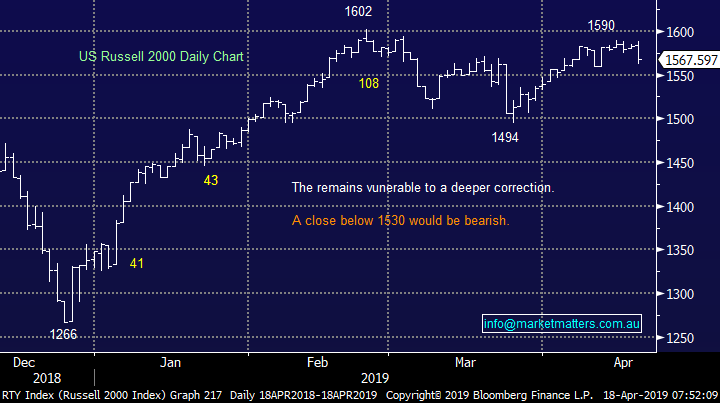

US Russell 2000 Chart

No change with European indices, we remain cautious as we enter the “sell in May and go away” period for European stocks.

German DAX Chart

Overnight Market Matters Wrap

· The US market closed little changed overnight with strong earnings from the likes of Morgan Stanley and PepsiCo offset by weaker IBM earnings number and continuing weakness in healthcare stocks, which fell 2.9% on fears of increased regulatory hurdles. Tech stock Qualcomm also rallied another 12%, following yesterday’s 23% jump, after settling a regulatory dispute with Apple.

· In this early stage of the US reporting season, with only a handful of companies reported, 84% are ahead of analyst estimates.

· Commodities were also mixed despite stronger than expected growth numbers from China as well as continued signs of buoyant US growth. Yesterday China reported GDP of 6.4% pa in the first quarter, while industrial production in particular was well ahead of expectations at 8.5% pa.

· BHP is expected to outperform the broader market, after ending its US session up an equivalent of 0.29% from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open 10 points higher, towards the 6270 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/04/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.