5 stocks MM is watching post Easter (SIQ, SGR, NCM, FMG, LLC)

I hope everyone had a wonderful Easter, the Sydney weather certainly turned it in on for us in the big smoke. Unfortunately we are going to hear a lot about the election over the coming few weeks but we will keep our day to day political comments to a minimum unless we see a major switch in the polls, if you believe the bookies the Federal election on May the 18th is slowly becoming a tighter affair with the Coalition coming in from 5.2 to 3.85 but with Labor remaining huge favourites at 1.25 - it still appears we about to witness a significant change to the Australian taxation policy towards dividend imputation.

Our short-term outlook for the ASX200 is unchanged, we continue to feel the market is positioning itself for a begrudging pullback towards 6100 and potentially 6000 with the recent 8-week consolidation fitting our mildly negative picture, a close below 6220 is now required technically for us to feel on the money. However as we have mentioned a number of times previously under the hood the action has been far more interesting with recently most of the fund managers gaining over 10% while the Energy & Healthcare stocks have struggled.

The ASX200 has achieved our upside target area switching us back to a neutral to slightly bearish stance short-term.

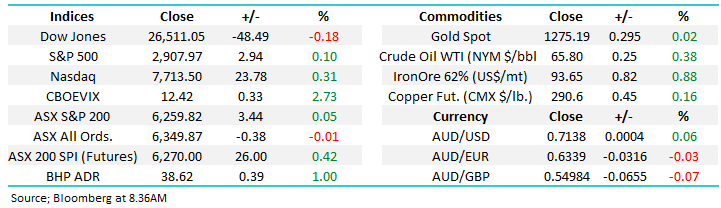

Overnight the US indices were quiet with gains in the tech based NASDAQ while the Dow slipped almost 50-points - the main standout was crude oil which surged +2.7% as the US toughened its sanctions towards Iran. The oil price appeared to help BHP in the US as it rallied ~1% which should help the local index this morning.

As we move into a very short week with Anzac Day on Thursday we have looked at 5 stocks MM are watching closely post Easter, especially as we are holding 30% cash in our Growth Portfolio.

ASX200 Chart

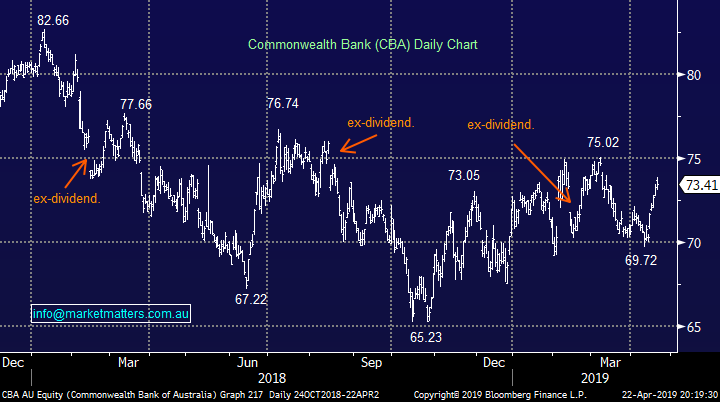

Commonwealth Bank (CBA) has rallied strongly over the last 6-days gaining ~5% as the banking sector has been the backbone of the index with the “Big Four” gaining an average of +4.5% in just 5 days.

One of the catalysts for the strength was the rumour that CBA was about to make 10,000 staff redundant and close 300 branches. However the Finance Union is now taking CBA to the Fair Work Commission in an effort to confront the bank on the supposed “secret plans”. We don’t anticipate a major sell-off in CBA after the news but a rest would not surprise.

MM remains comfortable with our 8% & 7.5% CBA holdings in our Platinum and Income portfolio’s respectively.

NB We recently tweaked our CBA holding from 10% down to 8% in our Growth Portfolio but we have no expectation of reducing further.

Commonwealth Bank (CBA) Chart

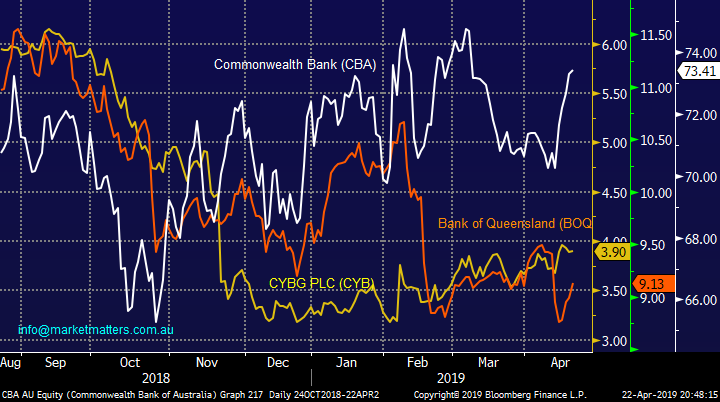

The banking sector has actually been fairly volatile on the fringes over the last 6-months with CYBG (CYB) tumbling by 50% into December before bouncing almost 30% - analysts almost on mass deserted the UK bank after some poor corporate performance but how often do we see shares find a bottom when things look awful i.e. CYB has outperformed the regionals BOQ and BEN by around 20% in 2019.

Following BOQ’s poor result just over 10-days ago MM is looking at the battered regional into current weakness i.e. over the last 3-months CBA has outperformed BOQ by ~13% even before CBA’s $2 fully franked dividend in February. BOQ goes ex-dividend 34c fully franked on the 1st of May, that’s a whopping 8.3% fully franked if it can be maintained.

MM is still considering underperformers BOQ and BEN as mergers by one or both feels almost inevitable.

Commonwealth Bank (CBA), CYBG (CYB) & Bank of Queensland (BOQ) Chart

5 stocks we are looking at post Easter.

Today we have taken a look at 5 stock we are considering post Easter with an eye on their relationship with the ASX200 which feels slightly tired at current levels.

1 SmartGroup (SIQ) $8.03

The salary packaging and fleet management provider shares have struggled badly in the last ~6-months falling over 45%. Earlier this month they were dumped to a 1 ½ year low following the announcement that their MD had sold over 1 million shares.

While we never like to see insider selling the fact that Mr Billimoria still holds another ~3 million shares is encouraging. In February the company announced a very encouraging 18% increase in revenue to over $240m and a 22% increase in Net Profit After Tax to almost $80m. Around the $8 area the shares are trading on an undemanding Est P/E of 12.47x for 2019 while yielding 5.2% fully franked with the possibility of further special dividends.

The stock is clearly running its own race which we like plus its in the basket of potentially cheap / oversold stocks which regularly outperform in mature bull markets.

MM likes SIQ at current levels with an initial target above $10.

SmartGroup (SIQ) Chart

2 Star Entertainment (SGR) $4.58

SGR has been in a number of MM reports recently as the shares fell close to our $4 target area just before Wynn Resorts made a bid for Crown (CWN) which has subsequently been abandoned. However SGR has remained strong as the move by the US based casino giant brought the sector back into focus.

With the local casino and hotel operator trading on an Est P/E of 16.6x for 2019 and yielding 5% fully franked we feel the downside is limited especially as the sector now feels “in play”. Similar to SIQ the companies shares have struggled since 2018 leaving plenty of room for at least an aggressive countertrend bounce.

MM likes SGR ideally slightly lower.

Star Entertainment (SGR) Chart

3 Newcrest Mining (NCM) $25.24

NCM has well and truly shaken off the mantle of serial underperformer in the gold space performing strongly in 2019. Similar to other resources companies the gold sector needs the underlying precious metal to remain strong to assist profitability. As we know the gold price is influenced by a number of factors including being regarded as a defensive play during times of uncertainty as well as an economic safe haven in periods of increasing inflation – neither of the these major factors are at play today but markets do look ahead.

While NCM has remained in a clear trading range for 3-years our feeling is a breakout to the upside is becoming an increasingly strong possibility. Our major concern is the tailwind for the sector of a very weak $A in our opinion may actually become a headwind in 2019 / 2020 but if the underlying gold price manages to rally strongly this can be more than offset.

MM likes NCM below $24.

Newcrest Mining (NCM) Chart

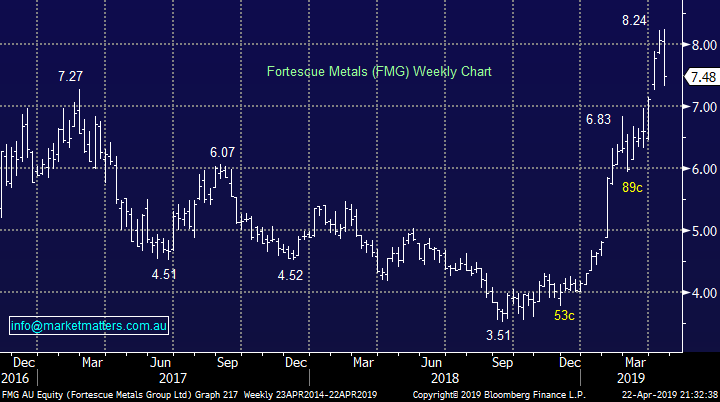

4 Fortescue Metals (FMG) $7.48

FMG has enjoyed an amazing 2019 with the 50% appreciation in iron ore due to the awful Vale disaster in Brazil clearly a major contributor.

We don’t want to chase a volatile stock that has doubled in 2019 but as last week illustrated decent pullbacks will almost definitely unfold in this stock e.g. FMG fell well over 8% in just one day last week. At this stage we are on the sidelines looking for a good risk / reward opportunity to unfold to enter what is a solid business paying a strong yield.

MM is neutral FMG just here but anticipates an opportunity between now and the end of May.

Fortescue Metals (FMG) Chart

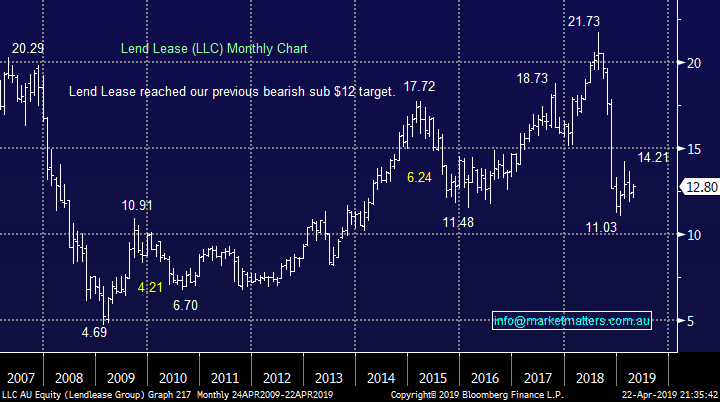

5 Lend Lease (LLC) $12.80

LLC undoubtedly has had an awful time of late but after reaching our $12 target we have switched to more positive stance after being bearish for virtually all of 2018.

Following the huge impairment charges in November it feels like the worst is behind LLC and the company is building a platform for a recovery – especially if they can divest themselves of their problematic engineering division. They are also facing a class action however if history is a guide, class actions create more media hype than financial impact.

MM likes LLC looking for an initial 15-20% upside.

Len Lease (LLC) Chart

Conclusion

Of the 5 stocks we looked at today our favourites at todays prices are SIQ and LLC with the others more appealing slightly lower.

Global Indices

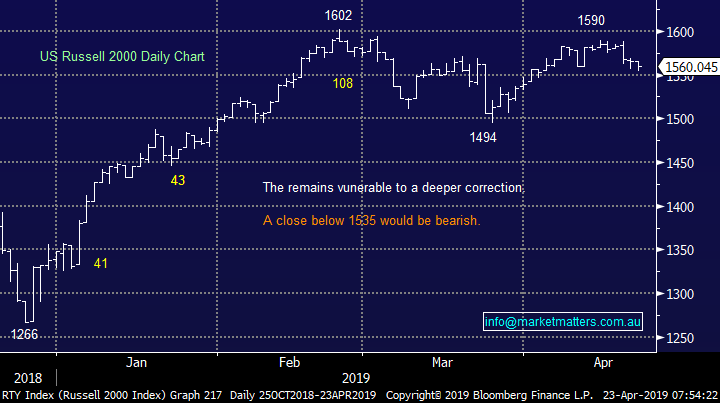

US stocks were again very quiet last night as the Easter influences continue. Medium-term we still think the NASDAQ has another ~5% upside but a pullback feels overdue – importantly our 8000 target for the NASDAQ is only a good week or two away in today’s market!

With both the S&P500 and tech based NASDAQ recently reaching fresh 2019 highs we have turned mildly neutral / negative US stocks.

US Russell 2000 Chart

No change with European indices, we remain cautious as we enter the “sell in May and go away” period for European stocks.

German DAX Chart

Overnight Market Matters Wrap

· The most recent trading session post the Easter break saw the Dow fall 0.18%, while the S&P 500 and NASDAQ rallied 0.1% and 0.22% respectively.

· The US said it would end waivers that allow some purchases of Iranian oil. As a consequence, crude rallied to $US65.80/bbl. The Saudis said they will try to fill the supply shortfall.

· On the data front, US existing home sales and housing starts both came in below analyst expectations. First quarter GDP data will be released on Friday. Major tech companies will be some of the most closely watched stocks in a full week of company earnings releases.

· Nickel fell, however most metals on the LME were better. Iron ore rose and gold is currently stable at $US 1275.19/oz.

· The energy sector is expected to outperform the broader market, with BHP set to open 1.00% higher from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open 33 points higher, testing the 6300 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/04/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.