Reviewing 5 of the World’s largest 10 companies

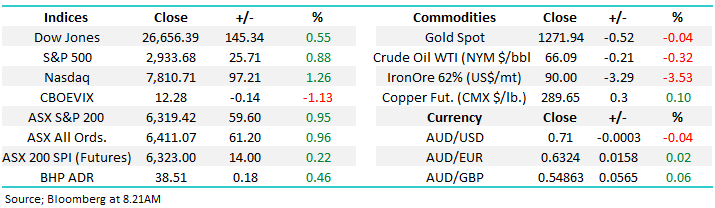

The ASX200 roared through the psychological 6300 area yesterday with all 11 market sectors closing in the green leading to thoughts / reflection on our latest PM report. Local stocks have again pre-empted a strong move on Wall Street where the tech based NASDAQ closed at all-time highs, it will be interesting to see if we see ongoing strength today or was an anticipated strong US session built into Tuesdays gains.

In yesterday’s PM report we outlined some thoughts by Phil King from Regal Funds Management (published on Livewire) which revolved around his questioning the consensus trade that the local market needs a correction, easy to argue but perhaps too many investors are sitting on cash, like ourselves, looking to buy lower.

“What happened in February last year and December last year, the market tried to go down, but just the power of buying pushed it higher. I certainly think that it's too early to get too negative on the market. I think with bond yields where they are in Australia, it makes the equity market look very, very cheap” (Phil King)

However an additional and very poignant thought crossed my mind overnight when talking to my parents who are selling their house(not a great time) plus feedback from our MM staff. The estate agent telling them ‘nothing likely to happen before the election’ while MM staff hearing the consistent theme of – “we are sitting on our hands and not investing until after the election, what Bill Shorten is going to do with dividends scares me” etc.

In other words this huge rally in 2019 has not been enjoyed by a huge number of Australian retail investors because of next months election. While we wrote yesterday we’d write very little on the election, it’s hard not to. Let’s just consider 2 scenarios:

1 – Labor wins the election as the market, polls and bookmakers expect, what then? The answer is nothing in our opinion – it’s no surprise and the market / overseas investors may actually applaud the fact Australia has a clear majority in power, even if it is the wrong colour for the mkt. It doesn’t change the fact investors will still struggle to get much over 2.5% from a term deposit compared to say Westpac (WBC) paying 6.92% fully franked for those can still enjoy the tax benefits moving forward plus to compound the differential, term deposit rates look likely fall further in 2019 / 2020.

2 – The Liberals pull off a BREXIT / Trump style surprise and the market will probably gap up strongly.

Either way it doesn’t look too bad for equities compared to fixed income especially as those invested are way ahead already as Q2 gets into its stride. Fortunately at MM although we do hold a large cash position our stock selection is holding up well.

Technically yesterday’s rally negates our bearish short-term thoughts unless the ASX200 closes back below 6285 – however we do remain wary of the next 4-6 weeks with the average return for May & June over the last decade -4.6%, especially following the basically uninterrupted 909-point / 16.8% rally since late December.

The ASX200 has achieved our upside target area leaving us now neutral while 6270 holds.

Overnight the US indices were again strong led by a rampaging NASDAQ which is rapidly approaching our 8000 target area i.e. less than 3% away. The SPI futures are pointing to the ASX200 opening up around

20-points implying we did most of our efforts on the upside yesterday.

This morning we have focused our report on 5 of the world’s largest 10 stocks as we evaluate if global stocks are a bullish train still worth chasing.

ASX200 Chart

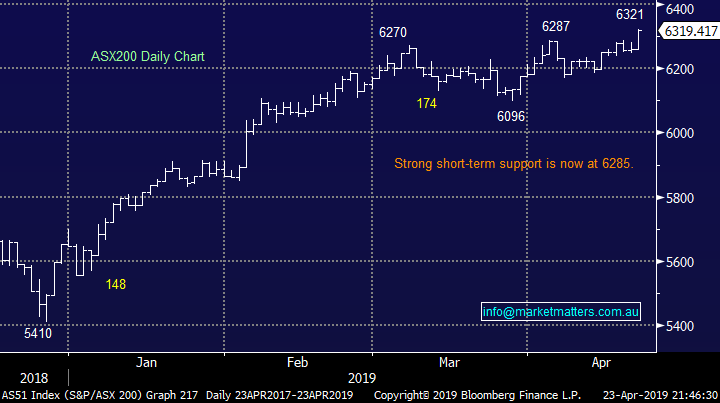

Yesterday we saw the Australian 3-year bonds again close below the official target RBA cash rate of 1.5% as expectations for a rate cut, or two, in 2019 intensify.

Pundits are anticipating todays inflation figures will pave the way for a local rate cut especially following the RBA’s comments in its latest statement that “an interest rate cut would be appropriate if inflation disappointed” – our interpretation at MM is Australia’s central bank is laying the foundations for at least one rate cut in 2019 and probably another in 2020.

MM expects Australian interest rates will be cut at least once in 2019.

Australian 3-year bond yield Chart

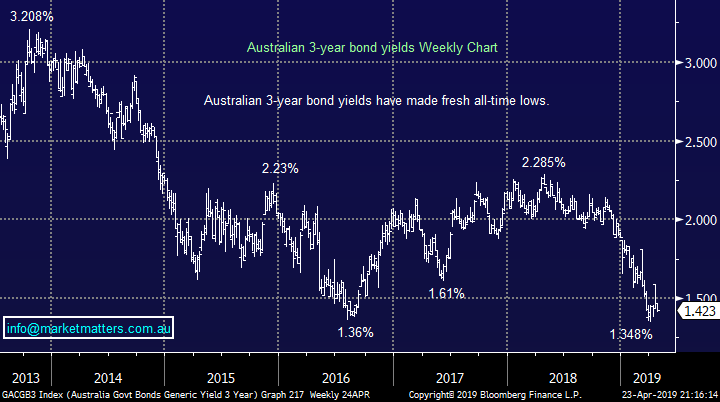

Over the last 3-months we have seen Australian regional Bank of Queensland (BOQ) fall -9.5% & Bendigo Bank (BEN) -7.5% while Telstra (TLS) has rallied +17.6% plus also paying a dividend in February.

We feel the elastic band is becoming stretched between the Australian regional banks and TLS with the later also nudging our $3.50 target yesterday. Focussing on yield (rather than growth) that gap now significantly favours the banks e.g. BOQ is yielding 8.25% fully franked compared to TLS at 5.6%.

Also to further cloud the water for Telstra (TLS) Macquarie Group (MQG) has announced they are preparing to launch a mobile phone business - a surprising move that will increase competition in an already tough market.

MM is still considering switching part of our Telstra (TLS) position to a regional bank.

Telstra (TLS) & Bank of Queensland (BOQ) Chart

Evaluating 5 of the world’s largest & most influential stocks.

Today we have taken a look at 5 stocks we consider have a major influence on global markets due to both their size and overall global footprint.

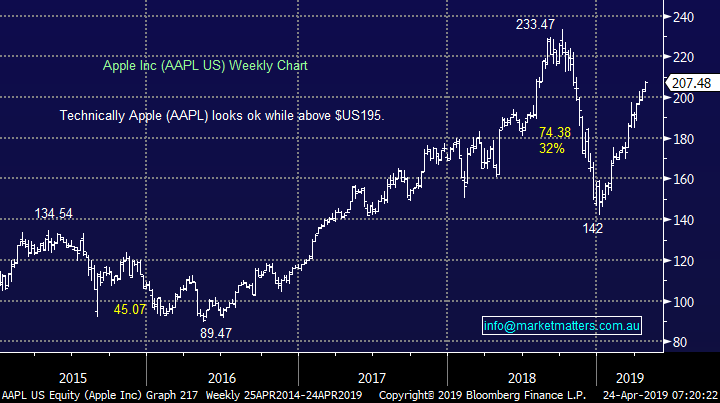

1 Apple Inc (AAPL US) $US207.48

Apple’s market cap sits just below $US1trillion and their release of earnings later this month could easily see them again break the psychological milestone.

The company has an amazing ~$US250bn cash pile providing huge ammunition to the business moving forward. While we are less excited by AAPL’s product offering now which doesn’t feel like its progressed too far over recent years + competition has intensified, they certainly have the cash to fund some exciting R&D moving forward. As would be expected the short-term direction of the stock is likely to be dictated by this month’s report.

MM is neutral / positive AAPL at present.

Apple Inc (AAPL US) Chart

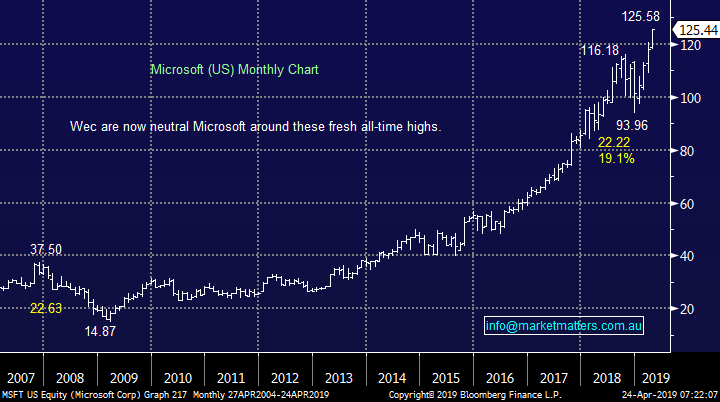

2 Microsoft (MSFT US) $US125.44

MSFT has broken to fresh all-time highs as we anticipated earlier in the year with tonight’s result likely to set the tone in Q2 – in January they smashed estimates by ~18%. The stock could easily join the elite $US1trillion club with a good set of numbers - its only ~4% away.

This is clearly an excellent company but the risk / reward from its shares is not as exciting as earlier in the year. From a technical perspective if we were long MSFT we would be taking part profit at today’s levels.

MM is now neutral / positive MSFT.

Microsoft (MSFT US) Chart

3 Alphabet Inc (GOOGL US) $US1270.59

Google as its better known looks very similar to MSFT did in January and as such we are bullish technically targeting a further 5-10% upside. The company reports in 5-days’ time hence a good set of numbers could easily see our target area achieved. Last quarter saw strong revenue growth fuelled by strong performance from advertising and “other” Google revenue and investors will be hoping for a repeat performance.

MM likes GOOGL just here but similar to MSFT would be lightening our holding if we were long above $US1300.

MM is short-term bullish GOOGL.

Alphabet Inc (GOOGL US) Chart

4 Alibaba (BABA US) $US187.29

E-commerce giant Alibaba dominates e-commerce in China with almost 60% market share while enjoying excellent growth in its “add on businesses” like digital advertising and cloud computing.

We like the company but the risk / reward is not exciting at present, we prefer the stock closer to $US170.

MM is neutral BABA.

Alibaba (BABA US) Chart

5 Tencent (700 HK) HKD393

Internet goliath Tencent has just managed to recover 50% of its losses from 2018 and compared to the previous 4 stocks it looks / feels fairly lacklustre.

The recovery has been assisted by China relaxing its gaming restrictions but this can always occur again – it’s the risk of doing business in the communist country. Fortunately for the company Tencent music appears on track but we are not excited by the stock back around this HKD400 area.

MM is now neutral Tencent.

Tencent (700 HK) Chart

Conclusion

Of the 5 stocks we looked at today we are not bearish any but only Google looks good value i.e. the group is moving from bullish to neutral.

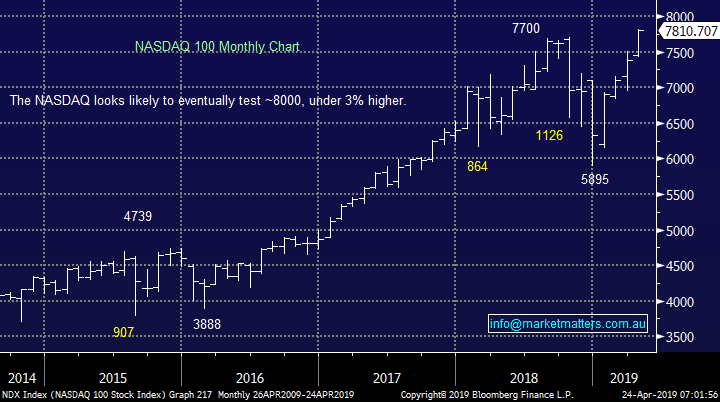

Global Indices

US stocks were strong last night as Easter fades into the distance and earnings take over. Medium-term we still think the NASDAQ has another ~3% upside medium-term but importantly our 8000 target for the NASDAQ is only a good day or two away in today’s market!

With both the S&P500 and tech based NASDAQ recently reaching fresh 2019 highs we becoming increasingly cautious US stocks.

US NASDAQ Chart

No change with European indices, we remain cautious as we enter the “sell in May and go away” period for European stocks.

Euro Stoxx 50 Chart

Overnight Market Matters Wrap

• The US equity markets rallied overnight, ending their session at record highs as recent earnings have generally reported better than analyst expectations.

• Sales of US homes rose to a 1.5 year high, exceeding all analyst expectations. Advisors involved in the US-China trade negotiations said they are closer to a deal and there are more calls for the Fed to cut rates. US 10 year bonds are currently yielding 2.56%.

• Over in the European region, the GBP lost ground as further challenges were apparent on her leadership and BREXIT.

• On the commodities front, crude oil extended its gains overnight, however has eased slightly this morning. BHP is expected to outperform yet again, after ending its US session up an equivalent of 0.46% from Australia’s previous close.

• The June SPI Futures is indicating the ASX 200 to open 27 points higher, testing the 6350 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/04/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.