Don’t panic, it’s only an election on May 18th

The ASX200 drifted lower yesterday on ok volume as the Banks, Financials, Energy, Insurance, Real Estate & “yield play” stocks received some selling pressure as investors appeared to take some money off the table after the recent strong rally courtesy of lower bond yields and the subsequent anticipation of rate cuts for Australia moving forward. The $A even bounced slightly as the AFR suggested that the RBA may weigh alternative stimulatory measures as opposed to simply cutting rates – MM still expects at least one cut by the RBA in 2019.

A busy week kicks off today with the Macquarie Equities Conference starting in Sydney - the agenda below. As we suggested in the PM note yesterday, the timing of the event is perfect for companies to update guidance and release outlook statements given it’s between the Feb & August reporting periods. A period usually known as ‘confession season’.

Today’s Macquarie Agenda:

8.45am – Transurban (TCL), oOh Media (OMH), Sealink (SLK),

9.30am – CSL, Afterpay (APT), Unibail-Rodamco- Westfield (URW), Super Retail Group (SUL)

10.30am – Oil Search (OSH), Domain Group (DHG), Dexus (DXS)

11.15am – JB Hi-Fi (JBH), WiseTech Global (WTC), Charter Hall Group (CHC), Elders (ELD)

12.00pm – Medibank Private (MPL), Costa Group (CGC), Vicinity Centres (VCX)

1.30pm – Fortescue Metals Group (FMG), Mirvac Group (MGR), Breville Group (BRG), Emeco (EHL)

2.15pm – Newcrest Mining (NCM), Corporate Travel Management (CTD), GPT

3.00pm – AGL Energy (AGL), Nufarm (NUF), Bravura Solutions (BVS)

4.00pm – ASX, Bapcor (BAP), Stockland (SGP), Southern Cross Media (SXL)

4.45pm – Tabcorp (TAH)

In our opinion this should be the main game in town for local investors this week. However unfortunately we are hearing numerous local investors becoming totally preoccupied with Bill Shorten and the Labor Party’s planned changes to franking around dividends and SMSF’s in general. While at MM we are definitely not fans of these economic planswe believe its almost financial madness to pack up your bags and leave the local stock market because of some legislative changes if we get a change of government. Remember one of Warren Buffett’s most famous quotes with regard to US stocks, it feels extremely pertinent locally today:

"American business will do fine over time. And stocks will do well just as certainly, since their fate is tied to business performance. Periodic setbacks will occur, yes, but investors and managers are in a game that is heavily stacked in their favour. (The Dow Jones Industrials advanced from 66 to 11,497 in the 20th Century, a staggering 17,320% increase that materialized despite four costly wars, a Great Depression and many recessions” – Warren Buffett.

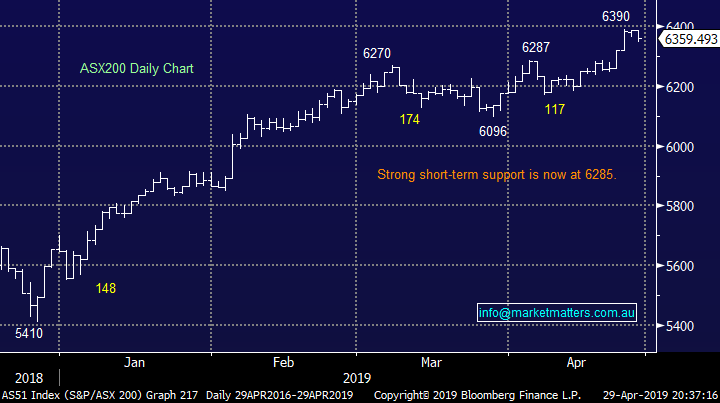

The ASX200 has breached our upside target area leaving us now mildly bullish assuming the 6280 area holds.

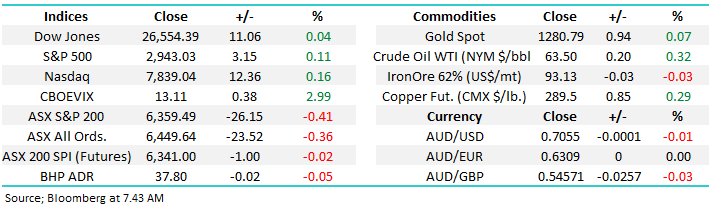

Overnight the US indices muddled through in a very quiet session which has left the SPI futures pointing an unchanged open by the Australian market.

This morning we have attempted to quell the retail investors almost panic around next months election by again delving into Labor’s plans, timing and impact around franking credits moving forward.

ASX200 Chart

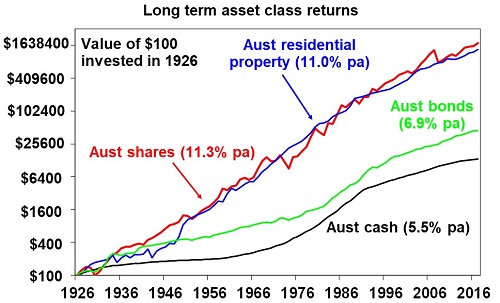

Probably first and foremost the Australian share market has outperformed all other major investments for many, many decades – its simply a proven winner.

The “goal posts” around dividends & SMSF may be moved by Labor but there have been plenty of upheavals over the last 120+ years yet the share market has still provided for the faithful. As a side note we are far more concerned for the ASX when the “free money” which has fuelled assets since the GFC is removed but as we’ve witnessed in early 2019 that may be years away.

Also, we believe 2 big issues are being overlooked by many investors in our opinion:

1 – Transaction costs have dropped dramatically over the last decade while available financial products have increased dramatically hence if you wish to protect against the capital downside risks why not consider some negative facing ETF’s and potentially add value as opposed to simply running to say cash, or overseas equities.

2 – Even when stocks fall some sectors often rally with gold being a classic example, stock and sector volatility should be regarded as an opportunity in our opinion at MM.

As we have mentioned a number of times over recent weeks the market is expecting a Labor victory hence their intended tax changes are already built into the stock prices. The “easy trade” to be in cash during the run up into the May election has proven to be flawed to-date as the ASX200 has appreciated over 18% from its December low – as we always say simply remain open-minded, the stock market will continue to provide many opportunities in the years ahead for the informed.

Australian Shares v Property, bonds and cash Chart

Source: ABS, REIA, Global Financial Data, AMP Capital

Some ramifications of the likely Labor victory.

Many people we talk to are simply considering “dumping” all their money into an Industry Super fund or alternative form of investment but we believe at MM far more thought and consideration is required i.e. assume Labor will win and then make a plan that suits you financially – with term deposits struggling to yield much over 2% there’s potentially a place for say the likes of National Australia Bank (NAB) paying 7.8% before franking in many folks investment portfolio.

Let’s look at a simplification of some of the major likely changes by Labor.

Franking Credits

A new Labor Government plans to remove cash refunds for excess imputation credits – or in other words, those in a no / very low tax environment who get a cash refund from the ATO will no longer get it unless you’re a government supported pensioner, a charity or can take advantage of a few other carve outs. In general terms (and we stress general) a SMSF investor (specifically in pension phase) with a balance of $200,000 and greater will lose income. This will clearly hurt some Australians including many subscribers who we sincerely sympathise with.

However I don’t think that we’ll see a sharp negative reaction to fully franked shares in the short-term given retail investors are not generally the biggest influence on price (institutions / fund managers are) the impact may increase over time and the move will probably add impetus to some already growing trends around asset allocation and the type of income orientated products that are being launched.

This is one of the reasons that MM has launched 2 exciting SMA products including an Income Portfolio.

For example, retail investors have arguably been too overweight Australian equities providing fully franked dividend yield at the expense of quality stocks paying unfranked dividends - we have seen some horrendous examples of fully franked yield traps over the last few years including Myer (MYR), Telstra (TLS) and even the Banks at times, perhaps a more overall market encompassing assessment of stocks will actually benefit local retail investors over time.

There would be a move away from fully franked yield was the obvious initial thought when Bill Shorten started banging his drum but that’s not been a standout trend in 2019 as falling bond yields have helped almost all stocks paying a decent yield, both franked and unfranked. I reiterate we believe it’s very dangerous to simply look at shares in terms of income / franking credits alone.

Our view is Australian investors should remain committed to share market investing and regard any legislative changes as very annoying speed bumps but not life changing events, as we can see below the market has performed strongly over time and selling when the crowd was scarred has proved costly every time.

ASX200 Accumulation Index Chart

Is a change of Government a risk for Hybrids?

Hybrids have been attractive over recent years for income conscious retail investors who can utilise franking credits however the concern is that this income stream will become less attractive for most people affected by Labors change to dividends. Actual demand for hybrids is a good first indicator of whether or not the market (as a collective) is concerned about this looming change. When the policy was first announced, we did see hybrid spreads move wider (implying lower demand) but not materially so.

MM’s view is that the perceived lack of supply of new hybrids over the next 12 months is the major driver of the current demand we’ve been seeing, and it implies that even under a Labor Government there is enough demand outside of the impacted cohort that will keep the market fairly well supported.

Although somewhat of a dark science, research shows that the SMSF investor base into franked hybrids is estimated at around 10 to 15% of the total investor set. While it’s very hard to pin point the likely reaction of investors when changes are made, looking at 1. Demand since the proposed change was announced 2. Low supply over the next 12 months 3. the relatively small proportion of holders that will actually be impacted, clearly suggests that the impact, if any, would be small.

As we’ve written in the past, simplifying things can actually be the best approach – the KISS strategy – and looking at where tier 1 bank hybrids as a group typically trade in terms of margin over the bank bill rate over time, and with varying external influences we can see where the floor and ceiling in the market generally is. As a rule of thumb for Tier 1 major bank securities, a 4% margin means the security is cheap and a 3.00% margin means it’s expensive – that is what history has shown, with the average since 2012 for financial hybrids at 3.60%.

In conclusion is a change of Government a risk for Hybrids? The answer is we doubt it.

Timing & related factors

Not often discussed is the composition of the Senate which looks a tougher call than who will be Australia’s next Prime Minister, and it should be remembered that Labor needs the Upper House to get this financial legislation passed. If the Senate does not tow the Labor line we could easily see a watered down version of Bill Shortens current plan, a not uncommon practice by any political party once they have been elected!

Our estimate on timing is mid-2020 before new policies come into effect hence another 12-months of franking credit benefits at the very worst.

We should also not forget Labor are planning to reduce the attractiveness of investing in property by limiting properties that can be negatively geared. While this is not good news for an already weak property market which clearly affects some related businesses its likely to force many Australian stalwart “property only investors” to consider alternative forms of investment – at MM we can put a glass half-full spin on most things!

One concern we do have at MM is whether the Australian economy is robust enough to withstand the uncertainty and concerns of a Labor victory especially with an indebted consumer. The equity market is usually the best barometer and its telling us things are ok at the moment but we will be on alert for any signs of a recession in the years ahead. Interestingly the banks would probably be the most impacted market sector on a number of fronts under a Labor Government and they’ve enjoyed a stellar 2019, another example of letting the market tell you want it wants to do.

Lastly what if the unthinkable happens and the Liberals win, our opinion is would be ‘hold onto your hats time’ with Retailers, Builders & Developers, Banks, Healthcare and AREIT’s likely to be some of the best performing sectors.

Conclusion (s)

We believe investors that remain open-minded and flexible may actually benefit from Labors proposed changes to franking credits in the medium to long-term BUT we understand it feels extremely unfair / tough medicine to swallow today.

Global Indices

US stocks were mixed overnight as Easter becomes a distant memory although our fridge is still packed with chocolate! Medium-term we still think the NASDAQ has another ~3% upside medium-term but importantly our 8000 target for the NASDAQ is only a good day or two away in today’s market!

With both the S&P500 and tech based NASDAQ recently reaching fresh 2019 highs we are slowly becoming more cautious US stocks.

US NASDAQ Chart

No change with European indices, we remain cautious as we enter the “sell in May and go away” period for European stocks.

German DAX Chart

Overnight Market Matters Wrap

· The US equity markets started their week on a positive note ending its session marginally higher, again hitting record highs led by the financial sector, while its defensive names such as the real estate sector was the laggard.

· Crude Oil settled higher in a volatile session, following a harsh crackdown on Iranian oil exports closing in.

· Plenty of corporate and economic news will be filled this week, particularly with the next round of US-China trade talks. On the US earnings front, almost 80% of the current S&P 500 companies reported have beaten analyst expectations.

· The June SPI Futures is indicating the ASX 200 to open 6 points higher, testing the 6365 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/04/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.