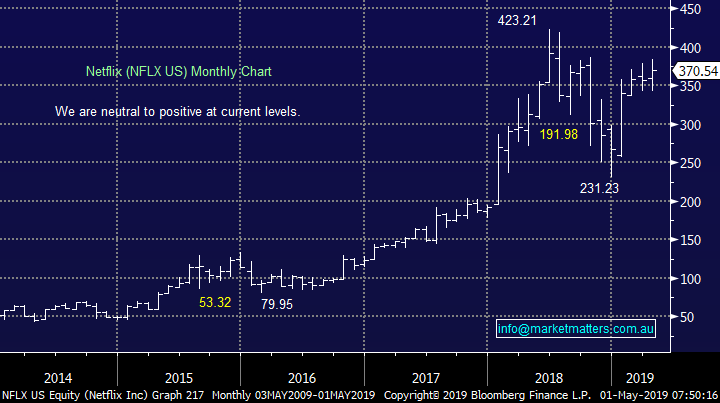

Weekly Overseas Report – the “FAANG’s” (RIO, NCM, FB US, AAPL US, AMZN US, NFLX US, GOOGL US)

The ASX200 again closed lower yesterday with the big miners noticeable drags on the index i.e. RIO Tinto (RIO) -2.4%, BHP Group (BHP) -1.1% and Fortescue (FMG) -1.4% - more on these later plus watch out for a video later in the week on this popular sector. As confession season kicks into gear, courtesy of the Macquarie Equities Conference, we saw the impact of the weak Australian housing market hit Domain (DHG) which fell -7.5% while elsewhere Nufarm (NUF) and oOhmedia (OML) both experienced selling falling ~5% after presenting at the Sheraton Grand in Sydney yesterday.

On the positive side of the ledger we saw Aveo Group (AOG) rally over 10% with 2 bidders emerging for the Australian retirement village owner with one of the bidders names as Gaw Capital Partners from Hong Kong. Its not long ago that Wynn Resorts (WYNN US) albeit briefly bid for Crown Resorts (CWN), there certainly remains a place in a balanced portfolio for a few stocks with potential to attract a suitor i.e. Healius (HLS)

Today the Sydney conference may throw up some stock volatility in the likes of A2 Milk (A2M), NIB Holdings (NHF), Bingo (BIN), Evolution Mining (EVN) and RIO Tinto (RIO) – a couple in the mix which MM hold in our Growth Portfolio.

Today’s agenda

9.30am – The A2 Milk Company (A2M), Mineral Resources (MIN), ARB Corporation (ARB)

10.30am – Origin Energy (ORG), NIB Holdings (NHF), Service Stream (SSM), Northern Star Resources (NST)

11.15am – APA Group (APA), Speedcast (SDA), Lifestyle Communities (LIC), Evolution Mining (EVN)

12.00pm – Aurizon (AZJ), IDP Education (IEL), ReadyTech (RDY), Regis Resources (RRL)

1.30pm – Suncorp Group (SUN), Bingo Industries (BIN), HUB24 (HUB), Saracen Mineral (SAR)

2.15pm – Rio Tinto (RIO), Steadfast Group (SDF), The Citadel Group (CTD), Resolute Mining (RSG)

3.00pm – Nine Entertainment Co (NEC), Perpetual (PPT), SG Fleet Group (SGF), Beach Energy (BPT)

4.00pm – Skycity Entertainment Group (SKC), NextDC (NXT), Vista Group International (VGI), St Barbara (SBM)

4.45pm – Coca-Cola Amatil (CCL), Nearmap (NEA), Starpharma (SPL), OceanaGold (OGC)

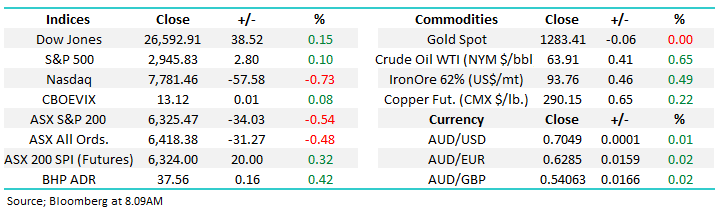

The ASX200 remains technically bullish while it can hold above 6285 but the index is “feeling” a little tired at present.

Overnight the US indices closed very mixed with the Dow marginally higher while the NASDAQ was slapped -0.7% following an awful day for Google which plunged well over 7%, enduring its worst day since 2012. However the SPI is pointing to a solid +20-point open locally suggesting there’s again some buying lurking around in the banks as ANZ reports earnings which on initial look, appear inline.

Today we are going to look at 5 overseas stocks that are catching our eye this week from both ends of the spectrum i.e. Winners and losers. Today’s focus is very much on the “FANNGS” which had over $US100bn wiped off their collective value last night, although Apple’s ~5% recovery following its result aftermarket this morning should help the groups sentiment on opening tonight.

ASX200 Chart

The resources sector has started to correct as we have been anticipating and our buy levels are slowly approaching for a couple of large names – at MMwe believe the miners will provide for the faithful longer than many sceptics believe.

MM is considering buying RIO around $90.

RIO Tinto (RIO) Chart

Another stock which presented in Sydney yesterday was Australia’s largest gold miner Newcrest Mining (NCM) which assisted by an overnight weak gold price managed to slip -2.4%, our buy zone is again slowly coming into range.

MM remains keen on NCM around $24.

Newcrest Mining (NCM) Chart

Five standout overseas stocks over the last week.

Today we have selected the 5 FAANG stocks following last nights $US100bn plunge in the group led by Google’s -7.5% fall i.e. Facebook, Apple, Amazon, Netflix and Google.

Surprisingly unlike the NASDAQ the NYSE FANG+ Index is still trading well below its 2018 high.

NYSE FANG+ Index Chart

1 Facebook (FB US) $US193.40

Facebook first quarter performance showed the anticipated slow-down in above the line growth but its evolving business model remains fully on track – the company still made a profit even after taking a $3bn legal charge.

Revenue was up an impressive 26% year on year to just under $US15bn with a staggering 1.56 billion daily active users.

MM remains positive Facebook expecting fresh highs above $US220.

Facebook (FB US) Chart

2 Apple Inc (AAPL US) $US200.67.

Overnight Apple slipped almost 2% into their report, released after the US market closed this morning. However the stock has performed well after the result rallying ~5% post official close.

They have realised US11.58bn profit on $US58bn revenue with services revenue hitting an all-time high although gross margins fell from 38.3% to 37.6% - Apple also announced another $75bn in share buybacks.

Apple looks to be allaying our concerns around life after just selling phones / iPads making the stock look potentially very exciting over the next few years.

MM likes Apple around the $US200 area.

Apple Inc (AAPL US) Chart

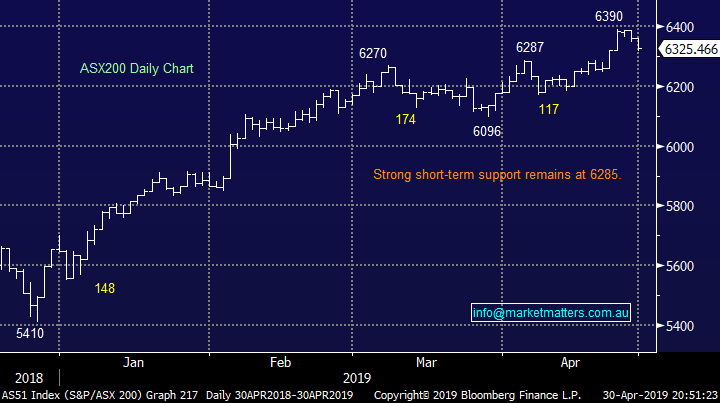

3 Amazon.com Inc (AMZN US) $US1926.52

Overnight Amazon slipped -0.6% in sympathy with the sector but we believe the stock remains on track for new all-time highs.

Last week the on-line retailing goliath produced a huge quarterly profit beat although revenue growth slowed as anticipated. The stocks now the 2ndd most valuable company in the world behind Apple at the time of typing but the trillion dollar mark is not far away. While we envisage Amazon will make fresh all-time highs in the next 12-months the ”easy money” we believe is behind it.

MM is mildly bullish Amazon targeting fresh all-time highs.

Amazon.com (AMZN US) Chart

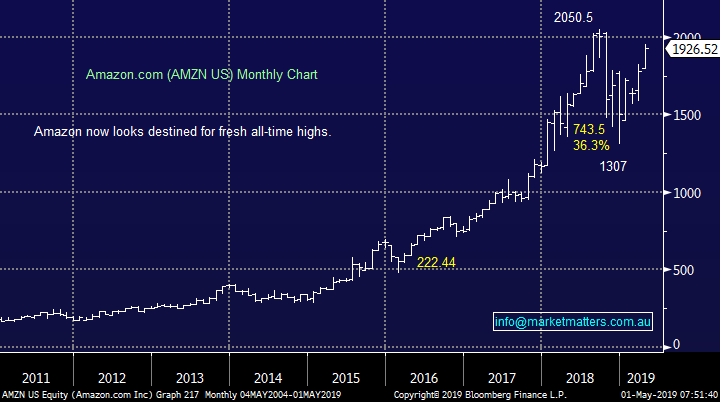

4 Netflix (NFLX US) $US370.54

Netflix has suffered slightly from higher costs plus increased competition with 4 new entrants in to the internet TV space but the first major player remains well positioned and barriers to entry are high.

The company beat expectations last month for Q1 2019 but future guidance disappointed some players – revenue of $US4.52 billion was slightly above the “Streets” numbers but 1.76 million and 7.86 international new subscribers was the big thumbs up for investors.

MM remains bullish Netflix, we can see another ~20% upside.

Netflix (NFLX US) Chart

5 Google (GOOGL US) $US1198.96

Google was hammered -7.5% last night following disappointing sales growth across all of its major sales categories with the executives blaming currencies for some of the miss – a strong $US is a meaningful headwind for Google moving forward.

MM is now neutral Google.

Google (GOOGL US) Chart

Conclusion

Of the 5 stocks we looked at Apple is the most appealing although Facebook, Amazon and Netflix still look bullish while Google is the one we would be cautious of at least short-term.

Global Indices

US stocks were again mixed last night as US reporting season kicks into gear. Medium-term we still think the Russell 2000 has another ~10% upside medium-term but a pullback feels increasingly likely – importantly our 8000 target for the NASDAQ is only a good week or two away in today’s market!

With both the S&P500 and tech based NASDAQ recently reaching fresh 2019 highs we have turned mildly neutral / negative US stocks short-term.

US Russell 2000 Chart

No change with European indices with BREXIT gaining an extension it’s again become yesterday’s “fish and chip paper”, we remain cautious or even slightly bearish in this region.

German DAX Chart

Overnight Market Matters Wrap

· The US had a mixed session, with the broader S&P 500 and Dow up marginally, while the tech. heavy, Nasdaq 100 closed 0.73% lower following disappointing earnings from Google’s parent, Alphabet.

· US President Trump called on the Federal Reserve overnight to cut rates by up to 1%, and re-introduce quantitative easing in an effort to further stimulate the US economy in the current low inflation environment. The Federal Reserve meeting tomorrow is unlikely to see any interest rate changes in the wake of a stronger than expected first quarter growth number of 3.2%.

· Also overnight, President Trump has discussed plans, along with the support of the Democrats, for US$2 trillion of much needed infrastructure spending.

· Commodities were mixed, with crude oil firming higher, testing the US$64.00/bbl., while US 10-year bonds rallied back to 2.5% again, despite the stimulatory noises from President Trump.

· The June SPI Futures is indicating the ASX 200 to open 24 points higher, testing the 6350 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/04/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.