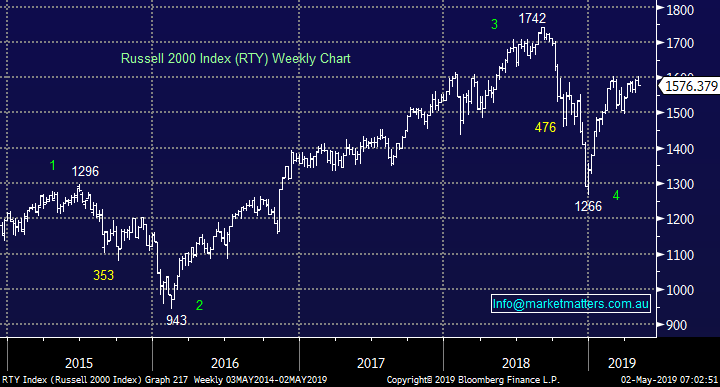

Is Wesfarmers timing correct to buy into the Electric Vehicle (EV) space? – (AJM, GXY, KDR, MIN, NAB, ORE)

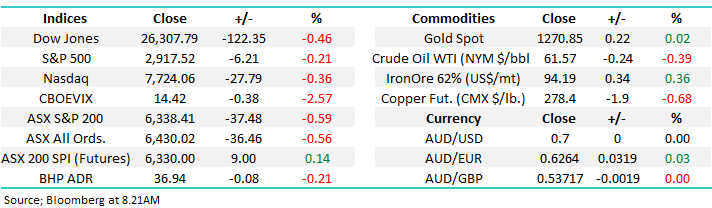

Yesterday the ASX200 fell 37-points with the “Big Four” banks and in particular ANZ & Westpac weighing on the index. The heavyweight resource stocks also failed to attract any buying, with both BHP & RIO falling ~1.2%, a decline which actually felt like a reasonable effort considering Coppers 4% plunge overnight – cracks maybe forming in the markets optimistic growth outlook. Losses on the day were limited by the defensive plays with healthcare, utilities, consumer staples and industrials all closing in the black as sector rotation remained very much in rigour.

The Macquarie conference continued and overall this classic “confession platform” has produced minimal disruption to the local market on the downside although the fund managers did endure a tough Thursday with Pendal Group (the old BT) by far the worst plunging 13% after announcing a greater than 90% decline in performance fees – I bet their glad its not a bear market!

Global markets now feel a little vulnerable after their strong advance from Decembers panic lows following the Feds less “dovish” than anticipated statement this week, stocks are pricing in central bank assistance and a failure to deliver by the likes of the Fed & RBA looks likely to take the enthusiasm from the recent rally. We feel it’s hard to see any catalyst for further sustained gains by stocks without the central banks hence we believe it remains a very stock / sector specific market.

The ASX200 breached our previous upside target area leaving us mildly bullish assuming the 6280 area holds – less than 1% away.

Overnight the US indices again closed lower with the broad based S&P500 dipping -0.2% but the SPI futures are positive calling the ASX200 to open up over 10-points implying the selling in our banks will not be ongoing.

This morning we are going to look at the Electric vehicle (EV) space following Wesfarmers (WES) almost $780m bid for Kidman Resources (KDR) at a whopping 47% premium to the lithium miners last traded price.

ASX200 Chart

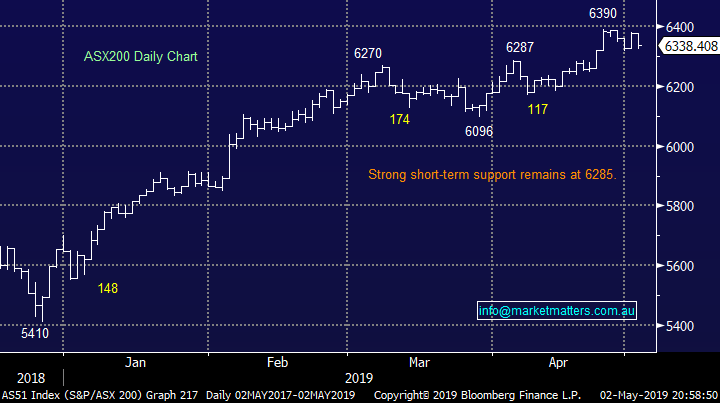

Yesterday we saw NAB slash its dividend from 99c to 83c but the market took this move in its stride with the stock only falling 8c in both a weak market and sector – the stock still yields an attractive 6.5% fully franked.

The local banks undoubtedly have a tricky few years ahead but the Hayne Royal Commission is behind us and housing prices have already corrected so the worst does potentially feel behind them. Interestingly this morning NAB warned that a rate cut would threaten their profitability which is 101 economics’ but it’s this very anticipation of lower rates that appeared to light the fuse under the banking stocks in 2019.

MM is comfortable with our position in NAB.

National Australia Bank (NAB) Chart

As mentioned earlier Copper tumbled in the US on Wednesday night and added to the losses last night – a clear sign the markets are becoming concerned around the health of the global economy i.e. “Dr Copper”.

At this stage we feel the “risk / reward” is not exciting for copper facing stocks hence our pedantic target to enter RIO of ~$90, or almost 5% lower.

MM is neutral to bearish copper at present.

Copper Chart

Looking at the electric vehicle (EV) space

Wesfarmers have opened their shoulders with respect to the EV space by bidding for Kidman Resources (KDR) with the move into battery metals clearly showing the company’s outlook for the future. Their previous Lynas (LYC) bid looks to have significantly higher hurdles before it becomes reality but with KDR planning to back the bid WES looks set to gain entry into lithium via KDR’s excellent asset when prices are low. Yesterday WES comments with regard to lithium made complete sense:

"Over the course of the last two years, we identified lithium as an interesting sector that will not only benefit from the growing global uptake of electric vehicles, but is also an area where Wesfarmers' capabilities are uniquely positioned to take advantage of the opportunity in this space,"

We like seeing businesses buy when prices are low as opposed to chasing bull markets, it generally adds value in the longer term. Today we have looked at a few other stocks in the lithium space, asking is it time for MM to re-enter lithium, and follow in the footsteps of WES.

It should also be remembered that massive short positions exist in the sector who may be getting extremely nervous after the WES bid, I would! - Galaxy (GXY) 16.6%, Orocobre 12.25% and Pilbara Minerals (PLS) 9.6%.

Kidman Resources (KDR) Chart

1 Pilbara Minerals (PLS) 66c

PLS presented at the Macquarie Conference yesterday and combined with overflow positive sentiment following the WES bid we saw the stock gain over 9% taking the stocks market cap to $1.2bn.

The company owns the top quality Pilgangoora lithium project which is one of the worlds biggest new lithium ore deposits. Technically we can see a squeeze above 80c.

MM is currently neutral / positive PLS.

Pilbara Minerals (PLS) Chart

2 Orocobre (ORE) $3.46

Orocobre (ORE) is a developer of lithium-potassium based brine projects with its flagship project in Argentina. The company is in partnership with Toyota who took a sizeable stake in the business at $7.50 - as the stock has fallen over 50% this feels like an optimum time for the Japanese car maker to increase or perhaps takeover ORE – the stocks current market cap is just over 900m.

An illustration of the bond between these 2 companies is that ORE and Toyota are now jointly developing a 10,000 tonne pa lithium hydroxide plant in Fukushima, Japan.

MM likes ORE at current levels.

Orocobre (ORE) Chart

3 Mineral Resources (MIN) $15.62

Perth based MIN is a leading mining services provider primarily focused on iron ore & lithium in WA. The company’s current lithium projects include Wodgina and Mt Marion, with a market cap of almost $3bn it’s the biggest of the 5 stocks looked at today. Interestingly the Mt Marion project is jointly owned with Neometals (NMT) and major lithium producer Jiangxi Ganfeng from China.

MM is neutral MIN at current levels.

Mineral Resources (MIN) Chart

4 Galaxy Resources (GXY) $1.52.

GXY owns a number of lithium production facilities in Australia, Canada and Argentina including the Mt Cattlin mine in WA. They are also developing a low-cost production facility in Argentina. Following the decline of the share price the stock only has a market cap of $621m.

Technically we can see a 30% bounce in 2019 /2020.

MM is neutral to bullish GXY.

Galaxy Resources (GXY) Chart

5 Altura Mining (AJM) 12c

Altura owns / operates the major lithium open-pit project in WA, the intention is to ship concentrate to partners in China – following the stocks aggressive decline its clearly the baby of the group with a market cap of just $255m.

This is clearly the “speccy” end of town for the adventurous but a bounce does feel overdue.

MM likes AJM as an aggressive trade.

Altura Mining (AJM) Chart

Conclusion (s)

Of the 5 stocks we looked at today MM believes WES has picked an ideal time to make a foray into the EV space with the whole sector significantly lower than a year ago.

We believe the large shorts in the sector may be considering reducing / closing their positions especially considering the large drops in the respective stocks, takeover by WES and of course EOFY approaching.

Our favourite stock in the sector is ORE followed by GXY as a more aggressive play.

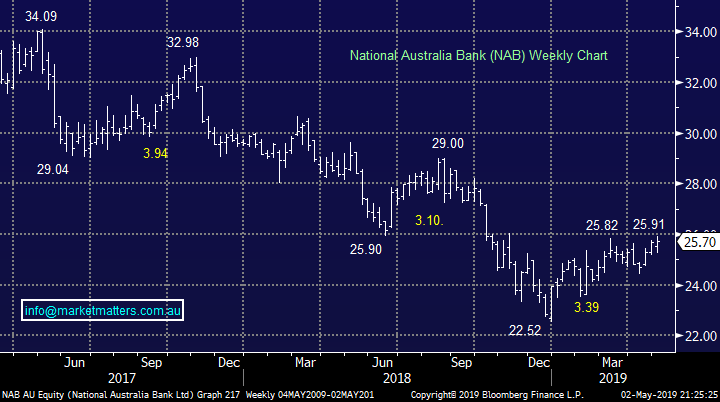

Global Indices

US stocks were soft overnight and we can see a deeper pullback following the Fed’s less dovish than anticipated statement earlier in the week.

We are now short term bearish US stocks looking for a ~5% correction.

US Russell 2000 Chart

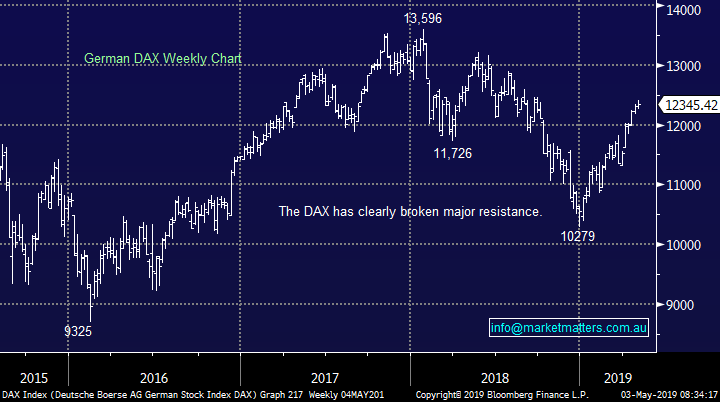

No change with European indices, we remain cautious as we enter the “sell in May and go away” period for European stocks.

German DAX Chart

Overnight Market Matters Wrap

• The US equity markets eased overnight, following hitting recent record levels, as investors digested Wednesday’s comments by the Federal Reserve on its interest rate outlook.

• US Ten-year bonds jumped to 2.55% while the US$ firmed further, taking the A$ at US70c this morning.

• Commodities remained under pressure on continuing growth concerns with oil down another 3%. Gold hit a 4 month low, while base metals also eased back further with key Asian markets still on holiday. Investors remain nervous about a US-China trade settlement as talks continue to drag on.

• The June SPI Futures is indicating the ASX 200 to open 16 points higher, testing the 6350 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 03/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.