Is Trump providing opportunity or creating a disaster? (FMG, SGR, WSA, LLC, APX, NCM)

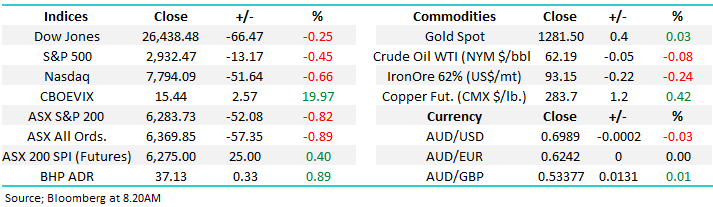

Yesterday the ASX200 fell 52-points following Donald Trump’s extremely aggressive threat to raise tariffs on Chinese goods which was compounded when rumours crossed the newswires that China may walk away from further trade talks. I feel like sighing while typing this, not only are we set to get a crescendo of local politicians throughout the media over the next fortnight but now the sleeping giant has woken and decided it’s time to begin Tweeting in earnest. Equity markets have been pricing in an amicable resolution on US – China trade this week not another bout of tantrums. Our interpretation is simple:

1 – Both Donald Trump and China want / need to do a trade deal and our best guess is President Trump wants to look strong at home with the next US election slowly but surely looming on the horizon in November 2020 plus of course this is how he tends to approach negotiations, with the bazooka!

2 – However if we do see a meaningful breakdown in US – China trade yesterday’s pullback is likely to be eclipsed in a major fashion. Markets have gone from factoring in a 5-10% risk of no trade deal to ~20% which seems reasonable.

In other words we have been looking for a correction to buy and don’t believe investors should panic because of one Tweet by “The US Don”:

However global markets have felt a little vulnerable after their strong advance from Decembers panic lows and many investors are likely to become increasingly nervous given its May, but at MM we are looking to be accumulators into this / any meaningful correction – slowly but surely.

MM remains bullish the ASX200 looking to buy short-term weakness while the 6280 area holds.

Overnight US stocks recovered strongly from early jitters to close 1.2% above the day’s low, and locally SPI Futures were up +40pts just before the market closed, however more news shot across the ticker saying that President Trumps top negotiator was sticking firm that tariffs would increase on Friday given China had ‘back peddled’ on commitments. The SPI closed +25pts higher while US Futures were incredibly volatile around their close ensuring a very interesting open locally feels likely.

The RBA decision on rates will throw another catalyst into the mix today with the decision due out at 2.30pm - the first ‘live’ decision in almost 3 years.

This morning we are going to look at 5 stocks that MM is considering buying / accumulating into further May market weakness – we cannot assume that the overnight / likely bounce this morning is the end to any pullback.

ASX200 Chart

The potential breakdown of US -China trade talks hit the growth sector fairly hard yesterday and we targeted a buy in Fortescue Metals (FMG) in the Growth Portfolio around $7 with a limit of $7.10. The stock traded to a $7.11 low.

We are still keen accumulators of FMG around $7.10

We would likely add to the position again on a decent dip below $7.

Fortescue Metals (FMG) Chart

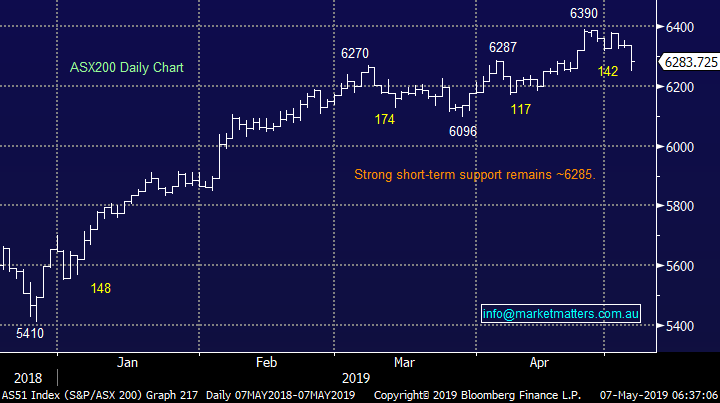

Yesterday, President Trump’s Tweet led to aggressive selling in equities across Asia while some monies flowed into safe havens especially the $US which not surprisingly sent the $A back under 70c BUT in our opinion the “little Aussie battler” held up pretty well only falling ~0.4%. Interestingly other safe havens like bonds, gold and the Yen were very muted to the Presidents Tweet – our interpretation is investors should become more worried for equities when arguably these more intelligent assets get a meaningful bid tone.

If the $A can hold onto the psychological 70c area it will confirm to us that its gaining strength around these decade lows.

MM is bullish the $A targeting the 81c area.

Australian Dollar ($A) Chart

Looking at 5 stocks MM is considering into ongoing selling.

Following the relatively stable night on Wall Street our look at stocks we are considering buying into weakness may prove optimistic for now although number 5 may tell a different tail.

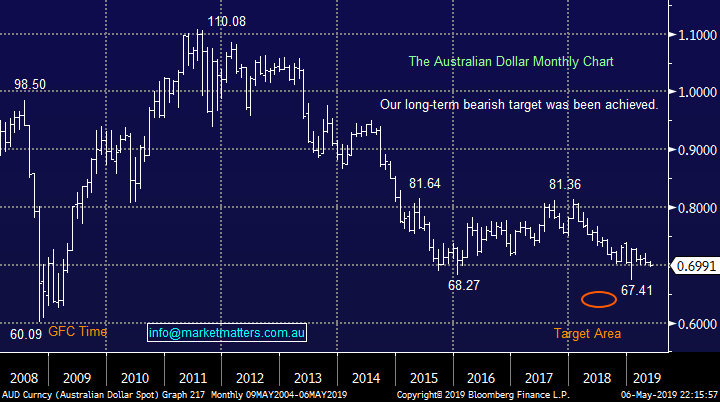

1 Star Entertainment (SGR) & / or Crown (CWN) $13.37

We have been considering a foray into the casino space for a number of weeks with an equal mix of Crown (CWN) and Star (SGR) feeling the optimum blend but we have remained patient over the last 2-weeks as SGR has a felt a little heavy following the initial euphoria following the Wynn bid, then retraction, for CWN. I wonder if Wynn are also waiting to hear further rhetoric from Labor around foreign takeovers - they are likely to raise the bar moving forward making it harder for overseas corporate raiders into Australia.

MM likes the casino stocks in 2019.

Star Entertainment (SGR) Chart

2 Western Areas (WSA) $2.10

Nickel producer WSA has experienced a fairly volatile 2019 rallying well over 30% only to then give back more than half of the gains– we exited our latest foray into WSA in March about 8% higher which still feels the correct move but in our opinion continued weakness will bring value back into the stock.

We touched on WSA in our resources report / video last week but it can clearly be a volatile beast hence its important to have optimum entry levels established if / when opportunities present themselves.

MM likes WSA on a decent break back below $2.

Western Areas (WSA) Chart

3 Lend Lease (LLC) $13.22

Property developer LLC is a fairly aggressive turnaround story but below the $13 area we can see decent risk reward as has been discussed in a couple of recent Weekend Reports.

MM likes LLC below $13.

Lend Lease (LLC )Chart

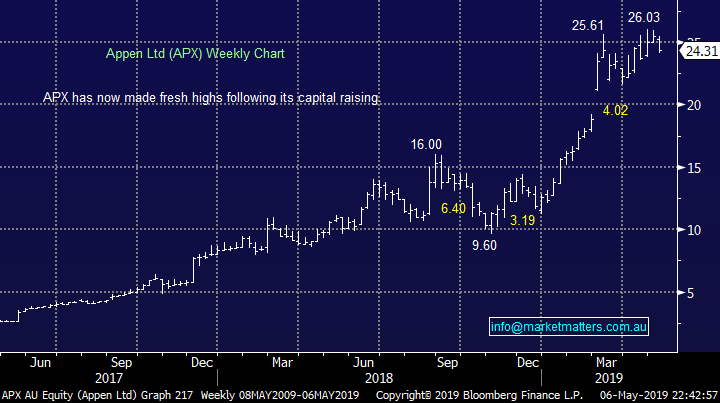

4 Appen Ltd (APX) $24.31.

High flying tech business Appen (APX) has also been on our radar for the last 1-2 months. The momentum players have pushed the stock significantly higher in 2019 but the last 6-months has demonstrated that APX can be volatile and opportunities do present themselves for the prepared.

The Software & Services sector, similar to the US NASDAQ, is likely to be one of areas hit the hardest if we see further “wobbles” around the US – China trade talks so it’s important to have a plan as opposed to being blinded by the headlights if further bouts of strong volatility hit stocks – the 4.6% drop by APX yesterday showed us how quickly the stock can decline when investors run for exits.

MM likes APX around the $20 area.

Appen Ltd (APX) Chart

5 Newcrest (NCM) $24.72.

The Gold sector enjoyed an ok safe haven bid tone yesterday with most of the group closing in the black illustrating why we want exposure to the space when its time for stocks to have a decent correction.

Again we have had a number of the sectors stocks on our radar through April and if we see equity markets recover in May from Trumps Tweet its easy to imagine a dip in the precious metals respective stocks e.g. Regis Resources (RRL), Evolution Mining (EVN) and St Barbara (SBM).

An example is MM still likes NCM below $24.

Newcrest Mining (NCM) Chart

Conclusion (s)

Of the 5 stocks / groups we looked at today MM is happy to be sitting on decent cash positions in both of our portfolio’s patiently waiting for opportunities.

**FMG ALERT UPDATE** We are still keen accumulators of FMG around $7.10 should it trade there today.

Global Indices

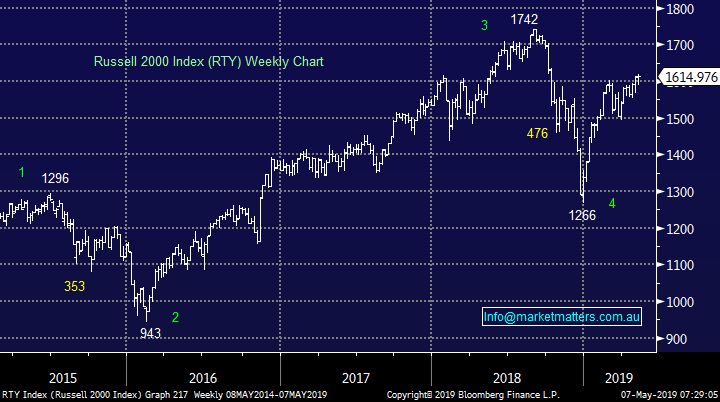

US stocks were actually mixed overnight with the small cap Russell 2000 closing up and still on track for fresh 2019 highs.

We are now cautious US stocks short-term but still feel the post GFC bull market has further to charge.

Russell 2000 Chart

No change with European indices, we remain cautious as we enter the “sell in May and go away” period for European stocks.

German DAX Chart

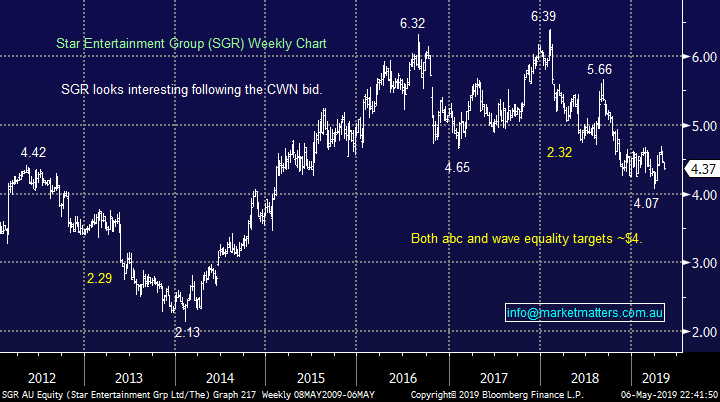

Overnight Market Matters Wrap

· US equities opened on their lows and gradually improved throughout most of the day. The Dow closed down 0.25%, while the S&P 500 and NASDAQ were 0.4% and 0.5% in the red respectively.

· This morning however we see the US Futures open over 0.5% lower and remain extremely volatile after top US negotiators said that the US will raise tariffs after the Chinese tried to backpedal on previously made commitments. The increase in tariffs is due to come into effect at 12.01am on May 10.

· The June SPI Futures is indicating the ASX 200 to open 16 points higher this morning, testing the 6300 level with the potential for a rate cut this afternoon at 2.30pm.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 07/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.