Evaluating 3 situations influencing the ASX200 hood (BIN, HLS, ASL, BOQ, TPM)

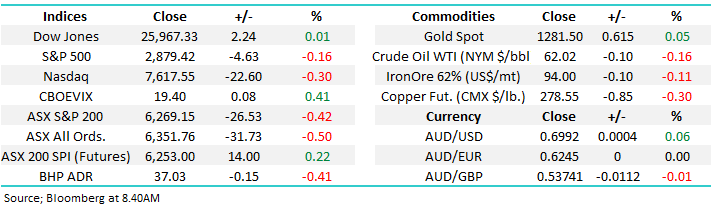

Yesterday the ASX200 only fell 26-points pretty much ignoring the Trump inspired 473-point plunge by the Dow on Tuesday night (US time) as MM often says “we don’t fall without the banks” and they actually rallied on Wednesday with the average move for the “Big Four” a gain of +0.18%. With the exception of NZ, which we will talk about later, Asia fared far worse with Japan, Hong Kong and China all falling well over -1%.

Volatility is the “Active Investors” dream and President Trump getting reacquainted with his Tweet account looks destined to deliver some opportunities in this traditionally unstable time of year – remember over the last decade the average return over May & June is -4.58% hence moving the cashed up MM Portfolios towards a fully invested position feels premature with the ASX200 only down -0.9% so far this month. We have been looking for a correction to buy and definitely don’t believe investors should panic because of current trade talk wobbles - but the plan remains to buy selectively.

At this stage we believe US & China will resolve a trade deal but not by Friday so the key to stock market stability is whether or not Trump will implement threatened elevated tariffs and then of course the million dollar question is does China decide to retaliate – this feels a close call.

Recently global markets have felt a little vulnerable after their strong advance from the December panic lows and many investors are likely to become increasingly nervous as its ‘that time of year’ but at MM we are looking to be accumulators into this / any meaningful correction – slowly but surely.Conversely we are still likely to be sellers if / when we get another rapid about turn by the ASX200 and an assault above the 6400 area i.e. “play” the value parameters.

MM believes the current weakness in stocks is a buying opportunity in cyclical stocks like the resources as opposed to defensive plays such as healthcare.

Overnight US stocks were choppy but finally closed little changed with the tech based NASDAQ the weakest link falling -0.3%, the SPI is calling the ASX200 to bounce ~10-points early on this morning.

This morning we are going to look at 3 unfolding market events on the macro, sector and stock level which we feel require consideration.

ASX200 Chart

Happily 3 of the MM positions in the Growth Portfolio have caught our eye for the correct reasons over the last few days, below is a quick update on our intentions at this point in time.

Waste management and recycling company Bingo (BIN) made fresh multi-week highs yesterday, not bad on a day when the Dow plunges almost 500-points.

MM remains bullish BIN initially targeting the $2.10 area, another 10% higher.

Bingo Industries (BIN) Chart

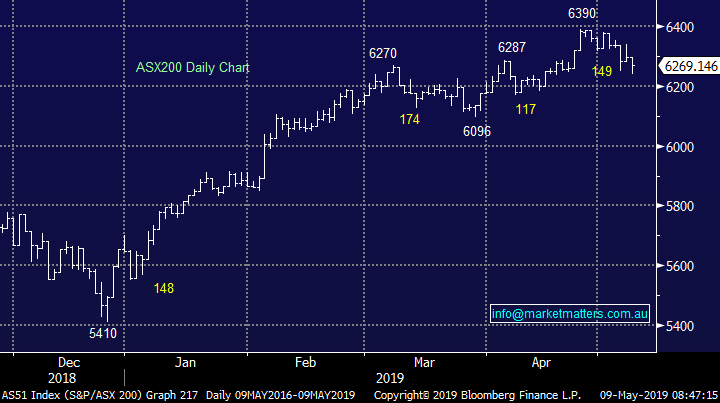

The previously named Primary Healthcare business Healius (HLS) made fresh highs for 2019 yesterday, now only 6c below the current takeover offer by Jangho following the talk / rumours of a number of private equity companies circling the stock.

MM remains mildly bullish HLS targeting the $3.25-$3.50 – but the positive risk / reward is rapidly diminishing.

Healius (HLS) Chart

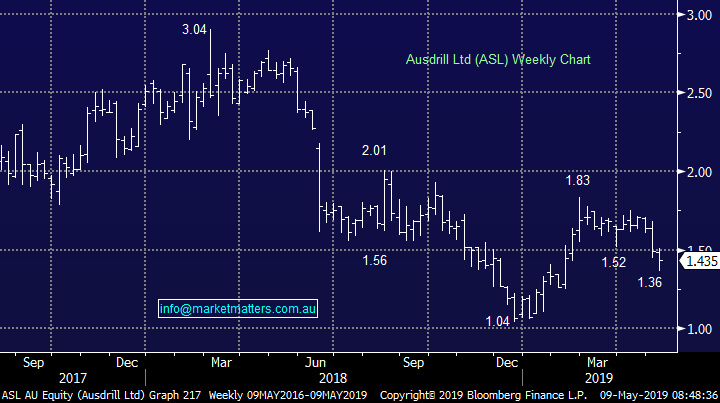

Mining services business Ausdrill (ASL) has endured a tough fortnight after refinancing some credit facilities in the US plus being caught in the downdraft of fellow sector member CIMIC (CIM) following a Hong Kong short seller claiming much of its earnings were basically “smoke and mirrors”.

MM will consider adding to our ASL position on a close back above $1.55.

Ausdrill (ASL) Chart

Looking at 3 interesting events catching our eye.

Following the relatively stable night on Wall Street today we have focused on 3 events / situations which we believe investors need to understand, especially the potential ramifications for influenced stocks / local sectors.

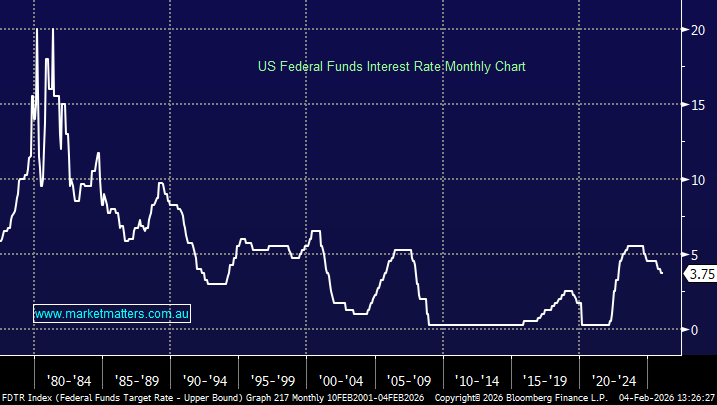

1 NZ cut interest rates - will we follow shortly?

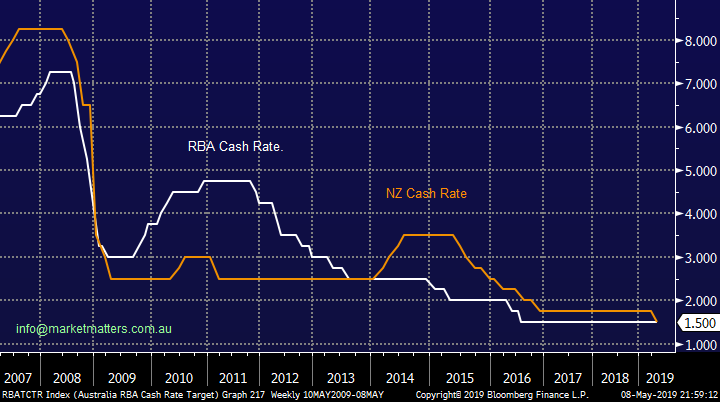

Yesterday NZ cut interest rates to the same 1.5% that the RBA has sat on for 33-months, their share market subsequently bucked the weak undertone of global stock indices and proceeded to rally +0.36%, closing at its high for the day almost making fresh 2019 & all-time highs – never underestimate the power of lower interest rates on equity markets in today’s environment.

The RBA left interest rates unchanged this month probably because of uncertainty created by the local election & US-China trade negotiations but we feel the market will start pricing in a cut in the months ahead and this means stocks should remain strong.

MM believes the RBA will cut rates in 2019 and the ASX200 will have another leg higher outperforming its global peers.

RBA & NZ cash Rates Chart

2 Which bank?

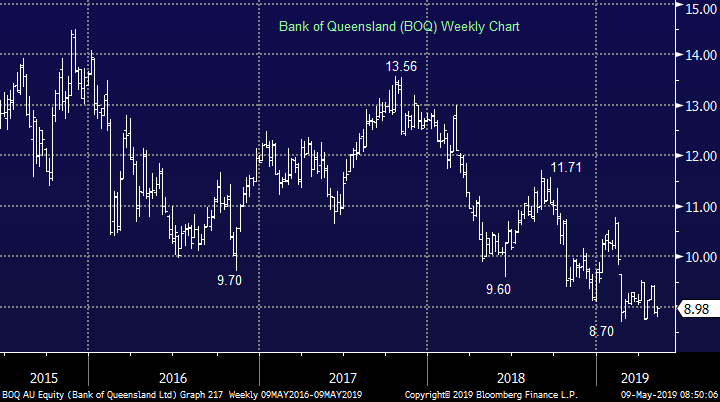

The local banking space is very interesting at present with a few potential scenarios getting our minds ticking:

1 – The AFR has reported that Suncorp (SUN) is considering spinning its bank division off so it fully realises the value of its insurance division. Applying a 12x P/E on the bank and a 15x P/E on insurance would give SUN around 50c upside from current levels, however the banks credit rating would likely be cut, leading to higher funding costs.

2 – However the regional banks as they are continue to struggle badly and we would not consider them without potential corporate action in the sector.

3 – A combination of SUN-BOQ or BOQ-BEN feels like a strong possibility - it would make sense for both parties however if 2 combine the 3rd would look extremely vulnerable in isolation.

MM likes BOQ below $9 considering the risk / reward of the above scenarios plus the banks hovering near multi-year low.

Bank Of Queensland (BOQ) Chart

3 TPG knocked back by ACCC

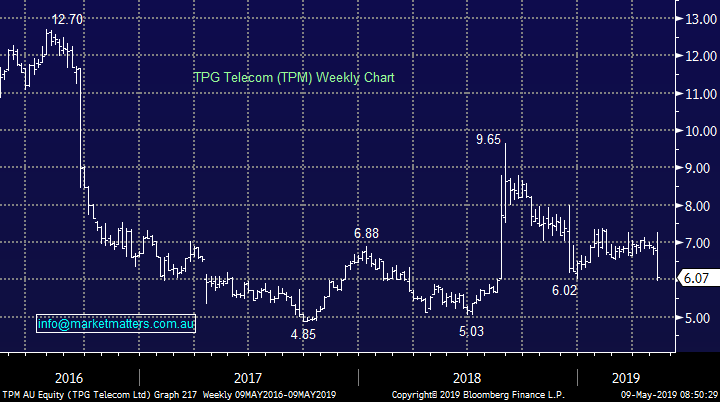

The ACCC has rejected the TPG – Vodafone merger but many pundits believe it will lose when challenged in court – as usual the lawyers are the winners!

The news embarrassingly leaked early from the ACCC (and picked up by Blomberg) led to a -13.5% plunge by TPG Telecom (TPM) and a -2.1% drop by Telstra (TLS). Markets simply hate uncertainty and the ACCC have certainly created this although if we look at the share price of TPM over the last 12-months it shouldn’t come as a huge surprise. MM can see value in TPM below $6 as a trade but it’s not a play we are likely to pursue.

MM is evaluating our reduced holding in TLS – it’s hard to see it outperforming in this new uncertain environment.

TPG Telecom (TPM) Chart

Conclusion (s)

Of the 3 situations we looked at today our views are simple to understand:

1 – MM believes the ASX200 remains bullish and will be supported by the prospect of lower interest rates in 2019 / 2020.

2 – MM likes BOQ as a “situation” play into 2019.

3 – MM feels the Telco sector is likely to struggle under the uncertainty around the ACCC’s decision although TPM looks a fair “punt” under $6.

*Watch for alerts*

Global Indices

US stocks were again mixed overnight with the Dow closing up on the night while the NASDAQ fell -0.3%. We remain cautious US stocks short-term but still feel the post GFC bull market has further to charge.

US S&P500 Chart

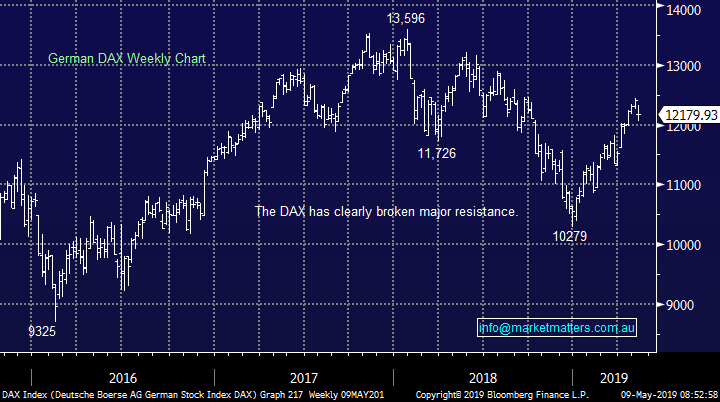

No change with European indices, we remain cautious as we enter the “sell in May and go away” period for European stocks.

German DAX Chart

Overnight Market Matters Wrap

· The US had a breather from its recent selloff overnight, ending the session with little change across the major indices.

· Crude oil however jumped above US$70/bbl. helping the assisting the energy sector to outperform the broader market, up 1.4%. This will likely assist BHP to claw back most of its losses overnight, as the US session ended up an equivalent of 1.2% from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open up around 10 points higher

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 09/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.