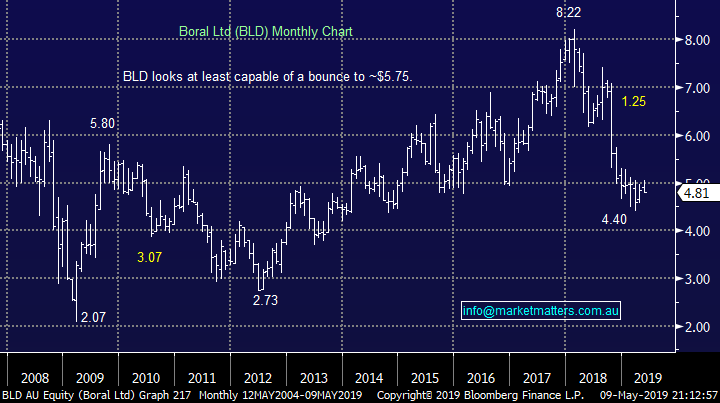

Is Adelaide Brighton (ABC) the sign for whats next for the Australian building sector? (ABC, CSR, BLD, JHX, FBU)

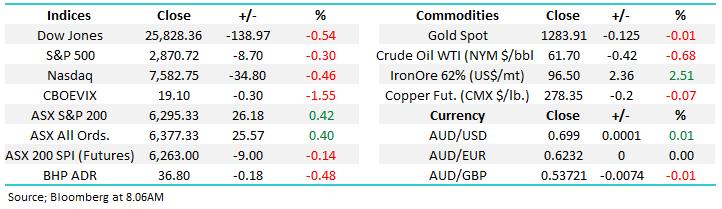

Yesterday the ASX200 rallied 26-points, perfectly offsetting the drop on Wednesday with the Telco and Utilities sectors leading the gains as rate cut fever led the market optimism. The local +0.4% gain matched the performance across the Tasman by the New Zealand market which has been clearly assisted by their rate cut to 1.5% on Wednesday. On the sector level we saw the lithium space dominate the top performers in the ASX200 with Galaxy (GXY), Orocobre (ORE) and Pilbara (PLS) occupying 3 of the top 6 stocks on the day whereas the standout loser was buildings products business Adelaide Brighton (ABC) which tumbled over 10% due to an earnings downgrade – more on this later.

The most eye catching aspect of yesterday’s trading session in my opinion was the almost disdain shown by the Australian & New Zealand markets towards weak global markets e.g. we rallied while US futures fell hard, the Nikkei was down almost 1% and Hong Kong was down 2.4%. Combined with the $A slipping well under 70c it confirmed to us that Trans-Tasman markets are revelling in the prospect of lower interest rates but remember we usually only ignore bad global news for so long.

As we have said all week global markets have felt a little vulnerable after their strong advance from the December panic lows but at MM we are looking to be accumulators into this / any meaningful correction – slowly but surely. Conversely we are still likely to be sellers if / when we get another rapid about turn by the ASX200 and an assault above the 6400 area i.e. “play” the value.

MM believes any ongoing weakness in stocks is a buying opportunity in cyclical stocks like the resources as opposed to defensive plays such as healthcare.

Overnight US stocks were extremely volatile with the S&P500 closing down 0.3% after languishing ~1.5% lower around midnight AEST, the SPI futures are calling the ASX200 to open down around 10-points with BHP closing down -0.4% in the US.

This morning we are going to look at the Australian Building sector following Adelaide Brighton’s (ABC) 10% plunge following yesterday’s earnings downgrade.

ASX200 Chart

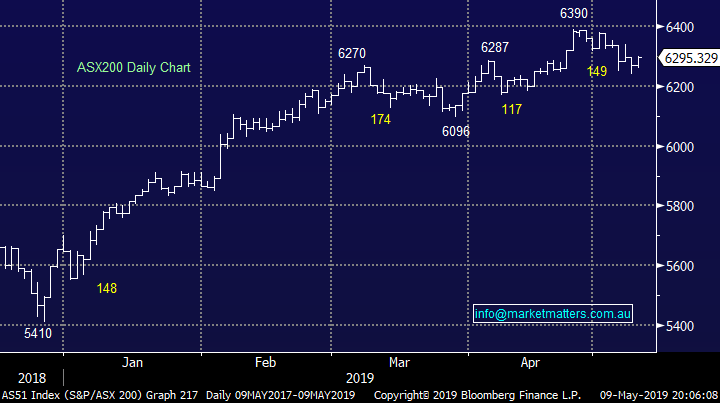

Yesterday MM took profit on its remaining Telstra (TLS) position and switched the funds (plus 1% more) into Bank of Queensland – a move we have discussed / flagged for most of the week.

We had discussed some of our thoughts around both BOQ and TLS in Thursdays morning Report but the below chart shows one of favourite phrases also coming into play – the elastic band of outperformance by TLS over BOQ we feel had essentially travelled too far. Please note the science behind this when comparing companies from very different sectors is not as perfect as when looking at say 2 banks.

MM believes BOQ will outperform TLS moving forward.

Bank of Queensland (BOQ) v Telstra (TLS) Chart

Looking at the Australian Building Sector.

MM is still holding relatively large cash positions across our 2 portfolios – largely because the market is fully valued which makes finding specific stock opportunities more difficult - hence when we see an already beaten up sector have a bad day it catches our eye. The situation is simple:

1 – We all know housing prices in Australia have endured a tough time recently but the question is are they closer to the end of this decline than the beginning.

2 – Building stocks have been smashed e.g. over the last 12 months Adelaide Brighton (ABC) -48% and CSR Ltd (CSR) -55%.

Equities generally move 6-12 months ahead of their underlying fundamentals and we saw with both CSR and ABC topped out about 6-months before housing prices themselves although the sales of new homes had been on the decline for a while. We have no doubt that the building sector will present some excellent bargains moving forward, the question we consider today is should we continue to accumulate names after our “dip the toe” purchase of CSR for the Income Portfolio yesterday, or is it too early?

Sourced from a Montgomery Investment Management presentation

Firstly a quick look at Adelaide Brighton (ABC) who received the markets thumbs down yesterday after announcing they expect a full year net profit after tax (NPAT) to be around 10-15% below last years $190m with the poor performance being blamed on weakening demand for construction materials in the residential space – should that be a surprise?

While ABC has a strong balance sheet and an interesting share register with the Chairman owning ~42% of the company, when to step up and catch the falling knife is the question? For those not familiar with the business they produce clinker, cement, ready mixed concrete, lime products etc.

We are watching ABC but are in no hurry just yet.

Adelaide Brighton (ABC) Chart

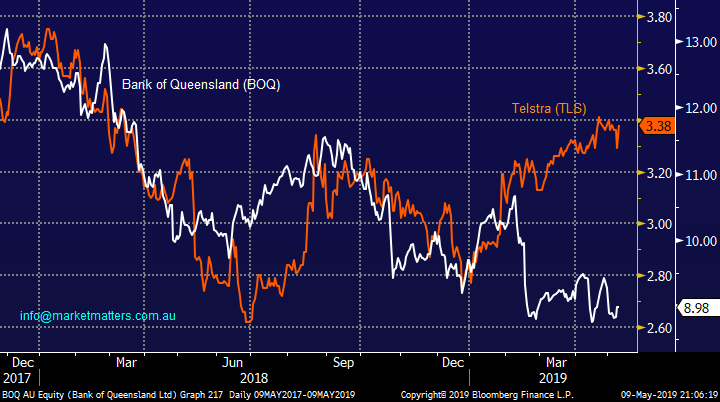

1 Boral (BLD) $4.81

Boral (BLD) is a household name which manufactures & supplies building and construction materials both locally and abroad. Recently, they completed a large $3.5bn acquisition of US based Headwaters forming a new division calls Boral Nth America which is a $1.8bn revenue company i.e. it’s big.

The stock has corrected 46% since its 2018 high, unfortunately keeping pace with much of the sector. The stocks trading relatively cheap on an Est P/E of 12.3x while yielding 5.6% fully franked. The downside momentum is intact as the stocks is rapidly losing all of its post GFC gains.

At this stage MM is considering BLD below $4.

Boral Ltd (BLD) Chart

2 CSR Ltd (CSR) $3.37

MM added CSR for the Income Portfolio yesterday which is easy to comprehend with the stock now yielding 7.8% fully franked while trading on a low Est P/E of 11.5x rebased earnings expectations, we feel there is some fat in both of these to absorb further bad stock / sector news.

Like the other stocks in the sector it sells products like plasterboard, insulation, glass, bricks, tiles etc hence it needs building activity to pick up, something that could be helped if the RBA do cut local interest rates.

MM likes CSR at current levels and will accumulate further weakness should it play out.

CSR Ltd (CSR) Chart

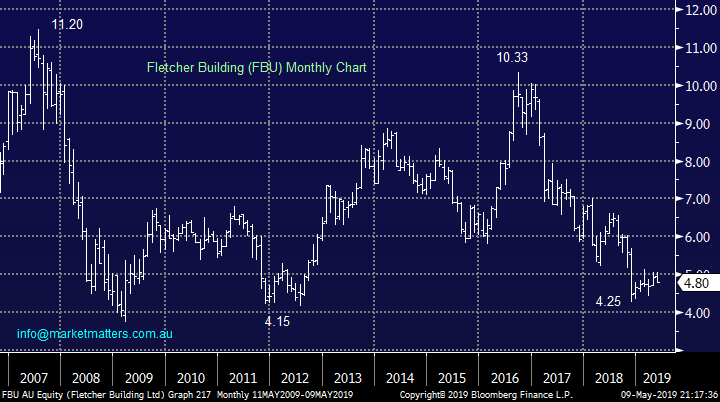

3 Fletcher Building (FBU) $4.80

Fletcher Building (FBU) manufactures wood-fibre based products, cement, aggregates, plasterboard, aluminium extrusion etc a similar mix to the others. This trans-Tasman is trading on an attractive P/E of 11.6x but a projected yield around 3% is less appealing given the growth outlook is yet to show its hand. Buying cheap stocks for a turnaround in our view makes sense if there is a clear catalyst, while having a strong yield underpinning it helps while we wait.

MM likes FBU closer to $4.

Fetcher Building (FBU) Chart

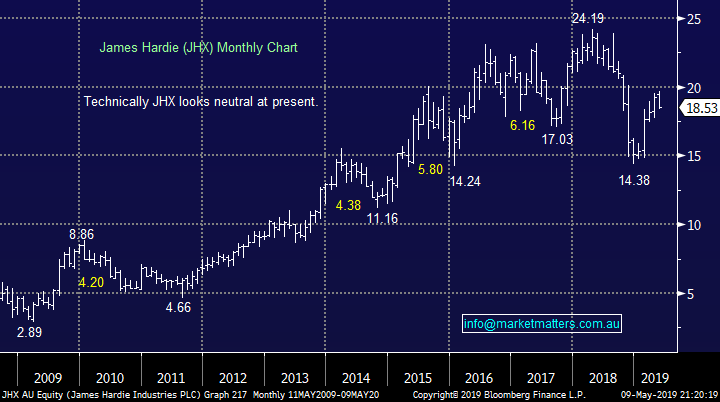

4 James Hardie (JHX) $18.53

JHX is a more international example of an Australian listed building company with a major footprint in the US hence its relative outperformance but this makes it far less exciting as a turnaround story.

MM is neutral JHX.

James Hardie (JHX) Chart

5 Brickworks (BKW) $15.83

BKW as its sounds distributes clay products including bricks, pavers and floor tiles and while its P/E of below 10x and yield of 5% fully franked is attractive the technical picture is a weak one.

MM is neutral / bearish BKW.

Brickworks (BKW) Chart

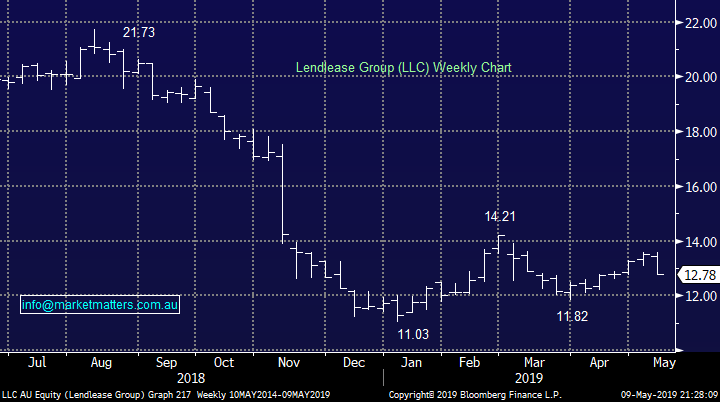

6 Lend Lease (LLC) $12.78

LLC is more involved in the large end of town on the construction front including infrastructure projects rather than the actual supply of building products. The stocks clearly been hammered but its not “cheap” trading on a P/E of 16.1x while it yields 3.7% but this makes sense because infrastructure is relatively recession proof. We like LLC as a turnaround story at todays levels but would definitely leave room to average into further weakness.

MM likes LLC below $13.

Lend Lease (LLC) Chart

Conclusion (s)

- Of the stocks / sector looked at today our favourite not surprisingly is CSR which we added to the Income Portfolio yesterday.

- We believe that the huge turnaround for the sector is approaching but one more down leg would be required for us to buy in our growth orientated Growth Portfolio

- Overall we will remain patient for now with most members of the construction industry.

Global Indices

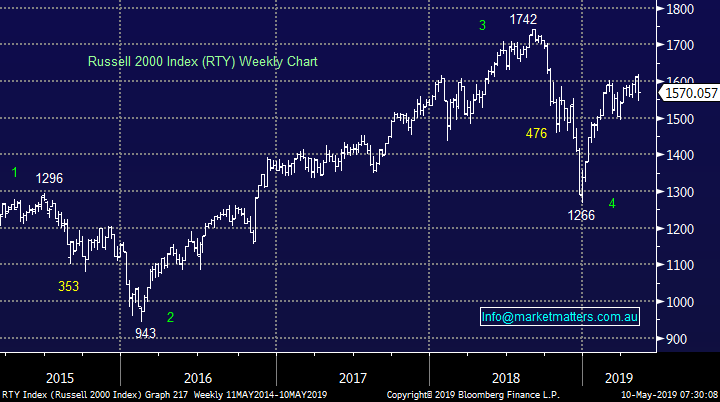

US stocks were recovered solidly last night as some optimism around US – China trade crept back into stocks, we remain keen to buy any pullback in the weeks ahead.

We remain cautious US stocks short-term but still feel the post GFC bull market has further to charge.

Russell 2000 Chart

No change with European indices, we remain cautious as we enter the “sell in May and go away” period for European stocks.

German DAX Chart

Overnight Market Matters Wrap

· The SPI is down 9 points after another night of weakness in US equities. The Dow fell more than 0.5%, with the S&P 500 down 0.3%, and the NASDAQ 0.4% in the red, although all indices traded well off the lows

· US-China trade negotiations are still the dominant topic as Chinese Vice Premier Liu arrived in Washington for talks. Trump is still positive that a deal can be reached this week, but is confident the US will thrive without an agreement.

· Equities rallied from their lows as Trump spoke, while the Chinese believe that the US economy is not as strong as touted, with the US President calling for lower interest rates. Meanwhile in Australia, the RBA will release its monetary policy statement at 11.30am today. Some are predicting a drop in growth forecasts.

· Copper and nickel both fell on the LME and iron ore traded a fraction lower at $US95.38/t. Brent Crude oil is just holding above $US70 and the $A is below 70c at 69.91c.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.