Looking for opportunities in today’s exciting & volatile market (FMG, RIO, ILU, MQG, SGR, CWN)

The ASX200 was amazingly resilient on Monday only falling -0.2% while US S&P500 futures tumbled ~1% following further negative Tweets from Mr Volatility himself – Donald Trump. The story remains the same Australian and New Zealand markets are strong courtesy of most things that appear to offer sustainable yield with our friends across the Tasman actually closing up +0.27% on the day reaching fresh all-time highs in the process. In anticipation of the RBA following the RBNZ by cutting official interest rates we saw the Real Estate sector lead the gains with none of the 20 members closing in the red i.e. 10% of the ASX200 by number of participants but only 7.4% by market weight.

The most eye catching aspect of yesterday’s trading session for most investors was probably CBA’s $1.90 fall which took ~11-points from the index – the Hayne bill for CBA alone now sits at $2.2bn as it appears that finally no stone will be left unturned. Our view for banks is overall unchanged i.e. minimal growth for the foreseeable future but while bond yields remain low their dividends remain attractive and largely sustainable - hence we are buyers of weakness but also sellers of strength.

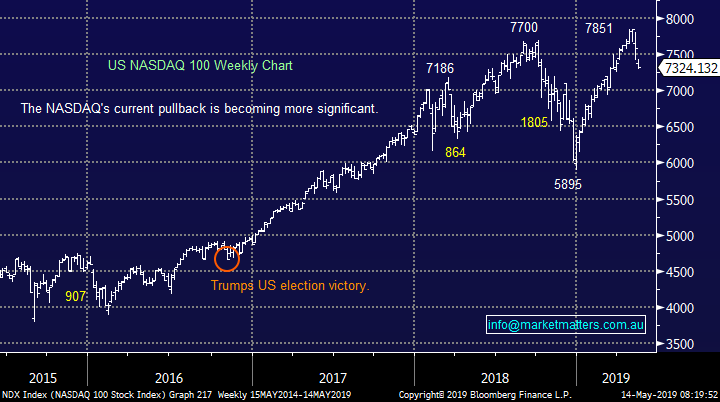

This morning is likely to be a far sterner test for local stocks following the overnight plunge on Wall Street where the tech based NASDAQ led the declines tumbling -3.5% following Chinas retaliation on Trumps fresh tariffs implemented on Friday – China is now planning on $US60bn of tariffs on US goods in a tit for tat like reaction. As we said last week global markets have felt a little vulnerable after their strong advance from the December panic lows but at MM we are looking to be accumulators into this & any further meaningful correction – slowly but surely. Conversely we are still likely to be sellers if / when we get another rapid about turn by the ASX200 and an assault above the 6400 area i.e. “play” the value.

MM believes any ongoing weakness in stocks is a buying opportunity in cyclical stocks like the resources as opposed to defensive plays such as healthcare.

Overnight US stocks were hammered and the SPI futures are calling the ASX200 to open down ~50-points / 0.8% with BHP looking set to drop almost 50c this morning on the open.

This morning we are going to look at 5 stocks that are catching our eye into current market weakness / volatility – we continue to look to buy weakness in select areas.

*Watch for alerts.

ASX200 Chart

Surprisingly overnight even though we saw the US VIX (volatility index) rally 28% back above the psychological 20% area it fell well short of last weeks 23.4% high implying investors still believe that eventually Trump and Xi will resolve their differences, as we do at MM – Trump actually said last night that he would meet China’s Xi at the G20 in June.

MM still believes a trade war will be averted but as we said yesterday things look likely to get worse before they get better – I guess a 617-point plunge on Wall Street confirmed that thesis.

The VIX Volatility Fear Gauge) Index Chart

At MM we often reference various indicators of liquidity because it’s simply this money supply which is required to push share prices higher - I’m sure it will surprise many that Bitcoin is considered by many as a useful indicator for liquidity.

During 2017 / 2018 rallies in bitcoin often led the way for stocks which can be explained as investors / traders would only pour monies into the high risk bitcoin market when confidence levels were high. However in 2019 bitcoin had struggled to get off the canvas while stocks rallied strongly but suddenly bitcoin is alive and running.

MM believes Bitcoin is a good indicator that the US S&P500 will regain its strength in 2019 and head for 3000.

Bitcoin v US S&P500 Chart

Looking for opportunities in today’s volatile market.

Overnight the US small cap Russell 2000 Index was smacked -3.2% making it one of the worst performing indices as investors clearly believe tariffs will have a greater impact on this end of town.

However at this stage the index is following our anticipated path of recent weeks with an ideal target below 1500, or only ~2% lower, hence we feel its time to be brave and not panic.

This mornings report has focused on 5 stocks we are considering into anticipated weakness, especially as we are happily sitting on elevated cash positions of 25% in our Growth Portfolio and 18% in the Income Portfolio. We have not gone into great detail with the 5 stocks as we have been discussing most of them over the last month, todays more a case of confirmation of our thoughts.

US Russell 2000 (small cap) Index Chart

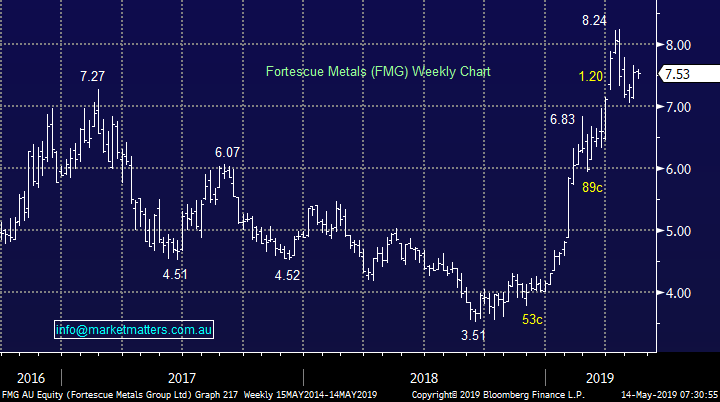

1 Fortescue Metals (FMG) $7.53

We tried to buy FMG at $7.10, or lower last week, but the low on the day was an extremely frustrating $7.11. However it now feels like we might get another bite at the cherry albeit probably at higher prices. With US rival Vale falling -4.3% overnight and BHP slipping 50c in the US a decent dip in FMG feels likely this morning.

NB Vale clearly has its own major issues in Brazil but it remains a reasonable indicator of how our iron ore names will trade on the day.

MM is still considering buying weakness in FMG.

Fortescue Metals (FMG) Chart

2 RIO Tinto (RIO) $96.03

MM has been watching / stalking RIO for weeks with an ideal entry level ~$90 however we are considering dipping our toe in the water below April’s $93.05 low with a plan to average if the opportunity arises nearer to $90.

MM likes RIO between $90 and $93.

RIO Tinto (RIO) Chart

3 Iluka Resources (ILU) $8.60

Mineral Sands business ILU has been on our radar for a while and was discussed in the last Weekend Report. They reported a pretty average first quarter last month but that’s helped present better risk / reward entry in our opinion i.e. the stock is 12% below its 2019 high and 30% below its dizzy heights achieved in 2018.

MM likes ILU below $8.50.

Iluka Resources (ILU) Chart

4 Macquarie Bank (MQG) $120.16

MQG has corrected over 12% from its high earlier in the month courtesy of a minor downgrade while also traded ex-dividend $3.60 45% franked yesterday – potentially under a Shorten government MQG will enjoy some positive flow of funds from the “Big Four banks” as their fully franked dividends become less attractive compared to that of MQG on a relative basis.

At MM we are not too concerned around the companies slightly less optimistic outlook due to the companies history of under promising and over-delivering, if anything its presenting an opportunity. Also the stock has a large correlation with US stocks which are correcting aggressively as we discussed earlier hence as we believe US stocks are close to their May lows its an opportune time to consider MQG on the correlation perspective.

MM likes MQG around $116 and $106 if the opportunity presents itself.

Macquarie Bank (MQG) Chart

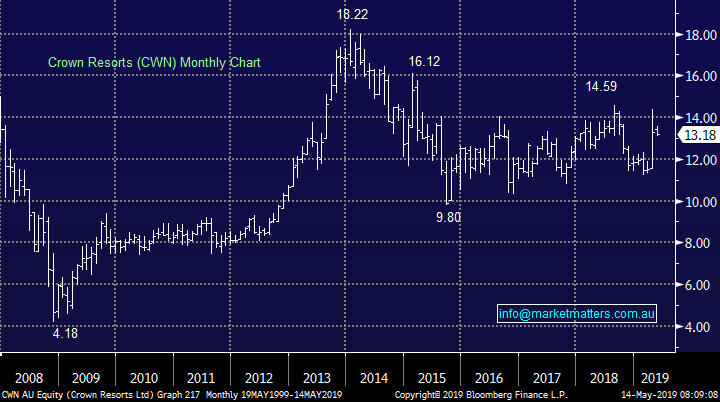

5 Star Entertainment &/or Crown (CWN)

Back in early April Las Vegas giant Wynn casinos made an audacious $10bn takeover bid for Crown Resorts (CWN) at the equivalent of $14.75. Strangely the bid was almost immediately retracted citing reasons around early disclosure of the bid, the plot thickens when we consider James Packer is a likely happy seller and he is / was friends with Steve Wynn.

However the US casino operator has repeated they are interested in casinos / resorts in the region to expand its Macau footprint but there’s no guarantees it’s going to be CWN.

MM likes both SGR and CWN a few % lower.

Star Entertainment (SGR) Chart

Crown Resorts (CWN) Chart

Conclusion (s)

Of the stocks we looked at today its hard to have a preference per say because its largely dependant on price but if I was forced to place them in order it would be in the chronological order listed above.

*Watch for alerts.

Global Indices

US stocks were hammered last night as China retaliated on President Trumps tariffs imposed on Friday - not we remain keen to buy this pullback in the days / weeks ahead.

We feel US stocks may fall a few more % short-term but feel it’s time to start accumulating.

NASDAQ 100 Chart

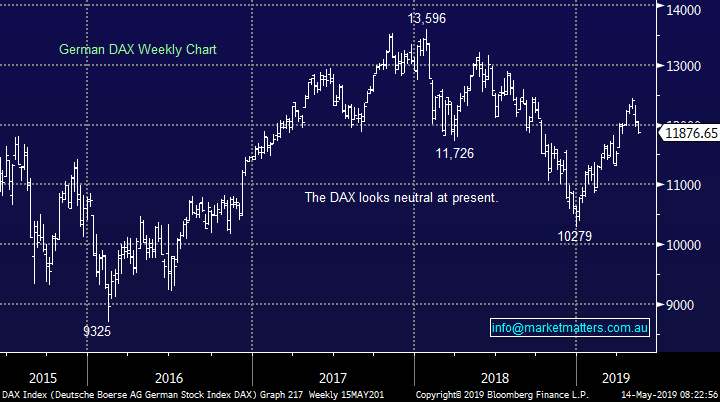

No change with European indices, we remain cautious as we enter the “sell in May and go away” period for European stocks.

German DAX Chart

Overnight Market Matters Wrap

· The US sold off aggressively, as the current US-China trade war continues to grow in a negative way, with China retaliating with higher tariffs on certain US goods.

· Investors clearly flocked to ‘safe haven’ assets, with US 10-year yield at its lowest in 2 months and the USD outperforming.

· The VIX index, a measure of volatility in the US remains above ultra-low complacency levels, above the 20 mark, with Dr. Copper (an indicator of global growth) lost 2% overnight.

· Emerging markets are expected to lose further ground, with BHP also expected to underperform the broader market after ending its US session down an equivalent of -1.27% from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open 50 points lower, testing the 6250 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.