Weekly Overseas Report as Trump hits stocks – Part 2 (ILU, FMG, AAPL, BABA US, MMM US, 005930 KS, WFC US)

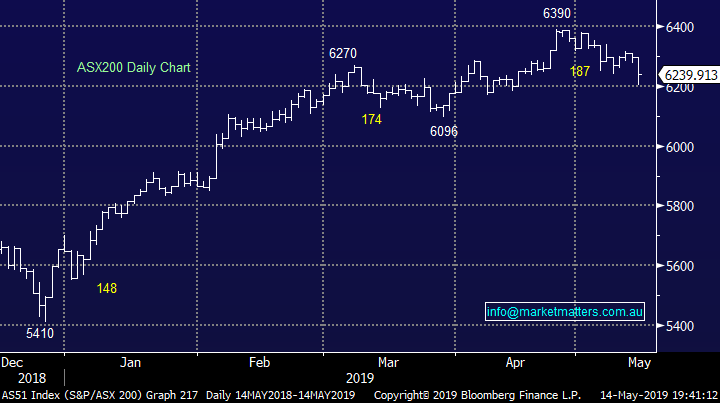

Yesterday the local market fell -0.9%, on balance an ok performance considering the Dow fell -617-points / 2.4% and the tech based NASDAQ was pummelled -3.5%. With global economic powerhouse’s exchanging body blows around trade it would have been easy to imagine local investors running a mile in the morning, especially with Bill Shorten looking set to win comfortably on Saturday, but they didn’t with the sellers clearly reticent or simply unable to push the ASX200 below the psychological 6200 area – an impressive 20% of the index actually closed up on the day with the safe haven of gold not surprisingly the standout beneficiary of this trade uncertainty.

As we mentioned above the gold stocks enjoyed an excellent bid tone with Evolution (EVN), Regis (RRL) and Northern Star (NST) all rallying between 4% and 7% respectively. At MM we are keen on the gold sector through 2019 / 2020 but if our medium-term outlook is correct and the US - China trade war will ultimately be finally resolved subsequently propelling the S&P to fresh all-time highs then more optimum entry opportunities should present themselves. However considering our thoughts moving forward I did feel a touch naked having no major gold exposure over the last 24-hours – fingers crossed we’re not trying to be too clever with this call.

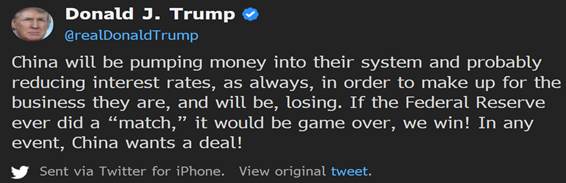

Investors should expect further volatility in the days / weeks ahead as both economic superpowers struggle to negotiate a deal which may get worse before it improves although we now feel it’s close to the crest of the wave. President Trump described the latest tensions as “a little squabble” overnight which actually helped US equities recover around a 1/3 of Monday nights losses. He also applied some pressure to the US Federal Reserve for good measure…

Overall we believe Trump has more to lose politically, if not economically, with an election next year so we remain optimistic that his tone will eventually become conciliatory.

MM believes current weakness in stocks is a buying opportunity, especially in cyclical stocks like the resources as opposed to defensive plays such as healthcare.

Overnight the US indices bounced with the S&P500 gaining +0.8%, the SPI futures are calling the ASX200 to open up ~15-points but with BHP closing up over 1% in the US we may go a touch better, at least early in the session.

Today we are going to look at 5 overseas stocks that have moved noticeably since President Trump started his latest trade Tweet campaign – this feels likely to present the ideal opportunity to commence MM’s International Portfolio’s.

ASX200 Chart

On Tuesday MM pressed the buy button on Iluka (ILU) & Macquarie Bank (MQG) for the Growth Portfolio plus RIO Tinto (RIO) for the Income Portfolio with an initial portfolio allocation of 3% in all cases hence leaving room to average lower. The levels where we would consider increasing the 3 positions are as follows:

1 – Iluka (ILU) $8.53 - around $8.35, or 2% lower.

2 – Macquarie Bank (MQG) $117.50 – below $110, or over 6% lower.

3 – RIO Tinto (RIO) – around $90, again over 6% lower.

Importantly we will be very pedantic with the averaging levels and in the case of ILU we may not press the button at all as the technical picture will be cloudy if the $8.40 area struggles to hold.

Iluka (ILU) Chart

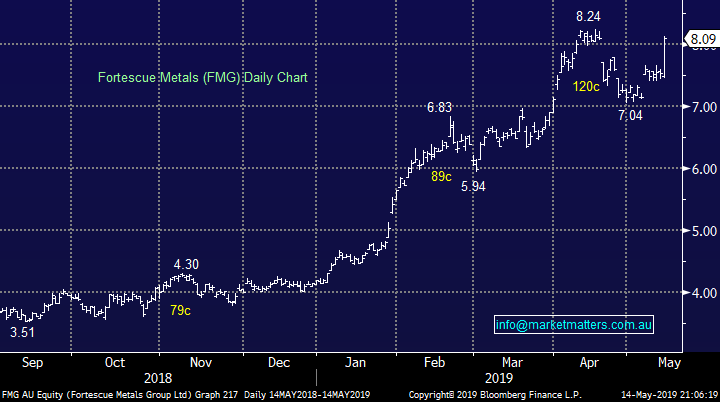

We saw one bright spot in yesterday’s tough day with FMG soaring +7.4% to be the top performer in the ASX200 thanks to a surprise 60c dividend announced in the afternoon, importantly the $1.85bn fully franked payout on June 14th will be booked this financial year, way out of the reach of Bill Shorten! It feels like Twiggy Forrest is assuming a Labor victory with this move and we ask the question if others like Gerry Harvey will follow?

We will cover FMG in more depth in today’s Income Note.

MM remains bullish FMG targeting fresh 2019 highs.

Fortescue Metals (FMG) Chart

Five potential buy candidates this last week.

With only 20% of the world’s largest 100 companies closing in the black over the last 5 trading days this morning we have focused on potential buying opportunities especially in the stocks who have endured a tough week. We have briefly looked at 5 stocks most importantly identifying where ideally we are buyers.

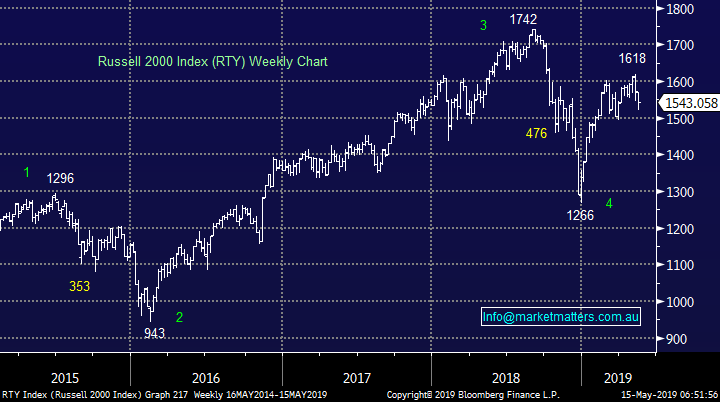

The chart below illustrates how the current pullback in US stocks is under 30% of the gains in 2019 and at MM our preferred scenario remains US stocks make fresh highs in the months ahead e.g. the Russell 2000 shown below gains over 10%.

Russell 2000 Index Chart

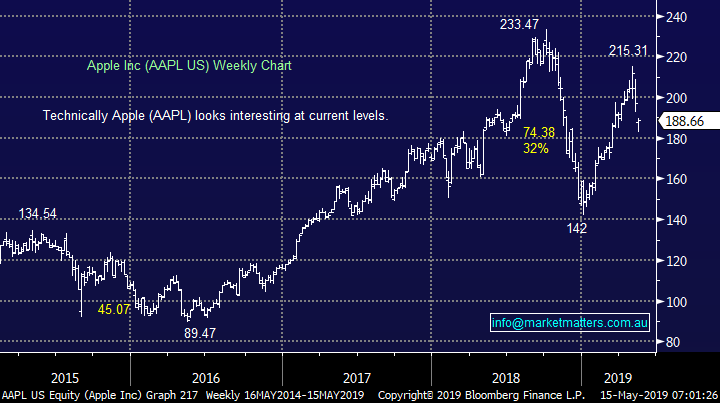

1 Apple (AAPL) $US188.66

No introductions required here as many subscribers will actually be reading this very report on an Apple device. The tech giant remains almost 20% below its 2018 all-time high and we like the upside potential in the stock if / when the US – China trade war is resolved.

MM feels Apple is a buy at current levels.

Apple (AAPL) Chart

2 Alibaba (BABA US) $US174.84

Internet and e-commerce giant BABA has corrected fairly aggressively over the last week creating some excellent risk / reward considering our target over 20% higher. They report earnings later in the week which will be keenly watched.

MM still likes BABA around $US175.

Alibaba (BABA US) Chart

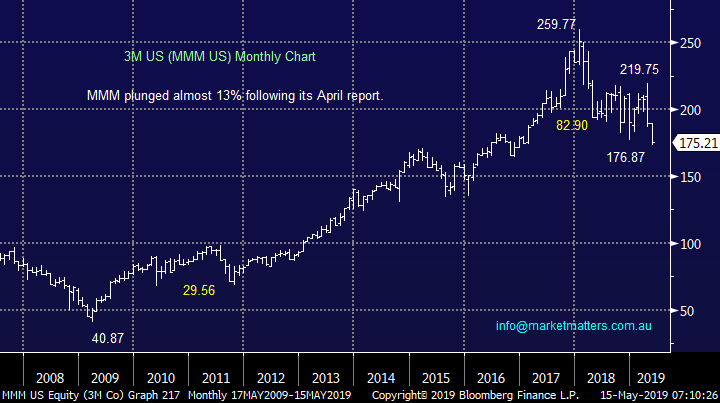

3 3M (MMM US) $US175.21

3M has had a tough 18-months and currently sits over 30% below its early 2018 high. However as the April report showed the companies struggling at present and we see no reason to be standing in front of this train.

MM only likes MMM below $US150.

3M (MMM US) Chart

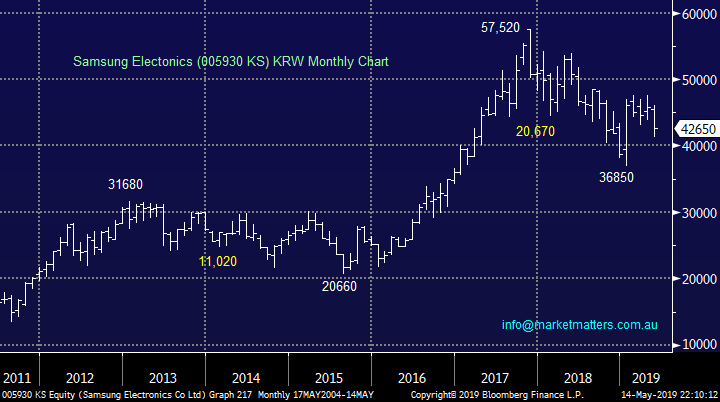

4 Samsung (005930 KS) FP) KRW42,650.

Korean electronics business Samsung has also endured a tough 18-months but unlike 3M we can see some light at the end of the tunnel but we do regard this play as more speculative than Apple and Alibaba.

MM likes Samsung at current levels.

Samsung (005930 KS) Chart

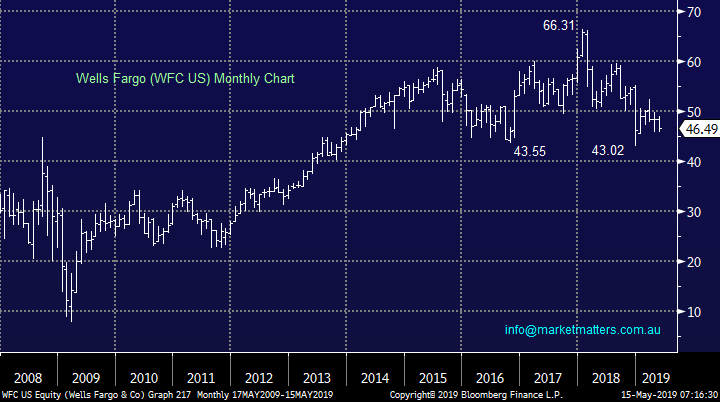

5 Wells Fargo (WFC US) $US46.49

US bank Wells Fargo which counts Warren Buffets Berkshire Hathaway as its No 1 shareholder (owning 10%) continues to struggle and remains well below its 2018 highs, the risk / reward is not exciting at present leaving us neutral at current prices.

MM likes Wells Fargo (WFC US) below $US43.

Wells Fargo (WFC US) Chart

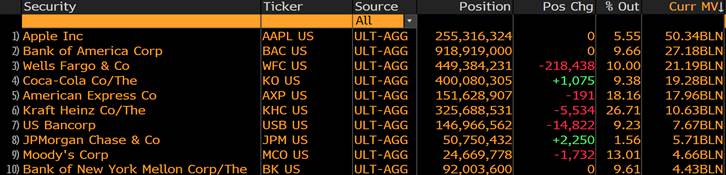

Speaking of Warren Buffet, here’s a quick look at Berkshire’s top 10 holdings – a likely topic for a future international note.

Buffet’s top 10 holdings

Conclusion

Of the 5 stocks we looked at today we like Apple, Alibaba and Samsung.

From previous overseas reports we still like Salesforce (CRM US), Amazon (AMZN US), Netflix (NFLX US), Walmart (WMT US) and Tencent (700 HK).

Global Indices

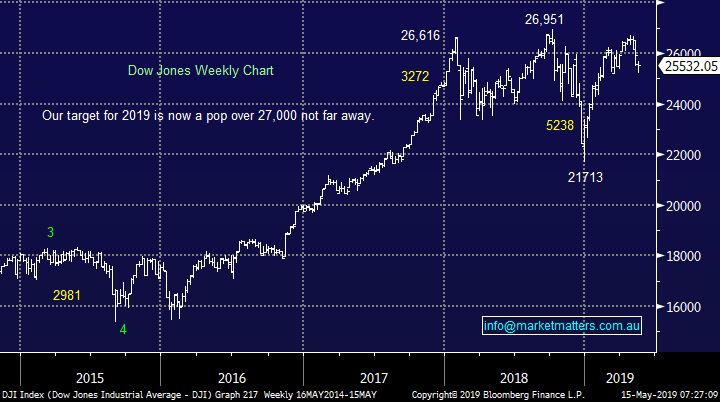

US stocks bounced reasonably well overnight following a few less scary comments by President Trump but its an optimistic investor who thinks he won’t at least make a few more ”out there” comments in the weeks ahead.

We still see fresh all-time highs by US stocks in 2019.

US Dow Jones Chart

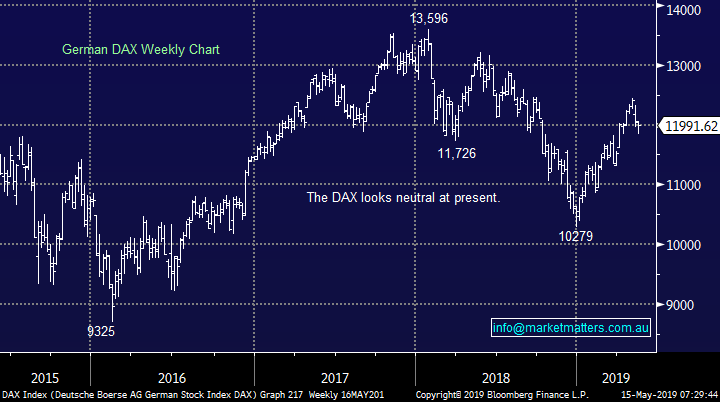

No change with European indices, we remain cautious in this region although we are slowly becoming more optimistic.

German DAX Chart

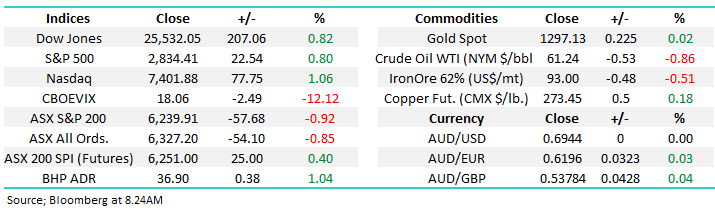

Overnight Market Matters Wrap

· The US recovered some of its losses from the previous session overnight, as investors look past the US-China trade dispute and new tariffs on both ends.

· Commodities also recovered a little ground with base metals firmer while gold eased back below the US$1300/oz. level. Crude Oil eased Saudi Arabia reported a drone explosive attack on one of their oil pipelines

· BHP is expected to outperform the broader market after ending its US session up and equivalent of 1.04% from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open 16 points higher this morning, towards the 6260 level.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.