Looking for opportunities in the ASX200’s big movers (FMG, LLC, EVN, RWC, ABC)

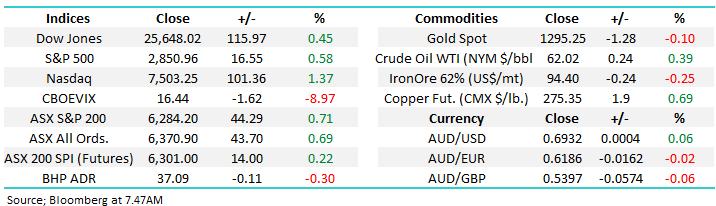

The ASX200 bounced back strongly yesterday gaining +0.7% with the Resource’s, Energy and IT sectors leading the gains while impressively none of the markets 11 sectors closed in the red. During the day the market relentlessly ground higher and it continues to feel like stocks want to go higher if President Trump would put away his bullying stick, of course that’s a big “if”. The market may feel “wobbly” to some but we are now only 1.7% below the years high while the S&P500 is 3.5% under its equivalent milestone even after last night’s +0.6% performance – when Trumps quiet global equities remain happy.

It feels like a breath of fresh air that only 2-days out from the election the political battle is finally getting a relatively low amount of air time, one of the benefits of a perceived one horse race! The bookmakers had the election “done & dusted” months ago so it should be business as usual next week with some major changes to franking credits appearing likely on the horizon assuming Bill Shorten gets a decent majority but as MM has repeated over recent months there’s still going to be plenty of opportunities in the months / years ahead – just consider the performance of the US NASDAQ since the GFC, its up over 600% without franking credits while the ASX200 is up ~100% i.e. its unlikely that many subscribers are enamoured by the likely changes to franking credits but it’s certainly no reason to throw in the towel.

This morning the ASX200 looks set to flirt with the psychological 6300 area, less than a 100-points below levels not witnessed for over 12-years and as we have often trumpeted markets that don’t fall on bad news are strong – in this case the combination of US & China trade concerns and the likely Labor victory on the weekend leading to the changes with franking credits benefits

No change, MM believes any ongoing weakness in stocks is a buying opportunity, especially in cyclical stocks like the resources as opposed to defensive plays such as healthcare.

Overnight US stocks rallied nicely with the S&P500 gaining +0.6%, the SPI futures are calling us up ~15-points this morning but not helped with BHP falling slightly in the US. Employment data out at 11.30am will be key with expectations for +15k jobs to be added.

In today’s report we are going to look at some of the best & worst stocks over recent days as value is becoming relatively thin on the ground at todays elevated levels.

ASX200 Chart

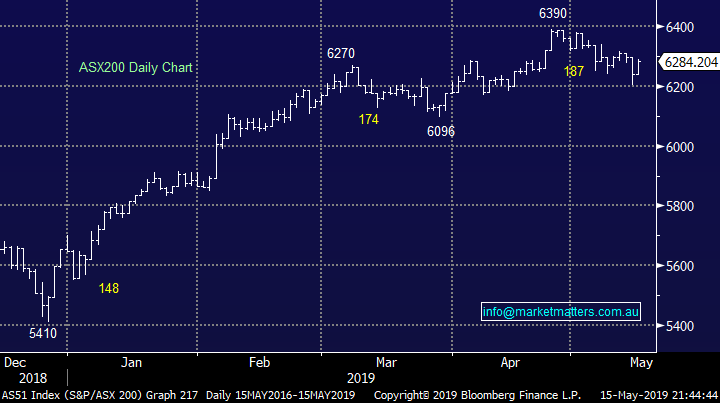

How quickly today’s market forgets concerns is almost worrying as well as encouraging, overnight we saw the US VIX (volatility index) fall 9% closing well below the psychological 20% area implying investors are basically discounting any risks that Trump and Xi will fail to resolve their differences on trade – we agree with the likely outcome but the degree of complacency feels a touch disconcerting moving forward.

The VIX Volatility Fear Gauge) Index Chart

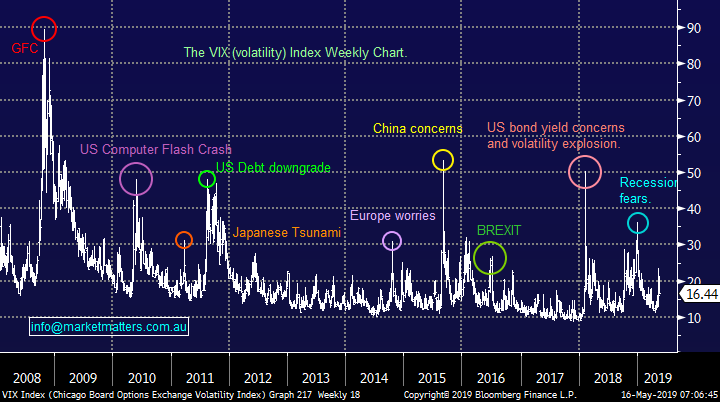

At MM we have been discussing the $A off and on for most of the year and our prognosis has not changed, we are bullish medium-term, a clear contrarian view.

However in the short-term we have been debating whether the panic low in January down towards 67c was it, or would we see another attempt a fresh decade low. At this stage the later feels far more likely which should be supportive for our US earners e.g. ResMed (RMD), Aristocrat (ALL) and Macquarie Group (MQG).

MM still believes the $A will see 80c before 60c but a break to fresh 2019 lows now feels likely.

The Australian Dollar ($A) Chart

Again looking for opportunities in the markets volatile pockets.

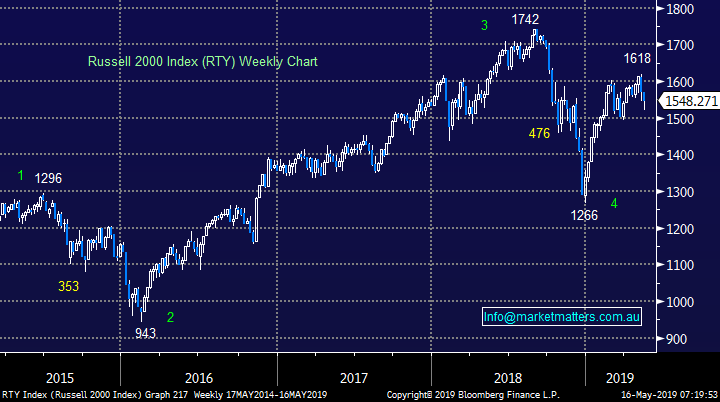

US stocks are still following MM’s anticipated path with our ideal target for the Russell 2000 during the year above 1750, or over 10% higher, hence we still feel it’s time to be brave and not panic when Trump “Tweets”.

This mornings report has focused on 5 stocks who are on the move in both directions as MM continues to look for buying opportunities, albeit for the more short/medium term.

US Russell 2000 (small cap) Index Chart

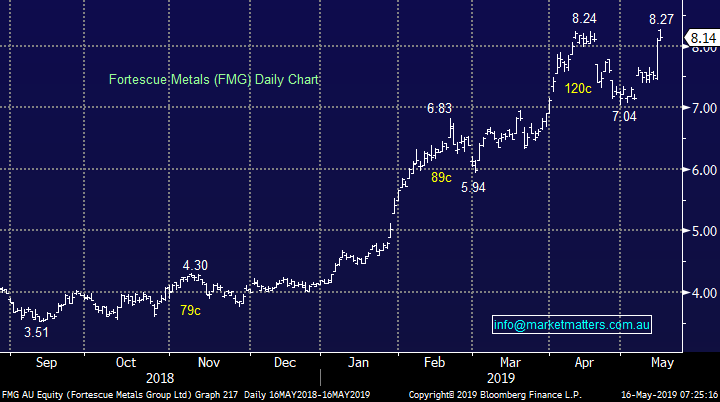

1 Fortescue Metals (FMG) $8.14

FMG surged almost 9% this week following the announcement by Twiggy Forrest that the company would pay a 60c fully franked “special” dividend later this month. We focussed on Fortescue (FMG) in the Income Report yesterday although it was others in the iron ore sector that performed better during Wednesday’s session. Rio Tinto, a stock we recently added to the Income portfolio led the gains adding more than 2% to close at $98.31 – RIO now looks strong for another assault on April’s all-time highs.

A bullish note on Iron Ore this week from First NZ Capital Securities targeting prices peaking ~$110 next quarter due to port stockpiles becoming completely depleted helped set the bullish sector tone – note stockpiles are then expected to slowly rebound, with prices easing from the fourth quarter.

Click here to view our previous note on Fortescue Metals (FMG). We are simply positive on FMG but the issue is now all around risk / reward, we like the stock even at the ~$8 area but prudence dictates if we go long here enough $$ should be left in the tank to average a decent pullback.

MM remains bullish FMG.

Fortescue Metals (FMG) Chart

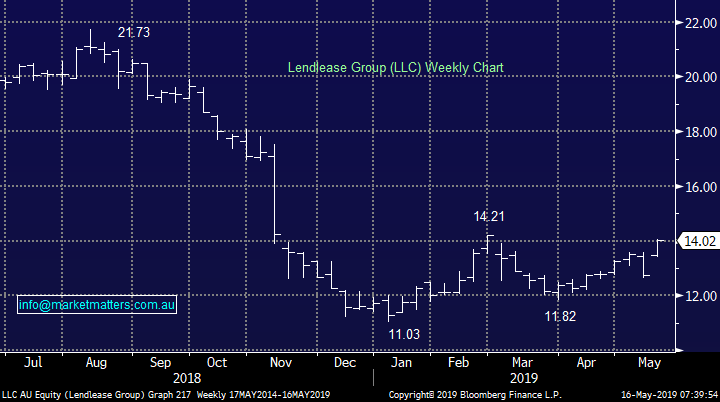

2 Lend Lease (LLC) $14.02

MM has been also been discussing Sydney based property and infrastructure developer LLC for a while and we feel its showed its hand in a big way this week by rallying over 9%. The stock is trading on a relatively conservative P/E for 2019 of 17.7x but as the chart below illustrates the business has not been without its issues over the last year.

The largest issue we have with LLC is the boring old risk / reward, we can buy targeting $15 with stops below $13.50, that’s ok 2-1 risk / reward but an initial target less than 10% higher puts it in the trade / aggressive play basket at this stage - importantly not something we are scarred of at MM.

MM is bullish LLC initially targeting $15.

Lend Lease (LLC) Chart

3 Evolution Mining (EVN) $3.58

The gold sector has enjoyed a cracking week courtesy of President Trump but while we are keen to gain a decent exposure to the sector this year it feels poor timing to step up to the plate while we are targeting fresh 2019 highs for equities in the months ahead. EVN is up almost 11% over the last 5-days illustrating exactly why we want to deploy some funds into this sector when we become nervous / bearish equities, a stance that may well be reached in 2019.

MM still likes EVN but ideally at lower levels.

Evolution Mining (EVN) Chart

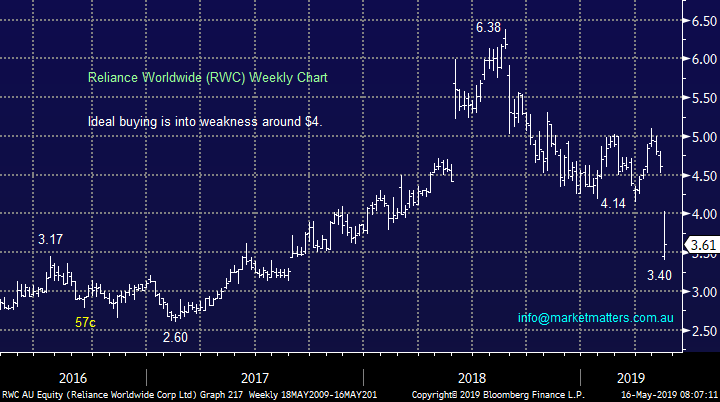

4 Reliance Worldwide (RWC) $3.61

Premium branded plumbing supplier RWC has been smashed over 20% in recent sessions following a profit downgrade for FY2019, the fall in guidance of under 10% has been harshly received. However considering where we are in the economic / housing cycle both locally and overseas its not surprising that the market has built in a rocky few years ahead. This is a simply one for the too hard basket in our opinion.

MM doesn’t plan on catching this falling knife.

Reliance Worldwide (RWC) Chart

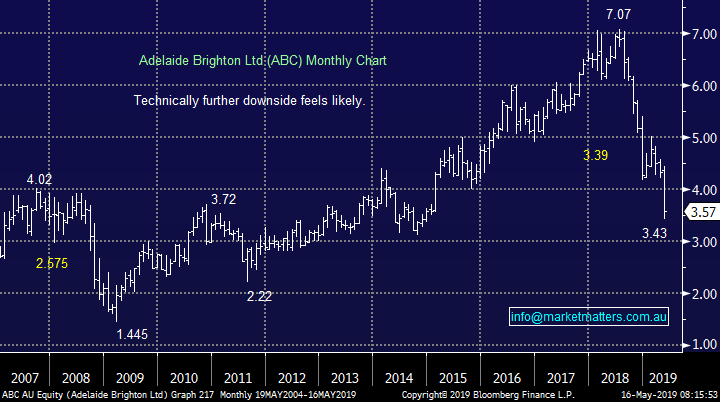

5 Adelaide Brighton (ABC) $3.57

Another stock in the Building sector and another very disappointing market update / downgrade, building products company ABC has made fresh 12-months lows this month after announcing this year’s profit will be down 10-15% on last years $190m.

At MM we love a bargain but it simply “feels” too early to be charging into this clearly challenged space.

MM remains neutral / negative ABC.

Adelaide Brighton (ABC) Chart

Conclusion (s)

Of the 5 stocks nothing felt like a “screaming” buy at todays levels while a couple felt best left alone:

1 – Buy FMG but leave room to average ~10% lower.

2 – Buy LLC as an aggressive play / trade.

3 – Leave EVN alone for now but it and the gold sector remains very much on our radar.

4 – Leave alone RWC & ABC.

*Watch for alerts*.

Global Indices

US stocks rallied for a second day last night and if they can close here, or higher, by the end of the week its feeling like were off to fresh all-time highs.

US stocks continue to feel like it’s time to be accumulating.

NASDAQ 100 Chart

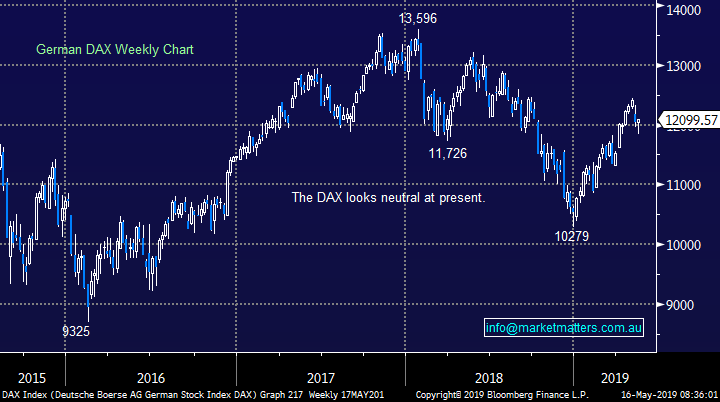

No change with European indices, we remain cautious as we enter the “sell in May and go away” period for European stocks but the tone is improving fast.

German DAX Chart

Overnight Market Matters Wrap

· The US equity markets edged higher overnight and its biggest 2-day gain in over a month as trade tensions eased between US and China, and investors refocused their attention on its own economy.

· Crude oil gained 0.39%, while the ‘safe haven’ assets such as gold were weaker. BHP is expected to underperform the broader market after ending its US session down an equivalent of -0.30% from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open 10 points higher, testing the 6300 level this morning. Note, Westpac (WBC) is trading ex-dividend today at $0.94 a share fully franked.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.