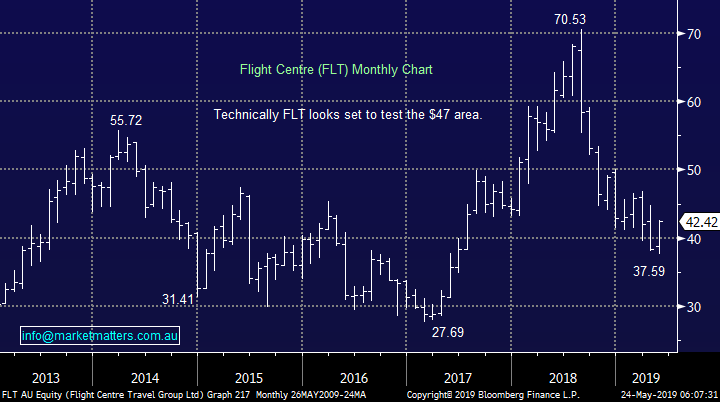

Is it time to follow the market back into Consumer Discretionary stocks? (ALL, HVN, SGR, BAP, FLT, AHG, APE)

The ASX200 retreated yesterday for the first time since the election following 6-consecutive days of solid gains but a 19-point drop shouldn’t be regarded as more than a healthy pause after a 5% uninterrupted rally. The “Big Four” banks gave back an average of -1.6% and the Energy sector fell -1.3% whereas the Consumer Discretionary stocks rallied 2% in anticipation of an upturn in the economy from the combination of the surprise election result and the RBA’s almost promise of interest rate cuts in 2019. Also considering that the average drop across Asia was ~1.6% the begrudging pullback by local stocks can easily be described as a good result.

Again the resources stocks were a touch heavy with BHP Group (BHP) -2% and OZ Minerals (OZL) -2.4% catching our eye plus as we said above the Energy sector struggled. We continue to look for an ideal time to increase our exposure to both sectors and the overnight -5.7% plunge in crude oil may throw up some opportunities today with both Woodside Petroleum (WPL) and Worley Parsons (WOR) in our sights – watch this space but there’s nothing like trade concerns to hurt oil prices and of course ultimately Trump wants lower fuel prices heading into an election at the end of next year.

I started writing this report at 9pm last night and the S&P500 futures were trading down ~30-points / 1%, a decent drop and yet our SPI futures had only slipped 10-points, it felt nobody wants to get short Australian equities for more than an hour or two! At MM we will look to commence taking some $$ from the table in the weeks / months ahead if the local market becomes too excited but at this stage it continues to feel like investors / fund managers have been caught hugely underweight domestic equities from late 2018, the euphoric buzz still feels like its missing for any meaningful inflection point.

MM remains bullish the ASX200 technically while the index can hold above 6380.

Overnight US stocks had another volatile night courtesy of President Trump and the ongoing US – China trade concerns, the Dow closed down 286-points / 1.1% but well off its intraday lows as US indices rapidly approach our targeted retracement areas. The SPI futures are calling the ASX200 to embrace some of the US weakness and open down ~0.5% but BHP has only closed down 15c implying some more profit taking in the banks is on the cards.

In today’s report we have looked at 5 stocks in the Consumer Discretionary space as we search for some upside potential into the EOFY.

ASX200 Chart

MM enjoyed Aristocrat’s +7.1% surge yesterday following the gaming company releasing a very strong first half result helped by an excellent input from the US side of the business plus a strong performance from its digital arm. They posted a normalized net profit of $422m for the half-year, a healthy 17% improvement on last year. Impressively the EBITDA figure of $766.3m was a 19% gain year on year beating the analysts’ consensus by nearly 5%.

MM remains bullish ALL while it can hold above $26.40.

Aristocrat Leisure (ALL) Chart

Is it time to back the Australian consumer?

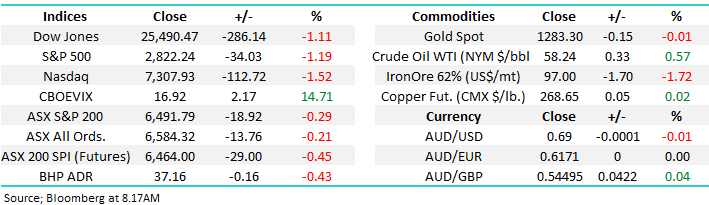

Yesterday we saw all 7 of the ASX200’s retail stocks close in the green up by between +0.7% and 3.4% and with the exception of Webjet (WEB) its been an excellent 5-days for the sector e.g. Super Retail (SUL) +14%, Nick Scali (NCK) +8.5% and Harvey Norman (HVN) +8.5%. Likewise the whole Consumer Discretionary sector has enjoyed 2019 and a fresh decade high looks on the cards in the weeks ahead as the election / rate cut euphoria feels likely to keep the momentum rolling.

The Consumer Discretionary sector today makes up 7.2% of the ASX200 while they yield 4.22% as a group. Today we have looked at 5 of these stocks as we consider any candidates that may “pop higher” into EOFY especially as we believe the sectors post GFC run is relatively mature and we’re potentially looking for the last piece of cake – note ALL mentioned earlier is in the sector but not covered again below for obvious reasons.

MM is short-term bullish the Consumer Discretionary sector.

ASX200 Consumer Discretionary Index Chart

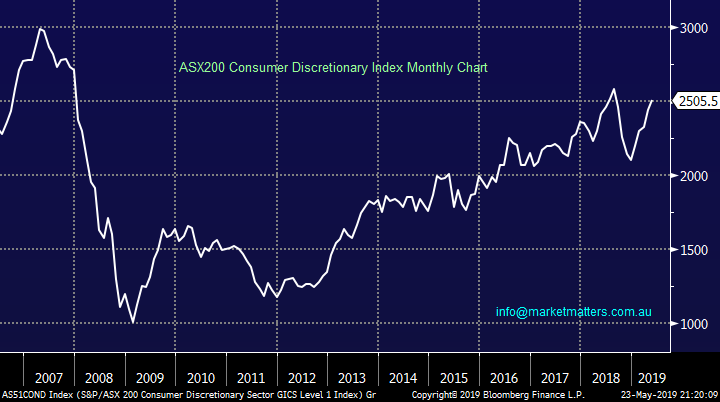

1 Bapcor (BAP) $5.84

Automotive retailer BAP has bounced 10% in May after making fresh 12-month lows following weaker than expected growth numbers in February. BAP has been a strong growth story in the after-market vehicle accessory business since listing in 2014, however that growth has started to slow.

Slowing growth has led to a re-rate in the multiple the market was prepared to pay for the stock, with BAP now trading on a Est P/E of 15.8x while its 2.7% fully franked dividend is not likely to attract yield seekers. Since listing, BAP has garnered a P/E top of 27x and a low of 14x, implying that today’s multiple of 15.8x is certainly on the cheap side of history.

Technically a 10% bounce looks likely and we could comfortably go long with stops below $5.60, or 4% risk – definitely acceptable risk / reward.

MM likes BAP for a 10% bounce.

Bapcor (BAP) Chart

2 Star Entertainment Group (SGR) $4.49

SGR has been on our radar for most of 2019 and the recent corporate activity between Wynn and Crown has thrown the sector back into the limelight, while a currently weak $A should help the overseas tourism numbers into Australia.

The current Est P/E of 16.3x is not too demanding while the yield of 5.2% fully franked is not to be sniffed at, simply there are some attractive tailwinds for the stock with good risk / reward at current levels.

The market does like this stock – has done for a while with 10 buys, 3 holds and no sells. The consensus view is clearly a positive one leaving the next marginal buyer harder to pinpoint, however the obvious catalyst comes from corporate activity towards Crown.

MM is bullish SGR with stops below $4.25.

Star Entertainment Group (SGR) Chart

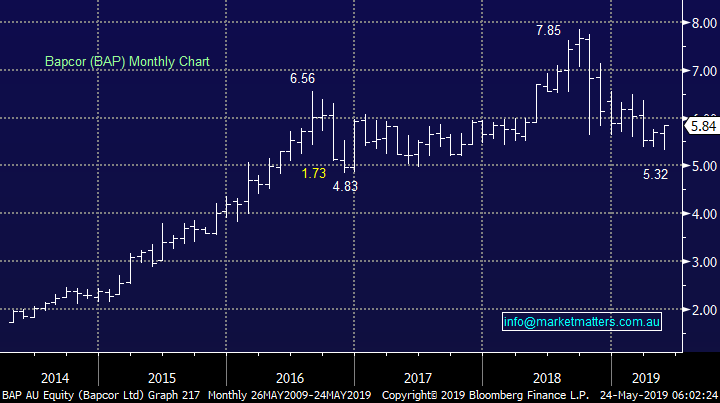

3 Flight Centre (FLT) $42.42

FLT looks great for a rally initially towards the high $40 region i.e. 15-20%. MM recently went long for the Income Portfolio and although early days, the investment currently feels on the money. While the yield in the coming 12 months will be lower than the previous (given a recent special dividend) and FY19 has been / will be a tough period from an earnings perspective for FLT, the likely bump in consumer sentiment post-election should change the markets currently negative view on the stock, and looking further out into FY20, the outlook is improving.

There’s also been some speculation between a tie up between Corporate Travel and Flight Centre which would be a big positive for FLT given strong growth in the corporate area.

While we added FLT to the Income Portfolio, this is a stock that could also fit into the Growth Portfolio with stops below $40.

MM is bullish FLT initially looking for 15-20% upside.

Flight Centre (FLT) Chart

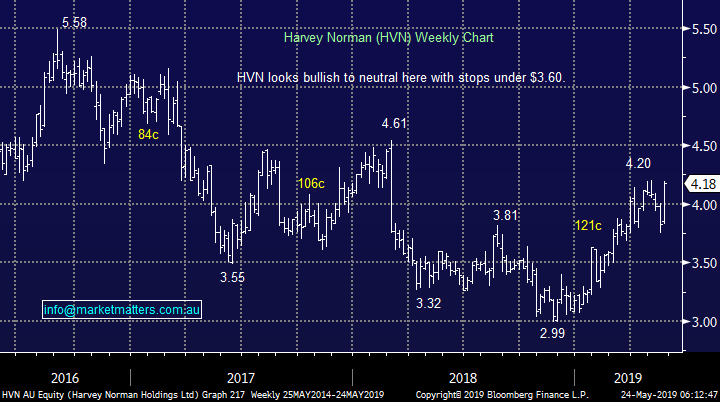

4 Harvey Norman (HVN) $4.18

Gerry Harveys HVN which was touted by many as a candidate along with Fortescue (FMG) to pay out a chunky special dividend to utilise its substantial franking balance, not required now after the demise of Bill Shorten.

We are looking for the retailer to make fresh 2019 highs but that’s very close now and if anything we would be considering taking some $$ from the table at these levels. HVN is no longer cheap, trading around 14x, up from a low below 10x. Clearly the market has become more excited about future earnings and is prepared to pay a higher multiple now to get set.

MM is neutral / bullish HVN at current levels.

Harvey Norman (HVN) Chart

5 Automotive Holdings (AHG) $2.65 & AP Eagers (APE) $9.36

A more complicated company / sector to think about currently with an off market takeover bid from rival AP Eagers (APE) playing out, with APE now speaking for ~58% of the AHG share register.

However, vehicle sales is a very good indicator of economic strength or otherwise and while AHG had a minor slip up earlier in the month as did APE, here we are today, with both APE & AHG stock 10% higher implying many investors believe the worst is behind the sector. Nick Politis, Chairman and major shareholder of APE certainly thinks so by looking to combine two of Australian largest car dealership networks at a low point in the cycle - a clear vote of confidence in the longer term outlook for vehicle sales in Australia.

The question in the shorter term is, can the combination of interest rate cuts and a Liberal government get the average Australian back into the car showrooms with wallets at the ready?

Technically both stocks look good risk / reward however given the takeover at play, some thought to relevant pricing between the two is important. The deal is 1 APE share for every 3.6 AHG shares held, meaning that at the current price of $9.36, AHG should be trading at $2.60 versus current price of $2.65.

MM likes both AHG & APE technically as a play for the more aggressive investor / trader.

Automotive Holdings (AHG) Chart

AP Eagers (APE) Chart

Conclusion (s)

Within the Consumer Discretionary sector space we have looked at today our favourite 2 stocks are Aristocrat (ALL) and Flight Centre (FLT) both of which we own in respective Platinum and Income Portfolios.

Of the remaining stocks we like Star Entertainment (SGR) followed by BAP and AHG / APE for the more aggressive players.

Global Indices

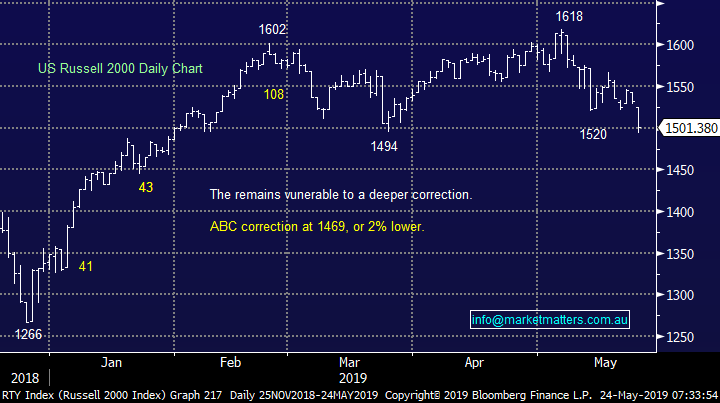

US stocks again slipped lower last night with the small cap Russell 2000 the worst performer -2% as trade talks continue to weigh on the market, MM’s target for this correction for the often leading Russell 2000 is now only ~2% lower.

US stocks continue to feel like it’s time to be accumulating for a final push higher.

US Russell 2000 (small cap) Index Chart

No change with European indices, we remain cautious as we’re in the “sell in May and go away” period for European stocks but the tone is improving fast.

German DAX Chart

Overnight Market Matters Wrap

· US equities traded lower overnight led by the tech. heavy NASDAQ 100, down 1.52% as the seriousness of the US-China trade war is starting to sink in. Many were optimistic that we would see a resolution “soon” but it seems the parties are moving further apart. A Chinese official said the US should adjust its wrong actions if it wants to resume dialogue.

· Data out of the US was mainly negative overnight. New home sales fell 6.9% last month to an annualised 673K units, below analyst expectations. May Markit manufacturing PMI fell to 50.6, the lowest in 10 years.

· Metals were mixed on the LME while iron ore fell. Crude oil traded higher, currently at US$58/24. We expect BHP to underperform the broader market after ending its US session down an equivalent of 0.43% from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open 32 points lower towards the 6460 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.