Weekly Overseas Report after the RBA cuts rates (VOC, FB US, AAPL US, AMZN US, NFLX US, GOOGL US)

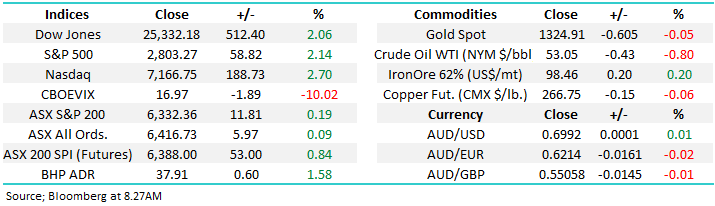

Yesterday the local market rallied 12-points following the anticipated 0.25% rate cut by the RBA, with Governor Philip Lowe adding further fuel to the fire as he prepared markets for another cut to take the official targeted rate down to an unprecedented 1%. Prominent AMP economist Dr Shane Oliver is now forecasting rates will actually reach 0.5% in 2020, great news for home owners with a mortgage but an unmitigated disaster for those living of fixed income. Its extremely hard to imagine stocks with sustainable decent yield not outperforming the index over the next 12-months as money is almost forced from term deposits in the hunt for income – medium term potentially very dangerous but for now supportive of the relevant sectors of the market.

Overnight the US Fed Chair Jerome Powell walked in the RBA’s footsteps saying he was open to interest rate cuts if required which sent US stocks surging over 2% to their largest one day gain in 5-months. Post the GFC these periods of increased dovish sentiment (lower rates) by central banks has led to meaningful rallies which have been sustained implying it’s a dangerous time to be too bearish stocks.

Under the hood yesterday we saw the banks continue to rally strongly with CBA now up over $6 / +8.3% in 2019 plus also having paid a $2 fully franked dividend in February. However while their earnings and growth maybe challenged its hard not to find the 5.5% fully franked yield attractive if interest rates are headed to 1%, and potentially lower. At MM we have been looking for an opportune time to switch our overweight banking position into the resources sector but at this stage we are in no hurry. Apart from the banks we also saw the traditional yield plays of Real Estate, Utilities’ and Telco’s rally solidly – looks like we took our $$ from Telstra (TLS) too early as it made fresh 16-month highs into yesterdays close.

We continue to believe investors should expect elevated volatility moving forward as the 2 main global economic superpowers continue their arm wrestle for a trade deal. Our preferred scenario remains the current May / June correction by international markets is either complete, or close to it, and a rally to fresh 2019 highs is a strong possibility fuelled again by lower rates but clearly we need trade concerns to recede.

MM believes recent weakness in o/s stocks is a buying opportunity implying local stocks will regain their mojo.

Overnight the US indices roared back to life with the Dow surging over 500-points as al the major indices gained over 2%, the SPI futures are calling the ASX200 to open up 1% with BHP trading up ~60c in the US.

Today we are going to revisit the FANG stocks following their volatile week due to fears of increased government scrutiny.

ASX200 Chart

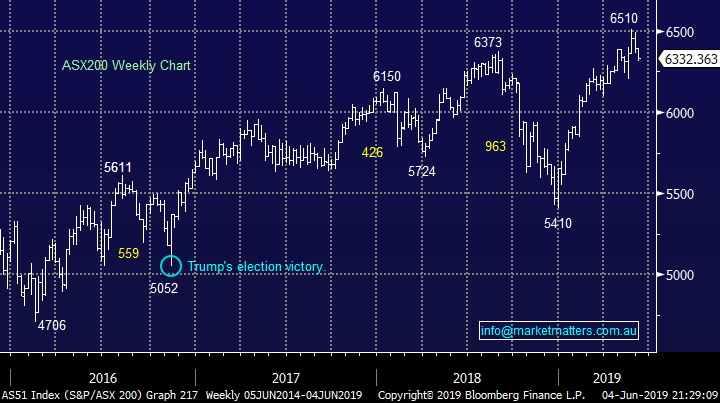

The high flying ASX200 Software & Services Index was clobbered yesterday with the IT Sector the weakest on the boards falling -2.4% led by Xero (XRO) -3.5%, Afterpay (APT), Altium (ALU) -4.3% and a Bravura (BVS) a whopping -11.2%.

We still have no interest in buying the dip in this sector of the market believing it to be the most expensive growth sector on the planet. It appears to have been chased higher by Fear of Missing Out (FOMO) and momentum systems but when it corrects, like in late 2018, we can see the picture again turning very ugly.

Our general view is there’s better value in global IT stocks and potentially the FANG’s we are considering today.

ASX200 Software & Services Index Chart

We learned last night that EQT have decided not to proceed with its $5.25 cash offer for Vocus (VOC) in an announcement that reminded me of Wynn Resorts almost immediate “walk away” from its takeover talks with Crown Resorts (CWN) – taking the money and running has been the best way to play takeover offers / speculation in 2019. Hence we are keeping a close eye on our “takeover” position in Healius (HLS).

MM not surprisingly anticipates VOC to gap down ~10% this morning.

Vocus (VOC) Chart

Are the FANG stocks presenting value?

Today we have revisited the major 5 FAANG stocks following this week’s volatility after the Wall St Journal reported the justice department was set to commence an antitrust investigation into Google and Facebook – the threat of increased regulation is a clear significant negative for the stock, just think of the previous 1-2 years experienced by our banks and many financial stocks.

It might surprise some subscribers to know that unlike the NASDAQ the NYSE FANG+ Index continues to trade well below its 2018 high.

NB The FANGS are household US names Facebook, Apple, Amazon, Netflix and Google while the + Index includes the likes of Alibaba and Tesla.

NYSE FANG+ Index Chart

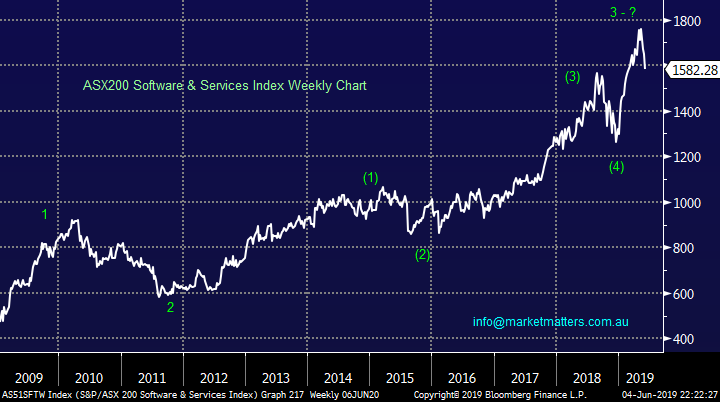

1 Facebook (FB US) $US167.50

Facebook first quarter performance showed the anticipated slow-down in above the line growth but its evolving business model remains fully on track – the company still made a profit even after taking a $3bn legal charge. Revenue was up an impressive 26% year on year to just under $US15bn with a staggering 1.56 billion daily active users.

However the shares have been hit this week as reports began surfacing that that the social media goliath was been looked at by federal regulators for potential antitrust violations. This feels like an issue that is unlikely to vanish anytime soon.

MM is now neutral Facebook.

Facebook (FB US) Chart

2 Apple Inc (AAPL US) $US179.64.

Overnight Apple rallied +3.7% in the US but it hardly registered compared to the recent +20% plunge on fears of deteriorating trade between the US and China. The company’s latest numbers showed they realised US11.58bn profit on $US58bn revenue with services revenue hitting an all-time high although gross margins fell from 38.3% to 37.6% - plus they announced another $75bn in share buybacks.

We see deep value in Apple at current levels on ~14x with buybacks, large cash balance etc i.e. at this price investors are not paying any premium for growth.

We acknowledge the current iPhone product cycle is going poorly especially in of course China but the business is looking to allay concerns around life after just selling phones / iPads by increasing its services revenue. Stocks with leverage to China have been sold down aggressively of late but we feel the risk / reward is now attractive with plenty of bad news built into the price.

Technically I can see months of choppy rotation between $US170 & $US200 making the stock attractive at todays levels.

MM likes Apple below $US180 area.

Apple Inc (AAPL US) Chart

3 Amazon.com Inc (AMZN US) $US1729.56

Overnight Amazon bounced over 2% in line with the NASDAQ but there’s still more ground to make up after Mondays 6% plunge following the rumours around anti-competitive business practices.

Recently the on-line retailing goliath produced a huge quarterly profit beat although revenue growth slowed as anticipated. While we still can see Amazon will making fresh all-time highs in the next 12-months the ”easy money” appears well behind it. Technically the picture is similar to both Apple and Facebook.

MM is mildly bullish Amazon targeting fresh all-time highs.

Amazon.com (AMZN US) Chart

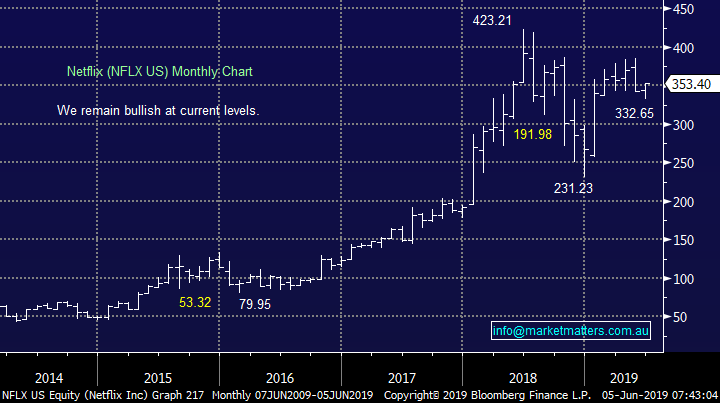

4 Netflix (NFLX US) $US353.40

Netflix has suffered slightly from higher costs plus increased competition with 4 new entrants in to the internet TV space but the first major player remains well positioned and barriers to entry are high. The company recently beat expectations for Q1 2019 but future guidance disappointed some players – revenue of $US4.52 billion was slightly above the “Streets” numbers but 1.76 million and 7.86 international new subscribers was the big positive driver for investors.

We feel technically NFLX is the strongest of the FANG group and this has been helped by no immediate concerns around regulatory issues.

MM remains bullish Netflix, we can see another ~20% upside.

Netflix (NFLX US) Chart

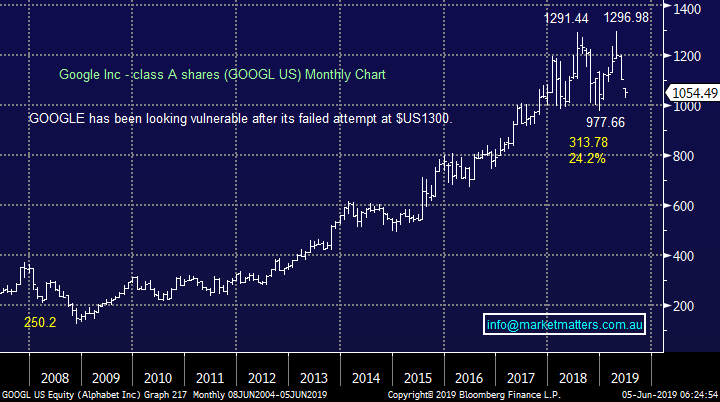

5 Google (GOOGL US) $US1054.49

Ant-trust concerns hammered Google along with Facebook with the stock falling over -6% on Monday. Back in 2013 Google was basically forced to change some business practices over its anti-competitive behaviour. Hence this not a new phenomenon to the company which has demonstrated it can move ahead once all is sorted but the uncertainty around at what cost is likely to weigh on the stock.

The stock has struggled since reporting disappointing sales growth across all of its major sales categories with the executives blaming currencies for some of the miss – a strong $US is a meaningful headwind for Google moving forward. Technically we were previously concerned when Google failed to follow through on its break above $US1292, now around the $1US1000 we see decent medium term support – over 20% below this year’s high.

MM is now neutral Google at best.

Google (GOOGL US) Chart

Conclusion

Of the 5 stocks we looked at today our preference is still Netflix (NFLX US) followed by Apple (AAPL US).

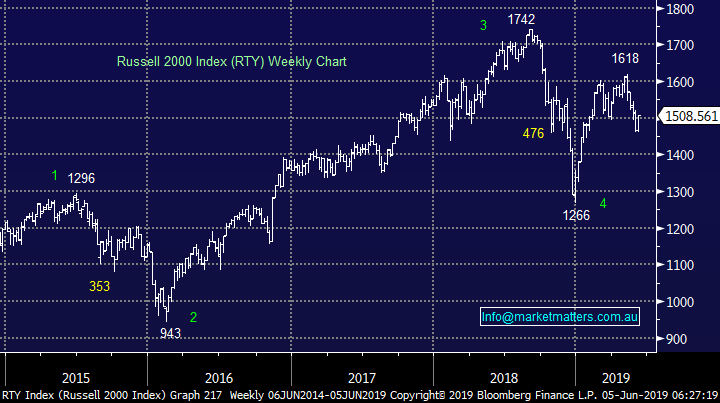

Global Indices

US stocks rallied strongly overnight following dovish comments by the Fed Chair Jerome Powell. Our favourite market guide the Russell 2000 outperformed most rallying +2.6% and we can still see a break of 1750, a whopping 16% higher!

We still see fresh all-time highs by US stocks in 2019.

US Russell 2000 Index Chart

No change with European indices, we remain cautious in this region although we are slowly becoming more optimistic.

German DAX Chart

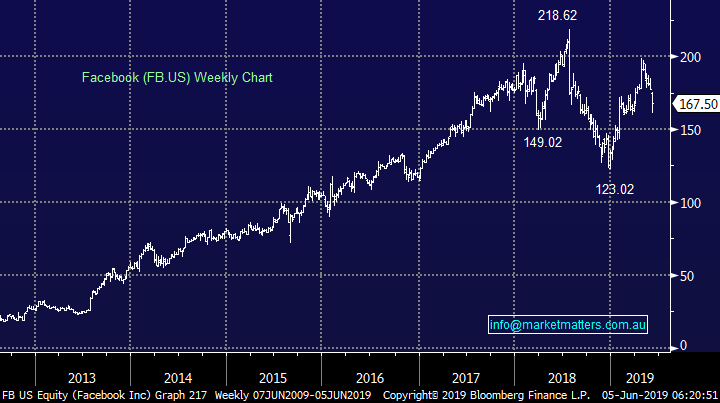

Overnight Market Matters Wrap

· The US equities bounced back overnight for their biggest gains in five months. The Dow and the S&P 500 both rose ~2.1%, while the NASDAQ 100 was the best performer, gaining back some of its recent losses.

· US Fed Chair Powell said the bank is closely watching the impact of US trade tensions and will cut rates to maintain economic expansion. Strong labour markets and inflation around 2% are the main objectives. It seems Trump’s desire for the Fed to stimulate the economy with looser monetary policy may come to fruition.

· The June SPI Futures is indicating the ASX 200 to open 52 points higher, testing the 6385 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 05/06/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.