Does Europe remain the wrong way for portfolios to face? (CPU, LNK, MQG, DMP, ANN)

The ASX200 again soared to fresh decade highs yesterday approaching the psychological 6700 area on its travels, Thursdays 6687 close is now less than 2.5% below its pre GFC all-time high and the major milestone is looking increasingly vulnerable. Under the hood the breadth was interestingly not as impressive as we’ve experienced recently with only 60% of the ASX200 closing up on the day but when 12% of the index closes up over 3% the impact generally compounds to push the index higher. The Asian region enjoyed a dynamic session with our +0.6% rally looking pedestrian compared to some - China +2.4%, Hong Kong +1.5% and Japan +0.6%.

The catalyst for the rally was yet again interest rates but this time it was the Fed whose dovish comments from the previous night were slowly digested after the US had closed sending US futures steadily higher throughout our session, at 9.30pm last night when I began contemplating this missive the S&P futures were up +0.9% implying all-time highs in the US would be at least tested while most of us were tucked up in bed.

At MM we have been bullish overseas equities for months targeting a potential test of the 3000 area, with this level now ~2% away we must revert to a more neutral / conservative stance.

At MM we remain in “sell mode” looking to increase our cash position and / or move the portfolios to a more defensive stance but the price action / momentum has told us to remain patient but I now feel the time is nigh. Expectations of lower interest rates have been built into stock prices at an extremely rapid rate, its almost panic like buying in some sectors. – we do anticipate pressing some sell button (s) in the coming weeks.

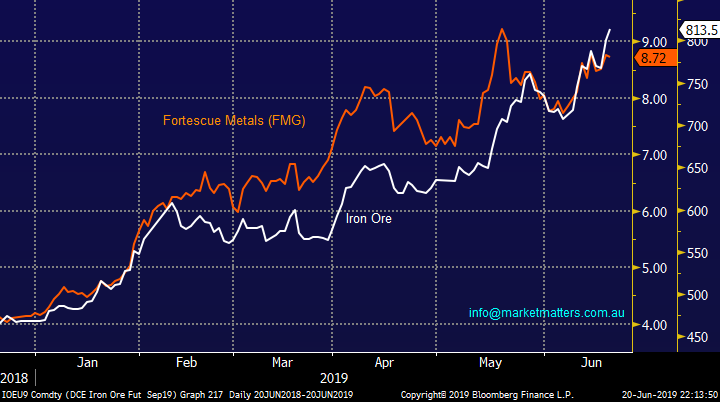

The volatility across markets is clearly increasing with not only equities surging yesterday we’ve also witnessed gold surge almost $US50/oz, crude gain +3.5% and iron ore trade in a 6% range with the $US weakness courtesy of the markets rethink on US rates the major influence.

MM is bullish the ASX200 while it holds above 6580 especially as we remain bullish global equities for now.

Overnight US stocks did make new all- time highs with the S&P 500 printing a 2958 just before the close and while the Dow Jones rallied by +249points / +0.94%, it wasn’t enough for a new milestone there. The Russell 2000 continues to lag its larger cap counter parts. This morning, SPI Futures are indicating a fairly flat start to trade after a bullish session yesterday captured the bulk of the US move overnight.

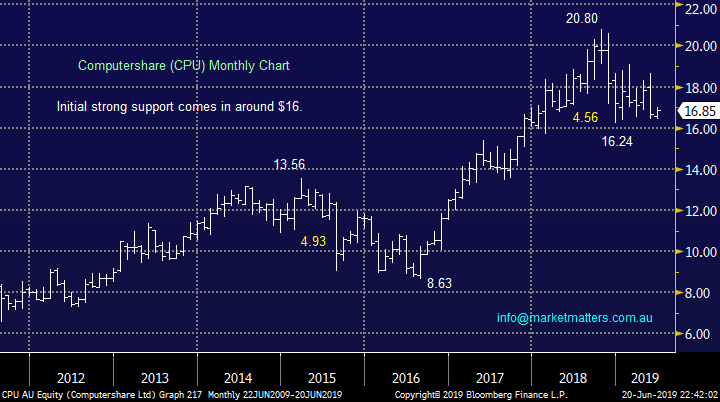

In today’s report we are looking at some of the European facing stocks in our index many of whom have endured an awful year, the question being, is it time be a contrarian investor or simply continue to prefer the sidelines from those companies operating in that part of the world.

ASX200 Chart

Bond yields continue to dominate markets at present and yesterday we saw US 10-years fall under 2% for the first time since 2016, this seems to have caught a lot of investors attention as we saw gold and crude oil both pop higher.

MM believes that rates are going lower with the only question how far & fast.

Australian & US 10-year Bond yield Chart

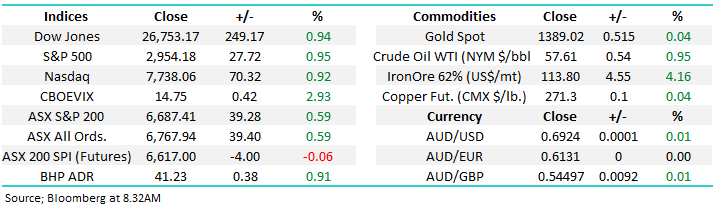

Yesterday we saw iron ore soar to fresh 2019 highs but the iron ore producers closed down courtesy of a production downgrade by RIO Tinto (RIO) which fell -4% but more importantly, news that Vale had received the go ahead to restart production at their Brucutu mine - other sector heavyweights Fortescue (FMG) -0.5% and BHP -0.3% also struggled in a strong market.

Our feeling is it’s time for iron ore to consolidate recent gains, rather than run further, with gold fast becoming our favoured commodity as we believe the $US50/oz pop higher yesterday was the start of a rerating of the precious metal.

MM now prefers the gold sector over iron ore.

FMG v iron ore Chart

As mentioned earlier we believe that gold has broken out in a major way, a view that coincides with our opinion that the $A is bullish against the $US medium-term.

We are now considering buying some gold exposure even into recent strength - Evolution (EVN), Regis Resources (RRL), Northern Star (NST) and Newcrest (NCM) are all on the radar.

MM is bullish the gold sector.

Gold Chart

Assessing European facing stocks

European facing stocks have suffered in a strong year, today we’ve picked out 5 companies we haven’t looked at recently to see if the regions become too negative. The numbers don’t lie and the performance of the region over the last year tells a tale e.g. CYBG (CYB) -34%, Janus Henderson (JHG) -29% and Link (LNK) -26%.

Steve Jacobs, Chairman of $55bn Asset Manager BTG Pactual & new Chairman of Shaw & partners is not a fan of Europe as can be heard below and at MM its frustrated us this financial year courtesy of our position in Janus Henderson (JHG). Our medium-term view that the EU probably wont survive still sits well with us at present.

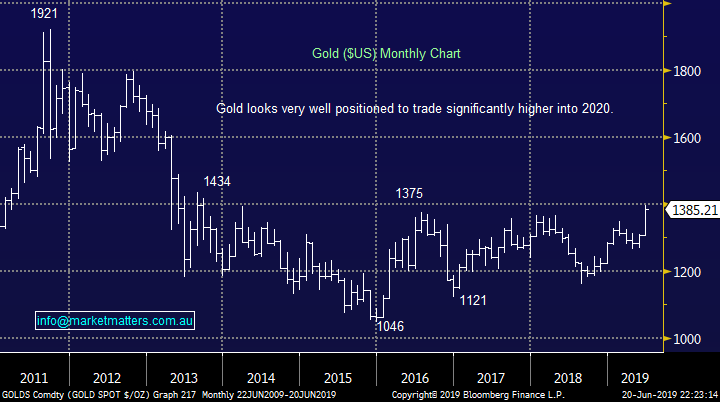

1 Computershare (CPU) $16.85

Share registry business Computershare has a UK operation that has provided some drag on the business in recent times. They are undertaking a major IT revamp at a time when there are a lot of potential changes happening in the UK / Europe. Lower interest rates are also a negative for CPU and as highlighted above, US 10 year yields dropping back below 2% is a clear headwind.

It seems ‘all too hard’ for CPU at the moment and on a Est P/E of 16x while yielding 2.61% part franked we see no compelling reason to be there.

MM remains neutral / bearish with a potential target sub $15.

Computershare (CPU) Chart

2 Link Admin (LNK) $5.32

Late last month, LNK announced a downgrade largely due to lower markets activity thanks to Brexit related uncertainty which meant lower earnings in FY19/20. The downgrade was a big one, around 15% in FY19 in 18% in FY20 resulting in a ~20% decline in the share price. It’s the second downgrade where they sighted Brexit related uncertainty as the reason.

This week, they hosted an investor day and while they talked about long term opportunities ranging from bank outsourcing in Ireland to new market opportunities in Luxembourg, it was always going to be a hard task to downplay the nearer term headwinds – which are significant.

MM is neutral / bearish showing no reason to be a hero.

Link Admin (LNK) Chart

3 Macquarie Group (MQG) $127.33

MQG will likely generate around 25% of its forecasted $12b revenue in Europe this year, around 30% in the US and 40% in Australia. At their last update in early May they said they expect profit to be slightly down from FY19 to FY20. Because of the large gains from asset sales they had last year, this seems to be a prudent position for the company to take.

Technically MQG looks capable of trading back towards its all-time high but we are likely to be tempted to take profit above $130 for our Growth Portfolio.

MM remains mildly bullish MQG, looking to sell further strength

Macquarie Group (MQG) Chart

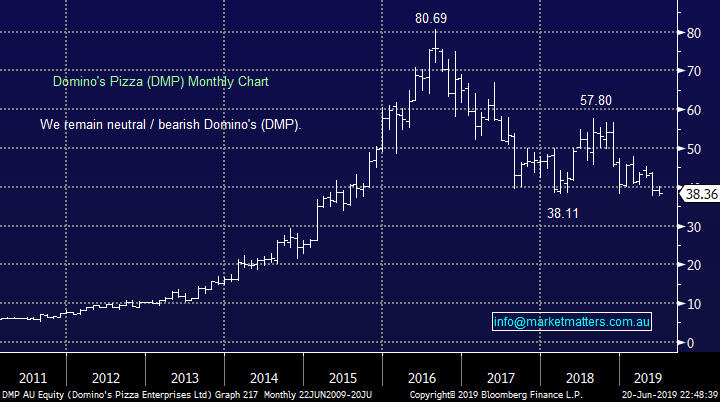

4 Domino’s Pizza (DMP) $38.36

In FY18, Europe just edged out Japan as the biggest contributor to DMP’s revenue with the company selling $407.2m worth of pizza in the region that year, although from a profitability standpoint Australia remains the biggest driver accounting for more than 53% of earnings. Dominoes have pinned their growth ambitions in Europe and Japan and to date, the level of growth has underwhelmed the market.

The only positive we can see in DMP for now is potential value into tax loss selling however the downtrend in the share price remains well engrained.

MM remains neutral to bearish DMP.

Domino’s Pizza (DMP) Chart

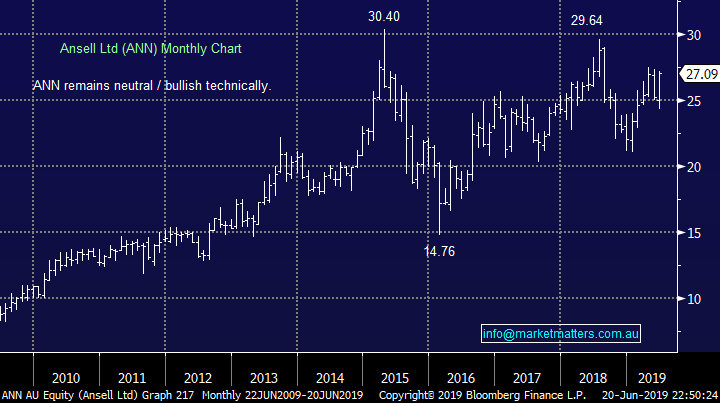

5 Ansell (ANN) $27.09

Ansell is now a large scale manufacturer of safety products used in the industrial, healthcare and life sciences fields with 37% of their ~$1.5b revenue being generated in Europe last year. The company is performing reasonably well with growth in earnings in the mid – high single digits. On an Est P/E of 17.4% while yielding 2.50% unfranked, the business is solid but hardly spectacular.

Technically ANN is mirroring it’s fundamentals, positive but not inspiring

MM remaisn neutral to bullish ANN

Ansell (ANN) Chart

Conclusion (s)

Of the 5 stocks we looked at today, we have no interest in CPU, LNK & DMP, we remain mildly bullish MQG looking to sell strength while ANN is neutral to bullish but not compelling.

Global Indices

Again nothing new with our preferred scenario - the recent pullback was a buying opportunity with our ideal target the 3000 area, now only a few % higher..

The current dovish stance by the Fed has helped the S&P500 to test its all-time high, perhaps some positive news from this week’s G20 meeting between on trade between the US & China will create the market optimism for a test of the large psychological 3000 area.

US S&P500 Index Chart

No change again with European indices, we remain cautious European stocks but the tone has improved recently and fresh highs in 2019 look a strong possibility.

German DAX Chart

Overnight Market Matters Wrap

· The key US majors rallied overnight, despite tension mounting with Iran as well US-China trade talks still not being resolved being a major risk to the downside.

· On the commodities front, crude oil rallied to US$57.61/bbl. following the downing of a US drone by Iran, while iron ore also gave it a nudge to the upside, rallying more than 3% along with nickel and copper at 3-week highs on the LME.

· BHP is expected to outperform the broader market after ending its US session up an equivalent of 0.91% from Australia’s previous close.

· The September SPI Futures is indicating the ASX 200 to open marginally higher and test the 6700 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/06/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.