We’ve mentioned in previous reports that real estate can perform solidly through a recession with a couple of obvious positives:

- When it comes to buying any asset class it pays to buy low and sell high and we’re already seeing Australian property prices come off the boil.

- If we do enter a recession interest rates usually fall which will help investors lock in decent mortgage rates although I cannot see them plumbing last years lows.

- Property stocks usually recover strongly once an economy has entered a recession.

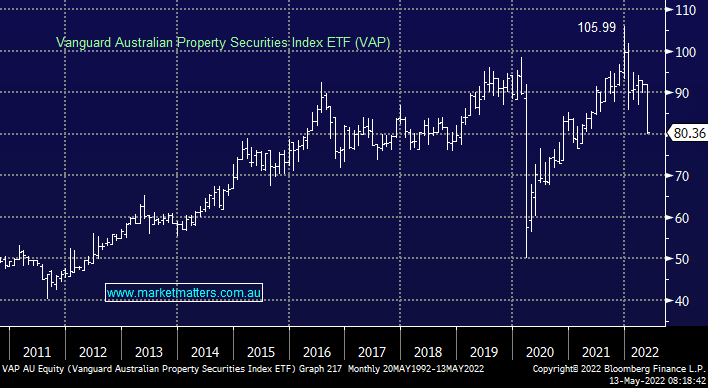

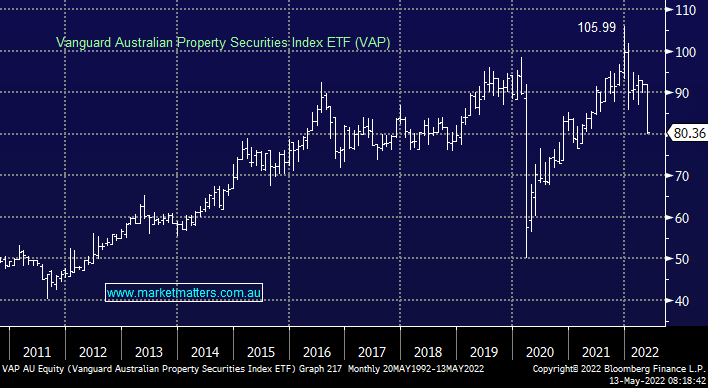

The ASX traded $2.2bn Vanguard Australian Property ETF (VAP) is an option to invest across the local sector, plus its forecast to yields above 6% over the next 12-months. The ETF has already dropped over 24% as doom and gloom surrounds the local property market, the journos are having a field day!! Similar to early thoughts we like the idea of accumulating into weakness as opposed to weighing all in but we are conscious that further downside does feel likely short term.