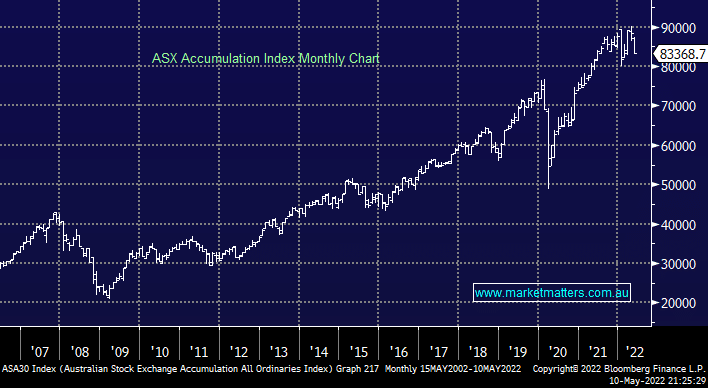

Interestingly the ASX Accumulation index did make fresh all-time highs in April as it takes into account dividends i.e. it’s a total return index based on the ASX with all dividends being reinvested. This is an excellent illustration of compound investing in the local share market with the index still up over 400% from its GFC low. The phones have been ringing hot at MM which can be awkward at times because we don’t give Personal Advice but a couple of points we have often recited to subscribers are:

- Stock market investment is a long term process where bear markets and pullbacks are accumulation opportunities as opposed to reasons to panic.

- Investors should be positioned to sleep hence too long / over-leveraged portfolios can lead to bad decisions and returns.

- Slowly accumulating quality stocks on the back foot into weakness often pays dividends as it positions the investor to actually welcome lower prices.