Overseas Wednesday & the launch of our MM Marco ETF Portfolio (CBA, 005930 KS, NFLX US, BAC US, AUDS, GDX US)

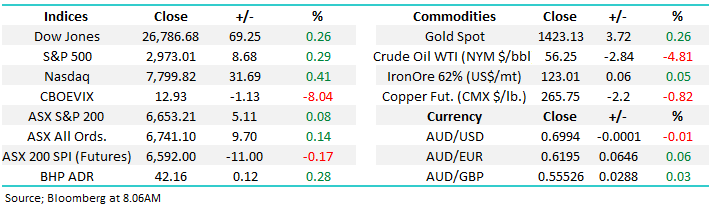

The ASX200 rallied briefly at 2.30pm yesterday following the RBA interest rate cut to an all-time low of 1.0% but equities failed to hold onto their strong intra-day gains with the index finally closing up only 5-points. Earlier in the session we were trading up 38-points at its best, within striking distance of the psychological 6700 level. While most stocks came off the boil it was the banks who inflicted the real damage on the index with the sector taking well over 20-points off the ASX200. The muted market reaction supports our view that lower rates are priced into stocks, this was also illustrated perfectly by classic “yield play” stocks Transurban (TCL) and Telstra (TLS) following the banks lower with both closing in the red. The resources kept our market in the green with both iron ore and gold stocks rallying strongly but it was still a close tussle to stop the market closing down on the day.

The following points are important to our current thinking on interest rates, the economy and stocks in 2019/2020:

1 – The RBA looks likely to pause with its rate cuts next month but they have signalled their intention to continue on their cutting path if the economy doesn’t improve, including a strive for full employment.

2 – Markets are now factoring in over a 75% chance of another rate cut to 0.75% by Melbourne Cup Day in November.

3 - However we feel the RBA is far less dovish than in June following their statement that a further rate cut would be delivered only “if needed” – at 10pm last night the Aussie $A was up strongly from its lows and retesting the 70c area, we may be at / approaching the “as it good as it gets” point on rates.

4 – Arguably if the RBA has to continue cutting interest rates later in the year it will signal they are almost acknowledging that a recession is unavoidable, this would be Australia’s first time in 28-years – that’s almost 10 million Australians who’ve never experienced a recession!

A recession is historically bad news for stocks and it feels like Scott Morrison will have an extremely tough job to prolong our period in the sun to 30-years and beyond.

MM remains now in “sell mode” looking to adopt a more conservative stance than over the previous 6-months.

After reducing our banking exposure yesterday the MM Growth Portfolio is now holding 23% in cash as we increase our flexibility into Augusts reporting season – it will be very unusual if some bargains don’t present themselves for the nimble and prepared. Also following the markets huge rally from Decembers panic low we feel the risk / reward from the market is far less compelling than at the start of 2019.

Sorry about the late alert yesterday but we wanted to observe the impact of the 2.30pm RBA decision on the banking sector before we pressed the sell / reduce button.

Overnight US stocks were quiet on the close with the Dow up 69-points in another choppy session when the tech based NASDAQ again led the gains rallying +0.4%. The SPI futures are calling the ASX200 to open unchanged this morning but resources should start the day of strongly with iron ore & gold strong overnight.

In today’s report we are going to consider 3 overseas stocks as we look to evolve the MM Overseas Equities Portfolio plus we also cover off on some macro views as we start to build out the Market Matters Global ETF Portfolio

ASX200 Chart

The RBA’s rate cut has brought the RBA cash rate and 3-year bond yield basically back to the same 1% level. The chart below shows perfectly that when 3-year bond yields are below that of the RBA cash rate investors should be positioned for lower interest rates, we could now argue that is no longer the case hence the support for the currency.

MM thinks another cut in 2019 is a possibility BUT no forgone conclusion.

Australian 3-year bond yield v RBA V Cash Rate Chart

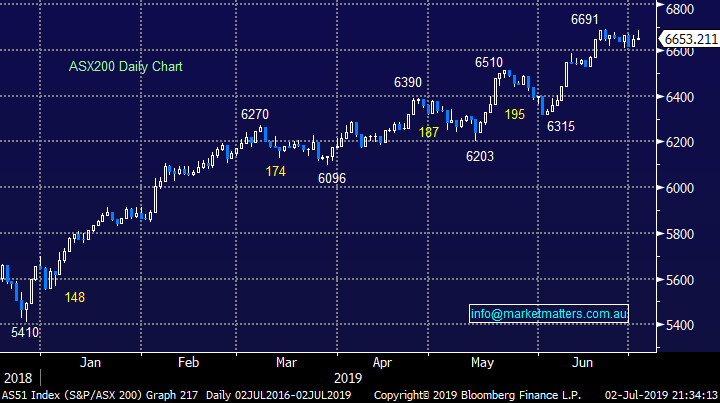

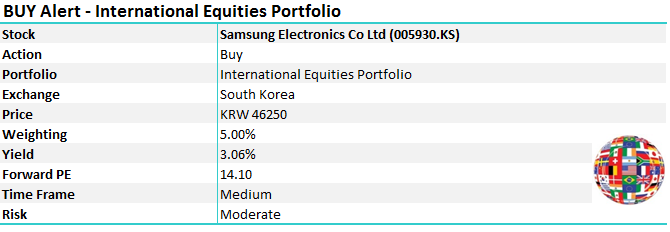

Recently we called the most likely next short-term swing for CBA to be a ~$4 pullback hence after we’ve already dropped $3 I can understand why some subscribers would question our decision to trim our holdings in CBA, NAB and Westpac from 8 to 6%. The answer is simply prudence following their strong advance over the last 9-months e.g. CBA has rallied almost 29% while also paying a $2 full franked dividend in February.

There are 2 major conflicting influences at play with our banks at present i.e. yield against profitability:

1 Lower interest rates hurts the profit margins of the banks as the gap narrows between interest paid on deposits and charged on loans with home loans garnering the most publicity e.g. Yesterday CBA cut home loan rates between 0.19% but their most popular savings account only received a 0.15% cut. Banks need to attract deposits to fund loan growth, and cutting deposit rates too much reduces the appeal of cash. Using the above as an example, cutting interest rates by 0.19% and deposit rates by 0.15% leads to a 0.04% contraction in margins all things being equal.

2 The banks are still paying an excellent fully franked yield from CBA at 5.32% to Westpac at 6.7%, both fully franked.

MM feels comfortable now holding a market weight exposure to the banking sector.

Commonwealth Bank (CBA) Chart

Overseas stocks on our radar

US indices have wobbled slightly over the last couple of days but in reality they have hardly made a dent in their 2019 gains with the NASDAQ shown below less than 1% away from its all-time high, while being close to our medium-term target. Importantly there remains no sell signals for US stocks at present but the good news on US-China trade and falling bond yields are already factored into share pieces forcing us to question what catalyst is required to kick the market strongly through its all-time high – earnings the obvious catalyst in the next few weeks.

MM is neutral and cautious US stocks at current levels.

US NASDAQ Index Chart

The Market Matters Overseas Equity Portfolio kicked into gear last week with 3 initial positions in Apple (AAPL US), Barrack Gold (ABX US) and Ping An (2318 HK). Today we have looked at an additional 3 stocks we are considering moving forward.

https://www.marketmatters.com.au/new-international-portfolio/

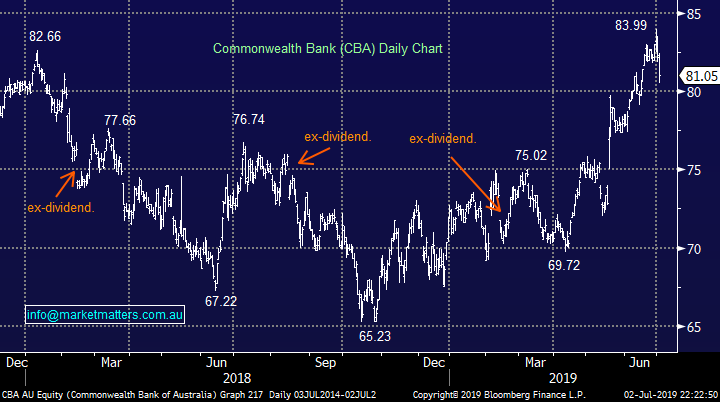

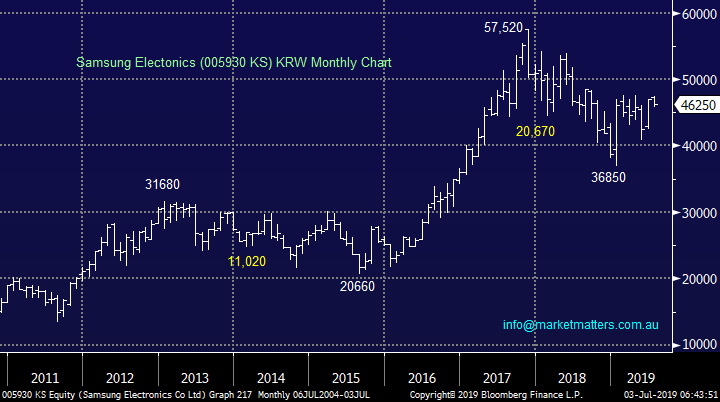

1 Samsung (005930 KS) KRW46259.

One of our favourite overseas stocks today is electronics giant Samsung which we have covered a number of times over the last 6-months. The stock is trading ~20% below its peak in 2017 as smart phones sales struggle but we feel this is providing some decent risk / reward for the world's largest smartphone maker. The stock’s current estimated P/E of 14.1x for 2019 is not too demanding for an established market leader.

Shares in Samsung have enjoyed the controversy around its main rival China’s Huawei's, including a critical decision by Google to sever ties with the Chinese mobile phone maker. Samsung produced 23% of smart phones in Q1 of 2019 a market share that could increase due to Huawei’s current uncertainty i.e. I wouldn’t buy a phone today from the Chinese manufacturer that couldn’t use say Google maps.

MM is bullish Samsung with an initial target over 16% higher and a stop ~6% lower – solid risk / reward.

Samsung (005930 KS) Chart

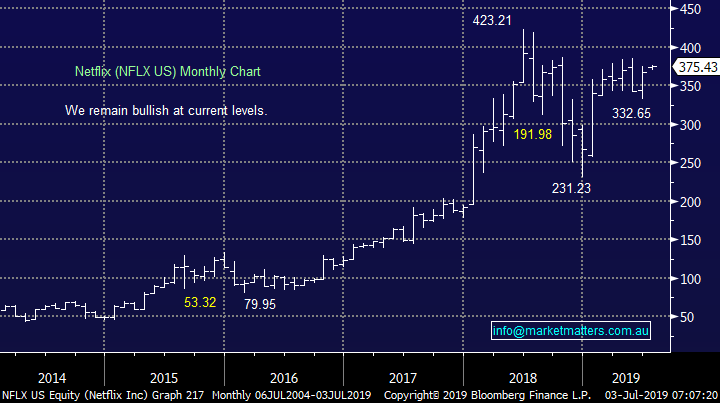

2 Netflix (NFLX US) $US375.43

Netflix has been a standout story of the last few years and our view is the subscription entertainment service has further to run as they turn the screws on their huge user base. We are bullish from around this $US370 area targeting fresh all-time highs, stops are a bit trickier and need to be under $US300 at this stage.

The streaming pioneer continues to impressively grow its subscriber base - Its enjoyed more than 25% year-over-year growth in each of the previous four quarters. This equates to almost 150 million subscribers, with its worldwide growth shows little signs of slowing. To-date Netflix has ignored ad-supported streaming, an opportunity that could be worth billions of dollars to Netflix, any moves in this direction should be watched carefully.

MM is bullish NFLX with a target ~20% higher.

Netflix (NFLX US) Chart

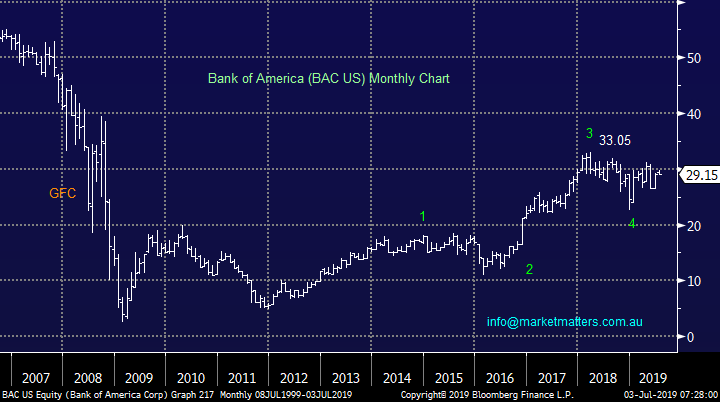

3 Bank of America (BAC US) $US29.15.

Bank of America remains a recovery story after its tumultuous time during the GFC but its improving steadily even in the current tough low interest rate environment.

BAC kicked some big gaols in the latest results of the Federal Reserve's Comprehensive Capital Analysis and Review (CCAR), usually referred to as the stress tests, where most banks received approval for their upcoming capital plan enabling them to increase their dividends and buyback plans starting in Q3.

However BAC was arguably the standout and between dividends and stock buybacks the bank plans to return an impressive $37 billion to shareholders over the coming year – a 42% increase. BAC announced that it has been authorized for over $30bn in stock buybacks over the 12-months. This is a whopping 50% increase over last year's $20 billion buyback, a truly huge buyback plan.

MM likes BAC targeting ~$US35 area with stops below $US26 i.e. solid 2:1 risk / reward.

Bank of America (BAC US) Chart

Market Matters Global ETF Portfolio

Today we launch the Global ETF Portfolio - exciting times for the MM team & our subscribers. This is a globally orientated model portfolio that will hold Exchange Traded Funds (ETF’s) that provide exposures to our bigger picture macro views. We will endeavour to use ASX listed ETFs however in reality there are considerably more ETFs listed overseas that are also on our radar. A judgement call between accessibility & simplicity versus underlying exposures will be made on a case by case basis.

We will shortly launch an overview of our ETF universe to provide a better understanding of the available exposures we are targeting

In terms of initial exposures, we continue to believe there are a couple of great “plays” evolving in today’s market and although by definition major macro views don’t change too often there are 2 we like today:

1 Australian Dollar ($A) 69.93c.

MM remains bullish the Australian Dollar against the $US over the next 12-months - a contrarian view.

We are looking to implement this view by going long the AUD while leaving enough ammunition to average at lower prices if the underlying $A spikes down to fresh multi-year lows under 67c – the trend in the $A is clearly down and surprises do often occur in the direction of the trend.

Details of the AUDS ETF: https://www.betashares.com.au/fund/strong-australian-dollar-fund/

BetaShares Strong AUD ETF (AUDS) Chart

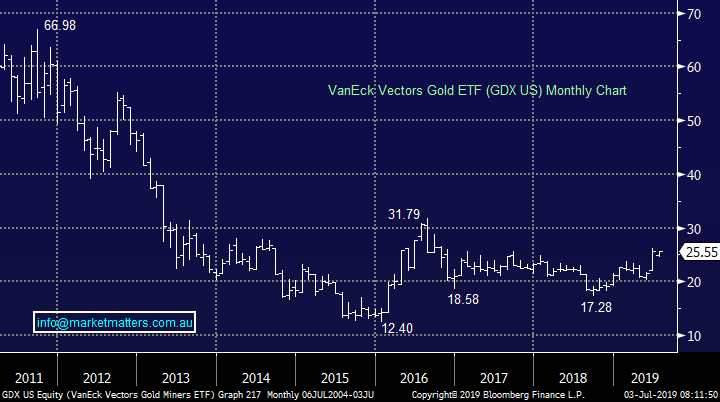

2 Gold ~$US1405/oz.

As subscribers know we are keen on gold over the next 12-months, this can be played via ETF’s or stocks, both locally and o/s depending on opinions around currencies and an individual companies quality / value.

We are keen on the below US Gold ETF where we are targeting a whopping ~50% upside, details of the ETF can be read on the VanEck link : https://www.vaneck.com.au/funds/gdx/snapshot/?audience=retail

MM likes the GDX Gold ETF over the next 6-12 months.

VanEck Vectors Gold ETF (GDX US) Chart

The following 2 macro ideas are on our radar moving forward with more likely to evolve over the coming weeks / months.

3 – We are considering buying Emerging markets in a pairs trade against selling Europe but this elastic band may have further to stretch.

4 – We are watching for potential turns in stocks and bonds BUT are in no hurry to fight the current bullish trends in both.

Conclusion (s)

1 - Of the 3 stocks looked at today for the International Portfolio we like all 3 i.e. Bank of America, Netflix and Samsung in that order of preference. We have provided an alert for Samsung given it trades in Asia while alerts will be provided for US denominated stocks in the Afternoon Note.

2 – For the MM ETF Portfolio we like the AUDS and GDX ETF’s at today’s prices.

Global Indices

The widely followed S&P500 index continues to trade around its all-time high and our medium target area of 3000-3050 is now only a few percent away.

We are neutral and cautious US stocks as they approach our target area.

US S&P 500 Index Chart

No change again with European indices, we remain cautious European stocks but the tone has improved recently and fresh highs in 2019 remain strong possibility.

EuroStoxx Chart

Overnight Market Matters Wrap

· The US closed higher overnight with the rest of the week expected to be quiet ahead of their celebration of Independence Day (half session tomorrow and Thursday closed).

· Despite a positive tone coming out of the G20 meeting on the weekend, there is still uncertainty about how a US-China trade deal will actually be achieved. Global growth and a slowdown in earnings are also proving a concern while the Fed is making all the right noises, giving the bulls a lot of hope.

· Crude oil lost close to 5%, its worst loss in a month despite OPEC+ agreeing to extend output cuts until March. This news was mostly factored in, while the market is focussing on the weak demand outlook.

· Nickel fell 2% and copper fell 1% on the LME while iron ore continued to march higher, up 1.7% to $US126/t. Gold bounced back to $US1421.5/oz and US 10 year bonds are now yielding less than 2%.

· The September SPI Futures is indicating the ASX 200 to open marginally higher, testing the 6660 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 03/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.