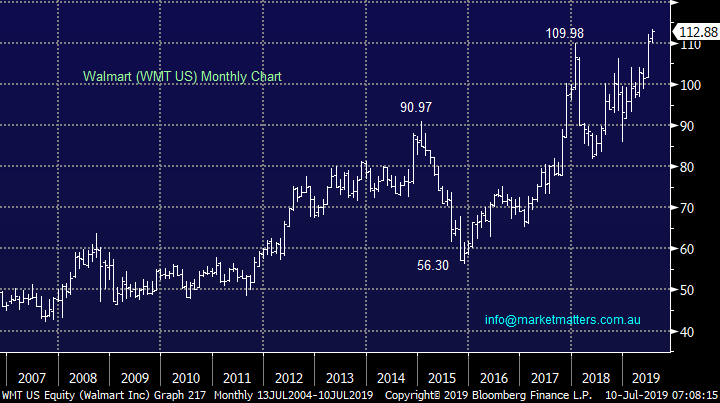

Overseas Wednesday – International & ETF Portfolios (DMP, NFLX US, MCD US, WMT US)

The ASX200 fought hard yesterday to remain in the black before finally closing down just -0.1%, an ok result considering at lunchtime we were down -0.45%. The main drag on the market were the Banks, Energy and IT sectors while the Consumer Services Sector rallied strongly led by Domino’s (DMP) which we will look at later. The high flying Software & Services (IT) stocks have led the markets rally in 2019, illustrated by Wisetech (WTC), Nearmap Ltd (NEA), Appen Ltd (APX) and Afterpay Touch (APT) all rallying by more than 50% over the last 6-months. Interestingly these stocks have started to “wobble” over the last week with only 1 of the 12 in the ASX200 closing positive while the average decline has been well over 3%, today will be interesting following a strong night by the NASDAQ.

Iron ore and its related stocks continue to catch our eye and although it finished up +4.4% yesterday at 883 CNY/MT the rally only told half the story with the bulk commodity continuing to swing around in an extremely volatile manner. At the close BHP +1.2%, RIO +1.4% and Fortescue +0.9% all benefited by the advance but we still believe this is the time to be taking some $$ off in the sector– watch for alerts on our BHP position.

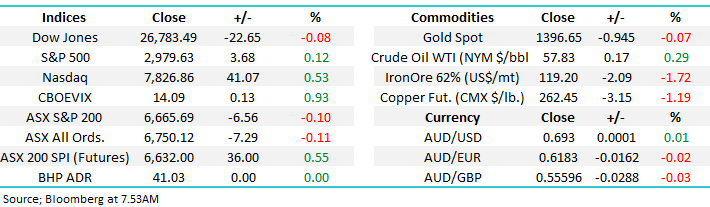

At MM we continue to believe that equities are “looking for a swing high / top” but as discussed previously if we are correct this can easily take a number of weeks to evolve. Subscribers are likely to receive more alerts / ideas around tweaking our portfolios moving forward, low beta stocks will be one area we will consider i.e. stocks that have not hugged the ASX200 over recent years, successful recovery stories fit this mould perfectly.

MM remains in “sell mode” looking to adopt a more defensive stance than over the previous 6-months.

Overnight US stocks were quiet although the tech based NASDAQ did close up +0.5% while the Dow was down marginally. The SPI futures are calling for a strong rebound by the local market up ~0.5% , no major surprise after the last few days sharp almost 2% pullback.

In today’s report we are going to look at a few positions MM is considering for both our new International Equity and Global ETF Portfolio’s.

ASX200 Chart

The news around bond yields / interest rates has died off over recent days, following last weeks RBA cut to 1%. At this stage the downtrend in bond yields feels very much intact and with 3-year bond yields having more than halved over the last 8-months a “rest” is to be expected. Our preferred scenario is they do have further to fall which implies another rate cut is a strong possibility.

MM thinks another rate cut in 2019 is a possibility BUT no forgone conclusion.

Australian 3-year bond yield Chart

Domino’s Pizza (DMP)

MM has been bearish DMP for the last few years but around the $40 area we see value returning to the technology / pizza business, although we acknowledge an Est. P/E of 24.2x is not “super cheap” by any means. Their progress in Europe has been slower than expected which has caused a re-rating of the stock however in more recent times headway is looking more promising while in Japan its maintaining the number one position. DMP’s internal growth remains strong and a webcast by the CEO in May made the correct noises in our opinion.

When I mentioned the DMP idea to our institutional desk it was met with the consensus of ‘you’re mad’ and that view is shown through ~11% of the stock short sold making it the 11th most shorted stock in Australia, just behind Bingo (BIN) in 10th.

Technically we like DMP targeting ~$55 while running stops at $38.50, excellent risk / reward.

MM likes DMP around $40 as a trade.

Domino’s Pizza (DMP) Chart

International Portfolio

Over the last week we have been quiet with our International Portfolio still holding just the 4 stocks and 80% in cash, I reiterate we see no hurry to set this portfolio : https://www.marketmatters.com.au/new-international-portfolio/

We have not hidden our nervous medium-term outlook for global equities which means if we are correct MM is looking for 1 of 2 things as we evolve this portfolio:

1 – Almost the proverbial needle (s) in a haystack i.e. stocks that can rally even if equities experience another decent pullback.

2 – Quality stocks that will outperform in both bullish and bearish markets which can be hedged with a market ETF (s), when appropriate, to produce positive returns even in a falling market.

I’m sure most subscribers would understand that investing along theme 2 is a more likely path for success hence as we do accumulate stocks in the weeks ahead be mindful that MM may only be one keystroke away from hedging our portfolio with 1 or even 2 ETF’s.

MM remains neutral and cautious both US & international equities at current levels.

US S&P500 Index Chart

Again today we have touched on 3 stocks we are considering moving forward, note these are not fresh additions to our watch list but all are stocks that we feel are relatively recession proof.

NB Today they are all US stocks because we are cautious Europe and especially the Emerging Markets at this point in time.

1 Netflix (NFLX US)

If things get tough people bunker down and save money, sitting on the couch watching NFLX is most definitely a relatively cheap entertainment option. Netflix has been a standout story of the last few years and our view is the subscription entertainment service has further to run. We are bullish from around this $US380 area targeting fresh all-time highs, stops are a bit trickier and need to be under $US300 at this stage.

As we wrote previously the streaming pioneer continues to impressively grow its subscriber base - Its enjoyed more than 25% year-over-year growth in each of the previous four quarters. This equates to almost 150 million subscribers, with its worldwide growth shows little signs of slowing. To-date Netflix has ignored ad-supported streaming an opportunity could be worth billions of dollars to Netflix, any moves in this direction should be watched carefully.

MM is bullish NFLX targeting ~20% upside.

Netflix (NFLX US) Chart

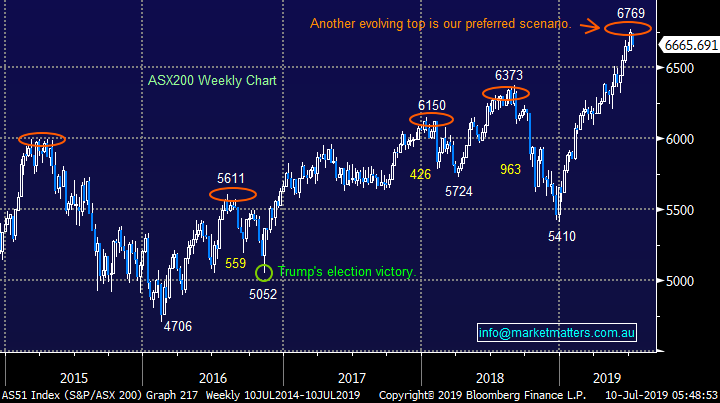

2 McDonalds (MCD US) $US212.09

McDonalds has been a leading force in fast food for decades, and it's worked hard to update its image while keeping up with changing times e.g. McCafé.

MCD's current valuation, like much of the market, is relatively rich on a historical basis. However MCD is a dividend investor favourite in the US yielding ~2.5%, with the company having recently celebrated its 42nd consecutive annual dividend hike – US investors are more easily pleased when it comes to yield! In addition to paying dividends, the business has also made stock buybacks, returning even more capital to its shareholders.

For McDonald's, growth plans are clear, they understand the need to keep up with the pace of innovation in serving customers the way they want to be served, and that involves integrating new technology.

Lastly but importantly MCD is always a cheap option for parents to treat the kids if the money belt becomes tight.

MM is bullish MCD although stops are tough.

McDonalds (MCD US) Chart

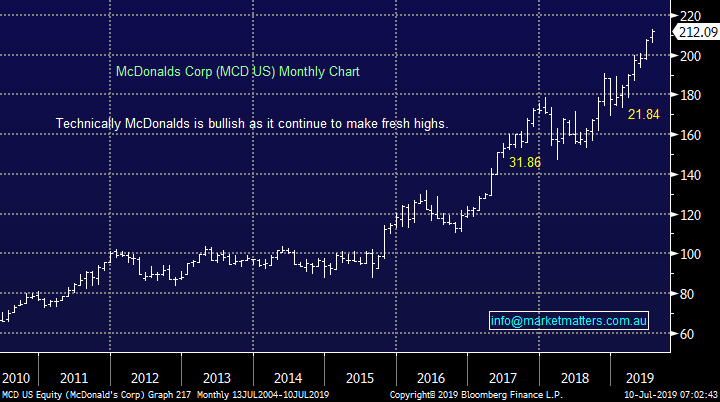

3 Walmart (WMT US) $US112.88

In the US Walmart operates discount stores and supercentres, a common destination points for consumers when times get tough.

The business has been kicking some goals of late and in its fiscal first-quarter report the company again looked solid with same-store sales growing plus it delivered a nice beat on earnings. However it was e-commerce, with its 37% growth, that caught most investors eye. This growth was driven by online grocery as well as home and fashion products. The rollout of free next-day shipping in major cities this year should help Walmart maintain its robust e-commerce growth rate. It sounds like Amazon mark 2.

MM likes WMT while it holds above $US105

Walmart (WMT US) Chart

Conclusion (s)

Of the 3 stocks looked at today for the International Portfolio we like all 3 i.e. Netflix (NFX), Walmart (WMT) and McDonalds (MCD) in that order of preference. A reminder that any alerts relating to US stocks will be included in the PM Report

MM Global ETF Portfolio

MM launched our Global ETF Portfolio last week in what was a very exciting fortnight for the business. We are now holding 3 positions in the portfolio simply put we are long gold, long the $A and short US stocks while still holding 80% in cash: https://www.marketmatters.com.au/new-global-portfolio/

We continue to believe there are a couple of great “plays” evolving in today’s market but I reiterate major macro views don’t change too often, there are 2 new positions we are considering today:

1 Emerging Markets.

We are currently short US stocks but only with a deliberate 5% allocation thus allowing us to either average or take a short position in equities i.e. the Emerging Markets which are already in a downtrend.

MM is bearish Emerging Markets and we’re considering taking a position accordingly. Our preferred vehicle is the ProShares Emerging Markets Short MSCI ETF (EUM US). Details of this ETF are explained on this link : https://www.proshares.com/funds/eum.html

Emerging Market ETF (EEM) Chart

2 US Interest Rates

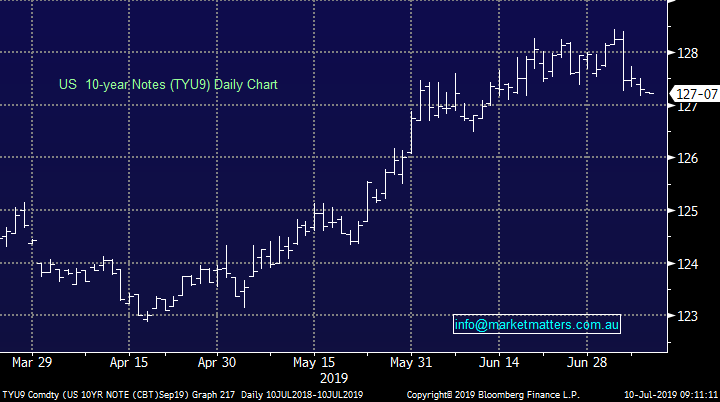

Markets are being driven by global bond yields hence it makes sense to be considering these as an investment vehicle for the MM Global ETF Portfolio. We feel rates are currently stabilising / bouncing before a probable another look lower hence this can be “played” by buying bonds into a correction. Given this is a relatively short term outlook a leveraged position is required.

The ETF we initially like to play this view is the Direxion Daily 20-year Treasury Bill 3x ETF (TMF US) but we make change in the days ahead as we evaluate further : https://www.direxioninvestments.com/products/direxion-daily-20-year-treasury-bull-3x-etf

MM likes US 10-year Notes ~126.50 (16/32).

US 10-year Notes (September) Chart

Direxion Daily 20+ year Treasury Bill 3x ETF Chart

Conclusion (s)

MM is bullish both the ProShares Emerging Markets Short MSCI ETF (EUM US) today and the Direxion Daily 20-year Treasury Bill 3x ETF (TMF US) about 4% lower.

Overnight Market Matters Wrap

· The broader US equity markets closed with little change overnight as investors remain on the sideline ahead of Fed Reserve, Jerome Powell’s testimony to congress tonight. The tech heavy Nasdaq 100 however, outperformed and rallied 0.53% higher.

· European markets were generally easier, with the German market in particular 0.8% weaker, weighed down by Deutsche bank falling another 4% following last weekend’s restructuring announcement, which will see it cut 18,000 jobs.

· The September SPI Futures is indicating the ASX 200 to open 34 points higher towards the 6700 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.