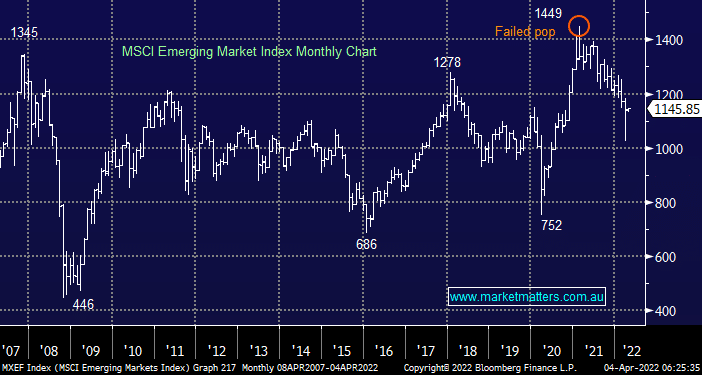

Emerging Markets (EM) have experienced a tumultuous year so far which is easy to comprehend with the geopolitical upheaval the world’s experienced but it’s important to recognise the EM had already been struggling since the $US started rallying in Q1 of 2021. Our current view towards EM is mixed depending on the timeframe:

- Short-term here we believe the greenback is poised for at least a reasonable pullback while bond yields take a rest on the upside – both supportive of EM.

- Conversely we believe commodities are headed into a bullish super cycle which is clearly inflationary – a headwind for EM.

NB EM has delivered another failed pop to new highs, a characteristic that has been so prevalent over the last 12-months.