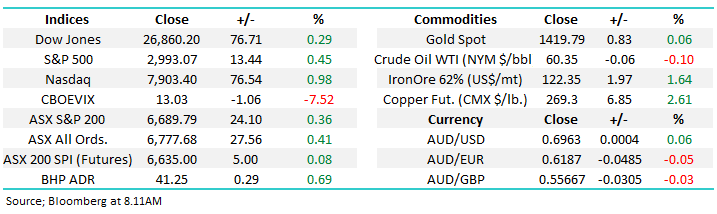

The Fed has spoken, will markets again follow? (COH, CBA, NFLX.US)

The ASX200 had a fairly disappointing Wednesday finally closing up +24-points after giving back more than half of the late mornings gains; the path of least resistance intra-day is now feeling on the downside. The only sector to actually close negative on the day was the Materials / Resources sector which fell around -0.5% courtesy of heavyweights BHP, RIO and Fortescue who all followed the iron ore price lower. At the moment the different market sectors are taking it in turn to push and pull the market, yesterdays weak resources look likely to be the strongest stocks this morning following a solid bounce in the underlying price of commodities overnight – Copper in particularly was strong.

The RBA would not have enjoyed seeing that consumer confidence has dropped to a 2-year low, with Australians becoming increasingly concerned about the economy, even with the prospect of income tax cuts and cheaper mortgages in 2019 / 2020. This reading was a touch surprising especially after we’ve seen housing prices and auction clearance rates improve noticeably over recent weeks. However the lack of movement by the Australian bond markets obviously dismissed the number as backward looking hence not particularly reflective of today and importantly moving into 2020.

After a relatively quiet start to July equities feel likely to at least show their hand short-term following the testimony overnight by Jerome Powell’s (Fed), our “Gut Feel” is the local market needs to test buyers resolve into a pullback. The last few days intra-day weakness has also created a negative short-term technical picture for MM with our initial downside target for the ASX200 ~6590, only 1.5% below yesterdays close, but lower none-the-less.

MM remains comfortable to adopt a more conservative stance over the next 6-months.

Overnight US stocks rallied on Jerome Powell’s dovish testimony to the house but in a fairly muted manner with the Dow closing up only 76-points, after being up almost 200-points at its best. However the likes of gold, copper and oil were all far happier rallying 1.4%, 2.5% and 4.3% respectively thanks to a weaker US currency. The SPI futures are pointing to an unchanged open even as resource stocks bounced in the US.

Today we are going to look at the ramifications of the Feds comments overnight.

ASX200 Chart

Hearing aid company Cochlear (COH) made fresh all-time highs yesterday, albeit by only a few cents. We have no doubt that COH is a world leader in its field with our only question around the valuation of its shares, an Est. P/E for 2019 of 47.8x feels pretty rich and potentially fraught with danger, remember only 6-months ago the high valuation / growth stocks were targeted by sellers sending COH down a whopping 30%.

With an excellent global distribution network COH is well positioned to benefit from the tailwind of an ageing population for decades, assuming of course COH can maintain its strong market position.

At MM we feel COH’s shares are expensive considering its current growth profile but we can hear investors say in unison “where else can I find a world class stock on the ASX?”.

We are neutral COH even as it makes fresh all-time highs.

Cochlear (COH) Chart

Following APRA’s decision to demand smaller increases in their capital requirements, ratings agencies upgraded their outlook for the big 4 banks but they continue to see a revenue headwind for the next few years e.g. S&P Global Ratings has upgraded its outlook for the big 4 banks to "stable" from "negative" after APRA announced it had lowered the level of bail-in capital it expected the major banks to raise over the next 5-years.

Unfortunately the news has had little impact on the share price of the ASX200’s largest sector.

MM continues to expect a trading range for CBA of $78.50 to $84.50 in coming weeks i.e. sell strength and buy weakness.

Commonwealth Bank (CBA) Chart

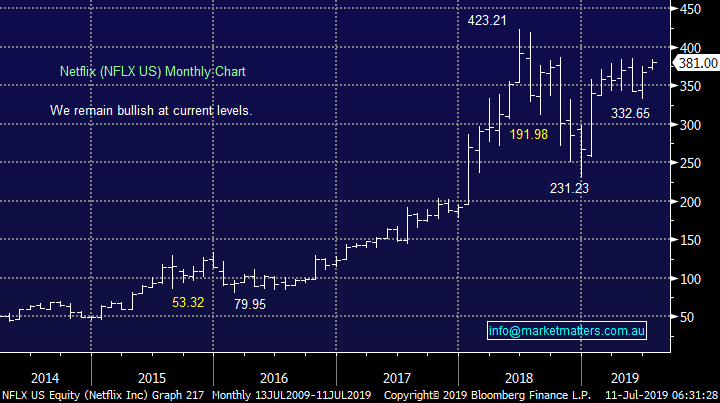

Overnight the MM International Portfolio went long Netflix (NFLX) with the stock closing well within our $US383.80 limit entry level. A break above the $US390 resistance area looks likely to give our position the momentum kick we are looking for.

MM remains bullish NFLX targeting ~20% upside.

Netflix (NFLX.US) Chart

The Fed has signalled US rates will fall

Fed Chair Jerome Powell made it abundantly clear overnight that the US FED is likely to cut interest rates for the first time in a decade due to concerns around a cooling global economy, as opposed to direct issues in the US. Importantly they see no indication of an overheating jobs market back in the US, overall this raises a red flag to MM – global central banks appear extremely concerned about the health of the world’s economy which is currently “chugging” along, we ponder what they are afraid of under the surface?

Since the Fed opened the door to lower interest rates last month, a plethora of global economic data has been announced to confirm the Fed’s stated view this week that “manufacturing, trade and investment are weak all around the world,”.

Both ourselves and the market now expect the Fed to cut rates in the coming weeks.

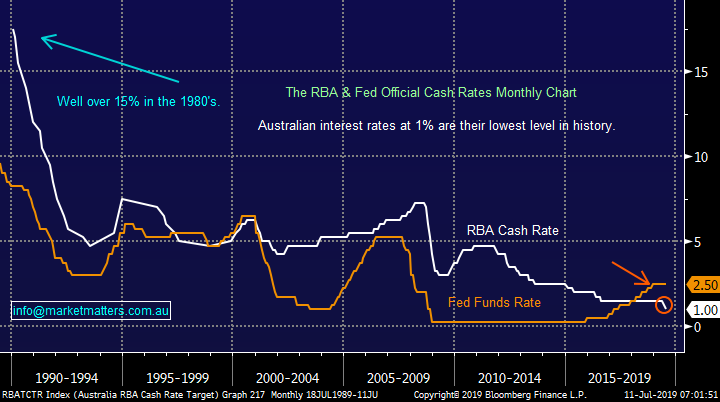

Australian official interest rates are currently 1.5% below those in the US which as can be seen from the chart below is a rare occurrence over the last 30-years and has only ever been temporary in nature. With the RBA having already cut rates twice in 2019, it would appear that the US is about to follow us for a change however when the combined interest rates of both countries only amounts to 3.5% the actual differential between the two cannot become particularly large – unless of course we see negative interest rates.

US & Australian official interest rates Chart

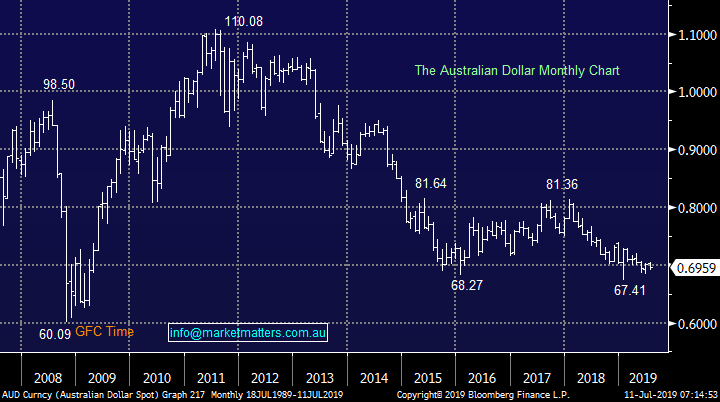

The Australian dollar has been a casualty of this rare interest rate differential but at MM we believe this period of relatively high US rates is coming to an end which should eventually push the $A back towards 80c. MM is long the AUDS ($A) ETF in our new MM ETF Portfolio and intend to average if we do see renewed weakness below the 67.4 low.

MM remains bullish the $A into current weakness.

Australian Dollar ($A) Chart

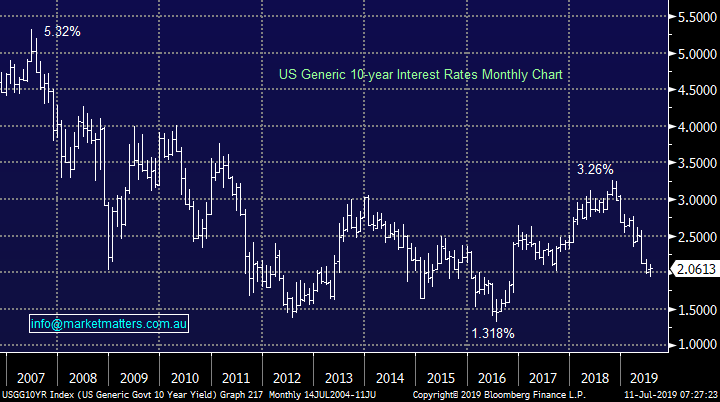

Interestingly overnight even the dovish comments around rates by Jerome Powell were not enough to make fresh 2019 lows for US 10-year bond yields implying they have reached a new level of equilibrium, at least for now. Hence we now expect rates to trade sideways while markets wait on further economic data.

MM remains mildly bearish US bond yields.

US 10-year Bond yield Chart

The rally by US stocks has been almost 100% correlated to US bond yields which is illustrated perfectly by the High yield (Junk Bond) ETF v S&P500 chart below – almost nothing else has mattered for asset values apart from relative value when compared to interest rates. At MM when the Junk Bond ETF was rallying to fresh 2019 highs ahead of the S&P500 we regarded the move as a buy signal for stocks, an indicator which worked exceptionally well over the last 6-months. However the opposite has been unfolding over the last few weeks, if this correlation holds true we are getting an excellent sell signal.

To add fuel to the fire, last night’s reaction by stocks to theoretically bullish news from the Fed was average and a market that cannot rally on good news concerns us.

MM is becoming increasingly nervous on US stocks.

S&P500 & Junk Bond ETF Chart

Market sentiment has become increasingly bullish over recent week which is exactly what MM was looking for before we felt it would be time to switch to a more defensive stance. The dovish about turn by the Fed was the catalyst for a sharp shift in investor sentiment but when everyone’s bullish whose left to buy?

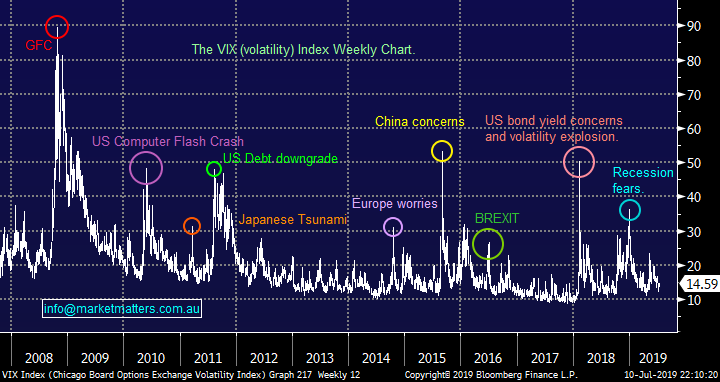

1 – The CBOE put/call ratio has hit very low levels implying we no longer have many investors hedged in the US market, this makes the market vulnerable for negative surprises which can accelerate in an unhedged market – see the VIX chart below which shows the ”Fear Index” has little fear!

2 - Retail positioning has seen a big bounce in the ISEE Sentiment index reaching levels that has historically corresponded with important SPX tops – investors are becoming complacent that the Fed will hold up equities.

3 – Thirdly we are seeing a deterioration in market breadth which is regularly witnessed ahead of important market tops.

MM remains comfortable holding a defensive stance towards stocks and we may still add negative facing ETF’s moving forward.

US VIX (Fear Index)d Chart

Conclusion (s)

A number of interesting points today:

1 – Interest rates look likely to be lower for longer as the US starts cutting for the first time in a decade.

2 – However, we feel lower rates are already built into equity prices which suggests downside risks are increasing rapidly.

3 – MM is seeing a number of significant warning signs evolve for stocks switching us from bullish a few weeks ago to neutral / bearish today.

4 – Our favourite sector remains gold which usually benefits from both lower rates and market “wobbles”. However we now expect outperformance from overseas gold stocks hence our Gold ETF (GDX US) position which we hold in our ETF Portfolio.

5 – Similarly the iron ore price should on balance enjoy a weaker $US but while we do feel prices will be higher for longer, it’s a journey that MM feels will be choppy and volatile enabling MM to invest around the prevailing ranges.

Global Indices

At this stage US stocks are only having a rest in the scheme of things, compared to its 28% rally from December lows, a break of 7850 by the NASDAQ should concern the bulls and especially 7700, still ~2.5% lower.

We reiterate that while US stocks have reached our target area they have not yet generated any technical sell signals.

US NASDAQ Index Chart

No change again with European indices, we remain cautious European stocks and their tone has become more bearish over the last 2 weeks.

German DAX Chart

Overnight Market Matters Wrap

· The US equity markets hit record highs again overnight, with the broader S&P 500 hitting touching the 3000 level for the first time in history, following the Fed Reserve chairman’s testimony to Congress reiterating investor expectations of a rate cut at the end of this month.

· Crude Oil prices also charged higher after a greater than expected fall in US inventories coupled with storm disruptions in the Gulf of Mexico which led to temporary production shutdown, while copper led the base metal suite higher.

· BHP is expected to outperform the broader market after ending its US session up an equivalent of 0.69% from Australia’s previous close.

· The September SPI Futures is indicating the ASX 200 to open flat / marginally higher, around the 6705 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 11/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.