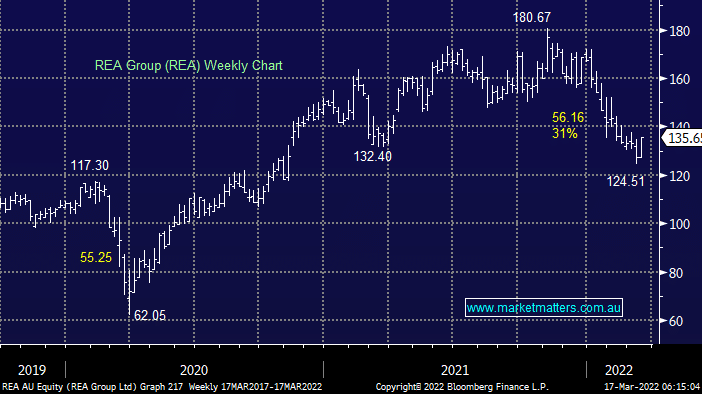

REA is a quality business that’s enjoyed strong pricing power over recent years but even after its 31% correction MM is nervous towards property volumes as mortgage rates rise, if people decide not to move REA makes less money. Conversely as the economy reopens post COVID more people will be looking to relocate for work as WFH becomes less prevalent hence it’s a tough balancing act to value REA through 2022.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Thursday 14th August – ASX +66pts, WBC, TLS, PME

Thursday 14th August – ASX +66pts, WBC, TLS, PME

Close

Close

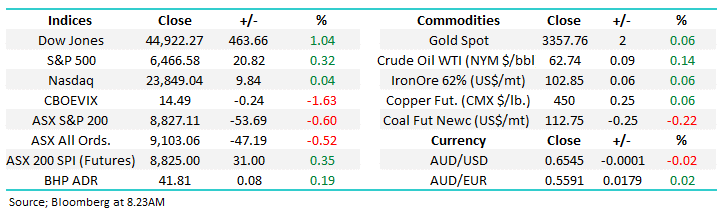

Thursday 14th August – Dow up +463pts, SPI up +31pts

Thursday 14th August – Dow up +463pts, SPI up +31pts

Close

Close

MM is neutral to positive REA under $140

Add To Hit List

Related Q&A

Thoughts on REA, CAR, & WES please

How should we handle the recent rally in SEK, AD8, HUB, REA & ALL?

What’s MM’s favourite 5 stocks for short term bull run?

Technical analysis of global indices please

Short term price targets for various stocks

Questions on CSL, REA & FMG

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Thursday 14th August – ASX +66pts, WBC, TLS, PME

Daily Podcast Direct from the Desk

Podcast

LISTEN

Thursday 14th August – Dow up +463pts, SPI up +31pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.