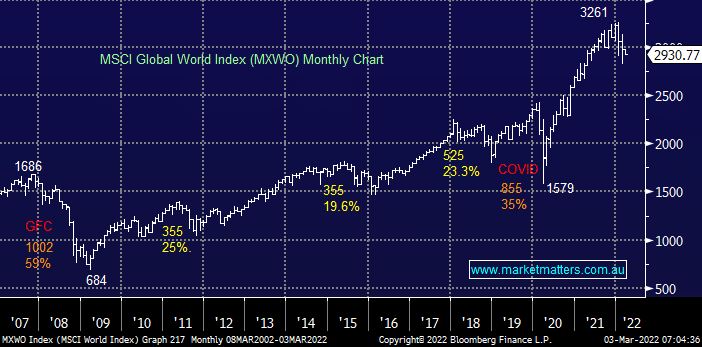

Firstly and very importantly while MM remains long term believers in the stock market we have no issue holding an elevated cash position for a few days / weeks especially in today’s volatile environment where opportunities are presenting themselves almost daily on the stock level. MM currently expects equities to bounce into Q2 however unlike recent years our preferred scenario is indices will be lower in a years’ time i.e. the awful Ukraine situation may eventually improve but inflation fears are unlikely to vanish over the medium term. Hence as discussed in previous reports MM anticipates migrating down the risk curve into any market strength over the coming weeks / months.

- MM is looking to increase our exposure to defensive names moving forward.

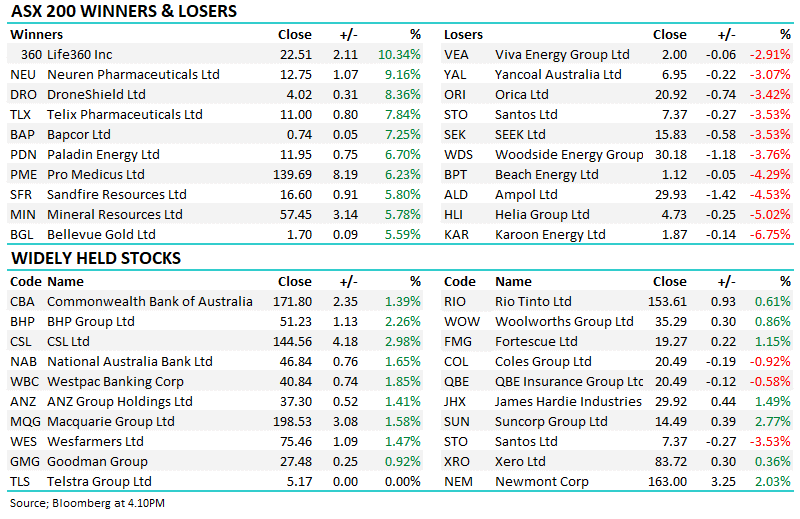

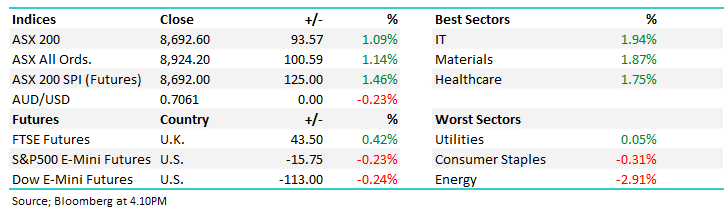

Its important to remember that during the bull market plenty of stocks and some sectors bucked the trend and fell, the reverse is highly likely to be true if indices do indeed fall e.g. the ASX200 has fallen in 2022 but the value stocks have performed strongly i.e. energy, miners and some banks.