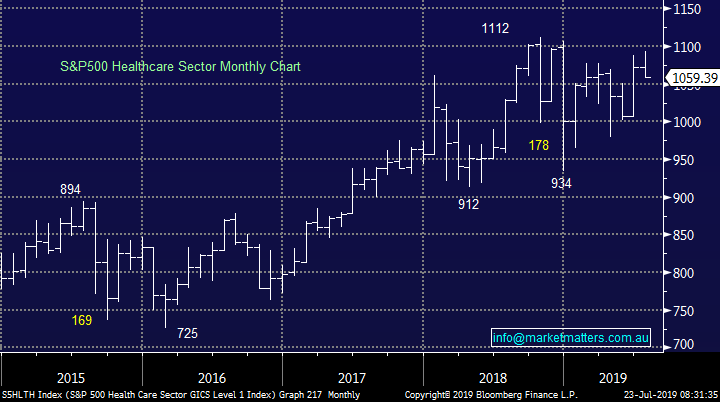

MM is concerned for the much loved Healthcare sector (CSL, COH, RMD)

The ASX200 experienced another quiet day at the office finally closing down just -0.14%, overall a pretty good effort considering the US S&P500 fell -0.6% on Friday spooked by fears the Fed will be conservative with their future interest rate cuts. On the sector level, things were relatively quiet with Energy and Resources stocks the standouts in the winner’s circle while Healthcare, Telco’s and Utilities struggled. On the stock level it was the in vogue gold names who again caught my eye with strong gains across board for the majors with Resolute the best gaining +4.6% while heavyweight Newcrest Mining (NCM) traded at its highest level since 2012, finally closing up +2.3% - an impressive session considering gold was trading ~$US20/oz below its Friday high.

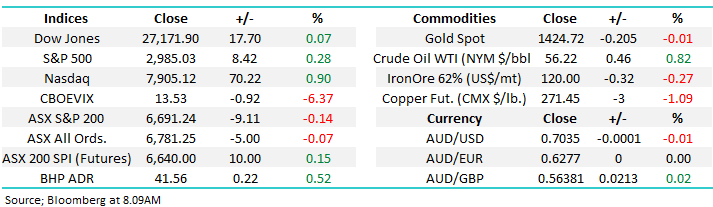

We’ve been “waffling” on about a potential rounded top for the ASX200 for around 3-weeks but it remains on track hence there remains no need to change our tune – see orange ellipses on the chart below. Indeed we still favour a break to fresh 2019 highs but with this only being 1.2% away its hardly a big call and really only micro noise that’s best ignored by investors – we simply feel from a risk / reward perspective it’s time to be more defensive, after all it’s not often the market shoots straight up 25%! A number of stocks we’ve mentioned previously including NIB Holdings (NHF) and BHP Group (BHP) look likely to spearhead any advance, although obviously the banks will need to join the party for any market rally to have a realistic chance of surging above the psychological 6800 area.

MM remains comfortable to adopt a more conservative stance over the next 6-months.

NB We are happy to be overweight cash for a few months, especially after the markets rallied 25% BUT not medium-term as history has illustrated that cash is an awful investment vehicle.

Overnight US stocks were firm led by the NASDAQ which rallied +0.9% although the Dow struggled to close positive, gaining just +0.07%. The ASX200 is looking to open up just over 10-points as most begin to focus on reporting season next month.

Today we are going to look at the Healthcare Sector which has delivered both excellent returns and market outperformance post the GFC.

ASX200 Chart

Yesterday MM switched from Healius (HLS) to Adelaide Brighton (ABC) for 2 simple reasons which we have flagged in recent reports:

1 – We sold HLS because of concerns around the business operationally. The takeover we thought might materialise looks to have been at least delayed making this a business we are not keen to own ahead of their upcoming earnings.

2 – We believe that Australia’s largest cement maker ABC is a solid business that is well positioned to benefit from a continued ramp up in infrastructure spend. The stock is still trading over 36% below its 2018 high, at a price which we believe provides good value, especially with its 4.5% fully franked yield.

MM is bullish ABC at current levels initially targeting a test of the $5 area.

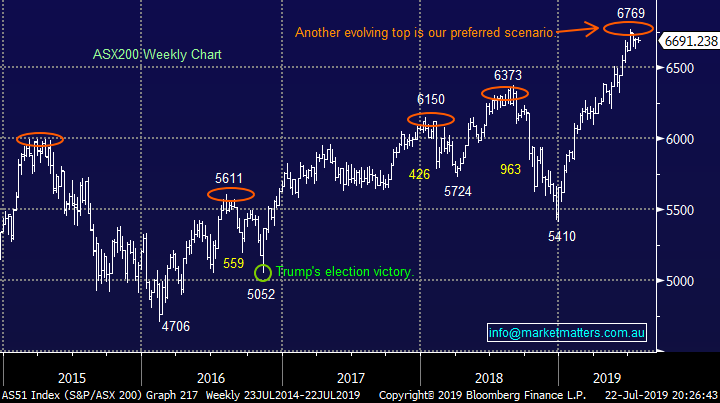

Considering the political tensions around Iran we feel it’s been a disappointing performance for the oil bulls over the last few weeks – MM generally believes that a market that cannot rally on good news is a weak market.

However there is a second side to this particular coin with reports that tankers are offloading millions of barrels of Iranian oil into storage tanks at Chinese ports, leading to a huge surplus of crude on the doorstep of the world’s largest user, hence it’s just a matter of time before this oil starts finding its way into China creating oversupply.

MM is neutral crude oil at best.

Crude Oil Chart

In our new Global ETF Portfolio the recent divergence between crude oil and gold might have many thinking that MM would be considering fading the stretched differential between these 2 usually largely correlated commodities, but not today as the underlying fundamentals feel wrong.

While we find it hard to buy gold compared to crude oil after their recent moves, if we were to make a play it would be still buy gold and sell crude oil hence we just sit on our hands.

Even after the recent strong divergence we prefer gold over crude oil.

Crude Oil v Gold Chart

MM’s concerned with the Healthcare Sector

Since we took a ~30% profit on our ResMed (RMD) position back in mid-June our only exposure to this much loved sector had been via Healius (HLS). After we sold Healius yesterday we have no exposure to the sector which makes up a significant 8.7% of the ASX200.

Today we are going to briefly consider both our own and the US Healthcare Sectors plus 3 leading stocks to ascertain whether we believe this is the correct stance at this point in time.

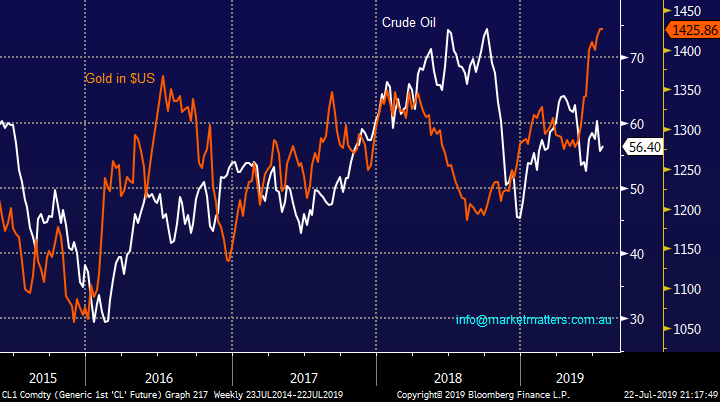

US Healthcare Sector

Firstly the US Healthcare Sector, which is significantly more influential in comparison to our own making up over 15% of the US S&P500, has so far failed to follow the broader index to fresh all-time highs this year, currently sitting ~5% below its 2018 top. If / when the sector manages to break into blue sky territory it’s a move we would be fading, as opposed to buying.

MM is neutral / bearish the US Healthcare Sector at current levels.

S&P500 Healthcare Sector Chart

Australian Healthcare Sector

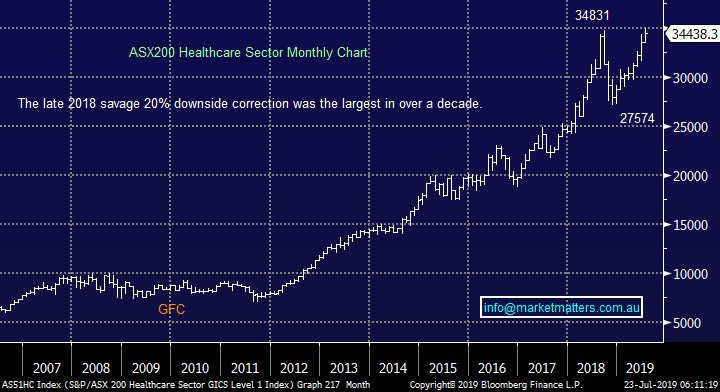

The local Healthcare Sector experienced its largest correction in over a decade in Q4 of 2018 with the 20.8% aggressive unwind catching many players napping. Our current concerns with the sector are 3-fold as everyone sits comfortably long, regularly quoting the Australian ageing population thesis:

1 – Valuations are very rich in this growth sector which can easily lead to another fast unwind, it feels to us that too many investors are again complacently long.

2 – Momentum traders / investors who we touched on yesterday are understandably likely to again be long the likes of CSL and Cochlear, making these influential stocks vulnerable to a downside correction, but from where is obviously the million dollar question.

3 – At MM we believe the next 10% move for the $A is up which will turn the last 8-year tailwind into a headwind for much of the sector with significant overseas earnings.

Importantly we believe that a number of the companies in this sector remain world class with our issue not their businesses but the price we should be buying their shares to provide value and hence solid risk / reward.

MM believes the sectors sell-off in Q4 of 2018 might be a classic warning to fragilities within the sector. On balance we believe there’s a strong possibility of gaining exposure to the sector at far better levels. i.e.MM went aggressively long the sector into the weakness in Q4 of 2018 and will do so again when value presents itself.

ASX200 Healthcare Sector Chart

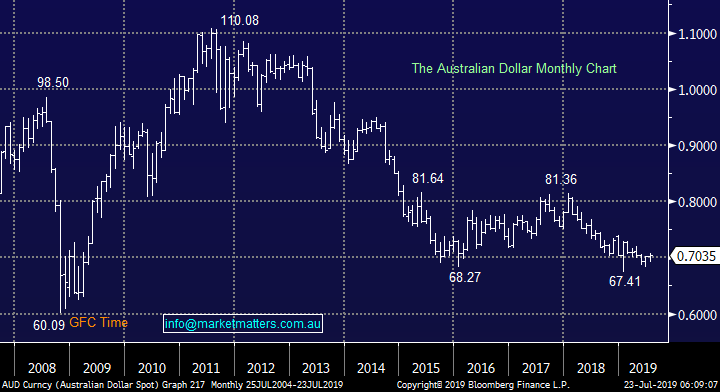

At MM one of our core macro views is that the “little Aussie battler” either has, or is looking for, a major low with the next meaningful move a rally towards 80c i.e. a contrarian view that we are also positioned for in our ETF portfolio.

A strong $A is an earnings headwind for much of the local Healthcare sector who enjoy strong income in $US.

Australian Dollar ($A) Chart

3 major local Healthcare stocks

Below is a brief look under the hood of the sector focusing on 3 heavyweights to see if on the stock level our caution feels warranted plus of course whether there any potential needles in the proverbial haystack.

1 CSL Ltd (CSL) $221.81

Blood Plasma goliath CSL has been an amazing success story becoming the 4th largest stock in Australia, with a market cap of $100bn, now only headed by CBA, BHP and Westpac – it makes up over 5% of the ASX200.

Not surprisingly we believe CSL is one of this country’s finest companies with the question being what price to pay for this business which continues to grow courtesy of the demand for its immunoglobulin products. The stock is again almost “priced for perfection” allowing for plenty of scope for disappointment. Since the market downturn around 5-years ago CSL’s average P/E has been around 25x but today its almost 37x, simply too rich for MM. The optimism in the share price is obviously not alone in today’s market which is underpinned by interest rates at their lowest level in history.

MM likes CSL but well below $200.

CSL Ltd (CSL) Chart

2 Cochlear (COH) $216.44

Hearing aid business COH is another high quality business that has provided excellent shareholder returns over the past decade and more. However as the chart below illustrates the stocks very capable of a decent correction and it’s such an event that is currently required to attract MM back to the stock – todays Est P/E for 2019 of 46.5x certainly carries with it plenty of room for disappointment.

At MM we feel that both CSL and COH fit into the basket of stocks that fund managers / investors are comfortable buying at almost any price bringing with it inherent risks i.e. yesterday we referenced the momentum stocks in the US trading as trading around 25% above their usual levels, not a sell signal in itself as they can easily go to 35% but a warning that should be acknowledged.

MM likes COH as a business but were only buyers well below $200.

Cochlear (COH) Chart

3 ResMed (RMD) $17.50

Sleep disorder business RMD reports this week and if its anything like last time hold onto your hat as volatility is about to enter town – their last result led to a 23% plunge in the stock.

This stock has been another excellent performer post the GFC, and especially since 2015, but again with a P/E of 35x we are concerned with how quickly the stock could get rerated on a solid result but one that fails to meet market expectations.

MM likes RMD but well over 10% lower.

ResMed (RMD) Chart

Conclusion (s)

MM likes many companies in the Australian Healthcare sector but at significantly lower levels, we are comfortable to be absent from the sector today and holding cash to provide flexibility to “pounce” if we see volatility / weakness through reporting season.

Global Indices

No change, US stocks feel extremely vulnerable to us at this stage although we need to see a break back below 2950 by the S&P500 to become seriously concerned with the markets health i.e. just around 1.5% lower.

We reiterate that while US stocks have reached our target area they have not yet generated any technical sell signals.

US S&P500 Index Chart

No change again with European indices, we remain cautious European stocks and their tone has become more bearish over the last few weeks.

German DAX Chart

Overnight Market Matters Wrap

· The US equity markets started its week in positive territory, led by the tech. heavy Nasdaq 100 as the earnings season kicks up a notch.

· Crude Oil continues to rise as the tension in the Persian Gulf escalates as reports of Iran claiming to have arrested 17 of its nationals allegedly recruited by the CIA to spy on sensitive nuclear and military sites in the country.

· BHP is expected to outperform the broader market after endings its US session up an equivalent of 0.52% from Australia’s previous close.

· The September SPI Futures is indicating the ASX 200 to open 18 points higher, testing the 6710 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.