Looking for the needle in the haystack called the ASX200 (NHF, NCM, ELD, BGA, TLS)

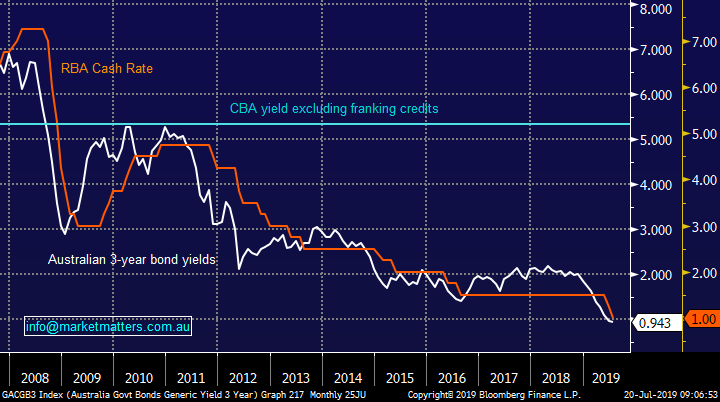

The ASX200 enjoyed a solid 52-point rally yesterday with only 15% of the index closing in the red, the extremely impressive broad based buying did actually see one casualty on the sector level with the Materials / Resources declining -0.5%. We touched on resources in yesterday’s AM report, not surprisingly we have not changed our view, MM remains keen on iron ore stocks but at lower levels e.g. we are keen to accumulate RIO Tinto (RIO) between 5 & 10% lower. Conversely the influential Banking sector rallied strongly with the “Big Four” gaining an average of +1.3%, market heavyweight Commonwealth Bank (CBA) is now only ~2.5% from our short-term technical target.

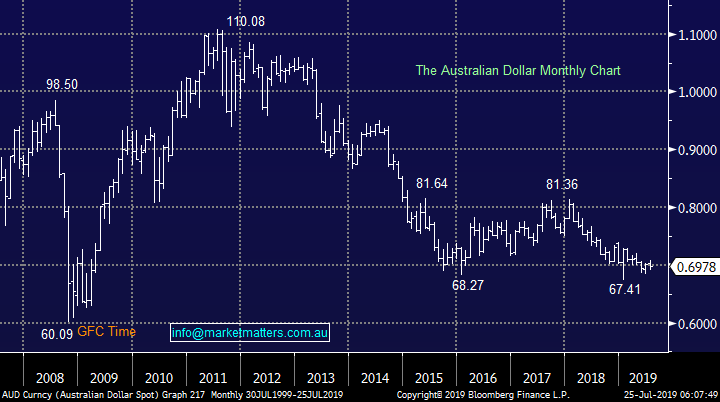

It’s a simple game at present – interest rates are heading to their lowest levels in history powering equities to all-time highs. To put things in perspective when the GFC started in late 2007 the RBA Cash Rate was 6.5% today it’s at 1% with pundits now calling 0.5% in 2020. This almost “free money” has fuelled a huge asset boom with stocks at the pointy end of performance, another change in tact by Central Banks or an unavoidable global recession feels the only events that could turn the tide of optimism at present.

The headline that really caught our attention yesterday was the forecast by Westpac’s highly regarded Chief Economist Bill Evans, a bloke who seems to say jump, and the markets reaction; how high! He brought forward his forecast for the next interest rate cut to October, from November – he feels by then the labour market will have deteriorated sufficiently from the Reserve Bank estimates to prompt a move. He also now anticipates another cut in February which would bring the cash rate to 0.5%, half of today’s level. His immediate impact on the market was pretty much as expected:

1 – The ASX200 rallied to a fresh decade high, taking its advance from December’s low to an impressive 25.4%.

2 – Australian 3-year bonds made fresh decade lows trading down to 0.878%, well below the current RBA Cash Rate of 1%.

Mr Evans has been the leader of the pack this year following his prediction back in late May that the RBA would cut 3 times in 2019, far more dovish at the time than any of the other Big Four Banks. Interestingly after his prediction back then the ASX200 proceeded to fall 195-points / 3% over the next 8 trading days – perhaps a quasi-case of buy on rumour but sell on fact event.

MM remains comfortable to adopt a more conservative stance over the next 6-months.

Overnight US stocks were mixed with the NASDAQ gaining +0.7% as Netflix bounced ~4% allowing us to exit our position while the Dow fell -0.3% as Caterpillar, who makes mining equipment, missed earnings expectations badly. The SPI futures are calling the ASX200 to open basically unchanged, this would be a good effort considering BHP is trading down over 2% in the US – the “The Big Australian” often follows Caterpillar’s lead as its regarded as an excellent indication on the strength of the global economy.

Today we are going to update subscribers on 3 stocks we are still considering buying for the Growth Portfolio even as the local makes fresh decade highs – as should be expected these are low Beta stocks.

ASX200 Chart

We have ridden the NIB Holdings (NHF) bullish ride since mid-February with our position currently showing a paper profit of ~47%, the Liberal election victory accelerated the stocks gains in May as the market was factoring in Labor’s planned private health insurance premium limits. However we no longer believe the stock is exciting / cheap around current levels as it trades on an estimated P/E for 2019 of 24.5x while yielding ~2.8% fully franked.

MM is considering taking profit on NHF above the $8.20 level.

NB We are happy to sit overweight cash for a few months, especially after the markets just rallied over 25% BUT not medium-term, if we increase funds now expect it to be deployed into the resources if / when they correct i.e. MM is looking to add value / alpha by “legging” this particular switch.

NIB Holdings (NHF) Chart

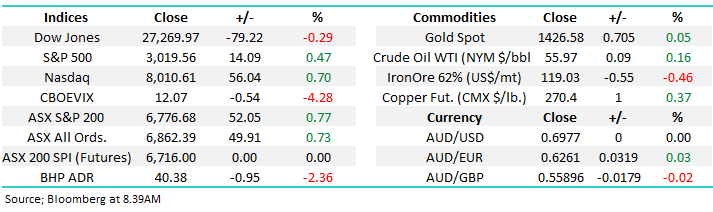

Our favourite sector for 2019 / 2020 had an extremely volatile day under the hood yesterday with Regis Resources (RRL) – 11.8% and Evolution (EVN) -1% both falling, while sector heavyweight Newcrest (NCM) rallied 0.7% achieving levels not enjoyed since 2012.

RRL was hammered courtesy of broker downgrades from both Macquarie and UBS, due to concerns around rising costs, the average of the 2 influential players new targets is still well over 10% below yesterdays close, an easy wait and see for us at MM – this stock risk around reporting season is exactly why we decided to buy an ETF for our latest foray into the sector plus of course our contrarian bullish call for the $A.

MM remains long & bullish NCM.

Newcrest Mining (NCM) Chart

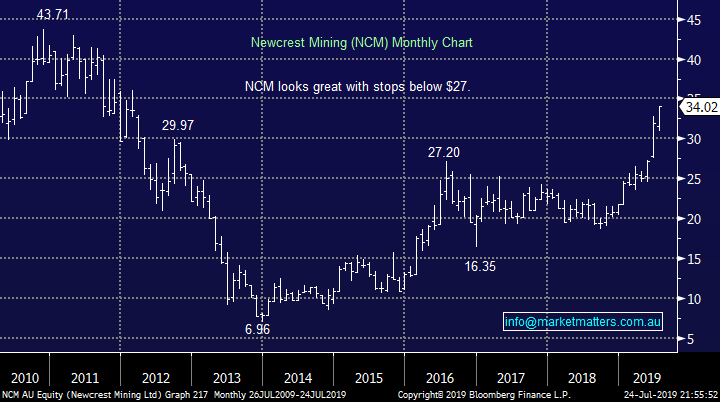

Australian and US bond yields are continuing their race to the bottom with Bill Evans helping our own stay ahead, dragging the $A down with them. We still feel the next 10c for the $A is up but a choppy ride feels on the cards.

MM remains bullish the $A moving into 2020.

The Australian Dollar ($A) Chart

Australian & US 10-year Bond Yields Chart

3 stocks MM is still considering as the ASX200 makes fresh decade highs

At MM we feel that the stock markets gains from its swing low back in early 2016 is maturing fast but with the RBA Cash Rate looking destined for sub 1% “parking” monies in a term deposit is not a particularly exciting proposition hence we remain focused on looking for stocks that can rally even if the market falls. One of Warren Buffett’s regularly quoted sayings points out that most stock’s look good / rally in a bull market but it’s a far tougher game picking winners in a correction, or a bear market.

“only when the tide goes out do you discover who has been swimming naked” – Warren Buffett.

The simple rhythm of the local market since the GFC implies that a decent pullback should not surprise in 2019 / 2020:

1 – After rallying for 6 quarters from its 2009 low the market then corrected 25% before starting another move higher from late 2011.

2 – The ASX200 then rallied for 15 quarters from its 2011 low before correcting 21.5% over 5 quarters.

3 – The market is now enjoying its 15th quarter of the bull market advance from its 2016 swing low.

ASX200 Chart

As we all know anybody can play with numbers and statistics, all we are pointing out is the current rally is fairly mature compared to the post GFC positive swings by local stocks. However if the RBA Cash Rate is indeed headed towards 0.5% stocks can still easily be described as extremely cheap i.e. term deposits will probably be yielding around 1.5% at best in 2020 while CBA is paying the faithful today over 5% fully franked – a significant positive differential for CBA.

Hence at MM we believe it’s a time to be conservative in our stock / sector picks but not one to be sitting on too much cash, for too long.

Todays report is a simple update for subscribers of 3 stocks we are considering around today’s prices as a few of our winners head towards our targeted sell levels.

Comparing some important interest rates Chart

1 Elders (ELD) $7.19

Elders is an iconic Australian agriculture business that can actually trace its history back to 1839. The stock has struggled over the last 12-months due to the prolonged East Coast drought, lower cattle prices and reduced wool volumes but although global warming is a real concern its not an overnight sensation. At MM we remain of the opinion that this is the stage in its cycle to buy ELD to acquire a position for more favourable conditions moving forward.

We feel their recent acquisition of Australian Independent Rural Retailers will help drive earnings higher in the years ahead and make ELD a better quality business.

MM continues to like ELD around $7.

Elders (ELD) Chart

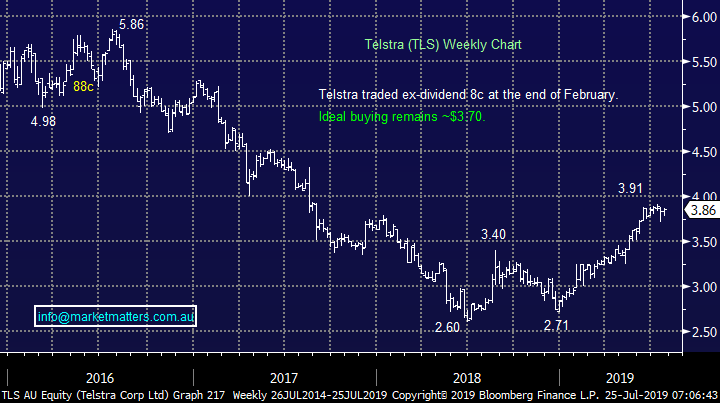

2 Telstra (TLS) $3.86

With reporting season almost upon us its important for subscribers to have some “what if” plans because volatility is undoubtedly set to rise for a number of stocks.

MM likes TLS’s current reliable income stream and yield in todays low interest rate environment. However Australia’s largest Telco, which still specialises in frustrating customer service, reports in a few weeks’ time and they have a reputation here also. The risk / reward into reporting is not compelling to MM around the $3.90 area but 4-5% lower would be a different story, assuming no material announcements in Augusts report we will be keen buyers around the $3.60 area.

MM likes TLS back around $3.60 post their result.

Alternatively in the sector we still like Chorus (CNU) under $5, or around 5% lower – this NZ based company yields ~4.5% unfranked.

Telstra (TLS) Chart

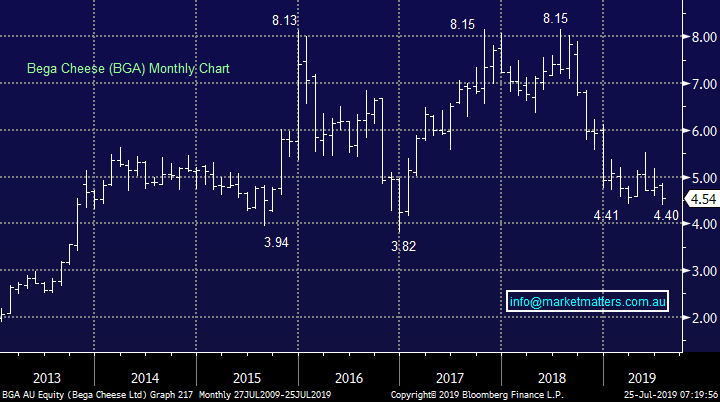

3 Bega Cheese (BGA) $4.54

Dairy food business BGA is in a sector we like although its not cheap trading on a Est P/E of 44x for 2019 while only yielding ~2.5% fully franked. The stock remains around a multi-year low as nerves are probably setting in ahead of August’s report - February’s numbers were poor showing a fall in profit to $18.9m from revenue of $649.2m. The stocks suffering from a classic case of struggling to bed down acquisitions.

MM is not prepared to take on the risk of reporting season but a spike down to the $4 level next month, if the company again fail to deliver, will probably see us consider building a position, obviously depending on the substance of their result.

MM is watching BGA closely.

Bega Cheese (BGA) Chart

Conclusion (s)

MM likes ELD, TLS and BGA at the levels discussed above.

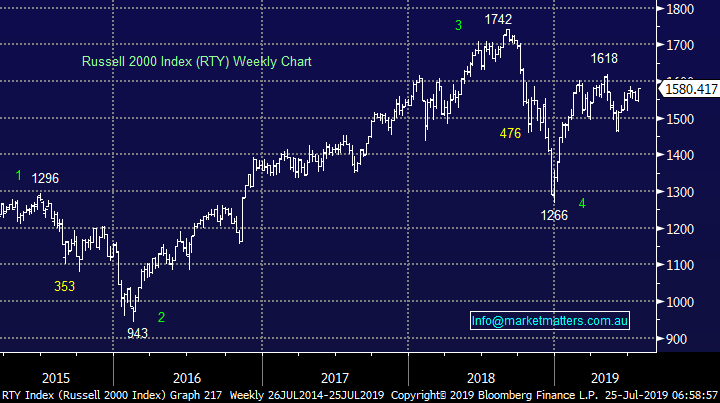

Global Indices

No change, US stocks feel vulnerable to us at this stage although we need to see a break back below 2950 by the S&P500 to become seriously concerned with the markets health i.e. over 2% lower. However the small cap Russell 2000 Index is painting a different picture and its overnight strong +1.6% rally should not be ignored – technically this index is still targeting over 10% higher levels

We reiterate that while US stocks have reached our target area they have not yet generated any technical sell signals.

US Russell 2000 Index Chart

No change again with European indices, we remain cautious European stocks and their tone has become more bearish over the last few weeks.

German DAX Chart

Overnight Market Matters Wrap

· The US closed mixed overnight, with the Nasdaq 100 outperforming yet again, up 0.7% following comments on a global slowdown in microchip demand would not be as long as feared.

· On the earnings front, 77% of the 138 S&P 500 companies that have reported so far have beaten earnings estimates. While construction and mining machinery, Caterpillar lost 4.5% following disappointing earnings.

· With the weakness in iron ore and mining machinery, BHP and its peers are expected to underperform the broader market after ending its US session off 2.36% from Australia’s previous close.

· The September SPI Futures is indicating the ASX 200 to open 11 points higher, testing the 6790 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.