Will IOOF spark a recovery for the struggling Fund Managers? (IFL, PDL, PPT, PNI)

The ASX200 enjoyed another solid day this time rallying +0.6% as winners outstripped the losers by almost 3:1, the driving force remained the banks with the “Big Four” enjoying an average gain of 1.1% - remember the old adage “the market (ASX200) cannot go down without the banks”. Volume is slowly creeping higher as a short squeeze appears to be unfolding in earnest, it’s going to be extremely hard for fund managers to justify poor performance when the stock market has rallied +26% since December, it’s now sitting only 0.5% below its all-time high set back before the GFC. Fighting the tape has been a painful experience for the non-believers both post the torrid 2007/8 period and indeed just last Christmas.

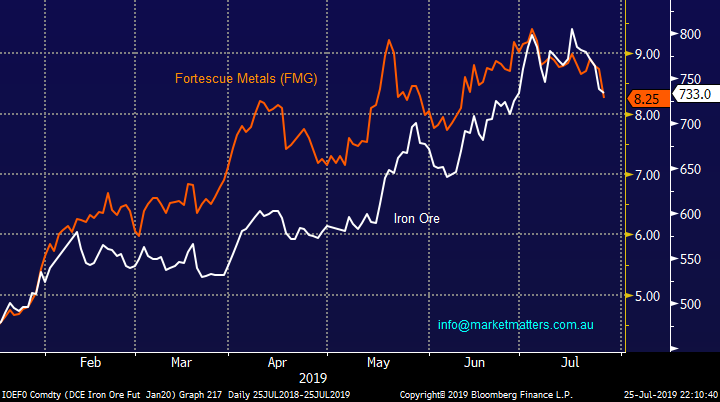

The resources continued their recent struggle yesterday led by the iron ore stocks with RIO Tino (RIO) and Fortescue Metals (FMG) tumbling -4.2% and -5.50% respectively, a classic illustration of how fickle the sector can be. We have moved to an elevated cash position over the last few weeks looking for opportunities from the looming reporting season and a pullback in the resources sector hence we have again fine tuned our plans for the sector later in todays report.

At MM we have been repeatedly postulating that about how cheap equities are if interest rates remain at current levels, let alone if they indeed fall further. At a lunch yesterday in Sydney we feel the RBA governor Philip Lowe made 2 extremely important points with regard to this thesis:

1 - The RBA believes Australians should expect an extended period of low interest rates – sounds like they want to both cushion the pain being experienced by the indebted Australian consumer while also stimulating some fresh borrowing along the way.

2 – He also reaffirmed the RBA was “strongly committed” to achieving its inflation target saying they are prepared to cut rates further if required to achieve this goal – looks like a RBA Cash Rate of 0.5% is a very real proposition.

Throughout the day markets totally embraced Mr Lowes comments driving Australian 3-year bond yields down to their lowest rate in history, just 0.845%. As we said yesterday it’s a simple game at present with interest rates heading to their lowest ever level equities are rallying to fresh to all-time highs, who wants to hold cash yielding basically zero. This almost “free money” environment has fuelled a huge asset boom with stocks at the pointy end of performance, a change in tact by Central Banks or an unavoidable deep global recession appears the only events which could turn the current tide of optimism.

MM remains comfortable to adopt a far more conservative stance than we did for the first half of 2019 but we are still keen on a number of stocks / sectors into 2020.

Overnight US stocks struggled with the S&P500 falling -0.5% as their reporting season had a net negative impact on their market while the European ECB were not as dovish as many hoped, although Mario Draghi lamented the deteriorating economic outlook – for the markets sake let’s hope they maintain focus on relative value as interest rates tumble as opposed to a potential recession looming on the horizon. The SPI futures are calling the ASX200 to open down around 30-points / 0.5% today with BHP falling another 25c in the US.

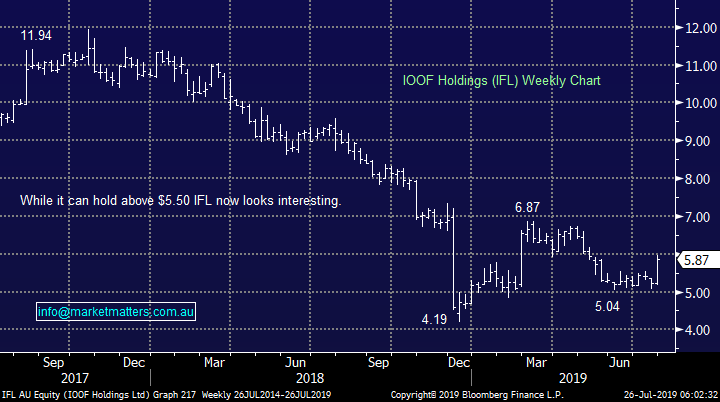

Today we are going to revisit the embattled Australian Fund Managers after some good news from IOOF Holdings (IFL) sent the stock up almost 7%, we ask the question will they finally receive some love from the soaring share market?

ASX200 Chart

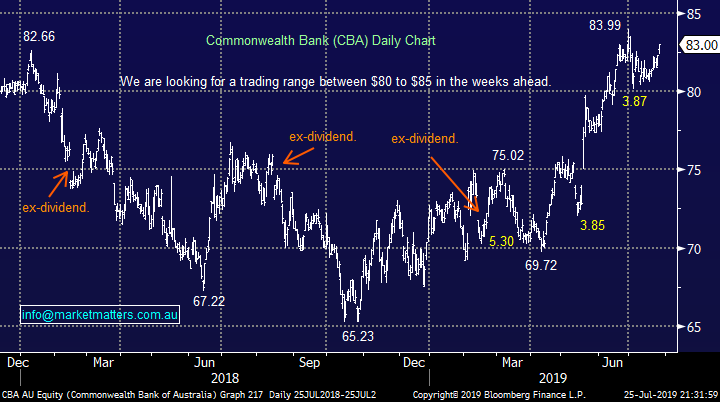

We have been watching market heavyweight CBA closely since its 4.6% pullback which commenced in late June, if you have a handle on our banks and CBA as an investor your half way to knowing where the markets are likely headed – CBA is now 7.7% of the ASX200 while the Big Four banks make up a whopping, and very influential, 23% of the ASX200. The entire local banking sector makes up well over a quarter of the local index.

MM is now anticipating an $80 to $85 trading range for CBA in the months ahead.

Hence we feel aggressive players looking for a top, or at least a resting point for the Australian market should wait for CBA to rally another few percent which if extrapolated targets over 6900 for the ASX200, assuming the heavyweight resources find some support sooner rather than later.

Commonwealth Bank (CBA) Chart

We have been very cautious iron ore short-term leading to our zero exposure in the MM Growth Portfolio to heavyweights BHP Group (BHP), RIO Tinto (RIO) and Fortescue Metals (FMG). Over the last few days we’ve heard a number of analysts call the top for iron ore, especially as Vale looks to ramp up production in Brazil, music to our eyes as we look to buy weakness.

Over the last 10-days we’ve seen the bulk commodity correct 12% taking FMG -14.5%, RIO -11.4% and BHP -4.4% along for the ride. Another 10% lower in iron ore and MM will become fairly aggressive buyers but on the stock level we have tweaked our buy levels. While we remain keen on the sector at the correct price we are going to be a touch fussier at this stage of proceedings:

MM likes FMG ~8% lower, RIO 6% lower while BHP is a tougher call at present.

Overnight BHP has slipped another -0.6% implying that FMG and RIO will be closer to our $7.60 and $90 buy zones.

Fortescue Metals (FMG) & Iron Ore Chart

Reviewing the underperforming Australian Fund Managers – again.

To quote the queen it’s been an “annulus horribilis” for the local fund managers with the standout exception of Magellan (MFG) which has more than doubled over the last 12-months. In a year which has seen the ASX200 soar to fresh all-time highs we’ve witnessed the likes of IOOF (IFL) -38%, Pendal Group (PDL) -17%, Janus Henderson (JHG) -21%, Perpetual (PPT) -11%, Platinum (PTM) -14% and Pinnacle Investment (PNI) -29% continue to decline. The fallout from the combination of the Royal Commission and APRA has been a huge headwind for the sector. However the banks endured a similar tale of woe into their 2018 lows but since investors almost gave up on the sector we’ve seen the likes of CBA rally over 30% including dividends.

Today we have now got many Australian investors sitting on “bucket loads of cash” as they consider moving down the risk curve in an attempt to receive some income from their monies. To give some flavour here, through Shaw & Partners I was involved in a $250m placement for Abacus Property (ABP) this week done at a 7% discount to the last traded price, and it was around 10x oversubscribed – which is huge. With term deposits moving towards a 1% pa and the classic “yields play” stocks having run extremely hard investors are scouring the landscape for alternative homes for the treasured cash, today we consider 3 of the above fund managers who are cheap compared to the market and currently pay an attractive yield – when, and I stress when, this sector turns the returns are likely to be very attractive, very quickly.

The catalyst for today’s report is IFL which rallied almost 7% yesterday after surprising the market with some positive news for a change – they enjoyed a stellar quarter of fund inflows, their best performance in a year. The companies shares are trading on an undemanding P/E for 2019 of 10.7x while the consensus yield over the next 12 months is a whopping 9.71%.

Technically IFL looks capable of testing $8 while the $5.50 holds firm i.e. excellent risk / reward for the brave who are prepared to venture where most investors are scarred – a potential aggressive play for both our Platinum & Income Portfolios.

MM likes IFL with stops below $5.50.

IOOF Holdings (IFL) Chart

1 Perpetual (PPT) $39.15

We have held PPT in our Income Portfolio since late 2017 and not surprisingly its been one of the more disappointing performers overall – we’re marginally in the black including dividends, and at today’s levels its again looking relatively attractive to MM. However, this month’s announcement of disappointing $1.1bn fund outflow has not helped matters dropping the stock over 10% from its highs of only 2-weeks ago, luckily for the business strong equity markets helped stabilise FUM but obviously these conditions cannot last forever.

Until we see a clear turnaround in capital inflow / outflows PPT has no place in our Growth orientated Growth Portfolio but its stable yield does remain attractive as an income play. PPT is now trading on an Est P/E for 2019 of 15.2x while yielding over 6% fully franked.

MM likes PPT into weakness below $39 as an Income Play.

Perpetual (PPT) Chart

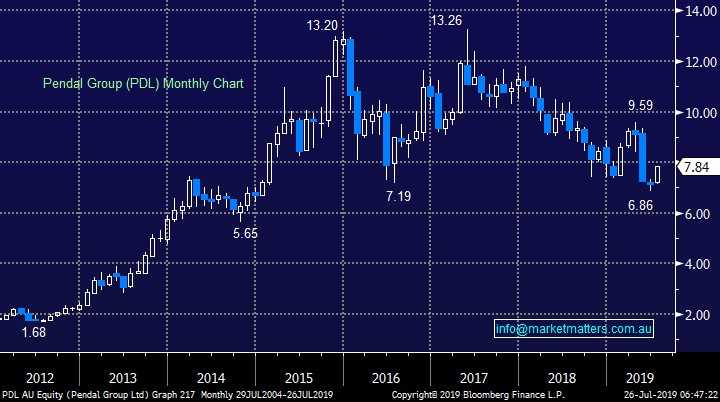

2 Pendal Group (PDL) $7.84

PDL (The former BT Investment Management) had a shocking May after disappointing the market with a weak half year result when it posted NPAT down 26% on the previous year. Management blamed a falloff in performance fees due to volatile / weak markets around December, hence this half should theoretically be much better. The business has a strong balance sheet and no debt hence the good cash flow should provide a sustainable dividend and hopefully some growth.

The investment business which serves companies in Australia is trading on an Est. P/E for 2019 of 15.1x while yielding over 6% part-franked. Technically we are bullish PDL targeting the $9.50 area with stops below $7, overall good risk / reward.

MM likes PDL at current levels with stops below $7.

Pendal Group (PDL) Chart

3 Pinnacle Investments (PNI) $4.48

This multi-affiliate investment company has endured a tough 3 quarters like much of the sector but our “Gut Feel” on this one is there’s probably more to come. Back in January the business announced a NPAT just over $10m on increased FUM to $46.7bn, not enough to impress the market which fell over 13% on the news.

PNI is currently trading on an Est. P/E for 2019 of 27.8x while yielding ~3% fully franked. Technically we are neutral PNI but a dip below $4 would not surprise.

MM is neutral PNI at present.

Pinnacle Investments (PNI) Chart

Conclusion (s)

Of the fund manager briefly covered today MM likes PDL, IFL, and PPT in that order. The question we ask ourselves as we consider PDL is should we switch our Janus Henderson (JHG) position or is this an optimum time to increase our sector exposure?

For now, we favour increasing our sector exposure into more value oriented managers, ideally into weakness rather than current strength.

Global Indices

No major change with US stocks still feeling vulnerable to us at this stage, a break back below 7850 by the NASDAQ, only 1% lower, will be a definite technical concern to MM.

We reiterate that while US stocks have reached our target area they have “not yet” generated any technical sell signals.

US NASDAQ Index Chart

No change again with European indices, we remain very cautious European stocks with their tone has becoming more bearish over the last week.

Euro Stoxx 50 Chart

Overnight Market Matters Wrap

· The US equity markets retreated from record levels overnight, with the Nasdaq 100 underperforming the most against its peers as investors became more cautious on the likely extent of the Federal Reserve’s rate cuts, following stronger than expected US economic data and the decision by ECB to leave rates unchanged.

· We expect the tech heavy, Nasdaq 100 to outperform tonight following after market news of Google’s parent, Alphabet rallying 8.54% as we type to US$1,233/share after exceeding consensus earnings expectations and announcing a further buyback of up to an additional US$25bn of shares. Amazon’s earnings were slightly weaker than expected, and the stock is 2% lower.

· The latest monthly US Durable goods orders beat expectations, rising 2%. All eyes will be on tomorrow’s second quarter GDP number ahead of next week’s Federal Reserve meeting when it is due to decide on the next rate move, with expectations remaining for a 0.25% cut. European markets were also weaker after the ECB left rates on hold, and ECB chair Mario Draghi commented that there was not a significant risk of a recession in the Euro region. However a rate cut in September is still forecast.

· BHP is expected to underperform further today after ending its US session off 0.57% from Australia’s previous close.

· The September SPI Futures is indicating the ASX 200 to open 26 points lower, towards the 6790 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 26/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.