To buy or sell now? – 5 stocks catching our eye (CBA, BIN, MXWO, CWN, FMG, WOR, JHX, EHL)

The ASX200 enjoyed yet another solid day this time rallying +0.5% with almost 70% of the index closing up on the day, the sheer lack of any meaningful selling remains the de rigueur for our local market. We continue to hear numerous stories of investors sitting on cash looking for a safe, high yielding home – a tough ask with Australian 3-year bond yields hitting 0.8% yesterday morning. The human emotions of “Fear & Greed” regularly drive extremes in the market but at the moment I’m not hearing any greedy stories which we would expect at a market top, if anything it’s the opposite – food for thought as we keep pushing ever higher.

With the index now sitting only 0.4% below its fresh all-time high the question I am hearing most from subscribers and investors alike continues to be how far can it rally before we see a crash, the very sentiment that actually implies a market crash is not around the corner just yet, just consider the following simple but important numbers:

1 – The ASX200 is yielding well over double that of term deposits, before we even consider franking credits. Plus interest rates are flagged to halve in the next 12-months. As term deposits head towards 1% pa huge piles of cash look set to continue flooding into stocks.

2 – The June Bank of America’s Fund Manager Survey showed investor confidence was at its lowest level since the GFC, a more typical reading for a market bottom than top.

3 – Statistically while the ASX200 remains above 6600 a test of the 7000-7100 region is most likely in the next 2-months.

Lastly the UK is currently keeping the newswires buzzing, even before the Ashes start on Thursday, as new Prime Minister Boris Johnson braces the country for a no deal BREXIT. As the 3-month deadline approaches the markets reactions might confuse some as the Pound tumbles to its lowest level in over 2-years but stocks surged with the FTSE up over 1.8%, while the rest of Europe struggled. The new PM looks set to push hard for an exit from Europe with or without a deal following the appointment of hard Brexiters to his key cabinet positions. One thing is slowly feeling certain, this 2-year debacle should be concluded in 2019 unfortunately the strong FTSE had little influence on Australian stocks exposed to the UK, they drifted overnight probably more focused on the deteriorating Pound.

MM remains comfortable to adopt a more conservative stance than we did for the first half of 2019 from a portfolio skew perspective but we are still keen on a number of stocks / sectors into 2020.

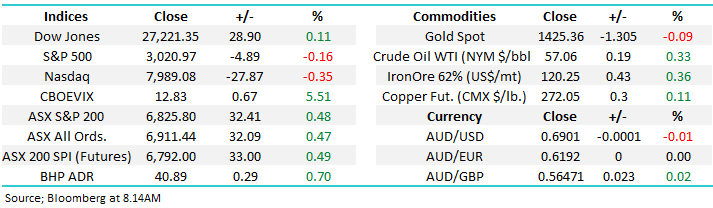

Overnight US stocks were mixed with the Dow up slightly while the NASDAQ fell -0.35%. However the SPI is indicating a strong open locally, up around +0.5%, which will take the ASX200 to a fresh all-time high.

Today we are going to focus on 5 stocks catching our eye as we move into reporting season, especially as we are mindful that our cash levels are on the high-side at this point in time.

ASX200 Chart

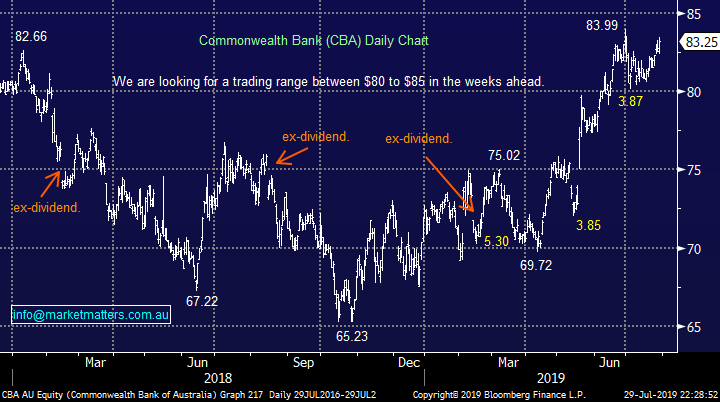

A quick update on our feelings towards the influential local banking sector, CBA has been following nicely a rhythm we identified over a month ago, until this changes we will play the banks accordingly. Unlike many we have remain committed to the banks for almost a year, although we did recently trim our holdings back towards “market weight” which represents 23% of the MM Growth Portfolio.

MM is still anticipating a $80 to $85 trading range for CBA in the months ahead.

Hence we are considering moving to an underweight stance towards the banking sector if / when CBA rallies another ~2.5%, conversely we will likely re-enter Australia’s largest stock if we see a retest of the psychological $80 area i.e. just adding value / alpha around the edges.

NB For aggressive players looking for a top, or at least a resting point for the Australian market, we feel CBA around $85 would represent an optimum time but that might be closer to 7000 for the ASX200.

Commonwealth Bank (CBA) Chart

High flying Bingo (BIN) experienced some selling yesterday courtesy of a downgrade to neutral by Goldman Sachs. About a month ago MM took a nice 55% profit on BIN around $2.25 and bought Pact Group around $2.45, seeing as they have both subsequently rallied around 20% I wish we had simply forgot to press the sell button side of the equation!

However at MM we are not too proud to buy back into a stock around, or higher, than where we sold previously – it’s just about trying to add value with solid risk / reward. Recovery story stocks are performing very strongly as they should be assisted by the ever declining interest rates, when we exited BIN we were not thinking the RBA would be at 0.5% in quick time, we again now like BIN into further weakness, but not ahead of its August result.

MM likes BIN back around the $2.30 area.

Bingo Industries (BIN) Chart

5 stocks catching our eye as the market climbs the wall of worry

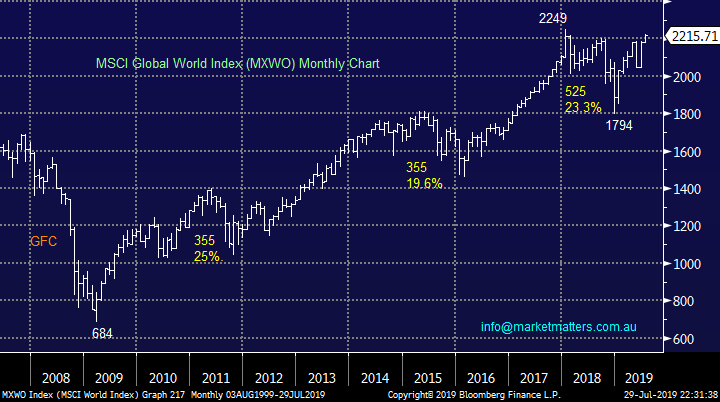

In Australia we are actually outperforming global indices for the first time in over a decade, a move we’ve been anticipating for a while but it’s taken ultra-low interest rates to bring things to fruition e.g. since the December low the ASX200 has rallied +26.3% in line with the Dow but better than Global World Index which is up ~23%. We feel this strong local performance may last longer than many anticipate simple because we are a high yielding index compared to our global peers.

MM is bullish the Global World Index while it holds above 2175 i.e. bullish equities.

MSCI Global World Index (MXWO) Chart

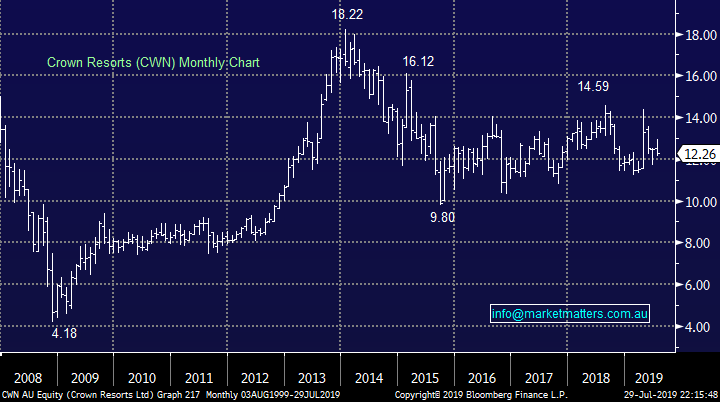

1 Crown Resorts (CWN) $12.26

CWN is currently being dragged through the mud as the allegations around junket operators and organised crime gather momentum, personally I am amazed people are surprised that crime is lurking beneath the surface of one of the last bastions of cash businesses – I ponder one day whether casino’s will be forced to give chips directly from a bank card and deposit back in a similar manner as the continued move towards a cashless society gathers momentum. There are even a few mummering’s of a parliamentary enquiry into casinos / junkets, almost guaranteed to send the stock lower:

When we consider CWN there are 3 parts of the equation we have considered carefully:

1 – As the high roller numbers destined for our shores look likely to fall we need to revalue CWN, especially as this is the very market Sydney’s new Barangaroo is targeting.

2 – Jamie Packer appears a keen seller of his 26% stake in the company while buyers are circling but at what price will they again make the right noises.

3 – Australians are gambling more but Sports Betting is winning the battle with casino gambling tracking lower .

Basically if it wasn’t for the takeover potential we would have CWN in the too hard basket, hence its unlikely to be in the MM portfolio’s anytime soon.

MM is neutral CWN.

Crown Resorts (CWN) Chart

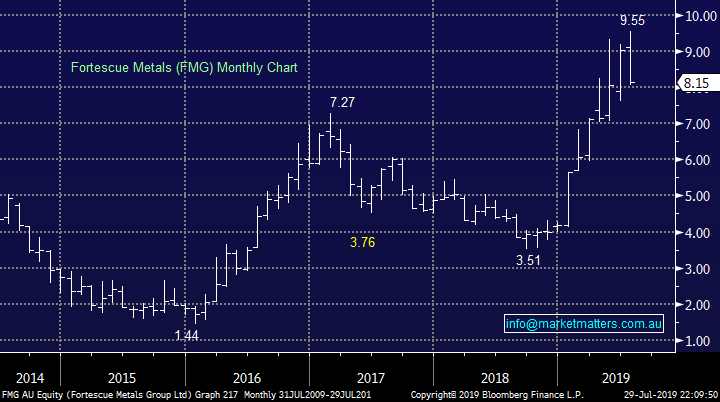

2 Fortescue Metals (FMG) $8.15

We have talked around FMG for a number of weeks but as the stock has now corrected ~15% its important to keep our finger on the pulse of this iron ore miner.

With a number of analysts now calling the iron ore squeeze over further consolidation within the sector feels a strong possibility. At this stage we feel the stocks are slowly representing value but we still feel patience is warranted with our ideal buy zone now ~8% lower i.e. the correction is 2/3 into its move.

MM likes FMG below $7.50 area.

Fortescue Metals (FMG) Chart

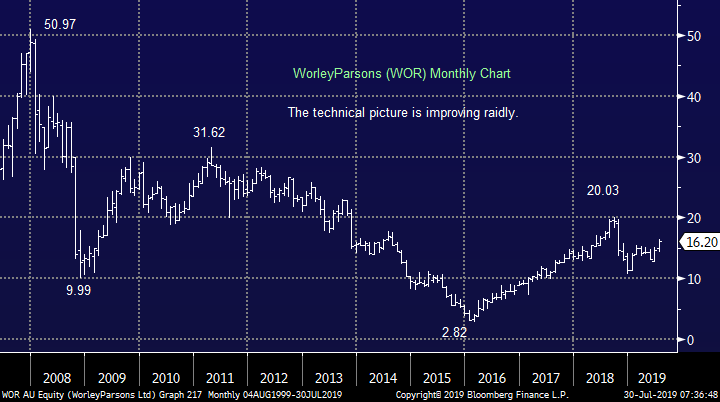

3 Worley Parsons (WOR) $16.20

MM has been watching oil & gas engineering group WOR for a number of weeks and the stock now looks perfectly positioned to accelerate higher.

The market appears to now be giving the company the thumbs up on the synergies of its $US3.3bn acquisition of Jacobs Energy, Chemicals and Resources division (ECR) which may easily see a stock repricing well over $20 in our opinion.

MM is bullish WOR with stops below $15.50, only 4.5% theoretical risk.

Worley Parsons (WOR) Chart

4 James Hardie (JHX) $20.01

JHX delivered an exciting FY19 57% profit increase back in May, assisted by a greater than 20% lift in revenue, a building company appearing to be tracking in the correct direction. This global construction business is grinding ahead in tough conditions and the current central banks attempts to stimulate international growth is likely to play into its hands.

The only thing missing from the story is yield with JHX paying ~2.6% unfranked. Technically the stock looks great while it can hold above $19.40, a 3% risk.

MM is considering buying JHX around this $20 area.

NB We already have exposure to the sector via Adelaide Brighton (ABC) which may keep us on the sidelines, however the technical setup here is a strong one.

James Hardie (JHX) Chart

5 Emeco Holdings (EHL) $2.38

Our EHL position continues to perform steadily for our Growth Portfolio, its currently showing a ~10% paper profit. We have not changed our thoughts with this renter of earthmoving equipment, our initial $2.50 target area is now only 5% away.

However this is an excellent cheap turnaround story and basis $2.50 we may simply raise our stops as opposed to simply selling.

MM is initially targeting ~$2.50 for EHL.

Emeco Holdings (EHL) Chart

Conclusion (s)

Of the stocks looked at today we like WOR and JHX at todays prices and FMG into further weakness.

Conversely we remain sellers of EHL around 5% higher, or as mentioned above we may simply raise our stops.

Global Indices

No major change with US stocks still feeling vulnerable to us at this stage, a break back below 2950 by the S&P500 only 2.3% lower, will be a definite technical concern to MM.

We reiterate that while US stocks have reached our target area they have “not yet” generated any technical sell signals.

US S&P500 Index Chart

No change again with European indices, we remain very cautious European stocks as their tone has becoming more bearish over the last week. However the UK FTSE is a very different picture after its explosive rally last night, we are bullish with stops below 7500 – a potential position for our ETF Portfolio that we will evaluate today and may include an alert in this afternoons report.

Euro Stoxx 50 Chart

UK FTSE Chart

Overnight Market Matters Wrap

· A mixed session was experienced in the US overnight, with only the Dow managing to keep above the red line.

· Crude oil continued to climb further, as investors refocus on an expected key US Fed interest rate cut along with a boost of confidence over US-China trade talks as Chinese and US officials are set to meet this week in Shanghai.

· BHP is expected to recover most of yesterday’s losses after ending its US session up an equivalent of 0.70% from Australia’s previous close.

· The September SPI Futures is indicating the ASX 200 to open 39 points higher to towards the 6865 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.