Wednesday Wrap – A look across our portfolios (CBA, NCM, RIO, FMG, EUM US)

The ASX200 was smashed another 162-points / 2.44% yesterday as relentless selling rolled through our market, the SPI futures volume was well over the double the average of 2019 with 91% of stock’s closing in the red, clearly a tough day at the office. The escalation of US – China trade concerns has sent the local market down over 400 -points / 6.2% in rapid fashion, just the last 2-days alone has seen almost $100bn wiped from the markets value, some previously complacent investors must be feeling very different this morning. To put things in perspective this week has already wiped out close to 10-weeks of gains – importantly to MM this is an exciting time, not one to panic and run to the hills – figuratively speaking. (Harry and I do leave for the Flinders Ranges today – more on that below).

The current news driven volatility is huge with the US futures yesterday swinging in a whopping 3% range before their index even opened. This significant increase by index volatility, combined with reporting season which has almost been relegated to the background, is highly likely to throw up further opportunities in the weeks ahead. At this moment in time all we need to make a fortune is a hotline to the PBOC (peoples Bank of China), they supported their Yuan yesterday after letting it plunge on Monday, the result an almost 4% turnaround by US stock futures. President Trump should understand the dynamics of the Chinese Yuan further before his next tweet, if the PBOC didn’t support their currency it would probably plunge by close to 30%, so he’s actually getting frustrated when they don’t manipulate enough!

MM remains comfortable to adopt a more defensive stance than over the first 6-months of 2019.

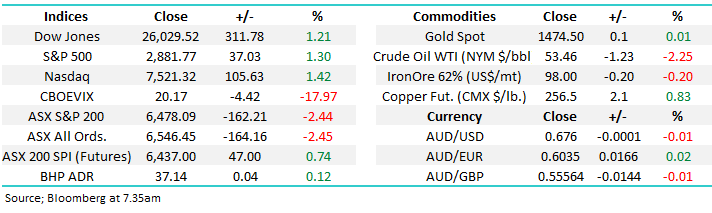

Overnight US stocks bounced strongly with the Dow recovering a solid 311-points, about 4% above the intra-day low for the futures. The SPI futures are calling the ASX200 to open up around 40-pints, disappointingly still well under where we were just after lunch yesterday.

In today’s report we are going to update our thoughts, ideas and plans for our International Equities and ETF Portfolios after first touching on the Growth Portfolio.

Reporting today: CBA, SUN, TCL

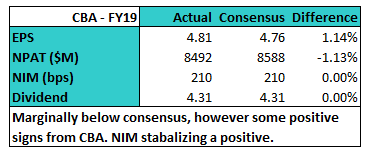

CBA result is just out and Australia’s biggest bank saw a ~5% hit to profits for FY19. Costs rising and income falling the culprit however these were not too far from expectations. NIM was flat first half to second half at 210bps, after falling from 214bps in 2H18. This comes despite the falling cash rate from the RBA which often hurts the bank margins. The remediation cycle of the banks is nearing the end which will help the FY20 result with earnings expected to recover from here. Dividend remained unchanged at $4.31/share for the year – nothing unexpected.

Capital is king for CBA with 130bp of excess capital post divestments – the market now looking for some capital management.

ASX200 Chart

APEX Postie Ride Starts Tomorrow

Just a massive thankyou to all who have sponsored Harry and I for the Apex Postie Ride. We’ve raised over $28,000 for a great cause and I reckon we’ll get to 30k by the time the ride is over! We leave today, start the ride tomorrow, 4 days, 1000k’s off road on a bike that should be delivering the mail.

Some recent TV press: https://www.facebook.com/SpencerGulfNightlyNews/videos/oam-recipient/1618720478226577/

And of course, for those that still want to donate, links and info here: https://www.mycause.com.au/page/205066/james-gerrish-harrison-watt-1311

Internet permitting, I’ll look to provide video updates along the way which (if possible) will be posted to the MM You Tube Channel – click here

Growth Portfolio

We transacted in 4 stocks yesterday, this should be no great surprise to our subscribers as all the transactions were flagged plus after all we are “Active Investors” who have been waiting for a strong correction to buy a few stocks: https://www.marketmatters.com.au/new-portfolio-csv/

1 Commonwealth Bank (CBA) $79.80

We allocated 5% into CBA as planned under $80, a risky play with CBA reporting today but after exiting recently it was always our plan to buy a correction, simply adding “alpha / value” around the edges.

CBA shares held for the next 12-months (plus a few days) should receive around $6.30 in fully franked dividends, an exciting yield of almost 8% fully franked, sound great if today’s company report is received positively by the market. We are considering funding this purchase by selling our Bank of Queensland (BOQ) position above $9 if the opportunity arises – only 2% higher.

MM remains bullish CBA, initially targeting the $85 area.

Commonwealth Bank (CBA) Chart

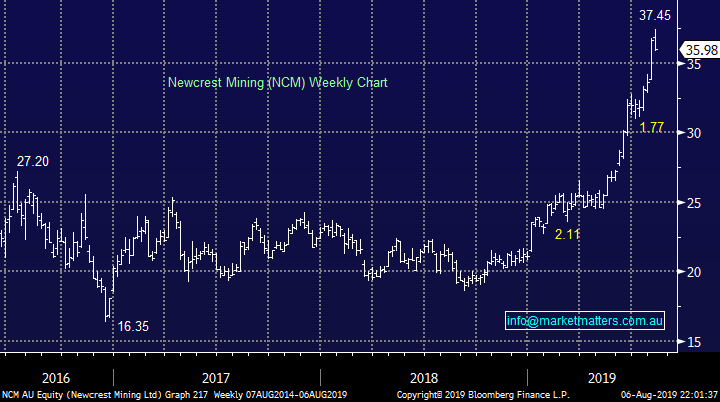

2 Newcrest Mining (NCM) $35.98

We sold Newcrest (NCM) yesterday above $37 in anticipation of a pullback / rest for Australia’s largest gold miner, especially as it reports next week. However we are looking to buy back into the sector, probably at this stage via an ETF – this move made us feel good at least on the day, realising a 15% profit and then watching the stock fall ~3% into the close, but as we all know 1-day swings are generally just noise.

MM remains bullish the gold / precious metals sector but from lower levels.

Newcrest Mining (NCM) Chart

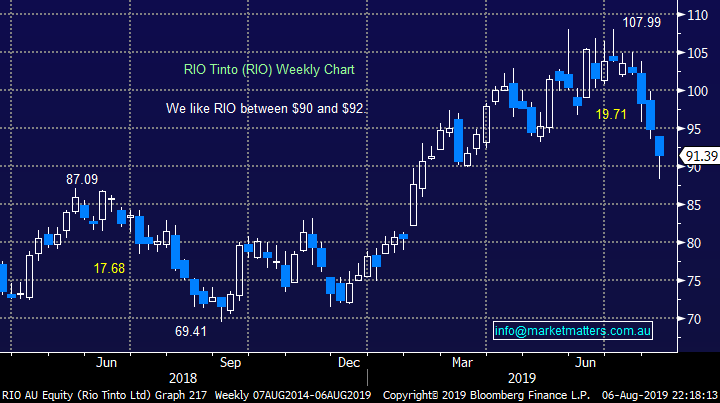

3 RIO Tinto (RIO) $91.39

Yesterday as RIO plunged below $90 we averaged our holding, we are now holding 5% of the Growth Portfolio in RIO looking forward to this weeks $4.27 fully franked dividend.

MM remains bullish RIO at current levels.

RIO Tinto (RIO) Chart

4 Fortescue Metals (FMG) $7.29

Lastly as FMG plunged below $7 we averaged our holding, we are now holding 5% of this iron ore miner in the Growth Portfolio just a few % higher, again we are looking forward to an attractive dividend, this time in early September.

MM remains bullish FMG at current levels with an ideal target ~$9.

Fortescue Metals (FMG) Chart

Due to our overall market view a foray into the BetaShares Australian Equities Strong Bear ETF (BBOZ) remains a strong possibility..

Income Portfolio

There will be no separate income note today, however we remain comfortable with the portfolio: https://www.marketmatters.com.au/new-income-portfolio-csv/

Over the past week, the portfolio lost -2.44% however when considered against a backdrop of the market correcting -5.36% the performance was as expected. Genworth (GMA) the standout after reporting better than expected results while announcing a big special dividend. CSR and Whitehaven Coal lagged while RIO was under pressure. The portfolio has turned negative FYTD, down by -0.86% versus absolute return benchmark of +0.49%. Since inception the portfolio is up 15.12% vs the benchmark of 11.42%.

International Equites Portfolio

The US S&P500 is currently sitting around 5% below its all-time high posted last month but importantly we are seeing no contrarian buy signals, no real surprise after only a few days down.

MM believes the risk / reward for US stocks is on the downside for at least the next 4-6 weeks.

Our preferred scenario is the S&P500 will correct at least another 6-8%.

US S&P500 Index Chart

Hence at this stage and especially with me on the postie bike for the next few days I see no reason to change our positioning: https://www.marketmatters.com.au/new-international-portfolio/

We are still holding 75% in cash plus market hedges 5% negative exposure to US stocks via an ETF (SH US) and 5% in Barrick Gold (GOLD US) an ideal mix while we are short-term bearish global equities.

MM expects to press the “Buy button” in an aggressive manner in the next 4-6 weeks but at this stage patience is a virtue paying the proverbial dividend, if anything we are likely to add to our bearish ETF into a decent bounce moving forward.

MM ETF Portfolio

MM is still holding 3 positions in the portfolio, we are long gold, long the $A and short US stocks while still holding 80% in cash: https://www.marketmatters.com.au/new-global-portfolio/

We remain comfortable with these 3 positions but tweaks may not be too far away:

1 – We plan to average the long $A if we see the local currency make fresh multi-year lows below the 67c area level.

2 – We are looking to increase our bearish exposure to US stocks into a correction which affords us a decent risk / reward profile, that is unless we make a bearish play on stocks via an alternative region.

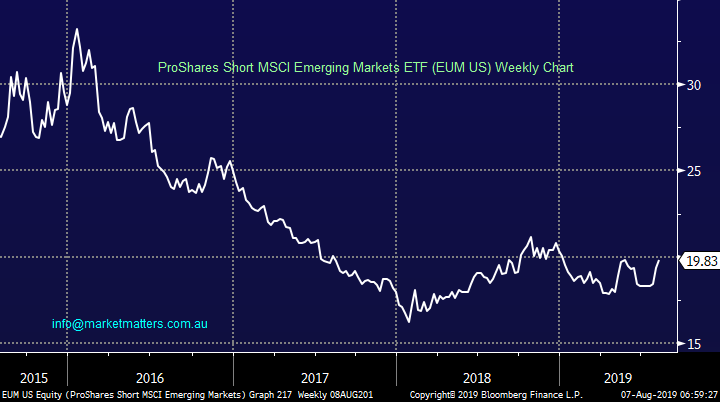

The other market which is still on our radar is very exposed to the US – China trade war:

1 Emerging Markets.

No change from last week, we are currently short US stocks but only with a deliberate 5% allocation hence allowing us to take a short position in another equities space e.g. the Emerging Markets (EM)

MM remains bearish the Emerging Markets and are considering taking a position accordingly, our current feeling is the US-China trade war may drag on for much longer than many anticipated just a few weeks ago, bad news for the EM.

Our preferred vehicle is the ProShares Emerging Markets Short MSCI ETF (EUM US). Details of this ETF are explained on this link : https://www.proshares.com/funds/eum.html

We are considering buying the EUM US ETF.

ProShares Short MSCI Emerging Markets ETF (EUM US) Chart

Conclusion (s)

While a short term bounce played out overnight – and more could come in the short term, MM is overall bearish global stocks in the weeks ahead and will be looking for opportunities to invest accordingly.

Overnight Market Matters Wrap

· The US equity markets retrieved some of its recent losses overnight, with investor hopes that a US-China trade battle to calm down following shift to stabilise its yuan currency.

· The Volatility (VIX) index eased, losing ~18%, however remains above the average complacency level at present.

· Crude oil slid, following investors’ opinion of a slowing US economy, currently off 2.25% overnight and off 8.82% from its recent highs.

· Locally, earnings will be the focus, with CBA, Suncorp (SUN) and Transurban (TCL) reporting this morning.

· The September SPI Futures is indicating the ASX 200 to open 32 points higher, towards the 6510 region this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 07/08/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.