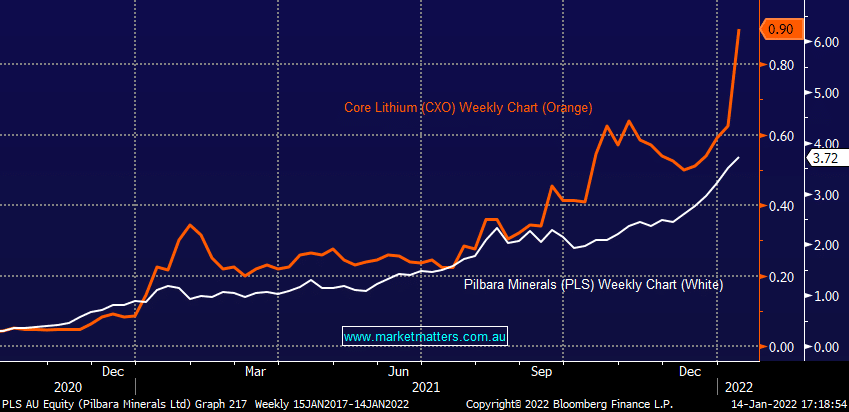

Views on Lithium, and how we sold too soon!

I was hoping that you would cover CXO Core Lithium Limited For a while, it was tracking with PLS but without major announcements this year it has persisted with great returns almost daily. What would you say is driving this and how long can it continue. Also, I held onto my PLS for a bit longer after you said to trim some exposure and I'm lucky it has done ok is it time to pull back now? Thank you in advance. Hi James, Keen to understand your thoughts on PLS from here onwards. In mid Dec we followed MM and exited PLS only to see it rally significantly in recent weeks. The original rationale for exit at that stage was that that MM was seeing near term weakness in lithium. However, since then, that weakness did not emerge . What is the reasoning behind that and where to from here for 2022? These things happen of course, but keen to learn and understand for the next time this arises! Cheers A