Keep your fingers on the pulse, there’s lots going on (JBH)

The ASX200 put in a solid performance yesterday closing marginally higher even after a negative lead from Wall Street and falling commodity prices. Sentiment was buoyed by positive reports by Ansell (ANN), Bendigo Bank (BEN) and JB Hi-Fi (JBH) while only the Resources sector weighed meaningfully on the index. All of the “Big 4” banks closed in the black as did the 2 regionals offering major support to an index which actually struggled for most of the day, it feels like we want to go up “if” we don’t see further negative macro-economic news but unfortunately fresh issues continue arising like green shoots in Spring, overnight Argentina plunged towards another debt crisis.

When I started thinking about this report last night there was bad news crossing the news wires as Hong Kong had been forced to cancel all flights as protestors literally swarmed into the airport. Political unrest is clearly rising which is weighing on equities, especially anything Hong Kong & China facing, while gold not surprisingly is well supported around the $US1500/oz area. This is clearly an unpleasant series of events but in a similar manner to North Korea we feel it will have a diminishing impact on markets over time i.e. short-term aggressive sell-offs because of such events are potentially buying opportunities - Hong Kong has already announced they are set to reopen the airport this morning.

However moving onto Argentina where another debt crisis feels almost inevitable, their currency at one stage last night plunged 30% against the greenback hence increasing their overseas debt repayments by the same degree which are denominated in $US, as opposed to the Peso. The downward spiral commences as fears grow of a default sending the Peso lower which increases the same problem leading to a chain like reaction. The last major Latin debt crisis unfolded in the early 1980’s and eventually the IMF had to step in with some “financial engineering” but the inevitable result is economic stagnation for the region – not what the developed world needs today. History shows us that in 1981-82 the Dow corrected ~25% before rallying by over 80%, that’s volatility!

MM remains comfortable adopting a conservative stance towards equities.

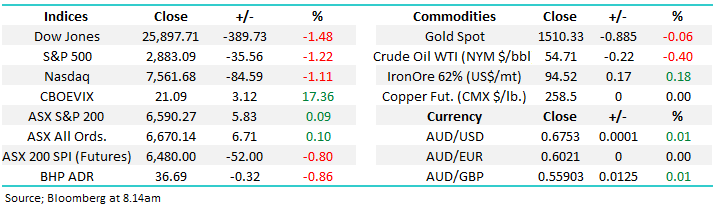

Overnight US stocks were smacked on the 1-2 of bad news with the Dow closing down almost 400-points / 1.5%, the SPI Futures are pointing to the ASX200 opening down around 50-points this morning, just where we were at 10.30 am yesterday.

Today we have written a sort of “ad-hoc” report with so many market influences impacting stocks but first I have looked at the retail sector and JBH in particular after covering off on today’s reporting in a quick audio update.

Reporting Today: CGF, MFG

ASX200 Chart

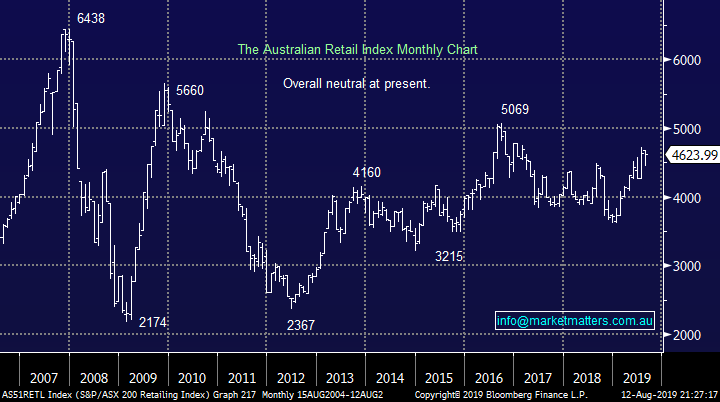

Many pundits have been calling doom and gloom for the Australian Retail sector which was easy to comprehend when we consider the huge household debt burden being carried by the average person – we’ve generally avoided the sector at MM on a risk / reward basis for these very reasons. However the sector itself has been fairly boring for many years and has not plunged as many expected, although the story has been different under the hood where the sector has not moved as one.

Our feeling is this is an under-owned sector by local investors which may well lead to outperformance by default e.g. JB Hi-Fi (JBH) and Harvey Norman (HVN) are amongst the most shorted stocks on the Australian market both with over 10% of their outstanding shares sold short. When Fund Managers are underweight and professional traders are already short the news needs to be meaningful for stocks to fall.

MM is neutral to slightly positive the Australian Retail Sector.

Australian Retail Index Chart

JBH surged almost 10% yesterday after beating market expectations with its financial year result, I would describe it as a solid result especially under weak retail conditions. The stock looks ok value if current margins can be maintained especially as it yields ~4.7% fully franked, clearly attractive compared to Term Deposits whose rates are falling almost weekly.

However JBH is the 6th most shorted stock on the ASX with over 14% short sold which is likely to have amplified Mondays upside reaction, as a buyer I’m not keen to join a stampede of short covering because it often ends in tears but it shows the risks which can unfold when the crowds wrong, in this case to the upside.

MM is neutral JBH at current levels.

JB Hi-Fi (JBH) Chart

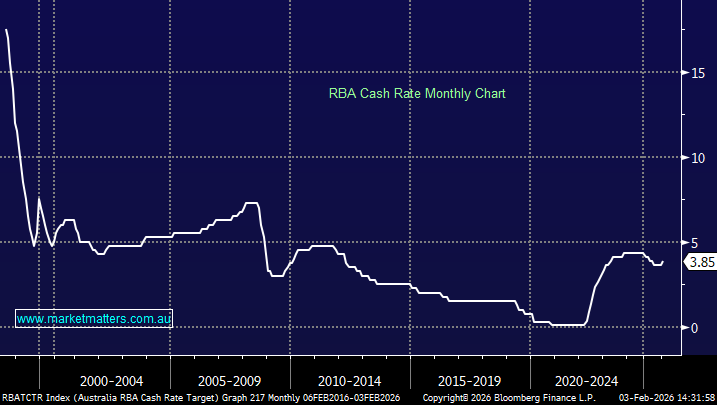

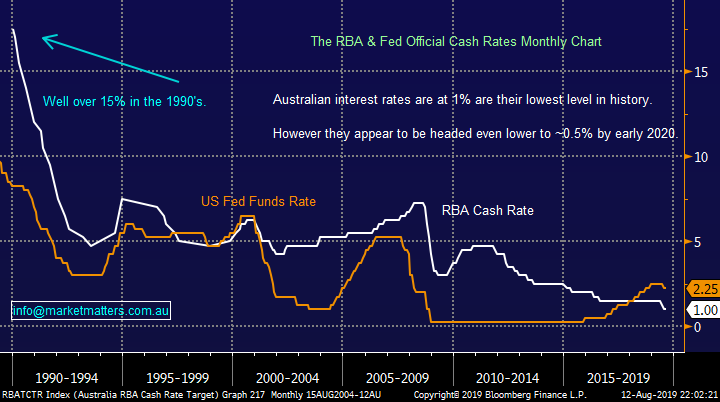

Ignoring the current deluge of news driven noise hitting equities we believe Interest rates remain the key to the health for stocks medium-term. Markets are becoming increasingly comfortable with “zero interest rate” thematic especially as its looks like more cuts are on the horizon:

Australian futures are now considering the possibility of 3 cuts to 0.25% while in the US some doves are now looking at the 1% handle, both levels theoretically very supportive for stocks. If we see this degree of monetary easing by central banks it would represent a contraction of the interest rate differential between the US and Australia, theoretically bullish for the $A but that worm doesn’t appear to have turned just yet.

Moving back to rates the earnings yield on stocks after “costs” is the highest since the GFC, not surprising there’s plenty of buyers into weakness for solid stocks paying sustainable yields – this trend looks to have further to unfold until we see inflation creep back into the global economy.

MM believes the RBA will cut again in 2019 but further Fiscal Stimulus must be around the corner as ammunition on the interest rate front is almost spent.

Official Australian & US Interest Rates Chart

Moving onto a subject garnering huge attention in the financial community – US yield curve inversion. Basically long-term interest rates are falling below the short-term ones, a basic economics 101 sign of a looming recession. The chart below of the 2 & 10-years has not inverted but the differential is almost zero and ominously we are now appearing to be in a very similar position as just before the GFC.

When we look across the whole interest rate curve (different maturities) the picture is arguably bleaker with the % of inversions hitting levels not seen since 2000 and 2007, prior to major stock market corrections.

A global recession is now almost expected by the market.

US 10 & 2-year bond yields Chart

Last week we wrote “MM believes we have entered a new short-term cycle for US stocks where bounces should be sold for the active trader” this continues to feel on the money although bounces will often be sharper than many expect:

1 - Our initial target for this aggressive market correction is ~2750, now around 4.5% lower.

2 – However this is likely to only be the initial leg lower, our ultimate target for this market pullback is potentially ~2350, a retest of Decembers panic low – we are certainly getting increasing fundamental “alarm bells” to test these levels.

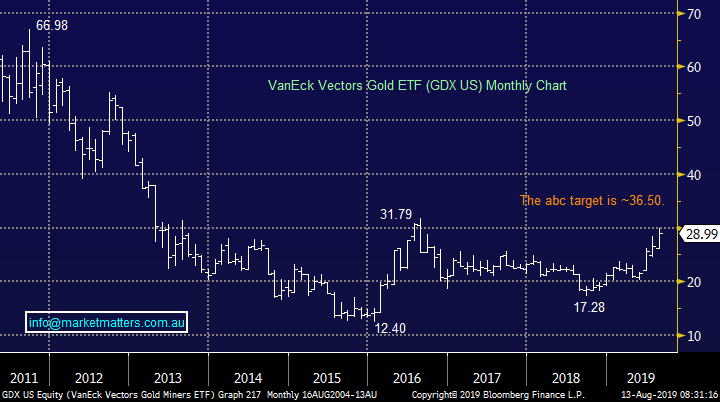

These are exciting times, not ones to panic and runaway but its essential investors have a plan otherwise these dominant human emotions of “Fear & Greed” will wreak havoc with your returns. The MM Growth Portfolio is holding 16% in cash plus 5% exposure to the GDX Gold ETF, relatively defensive but more so would not hurt.

Our initial target for this down leg in the S&P500 remains 2750, or ~4.5% lower.

US S&P500 Chart

At MM we have been bearish the Emerging Markets (EM) for a few weeks and the overnight reality check hitting Argentina has painted a very clear short-term picture and it’s not pretty. We remain bearish the EM with a target ~10% lower.

MM remains bearish the Emerging Markets.

Emerging Markets ETF (EEM) Chart

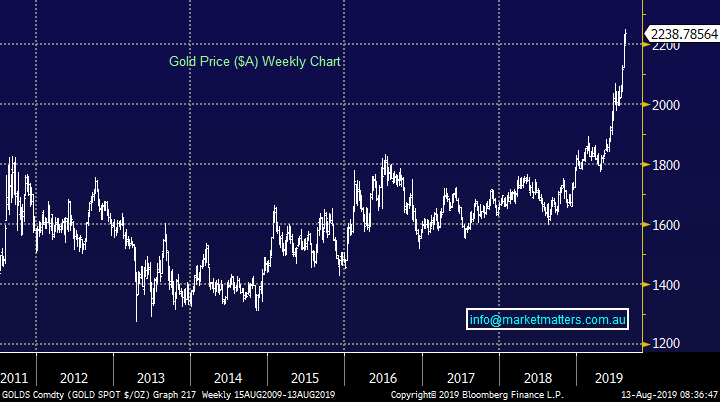

Gold continues to follow our expected bullish path but the overnight reaction to issues in Argentina and Hong Kong was fairly muted, the GDX Gold ETF actually closed in the red – we are bullish gold and gold stocks but a pullback feels close at hand e.g. Newcrest (NCM) has corrected 4.7% over the last 2-days alone. However with the gold price in $A continuing to rally the local stocks should remain firm for now, we will be looking to buy a pullback when it unfolds but patience feels prudent at present.

MM remains bullish the gold complex.

VanEck Gold ETF (GDX US) Chart

Gold in Aussie Dollars Chart

Conclusion (s)

No major change, investors should remain cautious in todays market but opportunities are likely to present themselves on both the buy and sell side – i.e. an ideal times for the active investor.

Global Indices

We believe US stocks are now bearish short-term as touched on earlier. The Dow’s initial target is ~3.5% lower.

US stocks having reached our target area plus they have now also generated technical sell signals.

US Dow Jones Index Chart

No change again with European indices, we remain very cautious European stocks as their tone has becoming more bearish over the last 2-weeks, we have been targeting a correction of at least 5% for the broad European indices, this looks likely to be achieved this week.

Euro Stoxx 50 Chart

Overnight Market Matters Wrap

· Global equity markets sold off overnight as geopolitical tensions continue to threaten global growth. Argentinian stocks, bonds and peso depressed after a left wing populist opposition candidate dominated Sunday’s primary election vote. Credit default swaps are indicating a 75% chance of another sovereign default on the horizon.

· Metals on the LME were mixed and gold is trading at $US1510.33/oz. US 10-year government bonds are now yielding just 1.65% and the Aussie battler currently at US67.53c.

· BHP is expected to underperform the broader market after ending its US session off an equivalent of -0.86% from Australia’s previous close.

· The September SPI Futures is indicating the ASX 200 to follow the global move overnight and gap 35 points lower, testing the 6555 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/08/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.