Actions MM are considering if we rally ~2% towards 6600 (NST, GDX AU, BBOZ, GDX US, BOQ, FMG, EHL)

The ASX200 bounced strongly yesterday with strength across the board except the defensive gold and utilities sectors. Investors enjoyed 74% of the index closing in the black while 25 stocks rallied by 4% or more compared to only 6 companies that fell by the same degree. Reporting season continues to be tough on companies that miss on almost any level with BlueScope Steel (BSL) and NIB Holdings (NHF) both coming under pressure after confessing their sins to the market – MM owns BSL in our Growth Portfolio but in this case we believe the market has got it wrong and we are considering adding to our position into further weakness. More potential fireworks under the hood today with more big names, including BHP just out with results. I cover in the recording below, however in terms of BHP, it looks light on, about a 2% miss at the earnings line.

Reporting Calendar – click here – below I cover: BHP, KGN, EHE, SEK, MND

A reliable indicator of market sentiment did the rounds of MM yesterday, it supported our belief that stocks are poised to bounce i.e. the AAII Investor Sentiment Survey. The conclusion was “optimism remains at an unusually low level and pessimism remains at an unusually high level over the last 2-weeks”. When markets are this bearish they are susceptible to aggressive rallies. We are ideally targeting the 6600 area for the ASX200 where MM is again likely to tweak our portfolio (s).

https://www.aaii.com/sentimentsurvey

The concerns of reporting season are slowly diminishing as we pass the half way mark, sure things haven’t been too flash locally but uncertainty is usually the greatest fear for stocks and that’s slowly fading into the rear view mirror. Plus we have central banks banging their stimulus drum albeit in a quiet way but when markets start focusing on the belief that central bank Fiscal and Monetary support is back on the agenda stocks are likely to enjoy a resurgence of their yield driven bid tone.

MM remains comfortable adopting a conservative stance towards equities.

Overnight US stocks rallied solidly with the S&P500 gaining 1.2%, unfortunately the SPI futures are suggesting the ASX200 will only bounce ~15-points, or 0.25% implying most of our good work played out yesterday.

Today we are going to look at 5 stocks / positions we are considering if the market continues its recovery.

ASX200 Chart

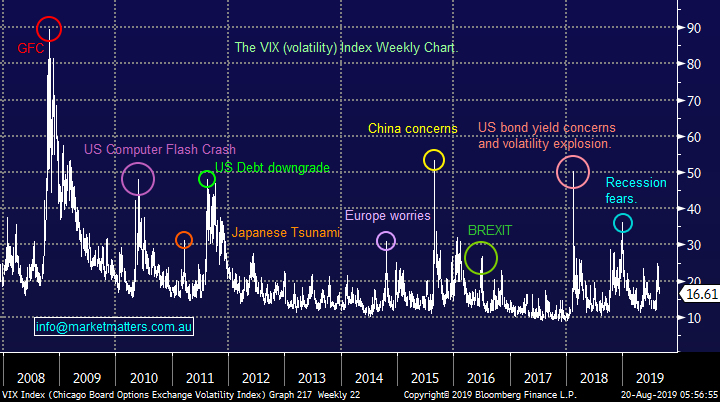

The volatility Index / “fear gauge” (VIX) is rapidly moving back into complacent territory. Amazingly the index is already back below its average post the GFC, clearly this indicator isn’t reading / believing all the negative stories dominating our press. Last night’s 10% drop has already retraced over half of the indexes gains since late July, we actually now believe the index is a buy into further weakness from current levels.

MM believes the VIX will eventually challenge late 2018 levels this year i.e. ~35.

Also the Put / Call ratio has become exaggerated over recent weeks as the bears have come out to play, illustrated by the AAII sentiment survey - another a solid indicator that a bottoming process is unfolding, or in other words the pessimism has simply gone too far in the short-term.

The VIX Index (Fear Gauge) Chart

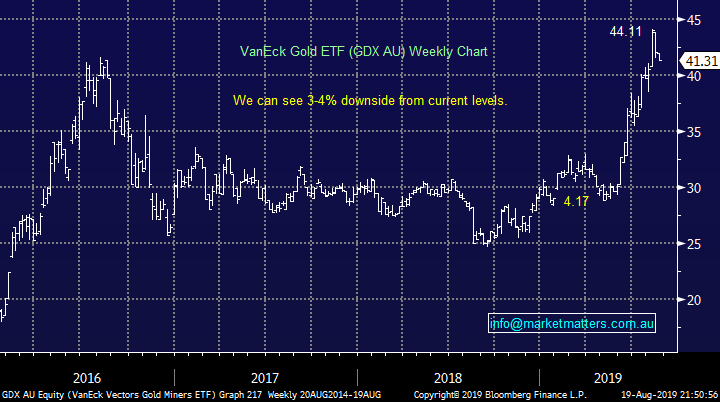

The gold sector has been correcting nicely since we recently took profit on our Newcrest (NCM) and GDX (GDX AU) ETF positions, we intend to re-establish our exposure to the precious metal into this pullback. While there is no deviation from our previously outlined plans it’s important that MM subscribers clearly comprehend our likely investments in the coming days / weeks. Our favourite 4 on the shopping list at this point in time are:

Resolute Mining (RSG) ~$1.65, Northern Star Resources (NST) under $11.50, Evolution (EVN) $4.90 and Newcrest Mining (NCM) $34 – all between 3 & 4% lower.

MM especially likes NST ~4% lower we but are considering taking a position in 2 of the above.

Northern Star Resources (NST) Chart

Interestingly the VanEck ETF (GDX AU) which MM invested in recently also looks poised to correct another 3-4% coinciding with most of our targets above – I hope that’s not tempting fate.

Ideally we come to work one day in the near future to see gold down aggressively creating an ideal buying opportunity.

VanEck Gold ETF (GDX AU) Chart

Over recent years many of us have struggled to comprehend that 25% of global bonds are paying a negative yield i.e. you are guaranteed to lose money if you invest in them.

However the unprecedented step by a Danish Bank has now taken things one step further, I can only imagine how the Australian property market would react if the same scenario unfolded locally:

1 – In Denmark you can now get from the 3rd largest lender a mortgage rate of zero for 20-years and +0.5% for 30-years.

2 - In Denmark you can now get from the 3rd largest lender a mortgage rate of minus -0.5% for 10-years.

In other words the bank funds your mortgage!

If we compare the 10-year bond yields between Australia and Denmark it’s actually a touch easier to comprehend the rate. The differential between the countries 10-year bond rate is over 1.5%, if we take this from the domestic mortgage rates they would be flirting with at least zero.

We believe the RBA Cash Rate has further to fall towards 0.5% i.e. 2 more cuts.

US 10-year bond yields Chart

No change in our opinion for US stocks: “MM believes we have entered a new short-term cycle for US stocks where bounces should be sold for the active trader” this continues to feel on the money with the Dow appearing on target to rally another ~300-points before we would be considering selling.

Our initial target for this aggressive market correction is around 6% lower, it certainly feels like an ideal time to be an active investor, after a bull market lasting over a decade simply buying and holding carries some risks from purely a statistical perspective.

Our initial target for this down leg by US stocks is ~6% lower.

US Dow Jones Chart

5 stocks / ideas on the MM radar.

In Friday mornings report our conclusion was: “MM is dusting off our buying finger as markets correct, above are 5 / 6 stocks we currently have firmly in our sights.”

Unfortunately the market didn’t give us a final capitulation style sell-off that would have enabled us to take a decent risk / reward opportunity on the upside but we managed to realise some healthy profits from our gold positions which have since pulled back.

MM believes equities are bouncing for another selling opportunity.

ASX200 Chart

Today we have briefly looked at 5 scenarios MM is considering if / when the ASX200 rallies towards 6600.

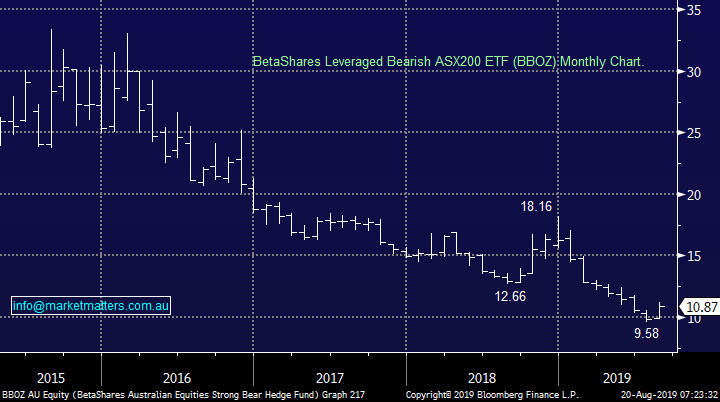

1 BetaShares Leveraged Bearish ASX200 ETF (BBOZ) $10.87

MM has been contemplating taking a position in bearish ETF for a while, similar to how we did in Q4 of 2018. However as the chart below illustrates this can be a painful exercise in a bull market which doesn’t pull back. The risk / reward for the leveraged BBOZ looks interesting around $10.40 but it may go a touch lower if the ASX200 does reach 6600 – the BBOZ looks to move around 2.4x the ASX200 hence if we hit 6600 the BBOZ should theoretically be closer to $10.30, not a huge difference.

MM likes the BBOX around 10.40, or 4% lower.

BetaShares Leveraged Bearish ASX200 ETF (BBOZ) Chart

2 Gold exposure.

Gold stocks have been moving with an inverse correlation to the ASX200 and as we have discussed above MM is looking to buy this current pullback in the sector. Overnight gold fell ~$US20/oz but the US based GDX ETF slipped a begrudging -1.2% implying that our sector will be relatively quiet today. On balance we can still see another 4% downside for this ETF and the corrective nature of the pullback to-date strengthens our view that this is a pullback to buy.

MM likes the Australian gold sector 3-4% lower.

VanEck Gold Miners ETF (GDX US) Chart

3 Bank of Queensland (BOQ) $8.96.

We are holding an overweight exposure to the banking sector which has held us in good stead over 2019 but 23% in the “Big Four” and 5% in Bank of Queensland (BOQ) is feeling a touch rich at present. Similar to markets relative performance BOQ is our least favourite holding, originally bought on anticipation of some form of sector consolidation amongst the regionals - we are now looking to cut it, ideally a few % higher.

MM is considering taking a small profit a few % higher.

Bank of Queensland (BOQ) Chart

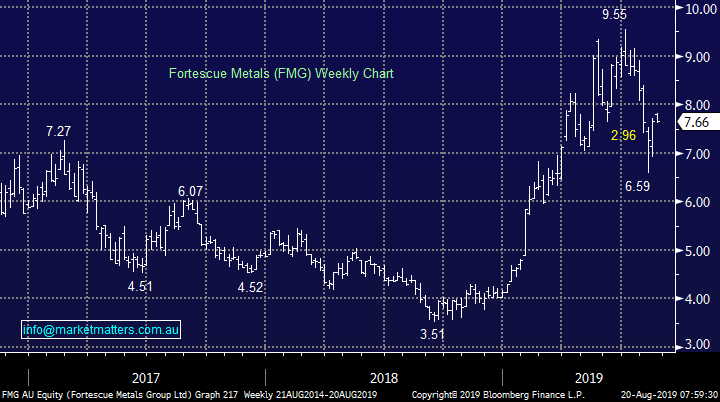

4 Fortescue Metals (FMG) $7.66.

Fortescue (FMG) has already bounced over 16% just because iron ore stopped falling, the bulk commodity hasn’t yet rallied the 10-12% from last weeks low that we believe looks likely – the recent 31% almost crash in FMG illustrated perfectly the dangers of a crowded trade / view.

The stock reports in 6-days’ time and we believe it could be a cracker hence we are no hurry to close this position i.e. we currently intend to be fussy. Another option in the space for MM is RIO, if we do see a strong bounce in the underlying iron ore price we may close this position depending on how both stocks are performing.

MM is looking to take profit on our FMG position around $8.50.

Fortescue Metals (FMG) Chart

Iron Ore Chart

5 Emeco Holdings (EHL) $2.16.

EHL has surrendered much of its last few months gains as its moves like a geared form of the ASX200. Hence if we are correct and the ASX200 is bouncing before another leg down its likely to provide an opportune time to take a profit in this volatile beast.

MM is considering taking profit on EHL around 5- 10% higher.

Emeco Holdings (EHL) Chart

Conclusion (s)

MM is planning on adopting a more conservative stance for the Growth Portfolio if the ASX200 bounces back towards the 6600 area i.e. buy gold stocks & / or increase cash position.

The above 5 ideas may come in part to fruition but the market is enjoying throwing curve balls at present hence we may end up implementing something from left field but both planning and flexibility remain key when markets are so volatile.

Global Indices

We believe US stocks are now bearish short-term as we touched on earlier, the tech based NASDAQ’s initial resistance is close at hand.

US stocks have generated technical sell signals.

US NASDAQ Index Chart

No change again with European indices, we remain very cautious European stocks as their tone has becoming more bearish over the last few weeks however we had been targeting a correction of at least 5% for the broad European indices, this has now been achieved.

The long-term trend is up hence “short squeezes” might be harder and longer than many anticipate.

Euro Stoxx 50 Chart

Overnight Market Matters Wrap

· Technology and bank shares led the US markets on the upside, with the broader S&P 500 ending its day up 1.21% as fears of a looming recession dissipated.

· US-China trade issues are currently looking to ease after the US granted a 90 day reprieve to a ban on China’s telco giant Huawei doing business with US companies.

· On the commodities front, crude oil gained, alongside Dr. Copper being 0.5% firmer, while Iron Ore lost some ground.

· The September SPI Futures is indicating the ASX 200 to open 26 points higher testing the 6500 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.