Subscribers questions (AAPL, FMG, FNP, CRN, MRG)

Spring has arrived and the Australian stock market is attempting to rally back towards its all-time high posted just one month ago. August made many investors feel uneasy as we ate our cornflakes on more than one occasion watching aggressive falls on Wall Street, accompanied by headlines including an escalating US - China trade war and imminent global recession. Yesterday the Trump administration implemented its planned 15% tariffs on $US110bn of Chinese goods including footwear and even the Apple Watch, and as promised China retaliated. More tariffs are planned by both sides for October and December. More and more it looks like BREXIT where common sense suggests the problem should be resolved sooner rather than later but instead politicians end up making it worse.

We received some positive local economic news over the weekend with the previously under siege Australian property market now bouncing so strongly that some prices are being compared to the dizzy heights reached back in mid-2017 – investors should never underestimate the power of ultra-low interest rates. Since Mays Federal Election, which halted the fears of Labor ending negative gearing, the RBA has cut interest rates twice taking them down to an unprecedented 1% with many believing there’s more to come – that’s a huge tailwind for both house prices and stocks.

At MM we still believe that interest rates are the controlling factor on stocks and hence decent sell-offs should be bought but with so many global macro issues and human egos influencing stocks we continue to believe that the recent volatility may become the norm in 2019 / 2020.

US markets are closed for Labor Day tonight which makes Fridays flat close, after a strong week, feel an even better performance short-term. Stocks feel like they want to grind higher until the next Tweet is lobbed into the fold by Trump et al, or we get another surprise event which knocks the already brittle investor confidence.

Now the ASX200 has bounced to our short-term 6600 target area MM intends to become more defensive, at least for a few months.

This morning US futures have opened down -0.8% which is likely to put pressure on local stocks early this morning but we stick to our view that this is a market to sell strength, not weakness.

Thanks as always for the questions.

ASX200 Index Chart

Similar to our own market, US stocks experienced a choppy and volatile August but just as we said last Monday this is the time to “plan your trade and trade your plan”.

1 – MM will look to increase our defensive stance with US stocks around current levels, although a squeeze a touch higher would not surprise.

2 – MM will look to increase our market exposure around 8% lower basis the tech based NASDAQ.

US NASDAQ Index Chart

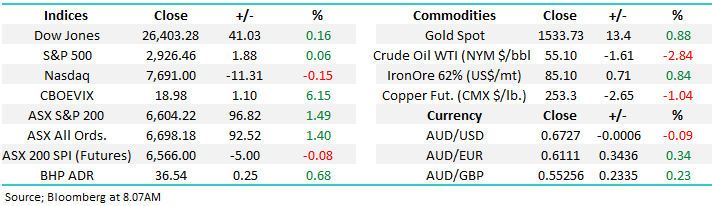

The fresh tariffs enforced yesterday will put real pressure on market goliath Apple (AAPL) – they’ll need to raise prices or tolerate margin pressure – price hikes would obviously make less competitive. Apples products that will be hit by the 15% tariff includes the Apple Watch but the important iPhone will not be affected until December – another ticking time bomb courtesy of President Trump. However it feels to me that the stepped manner in which the tariffs are being imposed suggests both leaders are ultimately looking for a compromise.

MM is currently only considering adding to our AAPL position on a sharp dip below $US180.

Apple Inc (AAPL US) Chart

Question 1

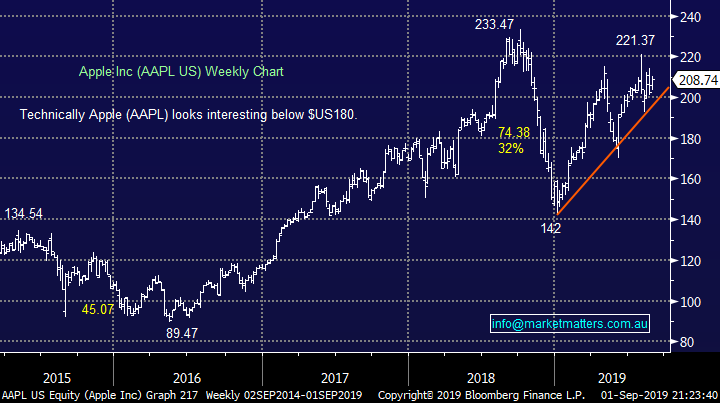

“Hi, just checking what’s your exit point for Fortescue Metals (FMG)?” – Tim W.

Morning Tim,

FMG should open strongly today assuming it follows BHP’s positive lead from the US and iron ores +3.4% advance. However we should be conscious that FMG can lead the bulk commodity both up and down – they both fell 30% but FMG has already bounced 21% compared to iron ore which has only recovered +7.5%, implying that FMG will start to underperform on a relative basis fairly soon.

At MM we believe FMG is one of the best resource stocks around at present but its volatile price action cannot be ignored, it’s tailor made for the active investor. Hence while we are happy to take our $$ from this position we intend to be relatively fussy

MM is currently considering taking our $$ on FMG around / above $8.50.

Fortescue Metals (FMG) Chart

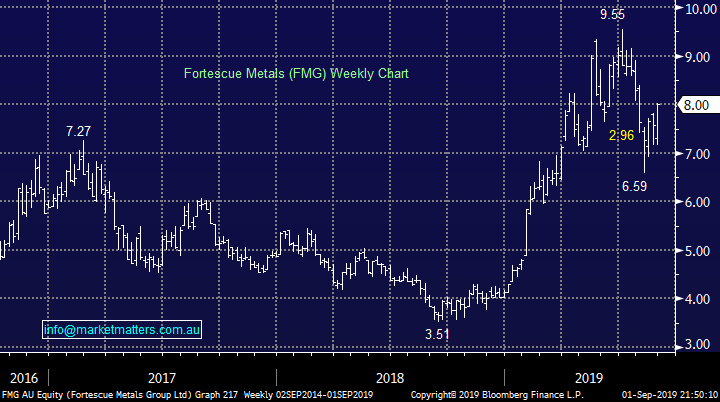

The iron ore price clearly has a significant impact on FMG but interestingly the stock bottomed 3-weeks before the bulk commodity i.e. as the iron ore price chopped around below 600 CNY/Tonne FMG had already commenced its recovery. A classic buy signal for a stock is when it doesn’t fall on bad news, in this case the underlying price of the commodity it produces.

Conversely the current recover will probably top out when the stock fails to embrace future gains in iron ore, we currently anticipate iron ore will encounter selling in the 640-650 CNY/Tonne area.

Iron Ore (CNY/Tonne) Chart

Fortescue Metals (FMG) v Iron Ore (CNY/Tonne) Chart

Question 2

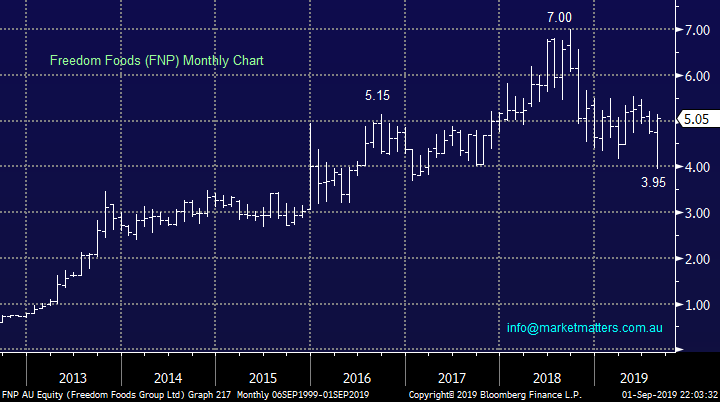

“Hi James, What do you think the future is for Freedom Foods following the huge gain on Friday which is now about where I bought them some months ago.” - Nick A.

Hi Nick,

Soy based / natural foods business Freedom Foods (FNP) roared over 20% higher last week following its stronger than expected full year result which showed an almost 35% increase in sales which (very importantly) was accompanied by better margins led to an over 40% increase in EBITDA to $55.2m for FY2019. This solid result was accompanied by a bullish outlook from the companies CEO for growth across Australia, SE Asia and China. Simply put there was nothing not to like in this result by FNP.

The stock is now trading on a Est P/E for 2020 of 30x but while this is not cheap further results like last weeks make it justified in our opinion.

MM likes FNP below $5 with stops under $4.40 – this should be a recession proof business but we thought that of Costa Group (CGC) which has since proven vulnerable to other external influences.

Freedom Foods (FNP) Chart

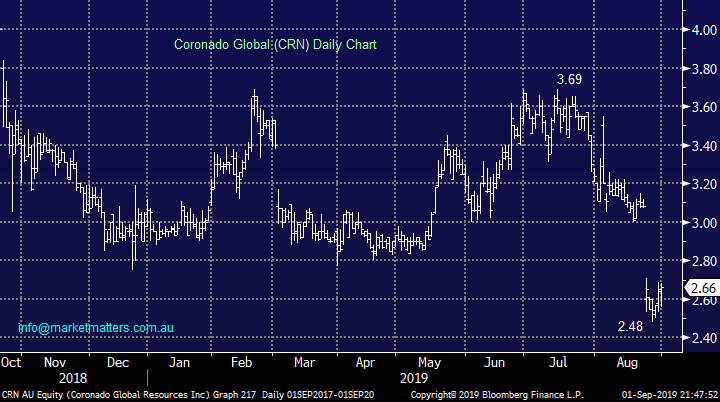

Question 3

“Hi James, looking at Coronado Global (CRN), I am impressed by the Operational & Financial performance. There has been a significant improvement over FY 2018 in all aspects of the Company. Much of the Income is also derived from its US operations providing a FOREX benefit

The Share Price has fallen considerably from $3.60 to $2.57 following the stock going ex- dividend and the release from Escrow of initially 11% of Shares held in Escrow by Group LLC and the remaining 66% in Escrow also released following the EOFY 2019 Report. The combination of these events and massive increase on Shares released to the market has obviously driven the collapse in the share price, despite the outstanding performance of the company financially. With a P/E of 5.18 and Dividend of 15.8% with no Debt what am I missing?? Possible dilution of Dividend in the future and dilution of NTA per share? I would be interested to hear your views“ – Richard O.

Morning Richard,

Coal miner CRN did initially rally following the release of its half-year net profit which showed a lift by over 90%. The result looked good on all headline metrics including a greater than 10% lift in revenue to $1.82bn and EBITDA of almost $600m, up over 50%. The directors approving the early release of over 10.5m shares appears to have put some pressure on the stock via good old fashioned supply and demand however the stock traded ex-dividend almost 30c through a return of capital which explains the majority of the fall in August.

As we suggested above with FMG and Iron Ore, over time, commodity stocks track the underlying commodity price with a greater than 90% correlation, and Coal prices have been under pressure. The stocks currently trading on an Est P/E for 2019 of 4.4x compared to say Whitehaven Coal (WHC) which is trading on an Est P/E of 12.8x for 2020 i.e. coal is out of vogue.

MM sees value in CRN around $2.40 but we feel the stock overhang will take time to filter through the system.

Coronado Global (CRN) Chart

Question 4

“Do you have a view on this? I have a "priority offer" and Magellan seem to be doing everything right to encourage the retail investor-me! They intend to invest in "eight to twelve of their best ideas" and past performance has been strong but very USA-centric I wonder whether this offer is to add FUM at the top of the market.” - Regards, Chris J.

Hi Nick,

MFG does appear to have tapped the market at an opportune time and the 22% decline in the share price tells us that a number of investors feel the same. Whilst the second chart below illustrates the strong correlation between the MFG share price and the US S&P500 there’s no reason why Hamish Douglass won’t change tact with his best 8-10 ideas away from the US in the months ahead and maintain his solid track record through say Asia or Europe.

As you say the “priority offer” to existing shareholders is attractive – we touched on this last week:

Magellan Financial Group (MFG) have launched is High Conviction Trust which will invest in a concentrated portfolio of high quality companies, weighted towards the companies best ideas – their words not mine. However the track record of MFG over the years is clearly one to be admired as Hamish Douglass steers a top quality ship.

We had the Magellan team in last week running through the deal. While we can make general rather than personal comments only, the 7.5% loyalty bonus for current holders of any Magellan listed fund or the headstock (MFG) is a good deal. For those that do not currently own stock in MFG or any of their listed funds there is a priority offer available through brokers, including Shaw and Partners that will entitle those participating to a 2.5% loyalty bonus of shares. Through Shaw & Partners we can assist in applying through the priority offer. if interested, please email me on [email protected]

In terms of the loyalty offer, to receive either 7.5% or 2.5% worth of additional units in the trust, unit holders need to be on the register on the 31st December 2019. This means that unit holder can actually sell after listing at any stage, however they need to be back on the register by the 31st December to receive the bonus. While the bonus issue of units is clearly a positive and it provides a buffer from a performance perspective, I wouldn’t be surprised if there were some unintended consequences of it. For example, subscribe for units through the loyalty offer, sell after allotment - before buying back in December to be on the register by the 31st to receive bonus shares. This could potentially put some pressure on the unit price of the trust on open.

MM is neutral MFG at current levels.

Magellan Financial Group (MFG) Chart

Magellan Financial Group (MFG) v US S&P500 Chart

Overnight Market Matters Wrap

· A quiet session was experienced last Friday in the US as investors prepared themselves for a rest day in the market tonight – bank holiday both in the US and Canada.

· The previously announced set of tariffs of 15% is now taking effect as of yesterday on ~US$$112bn worth of Chinese consumer goods. Despite the new round of taxes, President Trump said trade talks between the US and China were expected to proceed later this month.

· A standout over the weekend was a strong rally of around 9% in the nickel price to a five year high, driven by Indonesia’s decision to bring forward a proposed ban on nickel ore exports from December this year. Other commodity prices were mixed, with oil, copper and gold weaker while iron ore recovered nearly 4% from its recent selloff to around US$85/tonne.

· BHP is expected to outperform the broader market after ending its US session up an equivalent of 0.68% from Australia’s previous close.

· The September SPI Futures is indicating the ASX 200 to open marginally lower, hovering around the 6600 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.