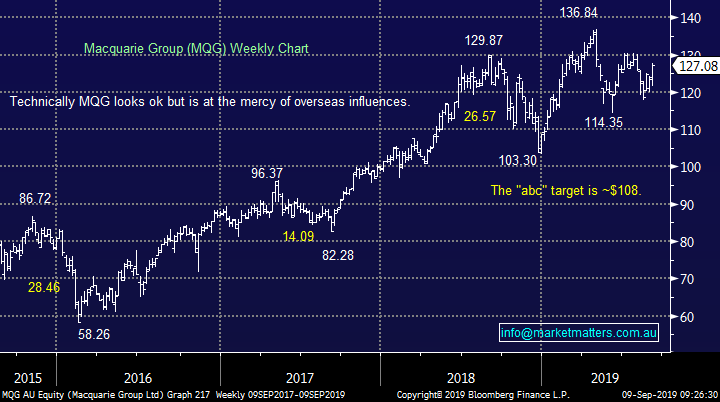

Subscriber’s questions (OZL, CIM, MQG, QBE, WOR, CYB, WPL, NAN, MQG, MGF, MFG)

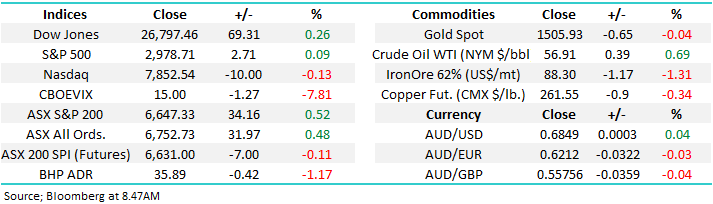

The local market ground higher last week, it actually felt stronger but we only closed up 43-points after an early week dip. At MM our ideal scenario over the last few weeks has been a pop above 6600 for the ASX200 prior to another leg down towards 6200 to complete a simple correction / rest for stocks after their strong gains from last Christmas time lows – we now have the move higher in place and stocks feel strong, further negative macro news is probably required to send the ASX200 down towards 6200, let’s see if we get any Trump tweets this week. “Risk on” was the tone last week with only the Utilities, Transport, Real Estate, Healthcare and Gold stocks experiencing notable selling but this group is only ~20% of the index hence we saw a positive net effect for the ASX200.

We received some mixed economic news over the weekend from home, and abroad:

1 – Auction clearance rates continue to improve at the start of spring with the final figures for both Sydney & Melbourne looking likely to settle well above 70%. If housing prices continue to improve confidence may flow through to the Retail sector.

2 – China’s exports for August declined, coming in lower than expected as US-China trade issues continue to bite. A delay / cancellation of next month’s talks between the 2 nations could send stocks lower, towards our target area.

Now the ASX200 has bounced to our short-term 6600 target area MM is comfortable for now being more defensive, at least for a few months.

This morning SPI futures are pointing to a slightly lower opening with resources looking set to give back some of their recent gains, early morning currency moves imply a quiet day ahead.

Thanks as always for the questions, the volume picked up this week as stocks made fresh 4-week highs, we do all love a strong market, me included.

ASX200 Index Chart

Similar to our own market US stocks have recovered solidly over recent weeks creating a very clear technical picture.

1 – The post Trump bull market remains clearly intact albeit with slowing upside momentum.

2 – A pullback of ~1.5% by the tech based will trigger technical sell signals targeting the 7700 area support – our preferred scenario.

US NASDAQ Index Chart

We mentioned earlier that a minor “risk on” move rolled through our market last week, a move which was reflected by the Aussie ($A) which closed +2% above recent decade lows. In our opinion this solid week is definitely not confirmation that a major swing low is in place but it does look like a market “looking for a low”. Hence MM is likely to largely avoid the safety stocks with only the golds interesting us into current weakness for a relatively short-term play.

MM still believes the next 10-15% for the $A is up.

Australian Dollar ($A) Chart

Question 1

“Hi there James, I'm relatively new to trading and wanted to clarify what you mean by: MM intends to become more defensive. Also what you mean by: this is a market to sell strength, not weakness.” - Thanks Kim B.

Morning Kim,

Welcome on board! Thanks for the question, it’s imperative that all subscribers understand any market “lingo” that we may use at times, please ask if / when this happens again.

1 – “MM becomes more defensive” – this means we have put ourselves in a position where we will be almost happy if the market suffers a correction in the short-term i.e. holding elevated cash levels and stocks which usually rally / outperform when markets fall, like Golds and Utilities. Currently MM is in a defensive position, holding 29% in cash hoping to increase our market exposure (buy) into weakness, ideally around the 6200 area.

2 – “this is a market to sell strength, not weakness” – statistically markets consolidate / rotate around 80% of the time compared to impulsing up / down to a new levels of equilibrium the remainder of the time. As we can see on the chart below the ASX200 roared up 1465-points from its late December low, we now believe the market is due to consolidate these gains hence giving investors the opportunity to buy weakness and sell strength i.e. there is no need to buy on strong days, unlike Q1 of 2019.

ASX200 Index Chart

Question 2

“Hi, would you also consider long on copper?” – Tim W.

Hi Tim,

Copper is arguably the ultimate “risk on” proxy and as can be seen below it enjoyed a strong recovery last week as the news of the planned US-China trade talks in October crossed the newswires. At this stage we feel there’s a strong possibility of another leg lower in stocks which is likely to mean a short-term tough time for copper and its respective stocks, assuming we are correct of course.

Hence the answer is a definite yes but ideally if / when we see the ASX200 correct back towards 6200, or when we decide this scenario has become unlikely and the market again looks bullish. Assuming no unusual news on the corporate front in the weeks ahead we particularly like OZ Minerals (OZL) for copper exposure, an excellent business which we believe the market is undervaluing medium-term.

MM’s favourite vehicle to buy for copper exposure is OZ Minerals (OZL).

Copper ($US/lb) Chart

OZ Minerals (OZL) Chart

Question 3

"With CIM:ASX on Friday commencing the buyback of 10% on limited float, I wonder now Market Matters view on CIM:ASX?" Thanks Rodney

Hi Rodney,

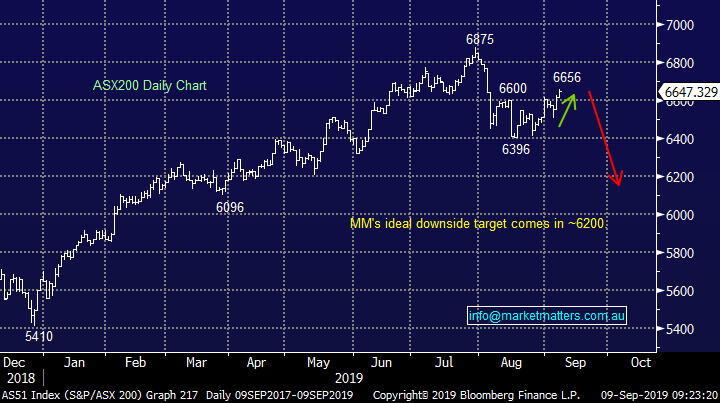

CIMIC (CIM) continues to struggle, significantly underperforming the market. As we said last week”some other industry insight we have garnered in recent times also paints a negative picture for CIM’s current position” hence we are leaving alone for now. The buy-back is positive however to me, the share price is telling us we should remain sceptical.

I reiterate what we said in last week’s Monday Am Report:

MM has no interest in CIM.

CIMIC Group (CIM) Chart

Question 4

“What is MM's view on the MQG SPP that they put out to existing shareholders? $120 a share. MQG trades at 122.4 right now.” - Regards, James D.

Hi James,

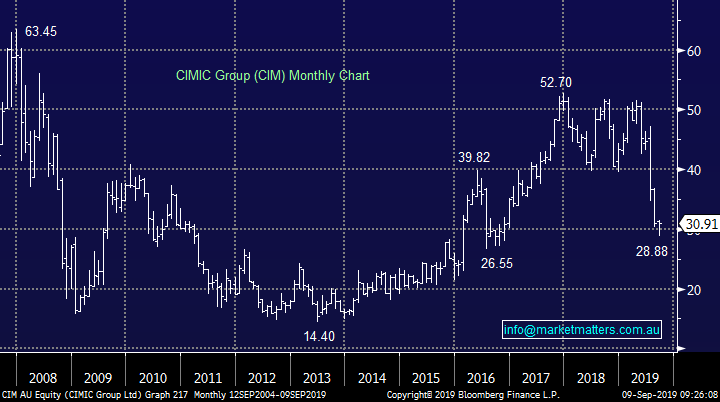

Macquarie Group (MQG) announced a surprise $1bn capital raising through an institutional placement and share purchase plan (SPP) at the end of August while at the same time re-confirming their full-year guidance for 2020. Importantly due to strong demand the “Silver Donut” was able to place the stock at $120, above the previously planned $118 – a good sign.

I would be happy to buy MQG all day long at $120 when it’s trading above $127, we like the business and it’s on our radar as a potential acquisition if we see a pullback in equities in the weeks ahead. Investors have to be conscious that the stock often dances a very similar tune to US stocks which can at times be used to buy MQG at attractive valuation levels.

MM likes MQG into weakness.

Macquarie Group (MQG) Chart

Question 5

“Hi James, thanks for the great coverage, I am looking to increase the percentage of cash held and looking to cut at least a couple of my “dogs “so wondering whether you can comment on the price targets for the following : QBE, WOR, CYB, WPL. Also how do you feel about the MQG offer …take it up (even if you have plenty of banks as per your Growth portfolio weighting?)” - Many Thanks, regards Don H.

Hi Don,

A reminder that we can only provide general comments only.

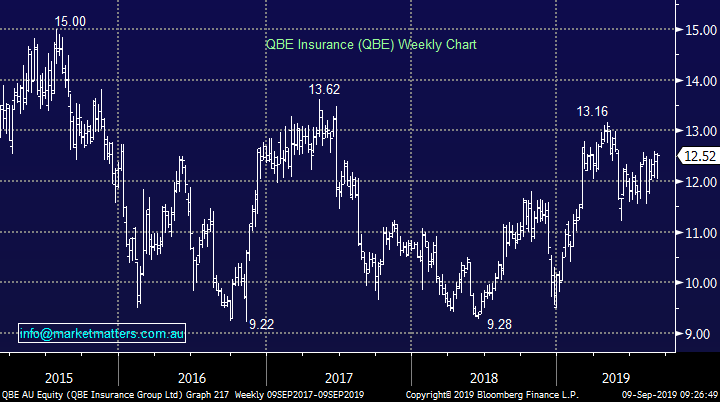

1 – QBE Insurance (QBE) $12.52 – we actually like QBE short-term as the decline in bond yields loses momentum, a test of $13.50 feels on the cards.

2 – Worley Parsons (WOR) $12.78 – WOR’s breakout above $15.50 failed leaving us neutral technically. The company beat expectations with last month’s report but future guidance were muted at best, a common occurrence in August. Concerns of US-China are clearly weighing on WOR leaving us also neutral on the fundamental front.

3 – CYBG Plc (CYB) $1.99 – There’s nothing to like about CYB either fundamentally or technically, we may see a bounce after the recent savage sell off but MM has no interest in the UK based bank.

4 – Woodside Petroleum (WPL) $31.85 – WPL has spent most of the last few years trading between $30 and $35 with no obvious reason for this to change. The stocks 5.7% fully franked yield is clearly attractive hence we hold the stock in our Income Portfolio but we are neutral on the directional front.

Lastly as we discussed in the previous question we like MQG at $120, we are considering buying ourselves as a quasi-replacement for Bank of Queensland (BOQ) which we sold into recent strength.

QBE Insurance (QBE) Chart

Question 6

“Hi James, I was wondering if you could have a look at Nanosonics (NAN) which has spiked up since their recent shareholder update. It appears that they have planted their roots globally under the stewardship of Michael Kavanagh who I think was the CEO of Cochlear along with others he brought with him. Is it time for their orchard to bear some plump fruit?” - Thanks, Peter M.

Hi Peter,

NAN has gone through the proverbial roof in 2019, especially since delivering an excellent report in August showing an almost 40% increase in revenue. The markets getting very excited with the companies ultrasound disinfection product but with these stock prices comes risk.

The company is now valued over $2bn but revenue is under $85m and its Est P/E for 2020 sitting at 157x, that’s certainly priced very optimistically.

MM is neutral NAN at current prices.

Nanosonics (NAN) Chart

Question 7

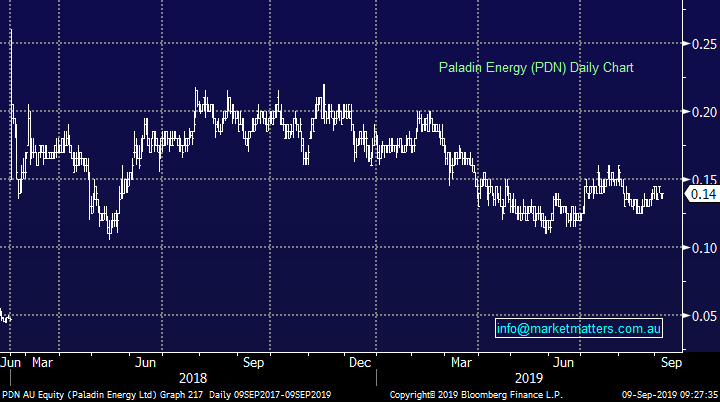

“Hi! James, thanks for your insights, what are your thoughts on PDN at the moment?” - thanks Tom.

Hi Tom,

PDN has been the subject of a number of questions this year following a certain famous and successful fund manager popping up on the share register but as we’ve said previously the share price is not exciting having fallen over 40% from its 2019 high. Plenty of pundits are becoming bullish nuclear power / uranium moving forward but at this stage we would rather let the share price do the talking and guide us.

MM is neutral PDN.

Paladin Energy (PDN) Chart

Question 8

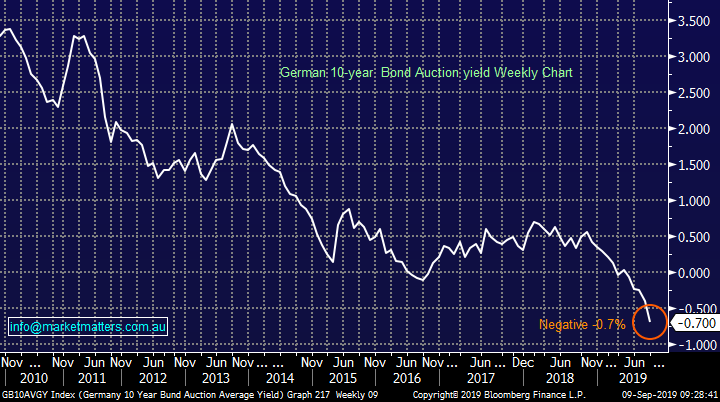

“Hi there, can you explain why people or investment funds buy negative interest bonds? How do they make money from this? What is their thinking?” - Thanks, Kim

Hi Kim,

A great question which baffles many, myself included at times! Fund managers usually have their hand tied by mandates e.g. they have to hold a certain amount of $$ in bonds of which a % may have to be European / Japan facing. Hence we have buyers in these regions of bonds which are paying a negative yield, the higher the bond price the lower the yield and in these countries amazingly the demand for bonds is so high its pushed bonds to these relatively new phenomenon of negative yields – not the 101 economics I learnt at university. Investors locking in a guaranteed loss makes zero sense and it does feel like a bubble slowly but surely inflating.

Two factors are worth considering when we extrapolate this scenario:

1 – Currently many fund managers are more comfortable buying a definite losing asset rather than chase the higher risk end of the spectrum like shares, or in other words they feel stocks are fully priced at best.

2 – When some of this “risk averse” money moves from bonds to equities the rally in stocks could be explosive, there’s clearly a lot of $$ in the system.

MM has no interest buying negative yielding bonds.

German 10-year Bonds Chart

Question 9

“How do we leave a question re a stock? I read the q&a on a Monday and would like to ask my own.” – Dale C.

Hi Dale,

Exactly as you have, simply email [email protected] and we will reply, I look forward to your first question.

Question 10

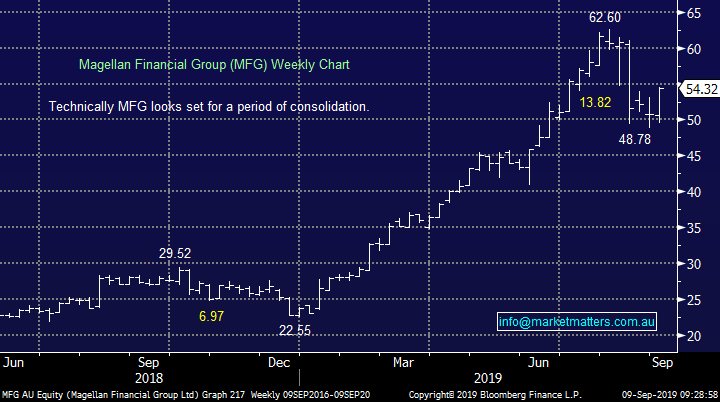

“James etc . Do you have an opinion on the Magellan High Conviction Trust float for MGF shareholders who get an allocation?” – Richard.

Morning Richard,

We answered this question in our Monday morning report on the 26th of August:

“Magellan Financial Group (MFG) have launched is High Conviction Trust which will invest in a concentrated portfolio of high quality companies, weighted towards the companies best ideas – their words not mine. However the track record of MFG over the years is clearly one to be admired as Hamish Douglass steers a top quality ship.

We had the Magellan team in last week running through the deal. While we can make general rather than personal comments only, the 7.5% loyalty bonus for current holders of any Magellan listed fund or the headstock (MFG) is a good deal. For those that do not currently own stock in MFG or any of their listed funds there is a priority offer available through brokers, including Shaw and Partners that will entitle those participating to a 2.5% loyalty bonus of shares. Through Shaw & Partners we can assist in applying through the priority offer. If interested, please email me on [email protected]

In terms of the loyalty offer, to receive either 7.5% or 2.5% worth of additional units in the trust, unit holders need to be on the register on the 31st December 2019. This means that unit holder can actually sell after listing at any stage, however they need to be back on the register by the 31st December to receive the bonus. While the bonus issue of units is clearly a positive and it provides a buffer from a performance perspective, I wouldn’t be surprised if there were some unintended consequences of it. For example, subscribe for units through the loyalty offer, sell after allotment - before buying back in December to be on the register by the 31st to receive bonus shares. This could potentially put some pressure on the unit price of the trust on open. “

Magellan Financial Group (MFG) Chart

Overnight Market Matters Wrap

· The US equities market closed mixed overnight however investors remain in the stance that the Fed lookslike its coming to the rescue again with Chariman Powerll vowing to act as appropriate to defend agains falling investment and manufacturing.

· Data released yesterday showed Chinese trade with the US is contracting quickly as trade talks stall. China’s central bank will inject $185 billion into the financial system starting next week as imports from the US fell 22% and exports to the US declined 16%.

· BHP is expected to start the week on a weak note and underperform the broader market after ending its US session off an equivalent of -1.17% from Australia’s previous close.

· The September SPI Futures is indicating the ASX 200 to open marginally lower, testing the 6640 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.