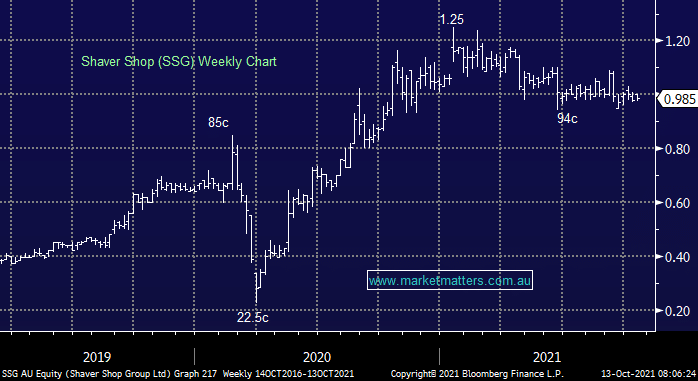

A lot has been written about the significant cash sitting in consumer’s bank accounts as a result of unprecedented stimulus and lockdowns which has kept people from spending. As we hurtle towards the festive season and freedom, retailers are likely to see a surge in spending into year end. Shaver Shop is our preferred pick amongst mid-cap retailers to take advantage of this theme. Revenues were up 10% in FY21 with NPAT up 68% with cash of over $7m on their balance sheet. There was no guidance provided at the result, though LFL sales were up +0.5% for the first few weeks of FY22. On a single digit PE and a high single digit yield, it’s cheap, it just needs a catalyst which reopening could provide. While cash levels are low in the portfolio right now, we may look to switch out of an ecommerce exposed company to fund the purchase of Shaver Shop which is more of an omni channel retailer.

scroll

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is bullish SSG

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.