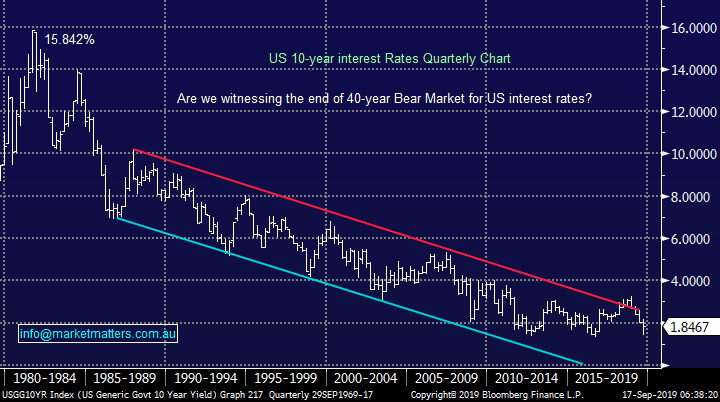

Bond yields firm, oil surges should we “run” from growth to cyclicals? (RHC, NCM, BSL, WPL)

The ASX200 kicked off the week with another volatile bang “under the hood” as the Energy sector surged 4% courtesy of the drone attack on Saudi Arabia’s Aramco oil production facilities – first reports say the world will experience a 5-6% loss of its global production. Early yesterday morning Brent crude surged almost +20% although gains were limited to a mere +13% by 6am AEST. Amazingly following the huge macro news the ASX200 managed to climb a wall of worry and close up +0.1%, a basically unchanged close implied another quiet day which of course was way off the mark as the markets switch out of growth & yield plays continued - the IT, Real Estate, Telco and Healthcare sectors all falling.

Once we take out the Oil and Gold stocks the meaningful gains yesterday were fairly thin on the ground apart from of course the China facing stocks following the hefty bid for Bellamy’s (BAL) by part government owned China Mengniu Dairy Company, only Domino’s gaining +3.3% caught my attention – we remain long and bullish DMP looking for another 10-15% upside. Conversely on the downside the story remained the same with a few of the well-known IT stocks entering our buy zone, hence today’s report – do we press the trigger or remain on the sidelines.

Interestingly overnight as US stocks fell -0.5% the worst performing sectors were the Consumer Discretionary and resources while resources had a tough time at the office falling -1.7%, not helped by copper falling over 2%. Over the last week we’ve seen some clear stock / sector rotation from growth to cyclicals, hence this morning looks likely to see at least a rest on this front if we follow moves in the States overnight.

Short-term MM remains comfortable adopting a conservative stance towards equities around current market levels.

Overnight global stocks were weak but not as bad as their futures were indicating yesterday morning AEST, the Dow and NASDAQ both fell -0.5%. The SPI futures are calling the ASX200 down just around 15-points with specific pockets of strength likely to largely be reversed from yesterday e.g. BHP closed down -40c in the US, giving back 1/3 of Monday’s gains.

This morning MM is going to again explore in more detail whether we want to own growth, or cyclical stocks over the next 12-months - it’s starting to look one of the most important decisions for investors moving forward.

ASX200 Chart

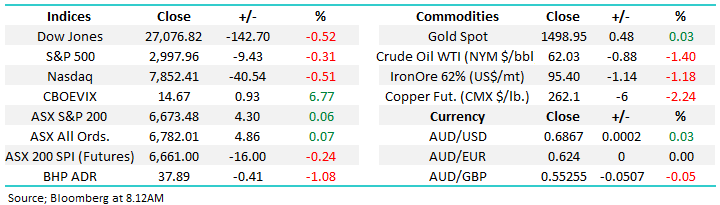

Overnight UBS & JP Morgan underwrote the sale of a 10.9% stake in Ramsay Healthcare (RHC) at $61.80 by the Paul Ramsay Foundation. The sale of 22 million shares represents about 1/3 of the foundations stake with the sale largely anticipated over time but considering only 603,000 changed hands yesterday its likely to suck up some decent buying appetite in both the stock and sector.

The sale looks to have come at an opportune time for the foundation after a ~40% recovery in RHC since late 2018, we see no reason to consider buying any initial dip in the companies shares today, or in the days ahead.

MM is neutral RHC at current levels.

Ramsay Healthcare (RHC) Chart

Yesterday MM allocated 3% of our Growth Portfolio to Newcrest Mining (NCM) around $34, it was nice to see the stock close about 2% higher but I feel there’s a lot more water to go under this volatile bridge. With gold failing to hold onto the majority of its gains from yesterday morning the local sector looks likely to open lower today, we feel bond yields need to pull back before the sector can challenge its dizzy heights reached a few weeks ago – assuming no more global incidents of course.

MM is bullish Newcrest Mining (NCM) targeting a test of $40.

Newcrest Mining (NCM) Chart

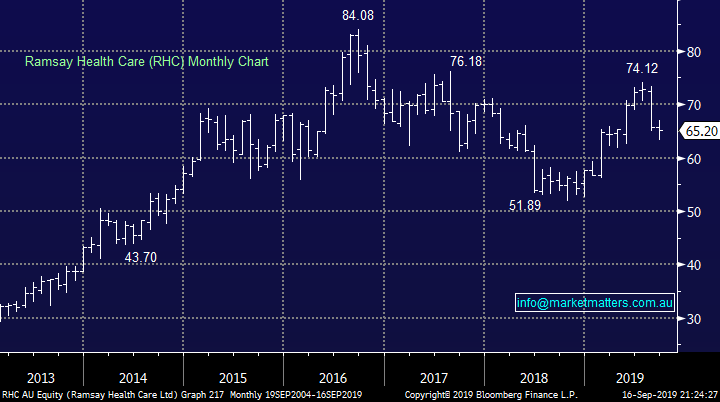

Following another awful announcement by Sims Metals (SGM), who basically gave up on their guidance, the scrap metal / recycling business was whacked a justifiable -13.3%. This lead to MM’s Growth Portfolio’s holding in BlueScope Steel (BSL) falling aggressively early in the day only to bounce nicely and close down just -1.5% - Fridays strong sell-off almost felt like it had a sniff of the influential SGM news. Some of the comments from SGM are clearly a concern for BSL:

“The company said that the trade escalation continued “to reduce the demand for steel and aluminium” to the point where scrap purchases and outlook from steel mills had eroded. Sims also noted that the spot prices had fallen to a level where it would not be economical for some suppliers while others “may choose to sit on inventory until the price recovers.” – see yesterdays afternoon report for more details.

MM is considering taking profit on our BSL position as we outlined in the Weekend Report.

BlueScope Steel (BSL) Chart

Growth or cycles, that is the question. (Part 1)

A cyclical stock generally moves up or down depending on the upward or downward movement in an economy. Cyclicals typically have a big asset base, lots of plant and equipment with high fixed costs and they need an economic tailwind to generate strong returns. Growth stocks typically have lower asset bases, are growing earnings very quickly but don’t have the perceived safety of an asset base to help justify their valuation. Simply put, they offer a higher chance of higher returns, but also a higher chance of going bankrupt.

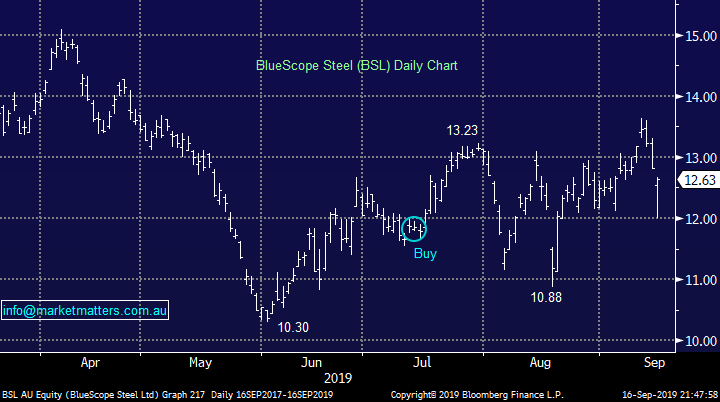

In our opinion before we consider valuations and opportunities on the stock / sector level the answer to this important question lies with what comes next for bond yields / interest rates. Unfortunately this is far from an easy call but at MM we will look at the situation with our usual pragmatic approach, keeping one eye firmly on the risk / reward. The 2 bond yield charts shown below illustrate a couple of important points very clearly:

1 – Bond yields have bounced strongly this month as a resolution to US - China trade issues appears closer with next months talks in Washington only a few weeks away.

2 – Bond yields have been in a bear market for around 40-years, usually this sort of entrenched trend needs a significant event to complete its journey, like a recession for example.

Markets have been convinced that if the US-China trade war escalates further a global recession is inevitable whereas recent more amicable noises from both parties has underpinned growing optimism of an agreement – one we feel both parties are keen to achieve. More open dialogue between both global economic super powers combined with central banks making it blatantly obvious that they will throw the proverbial kitchen sink at the global economy to avoid a recession has tipped the scales for many investors away from a clear path to a recession e.g. the European Central Bank (ECB) cut interest rates last week to minus -0.5%.

MM can see US 10-year bond yields trading between 1.5 and 2% into Christmas.

US 10-year Bond yields Chart

US 10-year Bond yields Chart

If we hold the view as we do that US 10 year bond yields will broadly remain in their current range / trend between a 2% peak and 1.5% floor then this implies strongly that we’re towards the upper end of that range, or in other words we simply think bond yields have moved from an overly pessimistic level to a more realistic level, but importantly market dynamics haven’t changed enough for an aggressive break of the current trend.

To MM, a full blown trade war now feels unlikely, although I type this acknowledging that President Trump’s moods can at times be more fickle than my 5 year daughters, plus when we look at the drivers for inflation and growth, it still feels tough going, particularly now with the added headwind of a higher Oil price. Most of the world has enjoyed post GFC economic expansion thanks largely to aggressive stimulus – low rates and quantitative easing supported growth and importantly asset prices, however with rates at record lows and negative in many parts there is clearly less capacity for central banks to provide support from here.

The risk is that we go through a period of anaemic global growth characterised by periods where optimism builds before disappointment sets in, but overall growth remains on the weaker side offset by low interest rates / cheap money. In simple terms, the underlying economy becomes fairly range bound.

So in answer to the question we posed above regarding growth versus cyclicals, we don’t think there’s a clear and sustainable economic tailwind to support cyclicals over growth (just yet), however there will be periods where the market believes there is. For that reason, we need to be taking stocks / sectors on their individual merits at the time and as we typically suggest, remain open minded.

For now we believe the rally in bonds yields is a move to fade rather than a dramatic change of trend and for that reason, growth is likely to continue to trump cyclicals. The rise in the Oil price only supports this view. Higher Oil prices are another headwind for global growth and it seems from early indications that prices should stay high for some time.

The Saudi Oil Ministry has said that 5.7MM barrels per day has been curtailed which puts the market into immediate deficit. They say that 1/3 of that could be brought back on line in weeks while the remainder is at least months away. The US has strategic stockpiles which they have pledged to release, however even at capacity they could only plug a portion of the gap for a few months, meaning that the Oil market will remain tight for some time. In terms of local stocks, Santos (STO) has the most leverage to a higher Oil price while Beach (BPT) has the lowest leverage. On Shaw and Partners estimates, a 10% increase in Brent prices would see Santos’s expected earnings in FY20 increase +27%, Woodside +20%, Oil Search +19% & Beach +16%.

MM is now bullish Woodside (WPL), a stock we hold in the Income Portfolio and are considering for the Growth Portfolio.

Woodside Petroleum (WPL) Chart

Conclusion (s)

MM continues to believe that we need to pick stocks / sectors on individual merits, and part 2 of this report will look at areas we are focussing on now.

The supply curtailment in the Oil market is large and this will likely see Oil prices remain supported for a while yet.

Global Indices

No major change yet, we are looking for a decent pullback for US stocks but no specific sell signals have been triggered – note at the moment we still feel a break to fresh all-time highs will fail to aggressively follow through to the upside.

US stocks remain clearly firm but with little upside momentum.

US S&P500 Index Chart

No change again with European indices, while we remain cautious European stocks as their tone has become more bearish over the last few months, however we had been targeting a correction of at least 5% for the broad European indices, this was achieved.

The long-term trend is up hence any “short squeezes” might be harder and longer than many anticipate, potentially one is currently unfolding.

Euro Stoxx 50 Chart

Overnight Market Matters Wrap

· Global equities weakened and bonds rallied overnight following the weekend attack on Saudi oil facilities which saw oil prices surge up to 20% at one stage, raising investor fears that this will accelerate a global economic slowdown.

· Gold has also jumped about 1% to around US$1500/oz as geopolitical tensions rise on the fears of a retaliatory strike.

· The Dow fell 142 points (0.5%) and the S&P 500 and NASDAQ dropped 0.3% while European markets also sold off between 0.6% (UK) and 0.9% (France).

· The September SPI Futures is indicating the ASX 200 to open 11 points lower, testing the 6,660 level.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.