The ASX200 and global equities have rallied strongly since their early 2020 COVID meltdown with virtually all major indices posting fresh all-time highs in recent weeks but there might be a new canary in the coal mine, the main question being will it be around for just a few weeks, or much longer. Firstly lets reiterate 3 of the main reasons stocks have “wobbled” in recent sessions:

- Investors are concerned that either / or both the Delta Strain and reigning in of stimulus by central banks will derail the economic recovery – bond yields are calling it a 50-50 scenario.

- To add spice to the pot we’ve just entered September the weakest month on the calendar for global stocks.

- Lastly, most indices remain within a few % of their all-time high making it an easy decision to take some profit and take a seat on the bench.

However like most situations there are 2 sides to this coin with a couple of compelling bullish arguments weighing into the fray:

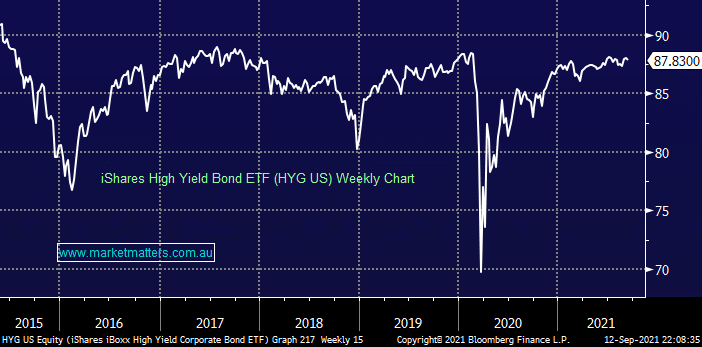

- Liquidity seems fine with high yield or “Junk” bonds remaining solid and they are usually one of the 1st instruments dumped by truly nervous investors.

- Historically, buying any meaningful weakness in September reaps solid rewards for brave investors into the back end of the year.

- Fund managers have already moved down the risk curve with Augusts Bank of America survey showing cash levels at their highest level in over 12-months i.e. this money will be looking for a home into weakness.

Obviously there are other factors at play such as risks around a slowing Chinese economy and companies struggling to maintain strong performances after successfully reducing costs but at this stage MM believes the current market jitters are no more than some self-fulfilling seasonal weakness which should be selectively bought.