Are the last month’s outperformers just getting started? – (NCM, TLS, RWC, ASB, SIQ, GEM, DMP)

The ASX200 endured another poor day as it totally failed to embrace the Dows 162-point rally on Wednesday night, it finally closed down a very disappointing -0.5%; its starting to feel like the market’s resilience may have been broken. When 60% of the market closes in the red including the “Big Four Banks”, the Healthcare and “yield play” stocks its always going to be a tough day at the office but on the other hand the volumes and momentum do not yet look like a market that has thrown in the towel. It was interesting to see the stocks / sectors that have revelled in the falling interest rate environment struggling even as the local 3-year bond yields are only inches away from their all-time low. Days like Thursday add weight to our belief that the interest rate sensitive play will underperform in the months, if not necessarily weeks ahead.

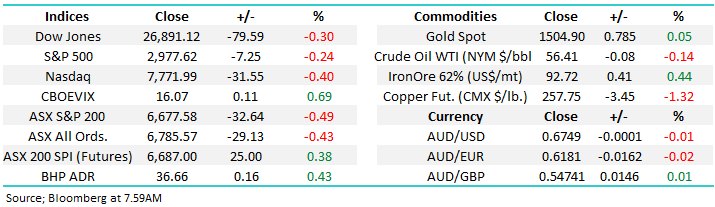

MM is now short-term bearish the ASX200 with an ideal target around 6300, over 5% lower.

At MM we often talk about the cyclical nature of markets and one of the main reasons behind the phenomenon is those human emotions “Fear & Greed”. Amazingly not long ago the government and RBA were worried about an Australian property bubble eventually bursting sending us into our first recession in almost 30-years. Here we are today only around 2-years later and many of the same bureaucrats are calling for a break to the “overly stringent lending restrictions” as a rising property market looks required to stop us drifting into a recession – come on guys!!

Short-term MM remains comfortable adopting a more conservative stance towards equities around current market levels.

Overnight global stocks were mixed with the US falling led by the small cap Russell 2000 which fell ~1% whereas European bourses bounced between 0.5% and 1%, as is so often the case the SPI futures are calling the ASX200 to follow Europe and open up around 25-points.

This morning MM has looked at 5 stocks that have rallied by more than 10% over the last month to see if its just the start of a new trend i.e. should we be getting onboard?

ASX200 Chart

The markets internals are feeling very fickle at present which can easily be illustrated by Australia’s main gold stock Newcrest Mining (NCM), on Wednesday morning it was trading above $38, within striking distance of our $40 target area. By the close of play on Thursday it closed back below $36, basically in the middle of the last few months range. In our opinion this is classic undecided late cycle price action, we will have no hesitation closing our NCM position if we see a spike to fresh 2019 highs.

MM remains bullish NCM targeting the $40 area.

Newcrest Mining (NCM) Chart

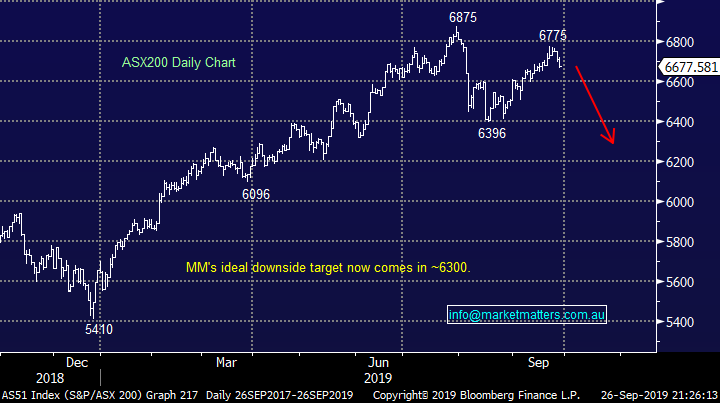

Much discussed Telstra (TLS) made fresh multi-week lows yesterday, taking its recent correction to over 13%. MM took profit in our TLS position back in May, clearly a touch early in hindsight. However we’ve been contemplating if / where we should buy back in since the stock started falling from the psychological $4 area, it currently just “feels wrong” and as a wise trader once told me : “if in doubt stay out!”.

MM now feels unlikely to buy TLS in 2019.

Telstra (TLS) Chart

Overnight US bond yields continued their drift to the downside but interesting the $US and gold ignored the fall. However the interest rate sensitive Utilities and Real Estate sectors were the positive standouts on the US bourse rallying 0.4% and 0.8% respectively – MM expects this will continue until US 10-years test / break 1.5% but then its time to be very wary to the risk / reward if bond yields look for a low.

MM is neutral / bearish US bond yields at present.

US 10-Year Bond Yield Chart

Looking at 5 stocks that have rallied by over 10% in the last month

Over the last month the ASX200 has climbed a wall of worry and although its only up a few points its managed to largely ignore an increasing number of geo-political concerns. Generally when stock markets are cashed up and bearish it offers significant support into weakness while a few companies often come strongly into favour, like the stocks we’ve looked at today.

ASX200 Index Chart

The relative strength in US indices illustrates investors are nervous as the large cap US S&P500 trades close to its all-time high while the small cap Russell 2000 Index appears to have already commenced a correction i.e. investors are seeking the perceived safety of larger stocks, often with sustainable dividends.

US S&P500 v Russell 2000 Index Chart

Today I have briefly looked at 5 stocks who enjoyed gains of more than 10% over the last month.

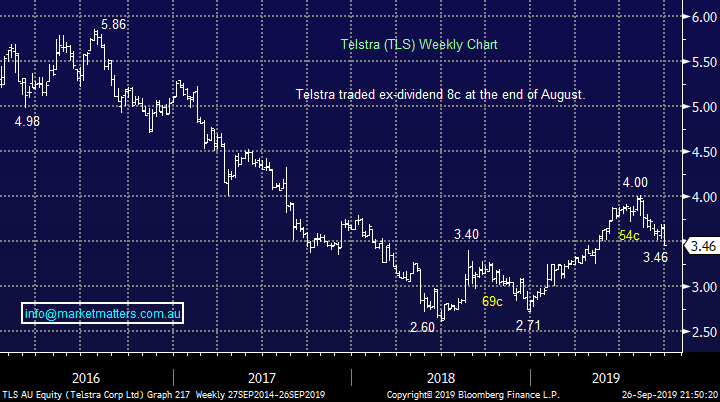

1 Reliance Worldwide (RWC) $3.96

Plumbing components producer RWC has bounced more than 13% over the last month as it attempts to recover from an awful trading update in May – there are a number of moving parts in this global business but its FY19 guidance was revised lower by ~10% primarily due to a modest freeze in the US leading to lower demand for new pipes etc.

We like the RWC business although it’s not particularly cheap trading on an Est P/E for 2020 of 19.7x while yielding over 3% unfranked. The stocks already bounced ~30% from its panic lows and we would not be chasing at current levels - around $3.60 the risk / reward would look far more appealing.

MM likes RWC around $3.60.

Reliance Worldwide (RWC) Chart

2 Austal Ltd (ASB) $4.19

Emerging defence contractor ASB has rallied more than 13% over the last month although technically its looking pretty average after aggressively rejecting the $4.50 area. The shipbuilders shares have enjoyed a stellar rally due to its US business which is building vessels for the US navy – President Trump loves his military!

Current guidance is for earnings to rise another 13% in FY20 but with the stock trading on a P/E of over 20x for 2020 and yielding 1.4% its simply not exciting at current levels.

MM likes ASB around $3.50.

Austal Ltd (ASB) Chart

3 SmartGroup (SIQ) $12.16

SIQ has rallied more than 10% over the last month and now looks destined to make fresh all-time highs up towards $14. The market clearly embraced the companies half year results which saw a 5% increase in NPAT, to just over $40m.

The salary packaging business is trading on a P/E for 2019 of ~20x while forecasts are for the shares to yield 3.6% fully franked, not bad with the RBA Cash Rate appearing headed to 0.5%.

MM likes SIQ closer to $11.50 from a risk / reward basis.

SmartGroup (SIQ) Chart

4 G8 Education (GEM) $2.56

Childcare services business GEM has bounced more than 15% over the last month, albeit it from a low base. The company’s latest half years results showed NPAT plummeting 20% and occupancy rates continuing to decline, they came in just above 70% - if they cannot fill their current centres it’s hard to envisage them growing particularly well in the short-term.

MM is neutral GEM at best.

G8 Education (GEM) Chart

5 Domino’s Pizza (DMP) $47.49

DMP has rallied more than 10% over the last month much to the delight of MM who hold the stock in our Growth Portfolio after catching the proverbial falling knife in July. We remain bullish targeting the $55 area, or 15% higher.

MM remains long and bullish DMP.

Domino’s Pizza (DMP) Chart

Conclusion (s)

Of the 5 stocks looked at today we like DMP at current levels, RWC & SIQ a touch lower from a risk / reward perspective while ASB & GEM don’t currently interest us.

Global Indices

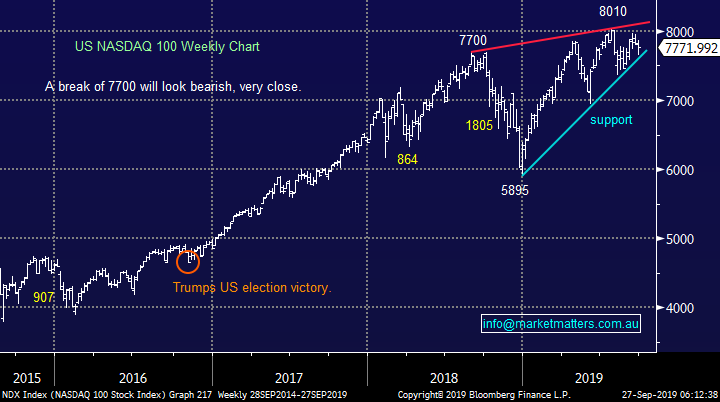

No major change yet, we are looking for a decent pullback for US stocks but no specific sell signals have been triggered – note at the moment we still feel a break to fresh all-time highs will fail to aggressively follow through to the upside.

US stocks remain clearly firm but with little upside momentum.

US NASDAQ Index Chart

No change again with European indices, while we remain cautious European stocks as their tone has become more bearish over the last few months, however we had been targeting a correction of at least 5% for the broad European indices, this was achieved.

The long-term trend is bullish hence any “short squeezes” might be harder and longer than many anticipate, potentially one is currently unfolding.

German DAX 50 Chart

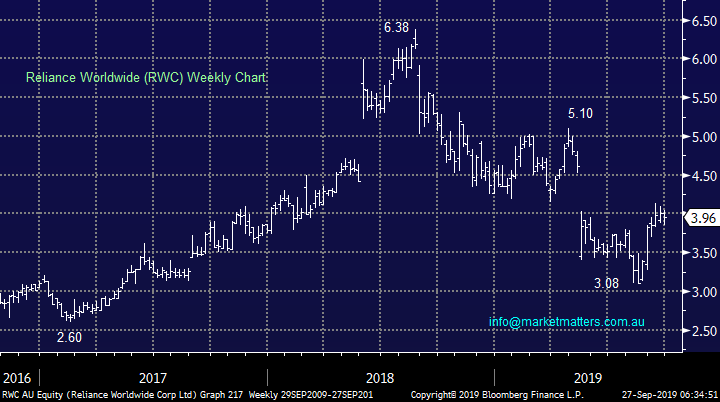

Overnight Market Matters Wrap

• The US equity markets closed in red territory overnight as investors took risk off the table ahead of the US China Trade meet and the current Political drama.

• The defensive names were outstanding as the US noted it will send military equipment to Saudi Arabia, adding air defence coverage following the recent oil attacks in the region.

• BHP is expected to outperform the broader market after endings its US session up an equivalent of 0.43% from Australia’s previous close.

• The December SPI Futures is indicating the ASX 200 to open ~30points highernitiusah, testing the 6710 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.