Buying overseas shares

Hi James,

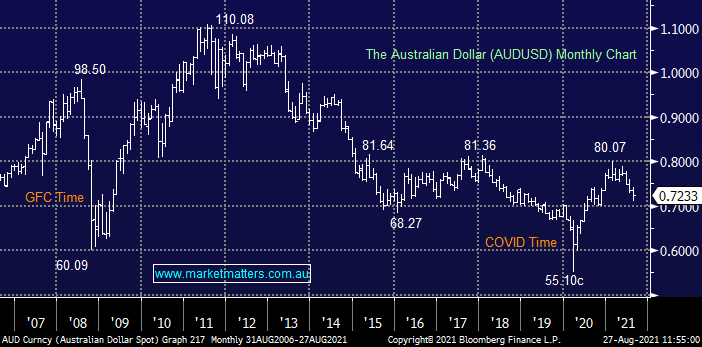

Thanks for the on-going good advice. I have a question about buying overseas shares. Why when the Australian dollar is so low would you buy shares on the US stock market? If the Aussie dollar goes down further, owning US or shares held in other currencies makes sense, but surely the Australian dollar is close to its bottom and, if it strengthens against the US dollar, then the Aussie dollar value of US holdings goes down. Wouldn't it make more sense to stay long in ASX shares and wait until the pendulum starts to swing back in our favour?

Bernie