Time for focus as stocks plunge! (GDX US, EEM US, DTYS US)

Please excuse todays title, it almost sounds like I’m talking to my two daughters but with markets there is a time for postulation / “what ifs” and a time for action with the later approaching rapidly - not always as interesting reading but arguably far more important. The Dow has now tumbled around 1000-points in just 2 sessions as weak economic data is suggesting strongly that the US is no longer immune to the negative impact from its homemade evolving US - China trade war. This morning my mind switched to a line from yesterday’s International & ETF report:

”Importantly subscribers should understand that if / when we get the buying opportunities MM has been patiently waiting for we are likely to deploy over 50% of our free cash into the market over only a few days.”– from the International Portfolio section.

The ASX200 is poised to open down around 130-points / 2% this morning, pretty much in-line with the US where all sectors closed lower but losses were pronounced in the Energy & Financial stocks. As subscribers know we are positioned very defensively across our portfolios with the intention of buying this current weakness in the weeks ahead. Stocks have a habit of “going up by the stairs and down by the escalators” hence its very important subscribers clearly understand our plans as MM’s target for the local market is suddenly only ~3% below this morning’s likely open. Technically the ASX200 needs to open back above 6680 for MM to doubt our view that the ASX200 is correcting as expected.

Short-term MM is looking to significantly increase its exposure to stocks ~6300, basis the ASX200.

Overnight global stocks were smacked across the board with US indices falling just under 2% while Europe fared far worse with loses around the 3% mark – as we’ve mentioned over the last week Australian stocks are more strongly correlated to Europe which is not encouraging for the ASX this morning. Gold rallied $US17 and its likely to offer a glimmer of green on the ASX this morning following the gold ETF’s which advanced ~2%.

Hence this morning MM has simply outlined our plans for the next few weeks as stocks accelerate to the downside and our patient approach to wait for a buying opportunity into a meaningful pullback feels like it’s paying off.

Importantly if MM is correct we don’t want subscribers to be scarred / overawed by the volume of alerts if stocks continue their current decline – this is the sort of period you pay us for!

ASX200 Chart

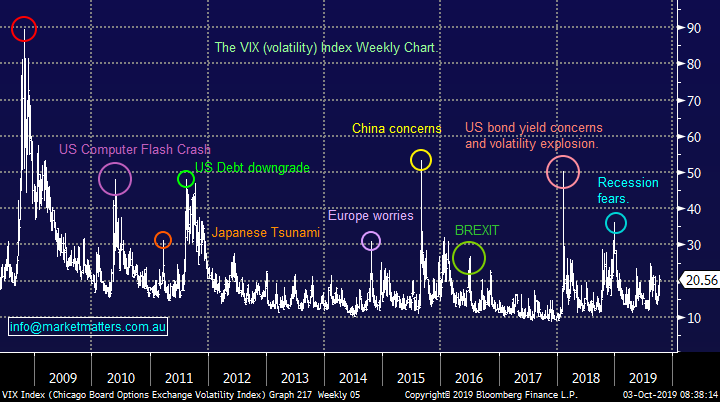

The volatility Index which is often referred to as the “Fear Gauge” is reflecting the growing unease in stocks, it rallied almost 11% last night to close back above the psychological 20% area for the first time in a while. Another decent down move tonight and we may see the perennial sellers of volatility start covering their hefty positions, exerting major short-term downside pressure on stocks.

The VIX (volatility) Index Chart

Equity Indices.

US stocks have endured their first consecutive falls of over 1% in more than a year – the bear has been woken from its slumber. Overnight disappointing employment indicators and auto figures added to the very weak manufacturing data from the previous night to significantly raise recession fears – as you would expect US bond yields fell and gold rallied in sympathy. To put last night’s declines into perspective the UK’s FTSE Index tumbled -3.2% experiencing its largest decline since 2016 in the process.

MM is ideally looking for a test of the 2740 area by the S&P500, or 5% lower.

US S&P500 index Chart

Hence our planned course of action around our Index ETF positions:

Growth Portfolio – Take profit on our BetaShares Leveraged Bearish ASX200 ETF (BBOZ) position around 6300 for the ASX200.

International Portfolio - Take profit on our ProShares Short S&P500 (SH US) position into further weakness.

Global Macro ETF Portfolio - Take profit on our ProShares Short S&P500 (SH US) position into further weakness.

Note as a rule of thumb we will usually take profit on bearish positions before reversing to the long side but the best laid plans can be negated by aggressive spikes – as the chart above illustrates perfectly stock markets usually form spike lows and rounded tops, the window of opportunity at market bottoms is usually short & sweet hence preparation is vital.

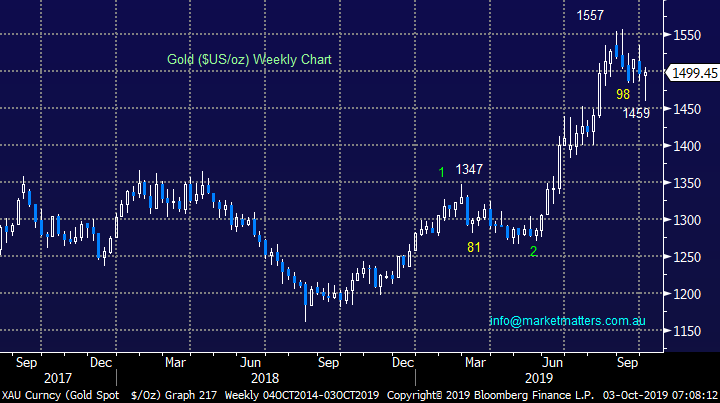

Gold / silver stocks & related ETF’s.

Gold has rapidly rallied $US40/oz from its intra-week low, from a technical perspective it looks set to make fresh 2019 highs, ideally up towards $US1600. The strong implication here is both stocks and bond yields have further to decline.

MM is bullish gold targeting fresh 2019 highs.

Gold ($US/oz) Chart

Hence our planned course of action around our gold positions:

Growth Portfolio – Take profit on our Newcrest (NCM) and Evolution (EVN) positions when gold rallies another ~5%.

International Portfolio - Take profit on our Barrick Gold (GOLD US) position when gold rallies another ~5%.

Global Macro ETF Portfolio - Take profit on our iShares MSCI Global Silver ETF (SLVP US) and our VanEck Gold Miners ETF (GDX US) when gold rallies another ~5%.

Equities

Obviously our plans extend beyond taking profit on long bearish ETF and gold positions, we are also looking to aggressively buy equities into the unfolding weakness.

MM’s planned course of action around equity positions is broadly outlined below:

Growth Portfolio – Assuming we have taken profit on our ETF and gold positions we will be holding 29% of this high conviction portfolio in cash, ideally we will be allocating this fairly aggressively into stocks around the 6300 area basis the ASX200. Our current intention is to focus our buying into cyclical stock as opposed to growth and yield sensitive plays but obviously there may be 1-2 exceptions to this theme if opportunities arise into panic selling.

Sectors / stocks on the MM radar : Banks, Resources, Consumer facing and building stocks.

International Portfolio - Similarly if we have taken profit on our ETF and gold positions we will be holding a whopping 85% of our International Portfolio in cash.

We have discussed a number of stocks in recent weeks which MM likes into weakness, especially in the US and Asia. Subscribers should not be surprised to see the vast majority of this cash put to work at lower levels in equity markets e.g. we still expect a break of 2018 lows by the Emerging Markets, around 8% lower which we believe will be an optimum time to buy Asian facing stocks.

Global Macro ETF Portfolio - Similarly if we have taken profit on our ETF and gold positions we will be holding 90% of our Global Macro ETF Portfolio in cash!

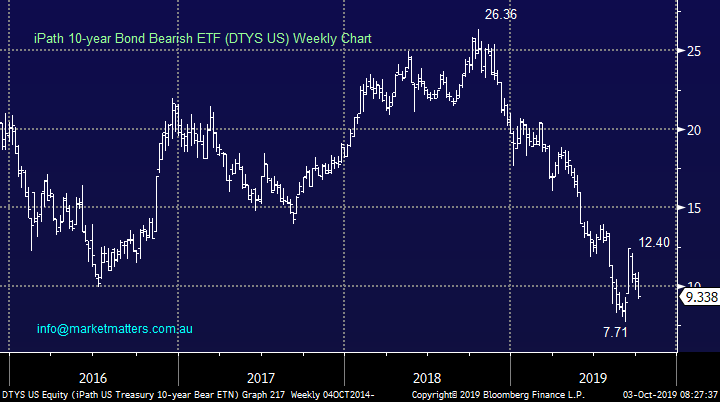

We will be looking to go long ETF’s with exposure to stocks in both the US and the Emerging Markets plus the very topical bond market; we feel that US 10-year bonds are in their final leg of declining yields for 2019. MM are keen buyers of a dip to fresh lows in the Bear ETF (DTYS US), ideally around the ~7.50 area.

Details of this ETF are explained on this link : https://etfdb.com/etf/DTYS/

Emerging Markets ETF (EEM US) Chart

iPath US 10-year Bond Bearish ETF (DTYS US) Chart

Conclusion (s)

Stock markets are following our anticipated path lower but no need to press any buy buttons just yet, the ASX200 is set to open around 6500 this morning which represent 60% of our targeted decline i.e. its encouraging but not yet time for action.

At MM we have been patient through September, now markets are unfolding as we expect patience is required, as investors MM must maximise returns when we’re correct as unfortunately we will certainly get hurt when wrong!

Global Indices

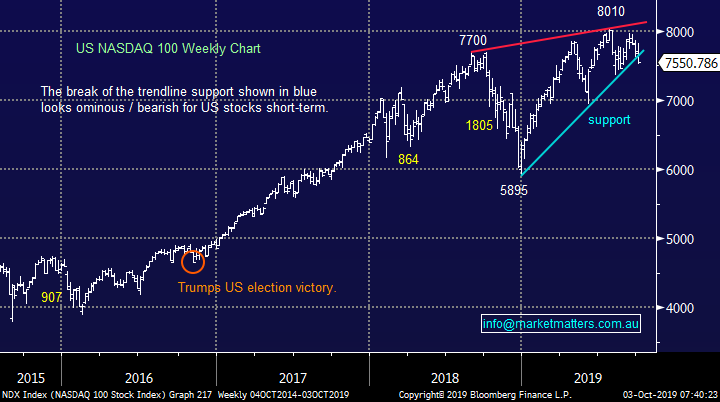

Last night’s savage decline by stocks looks to have put the wheels in motion for the stock market decline MM has been patiently waiting for, a short sharp spike towards the 7000 area for the tech based NASDAQ looks ideal i.e. around 6% lower.

US stocks have generated short-term bearish signals.

US NASDAQ Index Chart

Similarly European indices now look bearish technically with another 5% downside felling likely.

Euro Stoxx 50 Chart

Overnight Market Matters Wrap

- Global growth worries continued to spread with a lower than expected US employment data provided further signs to convince investors to take risk off the table overnight.

- The US 10 year bond yields traded lower for a fifth consecutive day, while the Euro Stoxx had its largest decline in 10 months and London’s FTSE plumbed the most in 3 years.

- Crude oil continued to slide, off 1.83% this morning to US$50.64/bbl. with BHP expected to underperform the broader market after ending its US session off an equivalent of -2.11% from Australia’s previous close.

- The December SPI Futures is indicating the ASX 200 to gap 120 points lower, towards the 6520 level this morning while the consensus of $6.1B is expected to be the number on Australia’s August trade balance.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.