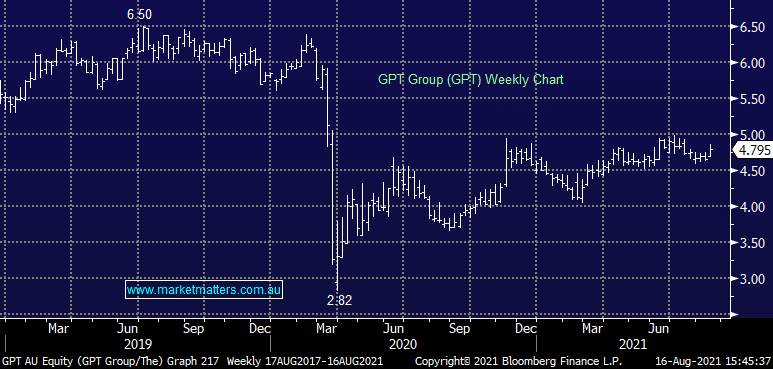

1H21 Result: A solid result out from the property company this morning despite being somewhat interrupted by COVID19 restrictions. The result was above consensus at the earnings line with Funds From Operations (FFO’s) at $302m versus $290m expected and that filtered down to a better than expected dividend of 13.3cps. They talked about increasing their exposure to logistics assets plus they made 2 interesting comments on rents, essentially cash flow was better as they were being paid rents accrued but not paid in FY20 plus they said that retail leasing was tracking better than they expected. Shares were trading 3% higher leading into the close.

scroll

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

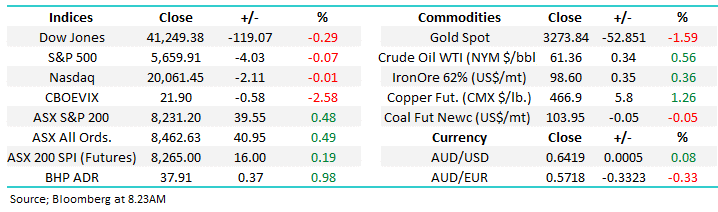

Monday 12th May – Dow down -119pts, SPI up +16pts

Monday 12th May – Dow down -119pts, SPI up +16pts

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

A solid property exposure

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Podcast

LISTEN

Monday 12th May – Dow down -119pts, SPI up +16pts

Daily Podcast Direct from the Desk

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.