Wisr (WZR) proving growth is still available

Wisr (WZR) -1.96%

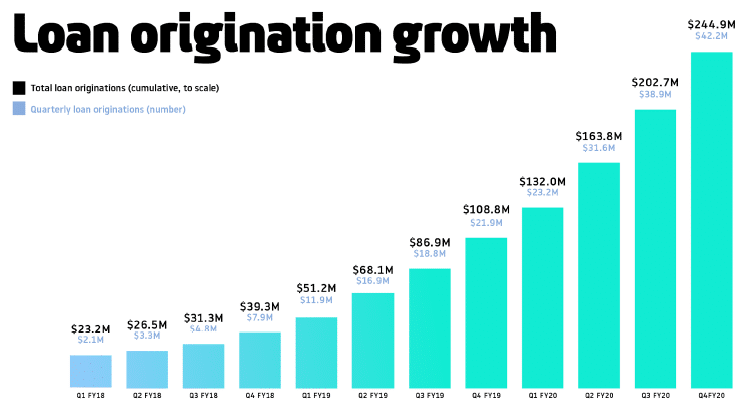

Alternative finance play Wisr was out with their 4th quarter update which showed more growth despite the resounding weakness in the broader economy. Loan originations for the quarter came in at $42.2m, 8% higher than the 3rd quarter, and nearly double that of the last quarter. Revenues followed suit, up 188% on pcp with the company now totaling $244.9m in originations. Further to this, 90 day+ arrears fell to a record low of 1.44% of the book, and the average credit score now an impressive 723. The growth did come at a cost, with operating cashflow at -$12.8m for the financial year. The trends are mostly improving for Wisr but the market wasn’t keen on giving it credit just yet. Shares finished lower despite touching recent highs intra-day. The company continues to show impressive results despite the COVID-19 impact on the economy.

Source; Wisr (WZR)

Liquidity remains strong with more than $44m in available funding. The fintech screens positively and should be further validated as the market share wins continue. We like the stock as a speculative play given the key driver, loan originations, continues to show solid growth. With more products and avenues coming online - including secured car lending - Wisr looks i good shape.

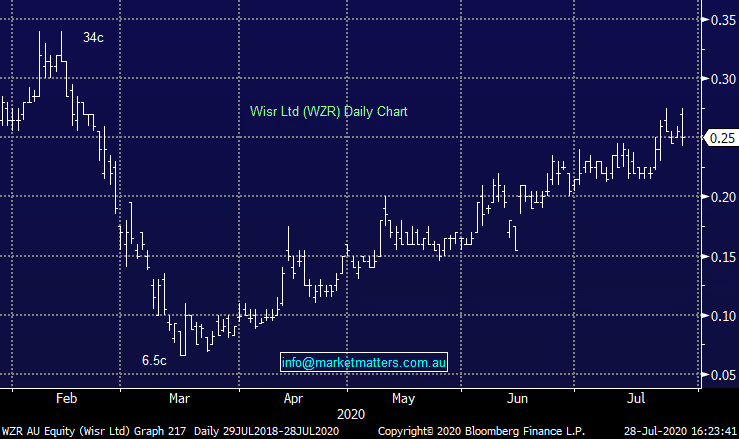

Wisr (WZR) Chart

Source; Wisr (WZR)

Liquidity remains strong with more than $44m in available funding. The fintech screens positively and should be further validated as the market share wins continue. We like the stock as a speculative play given the key driver, loan originations, continues to show solid growth. With more products and avenues coming online - including secured car lending - Wisr looks i good shape.

Wisr (WZR) Chart