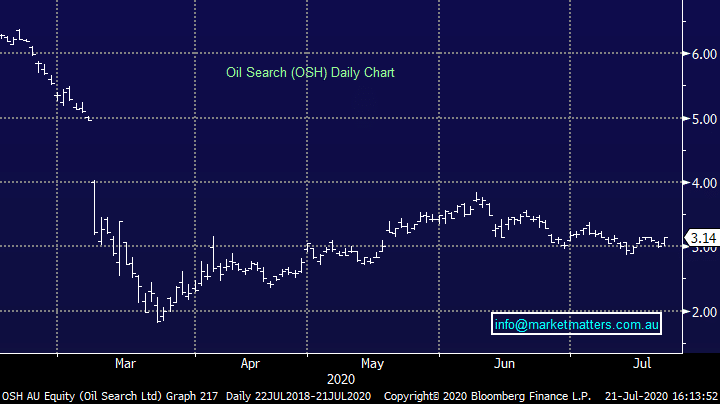

Oil Search (OSH) cuts costs as price falls

Oil Search (OSH) +4.32%

While energy names were broadly higher today, Oil Search stood out above the pack on a decent quarterly. While production fell 1% in the second quarter, revenue was smashed 26% for a first half total of $US625.6m, 19% on last year given the steep slide in energy prices in the period. They maintained full year production guidance of 27.5-29.5mmboe but lowered cost guidance by $US1-2/boe which the market liked given the boost it gives earnings in a low oil price environment.

At just $US9.5-10.5/boe, OSH is an extremely low-cost producer and is in good shape to weather another slide in oil prices if it comes, particularly after raising near $US700m in the half. While CAPEX is also being pinned back there was no changes to the current Alaskan and PNG project timelines, though Oil Search will likely look to push out production start dates for both projects at the strategic review later in the year.

Oil Search (OSH) Chart