Tresasury’s growth hits a brick wall (TWE)

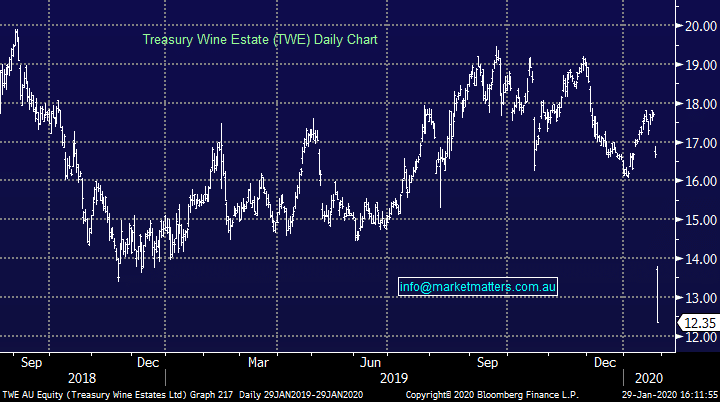

Treasury Wine Estate (TWE) $12.35

a quarter of the company’s value was wiped off the stock today after they pre-released their first half result. The unaudited numbers show growth has stagnated, while the Americas, which was touted as one of the big opportunities, saw EBITS collapse 26% with falling volume and price. The company blamed the miss on “a loss of execution momentum” after a number of leadership changes in the region combining with aggressive pricing of a number of other players led to a fall in market share.

Other regions performed reasonably well with ANZ growing 810 and Europe, Middle East and Africa flat. Asia was slightly behind expectations yet still growing EBITS nearly 20% in the first half.

As a result of the beating the Americas took, Treasury cut their EBITS growth forecasts for FY20 to 5-10%, down from 15-20% and well behind the consensus estimates of 19% for the year. They also gave an early look at FY21 expectations aiming for EBITS growth of 10-15%, already behind the market’s hopes. The announcement didn’t take into consideration a number of near term risks including the coronavirus, while the company is also undertaking a strategic review on the back of the disappointment.

Treasury Wine Estates (TWE) Chart