Afterpay (APT) shares to new heights

Stock

Afterpay Touch (APT) $35.37 as at 25/09/2019

Event

A double whammy of good news has rocketed APT to new heights this morning with shares trading over 11% higher at the time of writing.

The first kick came from the AUSTRAC investigation where external auditors were brought in to assess the systems Afterpay had in place to prevent money laundering and terror financing. At the halfway point the audit had yet to uncover any instances of the platform being used for these outcomes. Afterpay is not out of the woods just yet however, with recommendations being held until the final report.

The second kick comes from Goldman Sachs which drastically increased its target for Afterpay and put the stock into their conviction buy bucket. The report from the broker is extremely positive, and has revenue increase more than 4 fold in the three years from FY19 through to FY22 to $1.39bn on the assumption the Afterpay significantly beats their own base Gross Market Volume (GMV) by almost 50%.

The bulk of the Goldman’s 58% increase to the target price stems from a continuation of the growth infrequency of use for APT’s customers, as well as significant penetration into the US and UK markets which, when combined with Australian retail presents a $1tr market for the Buy Now Pay Later space. The broker has also thrown an M&A premium on the stock, with the analyst suggesting that an EV/EBITDA multiple of nearly 40x in FY22, and on their estimates suggests the potential for a $47/share takeover bid.

Goldman’s target price of $42.90 is 10% above the next highest in the market, while Morningstar are the only broker to have a sell on the stock with a $22 price target.

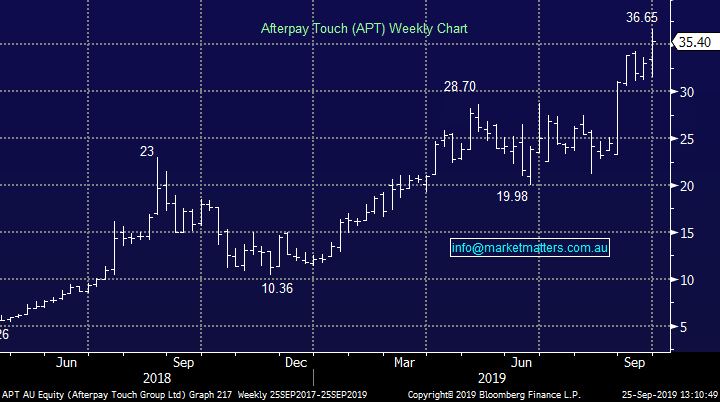

AfterPay Touch (APT) Chart

[caption id="attachment_3737" align="alignnone" width="720"] Afterpay Touch Weekly Chart[/caption]

Market Matters Take/Outlook

Afterpay Touch Weekly Chart[/caption]

Market Matters Take/Outlook