2020 Outlook – Inflation & Resources

**This is an extract from the Market Matters Morning Report from 13 January. Click here to get access to the full report and more

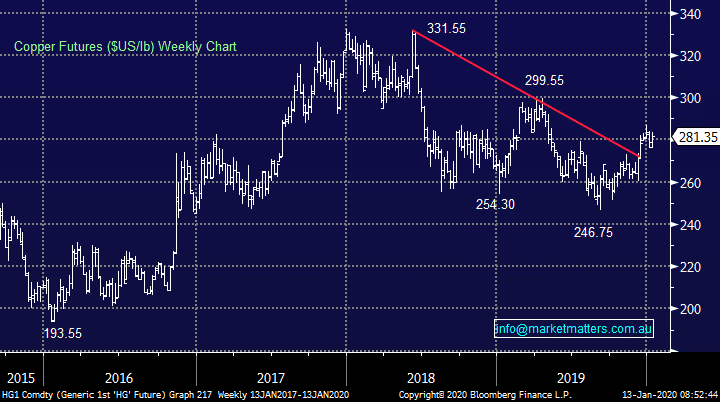

The chart below illustrates over the last few years the clear inverse correlation between the $US and Base Metals, if our opinion is correct on the $US then we believe there’s a strong likelihood that the resource sector will outperform in 2020.

The $US Index & Bloomberg Base Metals Index Chart

Inflation is also key in this equation. After a decade of low interest rates, substantial amounts of unconventional monetary policy (money printing) and global growth numbers that imply interest rates should be higher (global growth currently forecast to be 3.4%% while US rates are just 1.50%-1.75%) there lies a real risk of inflation resurfacing.

We ponder if the Fed will get behind the curve of this reflation rally because of likely political pressure from President Trump leading into an election. While this is more a 2021 concern it’s certainly a risk factor to consider, rising inflation usually puts bull markets to sleep.

Ultimately, with global growth solid at a time when central banks seem reluctant to tighten policy, and could even loosen further, we believe that base metals and inflation are set to rally in 2020 with our initial target for economic bell weather copper ~10% higher. Other base metals like nickel are yet to get excited but we feel they will eventually join the party.

MM Is bullish resources in 2020

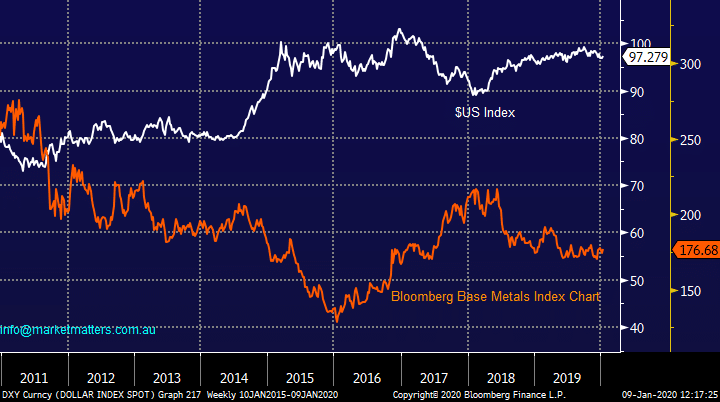

Copper Chart

Inflation is also key in this equation. After a decade of low interest rates, substantial amounts of unconventional monetary policy (money printing) and global growth numbers that imply interest rates should be higher (global growth currently forecast to be 3.4%% while US rates are just 1.50%-1.75%) there lies a real risk of inflation resurfacing.

We ponder if the Fed will get behind the curve of this reflation rally because of likely political pressure from President Trump leading into an election. While this is more a 2021 concern it’s certainly a risk factor to consider, rising inflation usually puts bull markets to sleep.

Ultimately, with global growth solid at a time when central banks seem reluctant to tighten policy, and could even loosen further, we believe that base metals and inflation are set to rally in 2020 with our initial target for economic bell weather copper ~10% higher. Other base metals like nickel are yet to get excited but we feel they will eventually join the party.

MM Is bullish resources in 2020

Copper Chart