Month: January 2017

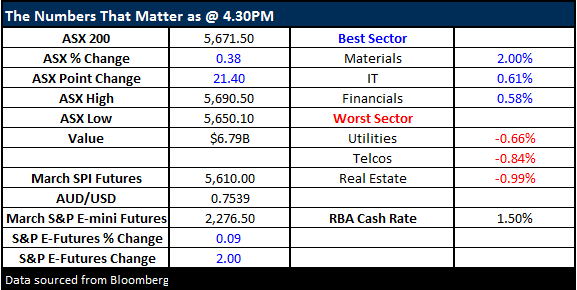

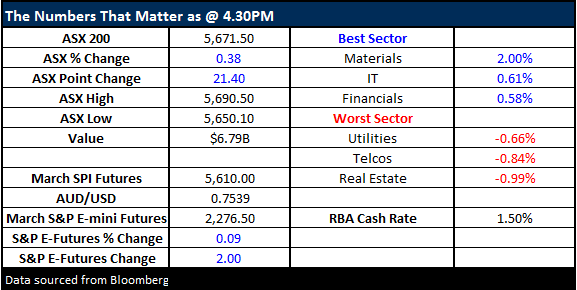

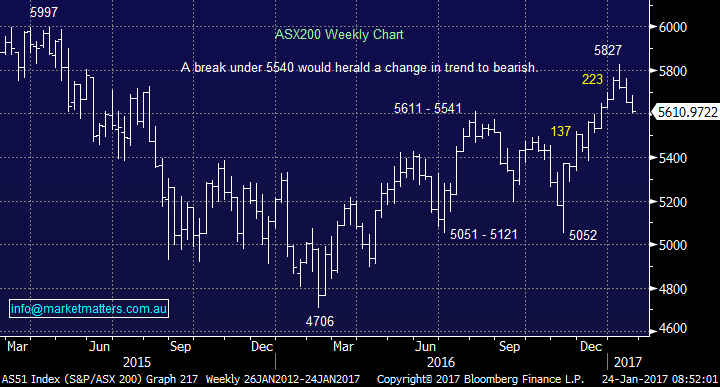

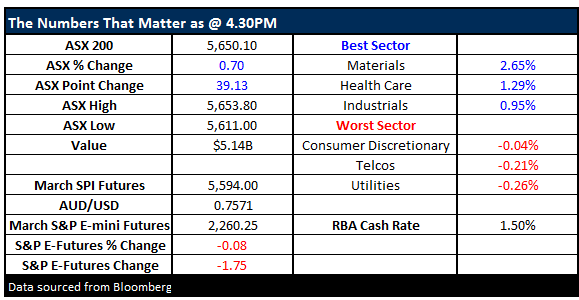

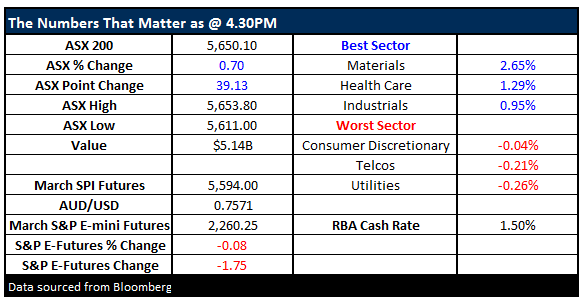

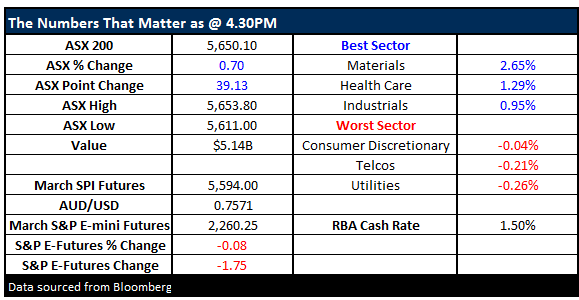

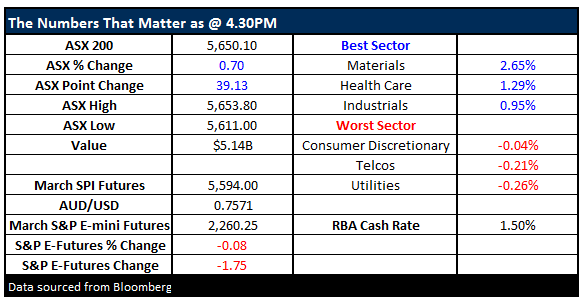

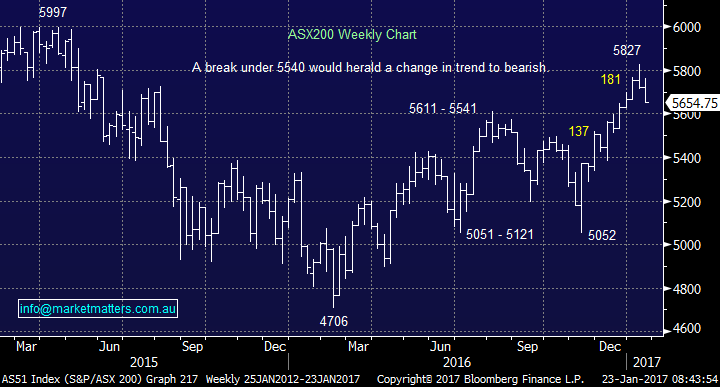

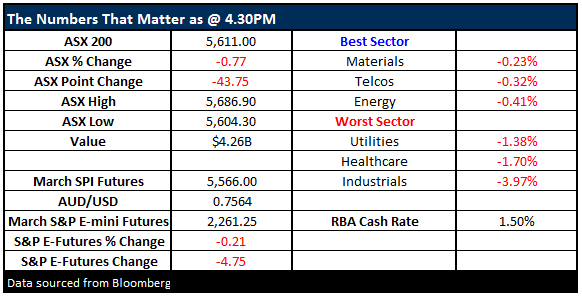

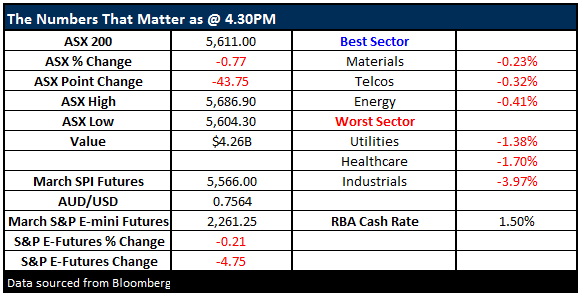

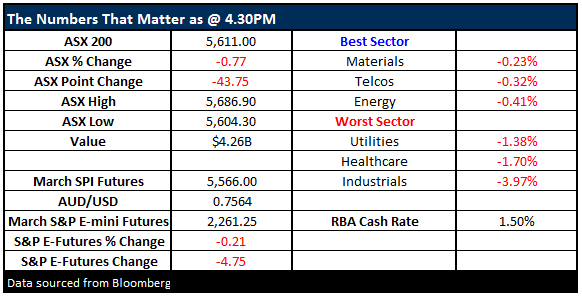

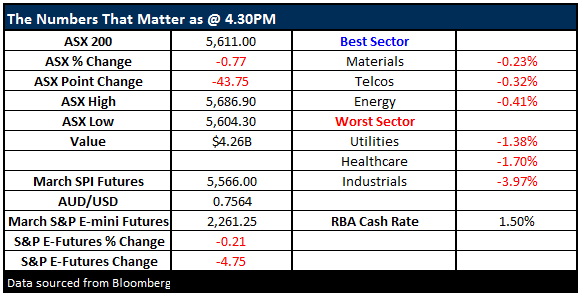

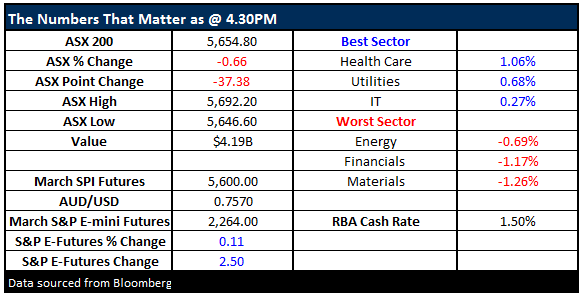

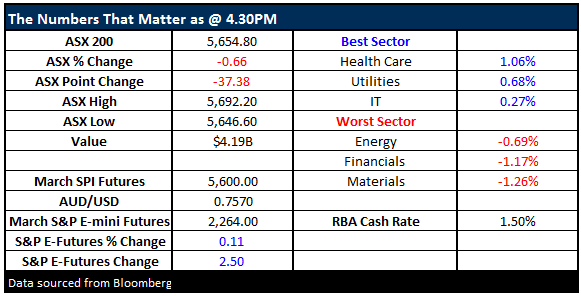

The local ASX200 has now fallen almost 4% over the last 3-weeks while US stocks continue to tread water. Having locked in some nice profits during the markets explosive rally after the US election we are now back in “buy mode” into current weakness. The ASX200’s correction has primarily been focused in the financial sector where investors appear to have locked in some profits while the resources have held up reasonably well courtesy of a pullback in the $US which supports underlying commodity prices – we have played this scenario via our purchase in Newcrest Mining (NCM).

Following the “Market Matters 2017 Outlook piece” on Sunday this morning to keep subscribers fingers on the pulse we have updated how we see markets over coming weeks / months plus answered some very pertinent / tough questions we received from subscribers last week, as we always say, ” keep the questions coming however hard!”

There has been a clear trend evolving over recent months which is whenever Janet Yellen (Chairwoman of the US Fed) speaks, she is clearly hawkish and it leads to support for the $US and weakness in the “yield play” sector of stocks. Investors should not forget that interest rates are at artificially low levels, after years of financial engineering by central banks to avoid a deep global recession / depression after the GFC. As interest rates rise, it simply offers an alternative to stocks for investors seeking some yield for income which has not been available for many years.

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.