Month: January 2017

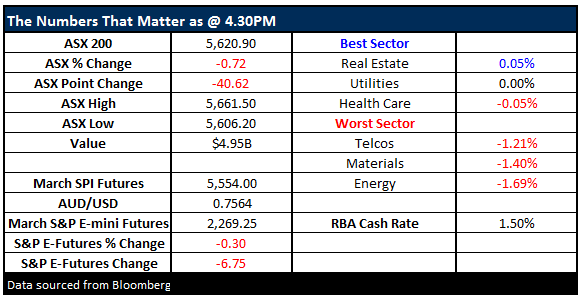

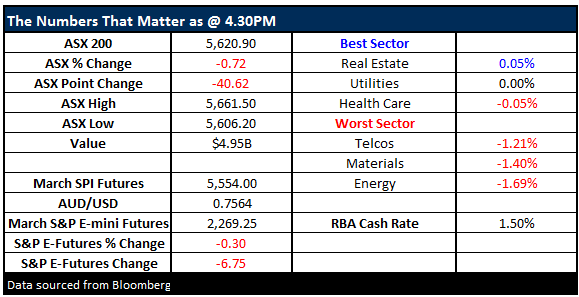

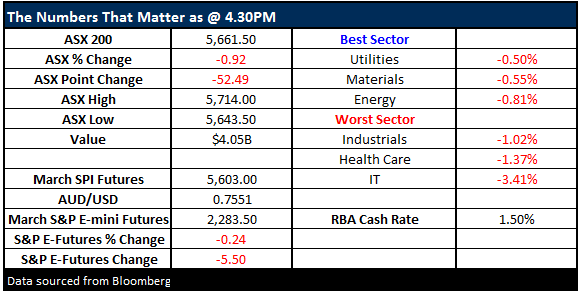

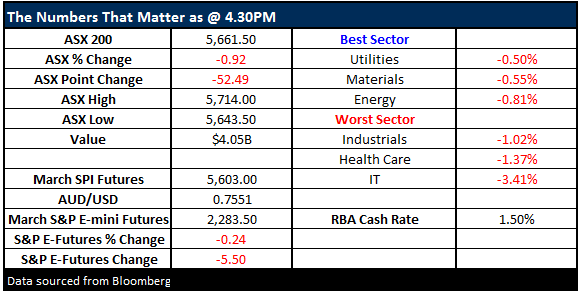

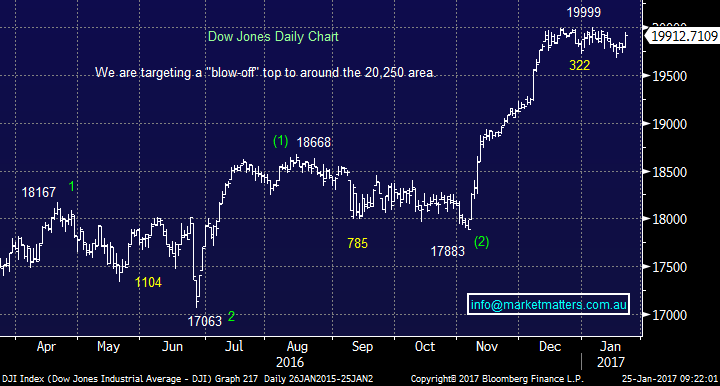

Donald Trump’s immigration actions over the weekend appear at least in the short-term to have put the brakes on US stocks as the Dow plunged over 200-points at one stage in its overnight session. The market has been totally in the “glass half full” camp since his election victory last November but we feel the growth euphoria is ready to evaporate as concerns are likely to grow around potential trade wars.

Stocks continue to climb a wall of worry as investors have one eye the Whitehouse awaiting Donald Trump’s next move while watching US equities continuing to eke out gains to all-time highs. We have now seen ~34% of the S&P500 stocks have now reported with 74% beating earnings estimates giving the market a nice shot in the arm (although that number is pretty much in-line with historical averages).

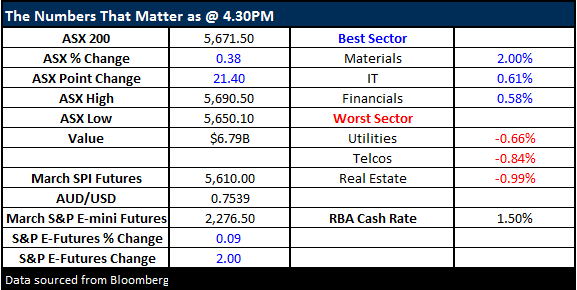

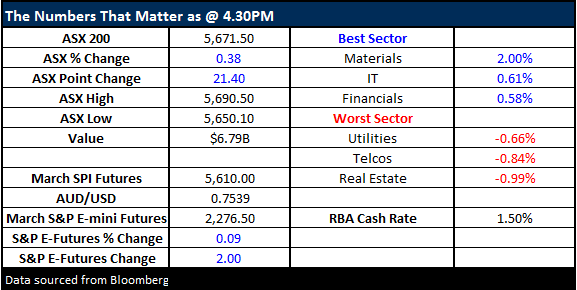

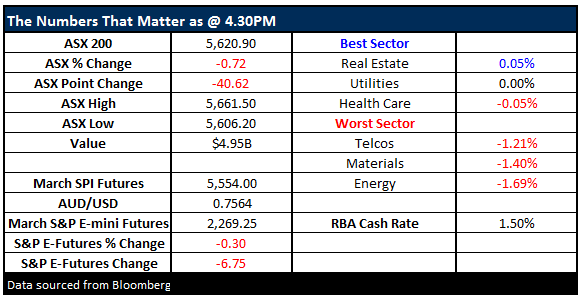

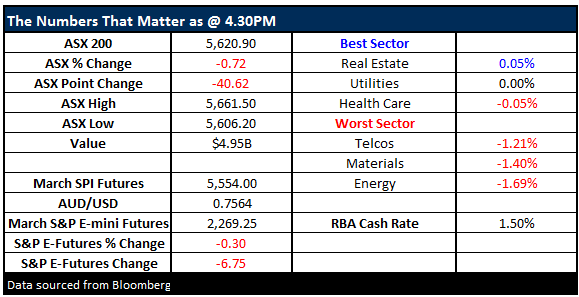

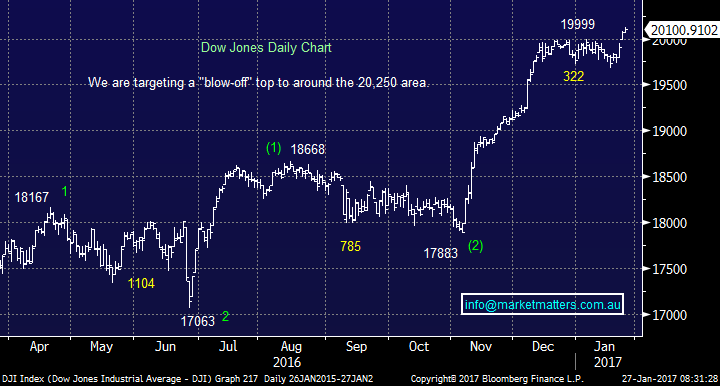

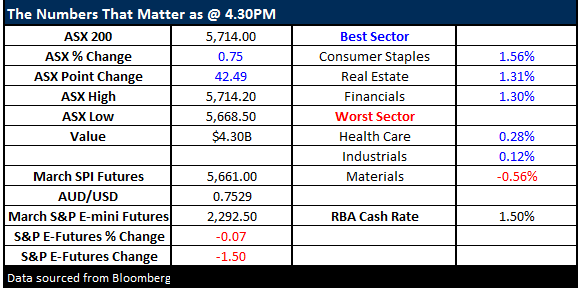

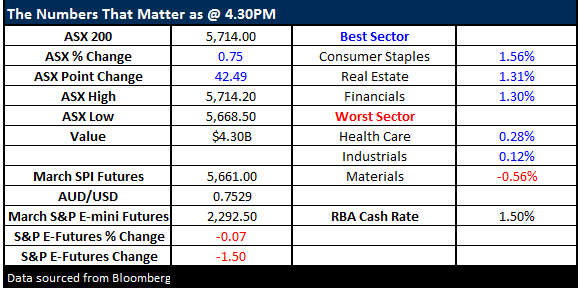

Two sessions of trade overseas, while we enjoyed the Australia Day break yesterday and no doubt many will be taking today off to make it a four day weekend! On Wednesday night the Dow Jones pushed through the 20,000 level for the first time in history, with a strong +150pt rally followed up overnight by a mixed session. Locally the SPI Futures are trading at 5649, up from the close on Wednesday of 5610, implying a ~40pt move higher in our market since we last traded. Obviously 20,000 is a ‘catchy’ number however it means very little other than providing a good headline for media reports. We’ve seen many ‘physiologically important’ numbers come and go over the years and it’s simply another one of those.

This weekend the year of the rooster will be welcomed in by China, the world’s second largest economy. At the same time the largest economy enjoys its share market pushing towards record all-time highs. The US market is currently embracing any sniff of good news and ignoring the bad, like potential trade wars with Mr Trump at the helm – we have seen this degree of optimism before and it always runs out of steam at some point. We reiterate our mantra for the coming year:

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.