Month: November 2016

Finally the US election should be over by the time our market closes today and there is a strong likelihood a winner will be announced around lunchtime today. The markets are clearly anticipating a Clinton victory and logic says they are correct. With this epic saga behind us we can finally focus on what’s going to impact the stock market moving forward, the main quandary remains:

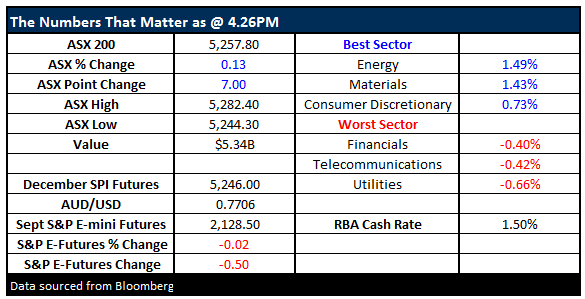

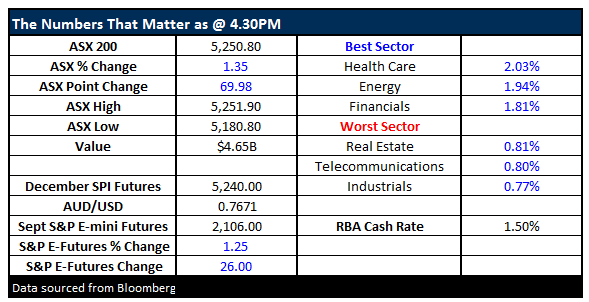

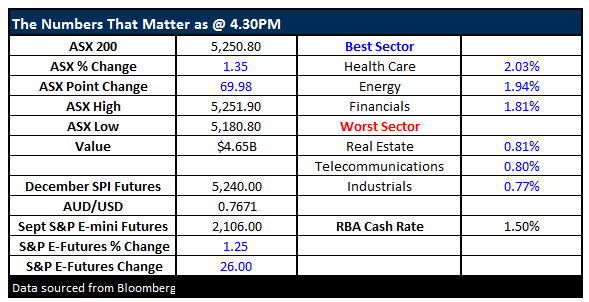

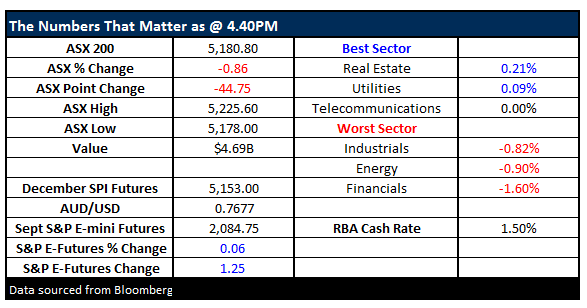

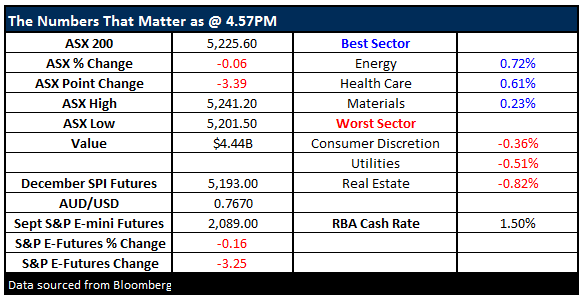

We certainly got our relief rally but interestingly courtesy of an FBI announcement on Sunday of all things! The local ASX200 rallied an impressive 70-points / 1.35% but as we are unfortunately accustomed to the US S&P500 outperformed gaining over 2.2%, with the Dow up 370-points. From our perspective it feels a touch premature to assume a Clinton victory tonight courtesy of the news that the FBI found no wrong doing by Mrs Clinton from her email saga. With over 20% of people having already voted and the email topic being very old news it feels unlikely to have made a material impact to voters, stocks just wanted an excuse to rally after 9-days of consecutive declines.

Firstly we are very sorry for the late Weekend Report yesterday, unfortunately, a few of our team were out of town over the weekend and they experienced poor internet connectivity. Basically, all this week’s questions are around the US election hence here are our thoughts in a nutshell barring any last minute bombshells. Nobody needs any reminder that this week is likely to be all about “Clinton v Trump” – this Tuesday US time. Markets have endured a rough ride into the election with US stocks falling for 9-consecutive days and the local ASX200 plunging 250-points (4.6%) over the last 2 trading weeks. Unlike BREXIT which caught markets totally off guard, a potential Trump victory has been analysed from all directions and to a certain degree built into prices.

Many local tech. stocks which charged ahead of the pack for so long have come back to earth with a huge bang over last few months. The standout 2 themes within our market recently has been the aggressive selling of the yield play stocks plus those with high demanding valuations (P/E’s) as the market fears disappointment – it’s received a few! Today we are focusing on 4 quality IT disruptors, all of which are household names, that have experienced significant corrections while asking the question are buying opportunities presenting themselves:

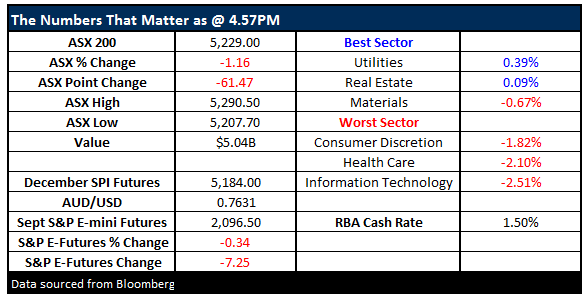

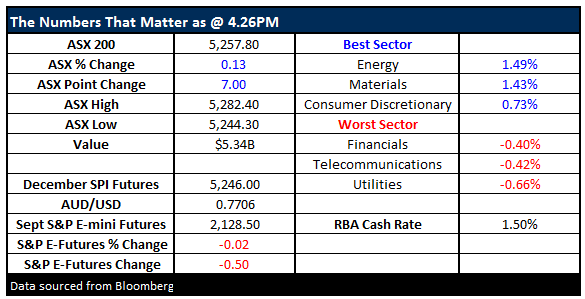

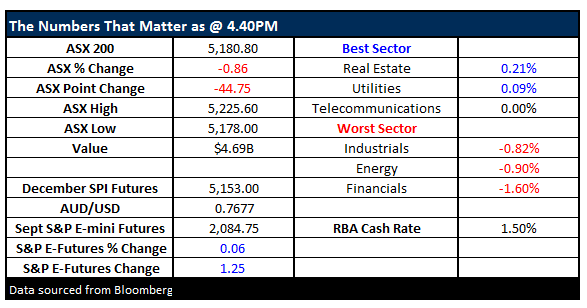

Yesterday the local ASX200 fell another 61-points (1.16%), over double the US retreat, as yet again “when the Dow sneezes we catch a cold!”. Fortunately, we increased our cash position to over 20% last month but it never feels enough when the market comes under such intense pressure. Today we are going to focus on the overall market and decide if we should start buying this weakness or perhaps even sell further. A tough decision with next week’s binary outcome looming i.e. Trump or Clinton. A Trump win is largely predicted to be negative for stocks – fear of the unknown.

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.